Oregon Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

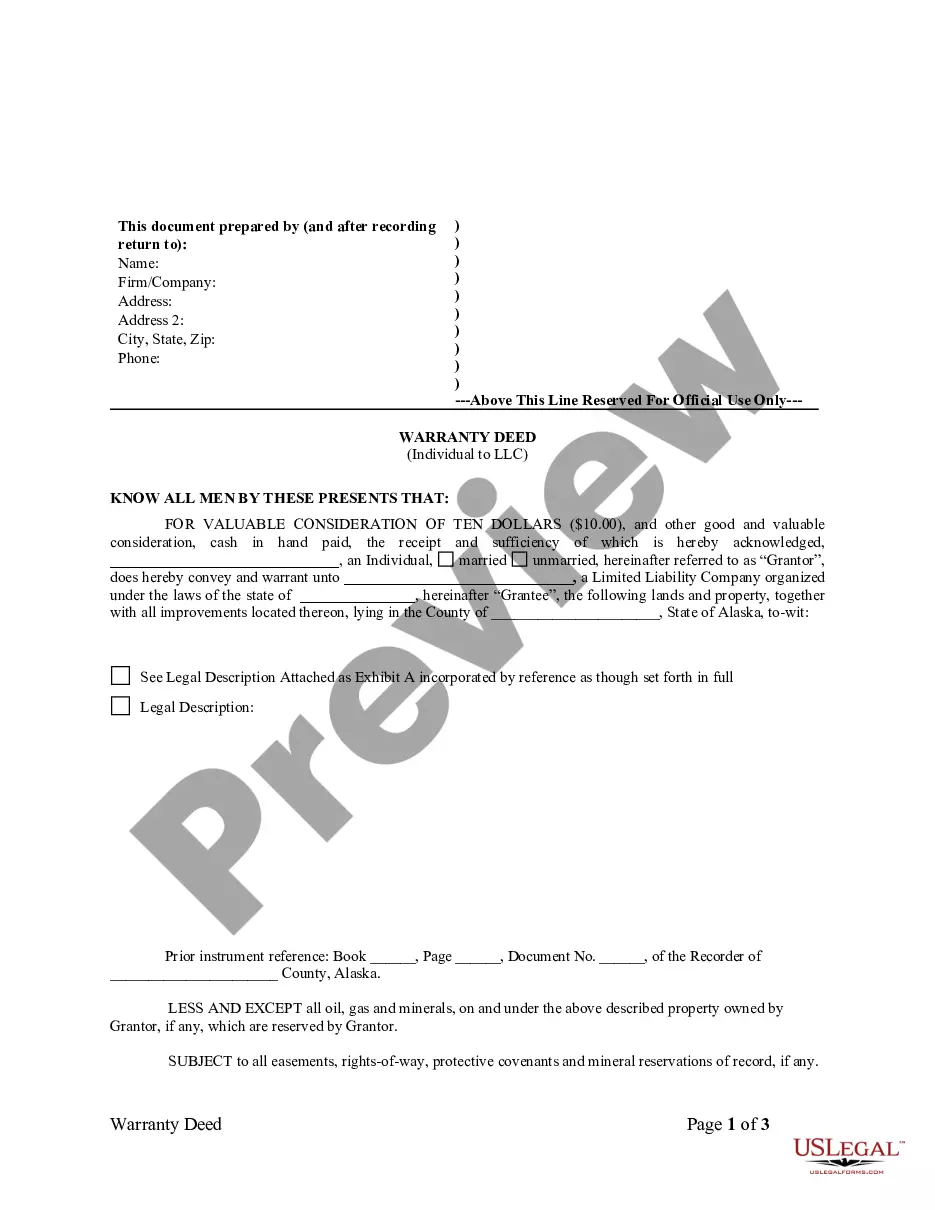

Finding the right legal papers design could be a battle. Of course, there are a lot of web templates available on the net, but how would you obtain the legal type you require? Use the US Legal Forms web site. The services delivers thousands of web templates, like the Oregon Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, which can be used for business and private requirements. All the types are inspected by specialists and meet up with federal and state requirements.

If you are already listed, log in to your accounts and click the Obtain switch to have the Oregon Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights. Make use of accounts to search with the legal types you may have purchased previously. Proceed to the My Forms tab of your respective accounts and obtain one more copy of your papers you require.

If you are a whole new end user of US Legal Forms, listed here are basic recommendations that you should stick to:

- Initially, ensure you have selected the proper type to your town/county. You may examine the shape utilizing the Review switch and browse the shape explanation to ensure this is basically the best for you.

- In case the type does not meet up with your expectations, use the Seach industry to discover the right type.

- Once you are sure that the shape is acceptable, click on the Buy now switch to have the type.

- Pick the prices strategy you desire and enter in the necessary info. Make your accounts and buy the transaction using your PayPal accounts or charge card.

- Choose the data file file format and acquire the legal papers design to your gadget.

- Total, revise and print out and signal the attained Oregon Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

US Legal Forms is definitely the largest catalogue of legal types for which you can find a variety of papers web templates. Use the service to acquire professionally-produced documents that stick to status requirements.

Form popularity

FAQ

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Non-qualified stock options are more straightforward, as the tax implications at exercise are generally agreed to be easier to understand. Incentive stock options, while more complicated, offer the opportunity for long-term capital gains if you meet the requisite holding period requirements.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.