Oregon Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary

Description

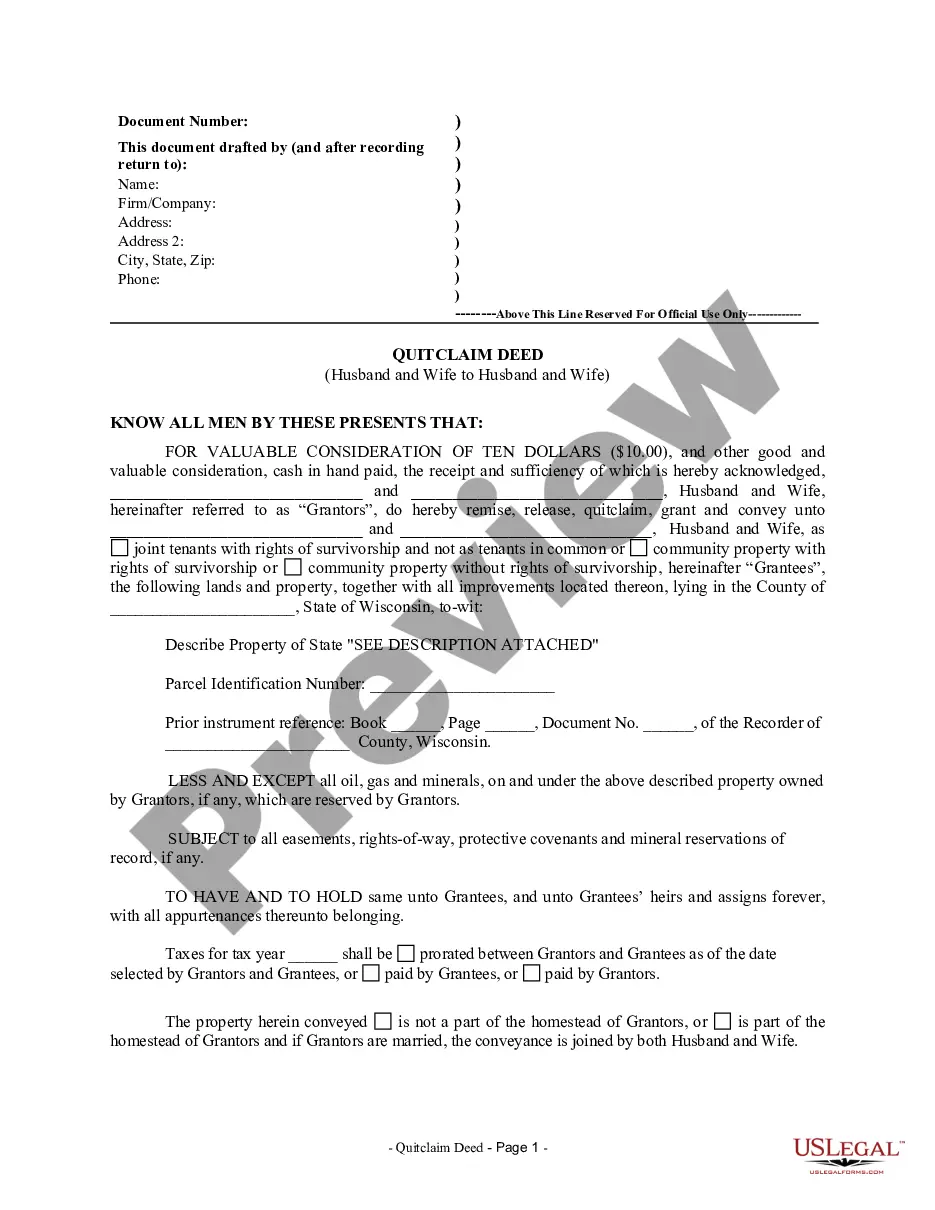

How to fill out Proposed Amendment To Articles Of Incorporation Regarding Distribution Of Stock Of A Subsidiary?

If you have to full, obtain, or print out lawful file web templates, use US Legal Forms, the biggest selection of lawful varieties, that can be found on the web. Utilize the site`s easy and hassle-free research to obtain the documents you will need. Different web templates for enterprise and person functions are sorted by groups and says, or key phrases. Use US Legal Forms to obtain the Oregon Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary in a couple of mouse clicks.

In case you are already a US Legal Forms buyer, log in to your accounts and click the Download button to get the Oregon Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary. You may also gain access to varieties you formerly saved within the My Forms tab of your own accounts.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape for that right town/region.

- Step 2. Make use of the Preview choice to examine the form`s articles. Never neglect to see the outline.

- Step 3. In case you are unhappy using the kind, take advantage of the Look for area on top of the screen to locate other types from the lawful kind web template.

- Step 4. Upon having found the shape you will need, go through the Get now button. Pick the rates prepare you favor and include your credentials to sign up on an accounts.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to accomplish the transaction.

- Step 6. Find the format from the lawful kind and obtain it on the device.

- Step 7. Comprehensive, change and print out or indication the Oregon Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary.

Each lawful file web template you get is your own property eternally. You possess acces to every single kind you saved within your acccount. Click on the My Forms area and choose a kind to print out or obtain yet again.

Be competitive and obtain, and print out the Oregon Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary with US Legal Forms. There are millions of professional and express-distinct varieties you can use for your personal enterprise or person requirements.

Form popularity

FAQ

(2) The offense described in this section, improper opening or leaving open a vehicle door, is a Class D traffic violation.

The Oregon Limited Liability Company Act allows companies to enjoy the taxation that partnerships do as well as the personal liability that corporations enjoy.

The Oregon Business Corporation Act includes laws and regulations for corporations doing business in the state of Oregon. By forming a corporation, the owner's personal assets aren't at risk for legal or financial issues relating to the business.

Corporate bylaws are legally required in Oregon. § 60.061, corporate bylaws shall be adopted by the incorporators or the corporation's board of directors. Bylaws are usually adopted by your corporation's directors at their first board meeting.

Limited liability companies organized under Oregon statute are "domestic" limited liability companies. Those formed under the laws of other states, but transacting business in Oregon, are "foreign" limited liability companies.

Corporations have more legal formalities than an LLC, like electing a board of directors, holding shareholder meetings, and maintaining internal records such as meeting minutes and stock issuance. Since an LLC is not a separate taxable entity apart from its owners, the LLC is a pass-through tax entity.

ORS Chapter 65 ? Nonprofit Corporations.