Oregon Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

How to fill out Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

You are able to devote time on the web attempting to find the legitimate record design that fits the state and federal demands you will need. US Legal Forms gives a large number of legitimate kinds that are reviewed by pros. It is simple to obtain or produce the Oregon Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split from your assistance.

If you already have a US Legal Forms bank account, you are able to log in and click the Download switch. Following that, you are able to complete, revise, produce, or signal the Oregon Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split. Every single legitimate record design you acquire is yours permanently. To acquire yet another backup associated with a bought develop, go to the My Forms tab and click the related switch.

If you are using the US Legal Forms internet site the very first time, adhere to the straightforward instructions under:

- Initial, make certain you have chosen the right record design for the state/metropolis of your liking. See the develop outline to ensure you have selected the proper develop. If offered, take advantage of the Review switch to look from the record design too.

- In order to find yet another edition from the develop, take advantage of the Search area to obtain the design that meets your needs and demands.

- Upon having identified the design you want, click on Purchase now to continue.

- Pick the costs prepare you want, key in your references, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal bank account to fund the legitimate develop.

- Pick the format from the record and obtain it in your device.

- Make changes in your record if needed. You are able to complete, revise and signal and produce Oregon Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split.

Download and produce a large number of record templates utilizing the US Legal Forms website, that offers the largest variety of legitimate kinds. Use specialist and express-particular templates to tackle your small business or person demands.

Form popularity

FAQ

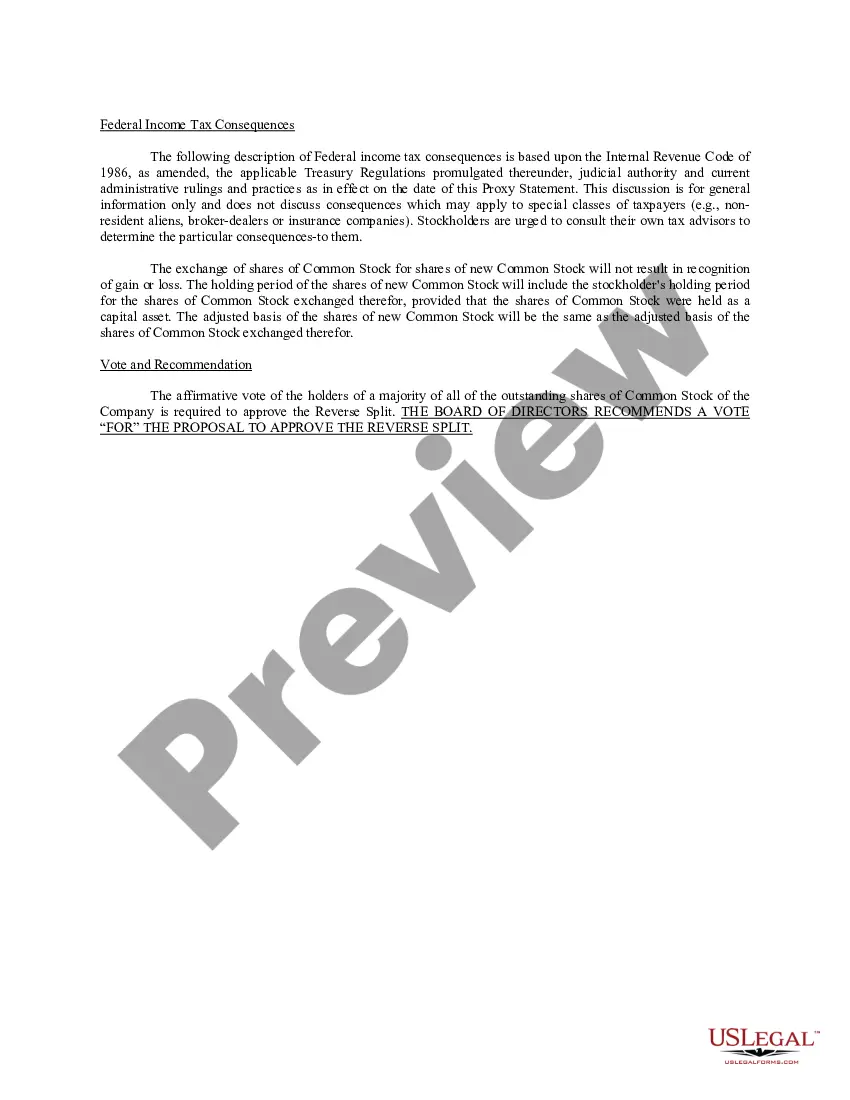

Listing Rule 5250(b)(4) will require companies to provide public notice of a reverse split, using a Reg FD-compliant method, no later than p.m. ET at least two business days prior to the proposed market effective date.

