Oregon Employee Evaluation Form for Soldier

Description

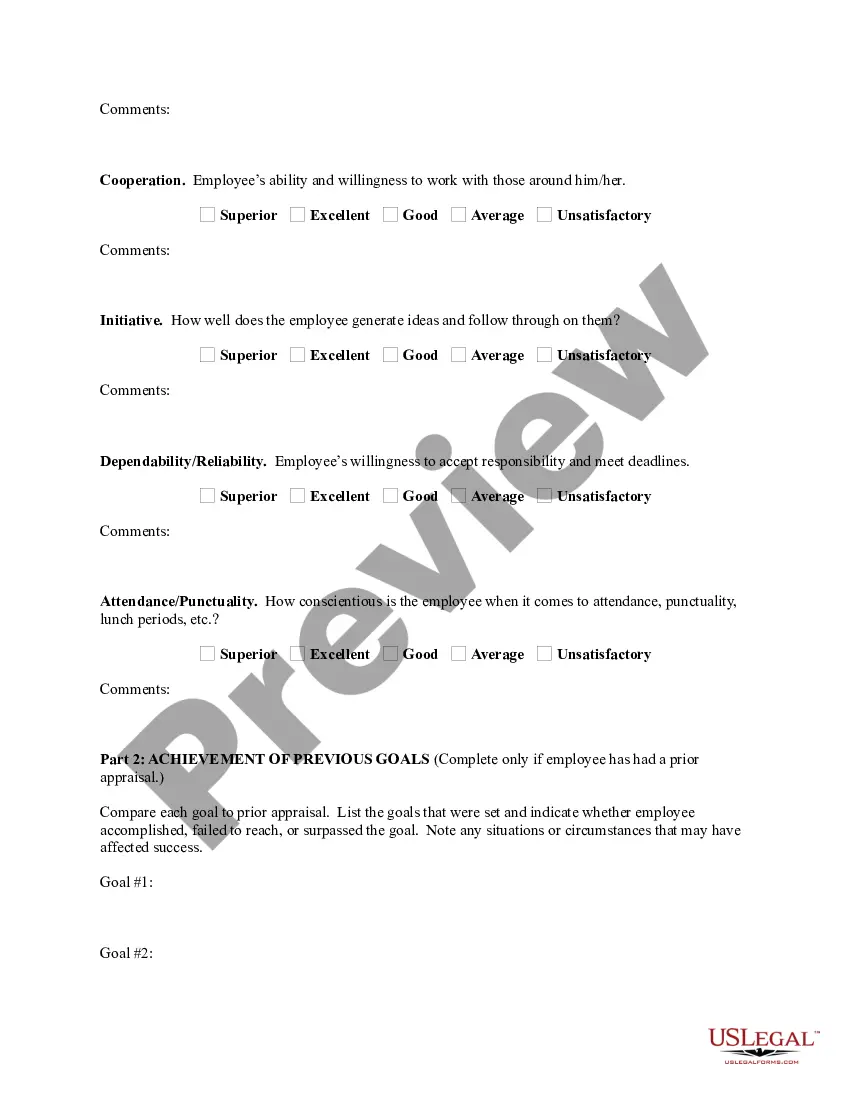

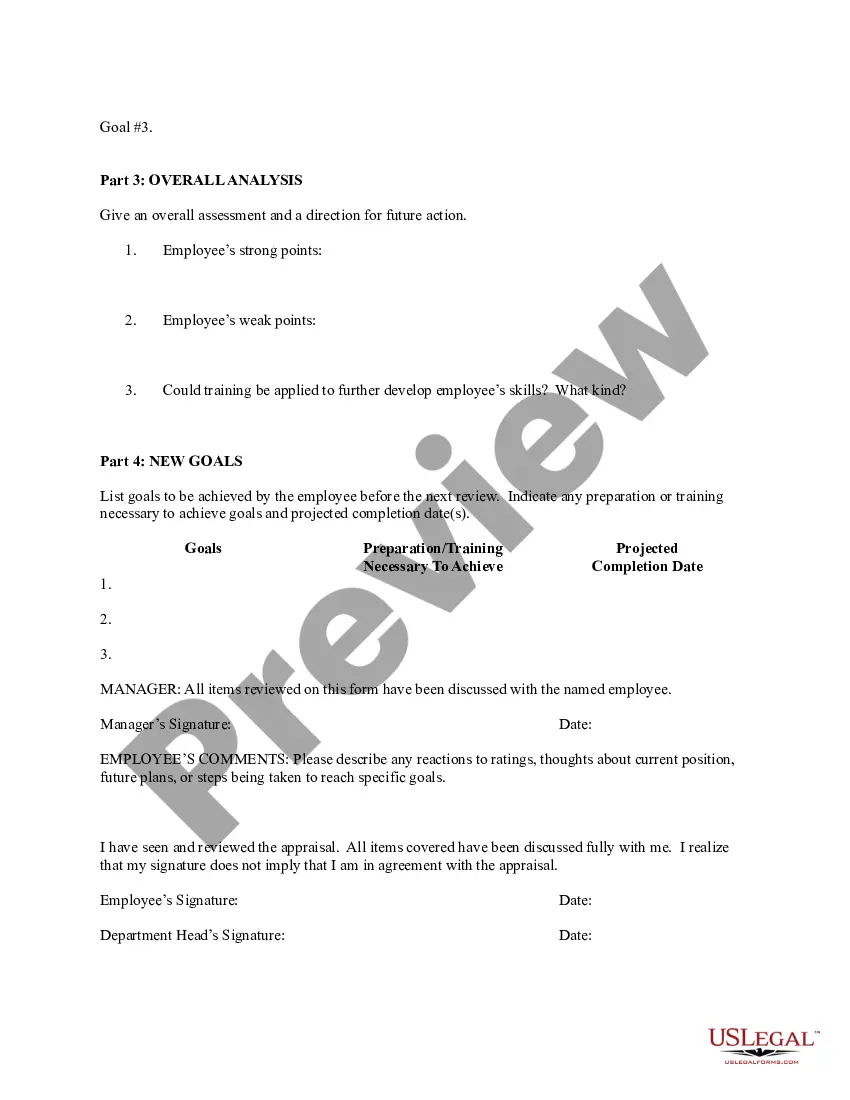

How to fill out Employee Evaluation Form For Soldier?

Selecting the appropriate official file format can be challenging. Naturally, there are numerous templates accessible online, but how can you find the official type you need.

Utilize the US Legal Forms website. This service offers a wide array of templates, including the Oregon Employee Evaluation Form for Soldier, which can be utilized for both business and personal purposes.

All forms are reviewed by experts and comply with federal and state regulations.

If the form does not fulfill your requirements, use the Search field to find the appropriate form. Once you are certain that the document is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and place an order using your PayPal account or credit card. Select the format and download the official document to your device. Complete, modify, print, and sign the acquired Oregon Employee Evaluation Form for Soldier. US Legal Forms is the largest repository of official forms where you can discover numerous document templates. Utilize this service to download properly crafted papers that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Obtain button to access the Oregon Employee Evaluation Form for Soldier.

- Use your account to browse the official forms you may have purchased previously.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, ensure that you have selected the correct form for your region/county.

- You can preview the document using the Preview button and read the description to confirm it is suitable for you.

Form popularity

FAQ

Summary of Oregon Military and Veterans Benefits: Oregon offers special benefits for Service members, Veterans and their Families including, state employment preferences, education and tuition assistance, vehicle tags, Oregon Parks and Recreation Special Access Pass for Veterans with disabilities and active military on

