Oregon Standard Conditions of Acceptance of Escrow

Description

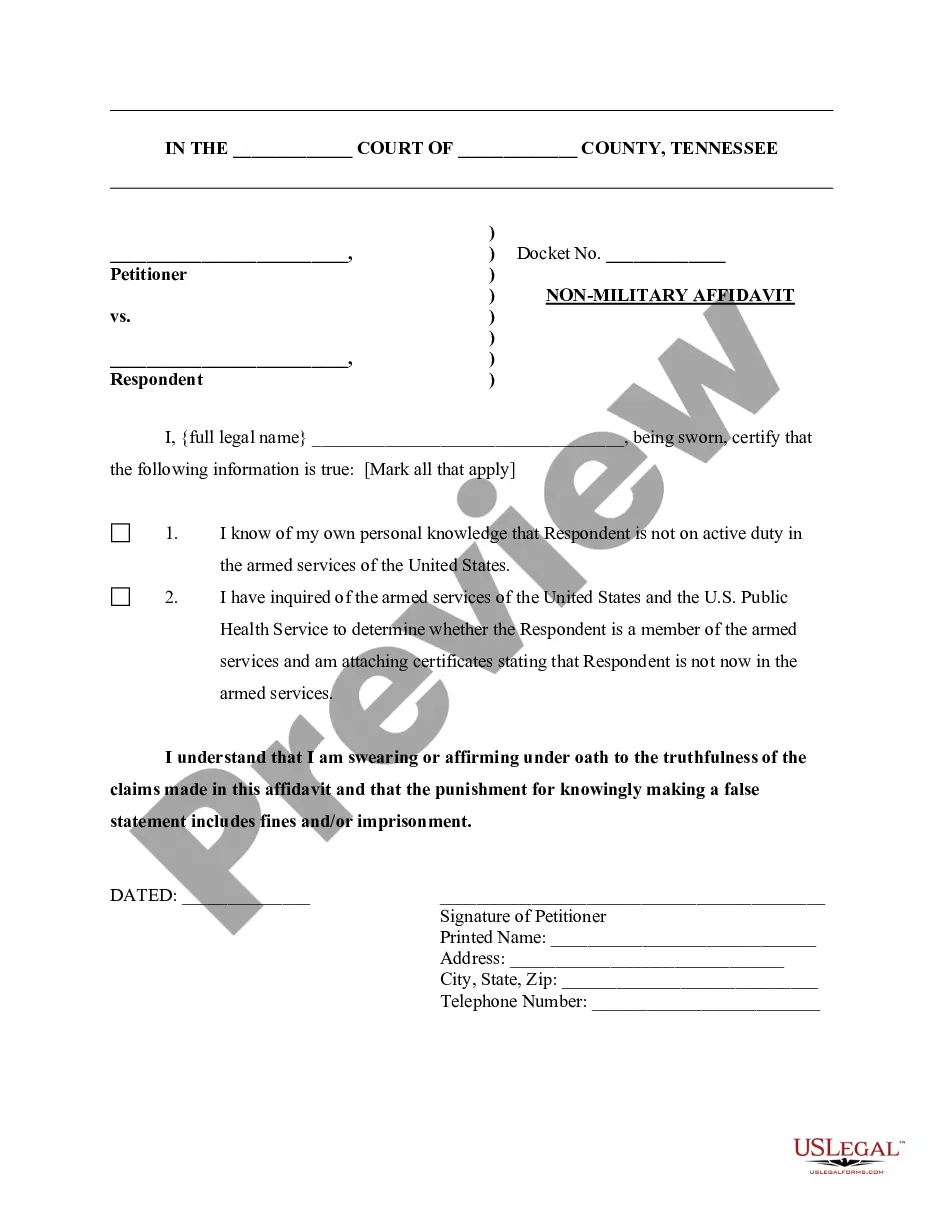

How to fill out Standard Conditions Of Acceptance Of Escrow?

It is feasible to spend hours online searching for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by specialists.

You can easily download or print the Oregon Standard Conditions of Acceptance of Escrow from our platform.

If available, utilize the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then select the Acquire option.

- Subsequently, you can complete, modify, print, or sign the Oregon Standard Conditions of Acceptance of Escrow.

- Each legal document template you purchase is yours to keep permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow these simple instructions underneath.

- First, ensure you have selected the correct document template for the county/region you choose.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

The seller might have a clause hidden deep in the contract that allows him to cancel the escrow without penalties for any reason he wishes to do so. Look for that carefully when going over the contract or you could get caught up in a mess down the road.

California is a unique state where the Title company is typically separate from the escrow company. However, in some areas of Northern California, most notably the Bay Area & San Francisco, it's more common that the Title company processes the escrow internally.

The timeline can vary depending on the agreement of the buyer and seller, who the escrow provider is, and more. Ideally, however, the escrow process should not take more than 30 days. If an escrow process lasts longer than 30 days, then there might have been some issues in the process.

In Oregon, the escrow process refers to the sequence of events that take place between contact and closing. Once you have a signed purchase agreement with the seller, you will enter escrow. This period ends when you actually close on the home and receive ownership.

If you sell your home between those two dates and haven't paid your taxes yet, you'll pay the buyer a prorated amount for the days that you lived in the home. On the other hand, if you sell and have already paid your taxes for the year, the buyer will credit you a prorated amount for the taxes you've already paid.

In short: Yes, buyers can typically back out of buying a house before closing. However, once both parties have signed the purchase agreement, backing out becomes more complex, particularly if your goal is to avoid losing your earnest money deposit.

Example of Escrow The offer is accepted and he must put his earnest money, say $5,000, into escrow. The money put in escrow allows the seller to know you're serious about potentially buying the property, and in return, the seller will take the property off the market and finalize repairs, etc.

The escrow process typically takes 30-60 days to complete.

Title insurance companies are licensed and regulated by the200b Division of Financial Regulation200b200b....Oregon escrow agent licensing200bA general plan of the escrow business.Description of the character of the escrow business.A history of the formation of the escrow business, including when it was established.More items...

Earnest money and deposits are held in an escrow account. Once you back out, those funds are released to the seller if you haven't performed them. However, if you get your inspections, appraisals, and financing within the agreed-upon date range and choose to back out, there are no penalties.