Companies may issue press releases notifying the public of a reverse split. If a company is required to file reports with the SEC, it may notify its shareholders of a reverse stock split on Forms 8-K, 10-Q and 10-K.

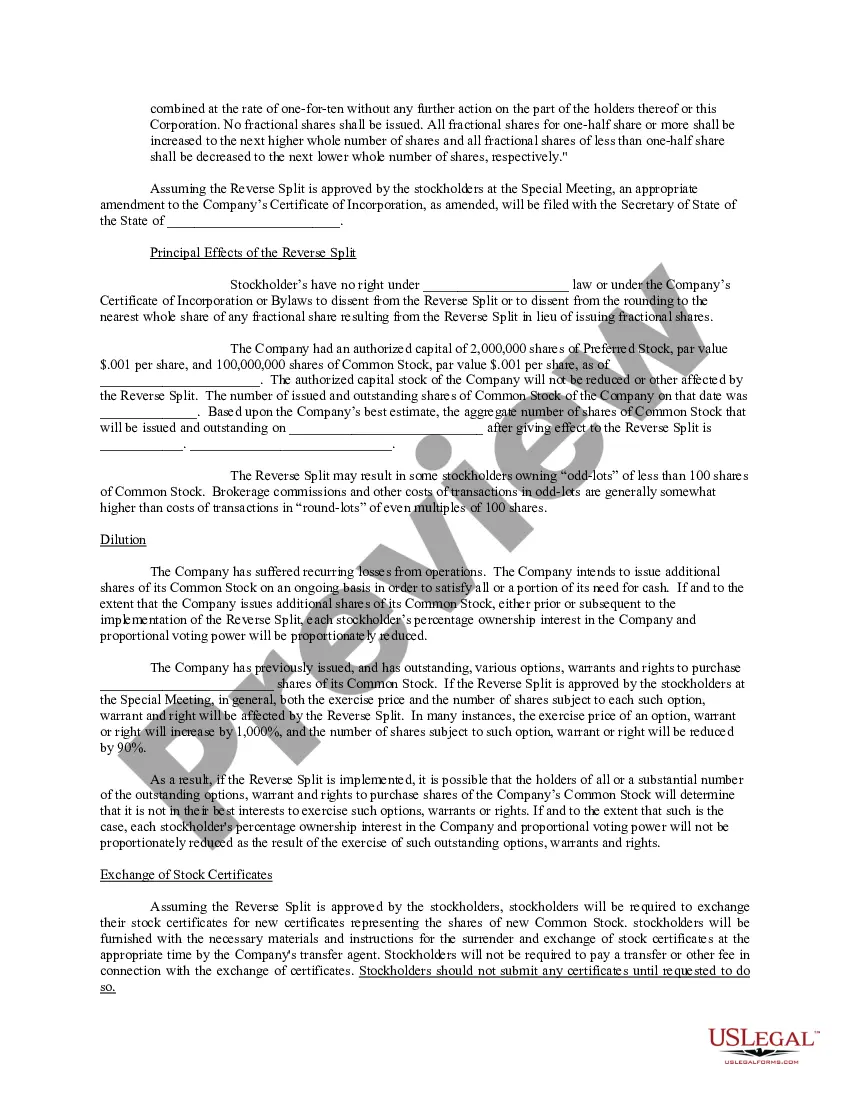

Simply divide the number of shares you own by the split ratio and multiply the pre-split share price by the same amount. For instance, say a stock trades at $1 per share and the company does a 1-for-10 reverse split.

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed. However, it often leads to a drop in the stock's market price as investors see it as a sign of financial weakness.

A stock split gets issued by a company's board of directors in an effort to become more affordable to potential investors. The announcement tends to come a few weeks before the stock split goes into effect so current investors aren't caught off guard and potential investors can make plans to buy shares.

NOTE: A new CUSIP number is required for a reverse stock split prior to the Marketplace Effective Date. This information can be provided by selecting the box for section 2 above. Is there a cash out associated with this reverse stock split?