Yes. Since January 2016, pay for active military service and summer encampment is exempt from local earned income tax.

Oregon: Military retirement pay is taxable as income for service after Oct. 1, 1991, and is exempt for service before that date. A portion may be exempt if you served both before and after that date.

In the military, the federal government generally only taxes base pay, and many states waive income taxes. Other military paythings like housing allowances, combat pay or cost-of-living adjustmentsisn't taxed.

Oregon's personal income tax is progressive, but mildly so. Marginal tax rates start at 4.75 percent and, as a taxpayer's income goes up, rates quickly rise to 6.75 percent and 8.75 percent, topping out at 9.9 percent.

Military income: Military pay is taxable if stationed in California.

ORS 316.680(1)(e) Subtraction code 307 You may be able to subtract some or all of your tax- able federal pension included in federal income. This includes benefits paid to the retiree or the beneficiary. It does not include disability payments if you have not attained the minimum retirement age.

Oregon doesn't tax your military pay while you are stationed in Oregon. File an Oregon Form OR-40-N if you or your spouse had income from other Oregon sources. Oregon-source income includes wages from an off-duty job or earnings from an Oregon business or rental property.

Oregon doesn't tax your military pay while you are stationed in Oregon. File an Oregon Form OR-40-N if you or your spouse had income from other Oregon sources. Oregon-source income includes wages from an off-duty job or earnings from an Oregon business or rental property.

The following states have no state income tax and, therefore, do not tax military retirement pay: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.