Oregon Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

Have you been inside a place where you need to have papers for sometimes business or person reasons nearly every working day? There are a variety of legal document themes available on the Internet, but finding versions you can rely is not easy. US Legal Forms delivers thousands of kind themes, just like the Oregon Second Warrant Agreement by General Physics Corp., that happen to be published in order to meet federal and state requirements.

When you are presently informed about US Legal Forms site and also have your account, basically log in. Afterward, you are able to down load the Oregon Second Warrant Agreement by General Physics Corp. template.

Unless you come with an profile and want to begin to use US Legal Forms, adopt these measures:

- Get the kind you require and make sure it is for that appropriate area/county.

- Make use of the Review key to check the shape.

- Browse the explanation to ensure that you have chosen the proper kind.

- If the kind is not what you`re searching for, make use of the Lookup area to obtain the kind that suits you and requirements.

- Once you obtain the appropriate kind, simply click Acquire now.

- Opt for the rates prepare you would like, submit the specified information and facts to produce your money, and purchase your order making use of your PayPal or bank card.

- Decide on a practical paper formatting and down load your backup.

Discover each of the document themes you might have bought in the My Forms food list. You can aquire a more backup of Oregon Second Warrant Agreement by General Physics Corp. any time, if possible. Just go through the needed kind to down load or print the document template.

Use US Legal Forms, probably the most extensive assortment of legal forms, to save time and prevent errors. The services delivers expertly produced legal document themes that you can use for a selection of reasons. Make your account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

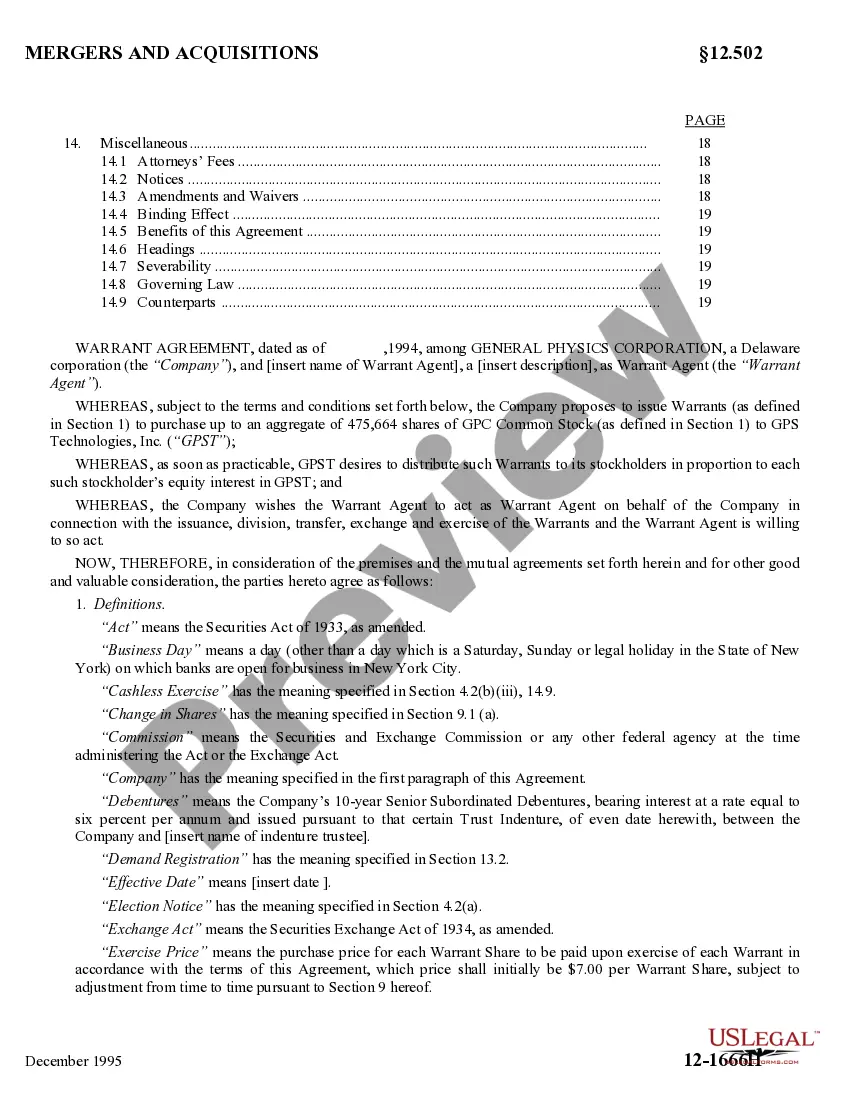

A warrant is an agreement between two parties that gives one party the right to buy the other party's stock at a set price, over a specified period of time. Once a warrant holder exercises their warrant, they get shares of stock in the issuing party's company.

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

What is a Warrant? A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.