Oregon Memo on Company Relocation including Relocation Pay for Employees

Description

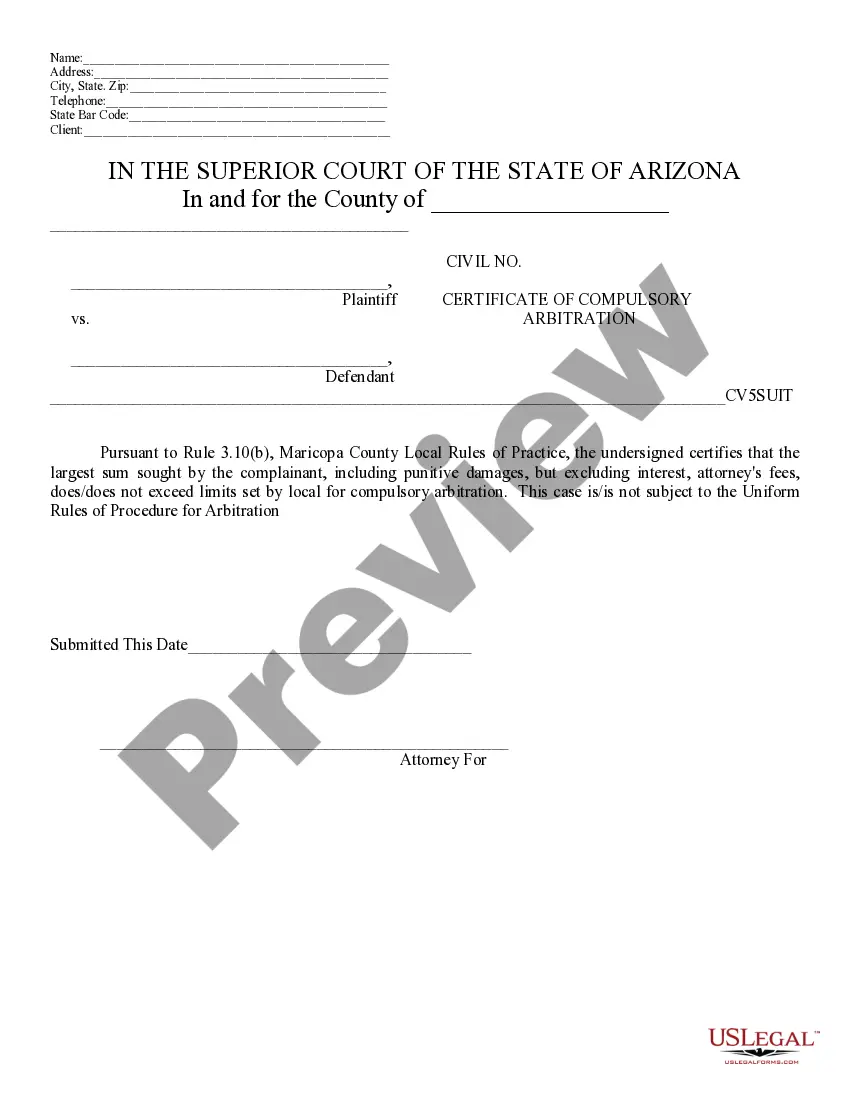

How to fill out Memo On Company Relocation Including Relocation Pay For Employees?

Are you presently in a circumstance where you need documents for possible business or personal reasons almost all the time.

There are numerous legal document templates accessible online, yet finding ones you can rely on isn't simple.

US Legal Forms offers thousands of form templates, including the Oregon Memo on Company Relocation with Relocation Pay for Employees, which can be tailored to meet state and federal regulations.

Access all the document templates you have purchased in the My documents menu.

You can download another copy of the Oregon Memo on Company Relocation with Relocation Pay for Employees at any time, if needed. Just click on the relevant form to obtain or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can obtain the Oregon Memo on Company Relocation with Relocation Pay for Employees template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the form.

- Read the description to confirm that you have chosen the right form.

- If the form isn't what you seek, use the Search field to find the form that meets your needs.

- Once you identify the correct form, click Buy now.

- Choose the pricing plan you prefer, complete the required information to set up your account, and purchase the order using your PayPal or credit card.

- Select a suitable document format and download your copy.

Form popularity

FAQ

When asking HR for a relocation allowance, it is helpful to prepare a sample letter that outlines your request clearly. Begin by stating your current situation and why relocation is necessary. Refer to the Oregon Memo on Company Relocation including Relocation Pay for Employees to back your request, ensuring HR recognizes the basis for your allowance and the potential impact of this support on your transition.

The employee relocation incentive is a benefit provided by employers to encourage employees to move for a job. This incentive can take the form of financial support for moving costs, housing assistance, or other relocation benefits. Familiarity with resources like the Oregon Memo on Company Relocation including Relocation Pay for Employees can help you better understand what to expect and how to leverage these incentives effectively.

When a company pays for your relocation, it is commonly referred to as a relocation package or relocation assistance. This package can encompass various elements, including direct payment for moving expenses, temporary housing, and travel costs. Ensuring clarity on these terms is crucial, especially with guidance from the Oregon Memo on Company Relocation including Relocation Pay for Employees.

To request a relocation allowance, gather necessary documentation that supports your move and related expenses. Present this information to your HR department or manager, clearly outlining the costs you are anticipating. Citing the Oregon Memo on Company Relocation including Relocation Pay for Employees can help demonstrate the standards that may apply to your situation.

When writing a letter to request relocation, start with your personal information followed by the date and the company's address. Clearly state your request for relocation and include specific reasons why this support is necessary for your move. Mention the Oregon Memo on Company Relocation including Relocation Pay for Employees to highlight the validity of your request and ensure your needs align with company policies.

To ask for a relocation allowance, first understand your company's policies regarding relocation pay. Then, approach your manager or HR department with a clear explanation of your situation and need for assistance. You can refer to the Oregon Memo on Company Relocation including Relocation Pay for Employees to strengthen your request, as it provides guidance on what employers may cover.

Debit "Relocation Benefits" or "Moving Expenses" for the same amount. For example, if you issue a $25,000 relocation benefit, credit the accrual account $25,000 and debit the expense account $25,000.

What's Included in a Job Relocation Package?The Cost of a House-Finding Trip. The company may cover the costs of traveling to the new location to find a suitable home.Home Sales / Home Buying.Job Search Help.Transportation.Temporary Housing.Moving.Full Pack / Unpack.Storage Unit Rental.More items...?

An average relocation package costs between $21,327-$24,913 for a transferee who is a renter and $61,622-$79,429 for a transferee who is a homeowner. Of course, this number is just an average of what larger corporations are spending on employee relocation the relocation amount can be anywhere from $2,000 - $100,000.

What is Relocation Assistance? Relocation assistance occurs when a company assists new hires or current employees with relocating for work from one location to another, whether it's a new city, state, or country.