Oregon Bill of Costs (District Court)

Description

How to fill out Bill Of Costs (District Court)?

You are able to spend several hours on-line attempting to find the legal document web template that suits the federal and state requirements you want. US Legal Forms offers thousands of legal kinds that happen to be examined by professionals. It is simple to down load or printing the Oregon AO-133 Bill of Costs - Federal District Court Official Form from the support.

If you have a US Legal Forms profile, you are able to log in and click on the Obtain switch. Following that, you are able to total, change, printing, or indicator the Oregon AO-133 Bill of Costs - Federal District Court Official Form. Each and every legal document web template you acquire is your own property forever. To have yet another copy for any obtained kind, proceed to the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms site for the first time, stick to the simple recommendations under:

- Initial, ensure that you have chosen the right document web template for that state/metropolis that you pick. Read the kind information to ensure you have picked the proper kind. If accessible, use the Preview switch to look throughout the document web template as well.

- If you would like discover yet another version from the kind, use the Search discipline to find the web template that meets your requirements and requirements.

- Upon having identified the web template you would like, click Purchase now to move forward.

- Select the costs prepare you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal profile to cover the legal kind.

- Select the format from the document and down load it for your system.

- Make alterations for your document if needed. You are able to total, change and indicator and printing Oregon AO-133 Bill of Costs - Federal District Court Official Form.

Obtain and printing thousands of document layouts using the US Legal Forms Internet site, which offers the largest assortment of legal kinds. Use specialist and express-certain layouts to take on your company or person requirements.

Form popularity

FAQ

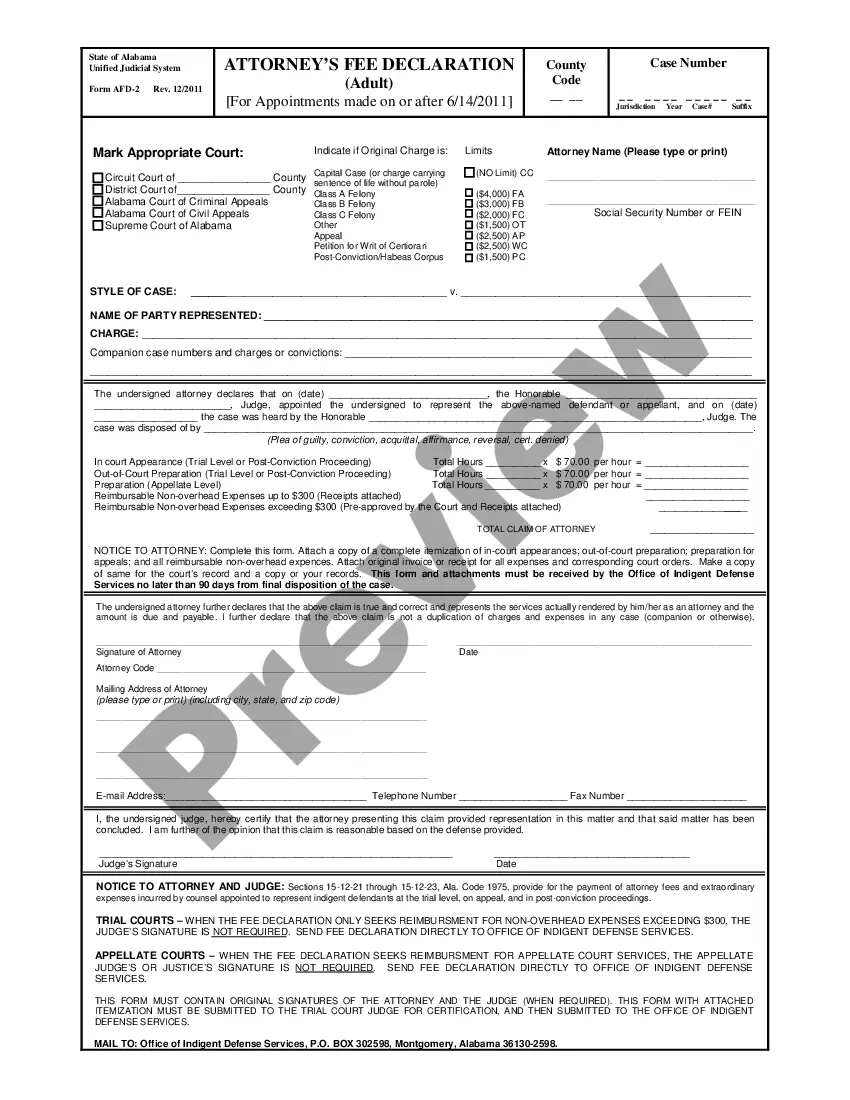

The Bill of Costs will list each category of cost and the amount the losing party must pay. Within 7 days after the Court issues a Bill of Costs, the losing party may file and serve a ?Motion to Retax Costs.? There are several reasons why a losing party may choose to file a Motion to Retax Costs.

Costs of to the plaintiff, in any event of the cause . = means that even if the party doesn't win the lawsuit at the end of the day, they are still entitled to costs for these applications.

The federal statute governing taxation of costs, 28 U.S.C. §1920, allows ?[f]ees of the court reporter for all or any part of the stenographic transcript necessarily obtained for use in the case.? The court ruled here that this language was not broad enough to reach remote deposition fees.

The general ?American Rule? on recovering attorney fees in Colorado lawsuits is that you don't ? each side pays their own costs and attorney fees in the case.

Cost bill, also referred to as bill of costs, is an itemized list of court costs incurred by the prevailing party in a lawsuit. The prevailing party submits this list to the court and the losing party after a judgment has been issued in the case.

Black's Law Dictionary says that expense means ?an expenditure of money, time, labor, or resources to accomplish a result; esp., a business expenditure chargeable against revenue for a specific period.? By contrast, it defines costs more narrowly, as ?the charges or fees taxed by the court, such as filing fees, jury ...

Taxation of costs is a ministerial function performed by a court upon the resolution of case. It involves entering the various costs and their amounts against the party (either the claimant or defendant) against whom those costs have been awarded by the court.

Federal Rule of Civil Procedure 54(d) outlines which party can recover costs, and it includes prevailing parties, subject to certain limitations. Recoverable costs may include deposition costs, printing expenses, postage, and other necessary expenditures detailed in 28 U.S.C. § 1920.