Oregon Payroll Deduction Authorization Form

Description

How to fill out Payroll Deduction Authorization Form?

If you want to finalize, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and efficient search feature to locate the documents you require.

Various templates for business and personal use are categorized by types and states, or keywords. Use US Legal Forms to find the Oregon Payroll Deduction Authorization Form with just a few clicks.

Each legal document template you purchase is yours permanently. You have access to every form you have downloaded in your account.

Compete and obtain, and print the Oregon Payroll Deduction Authorization Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Oregon Payroll Deduction Authorization Form.

- You can also access forms you previously downloaded through the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

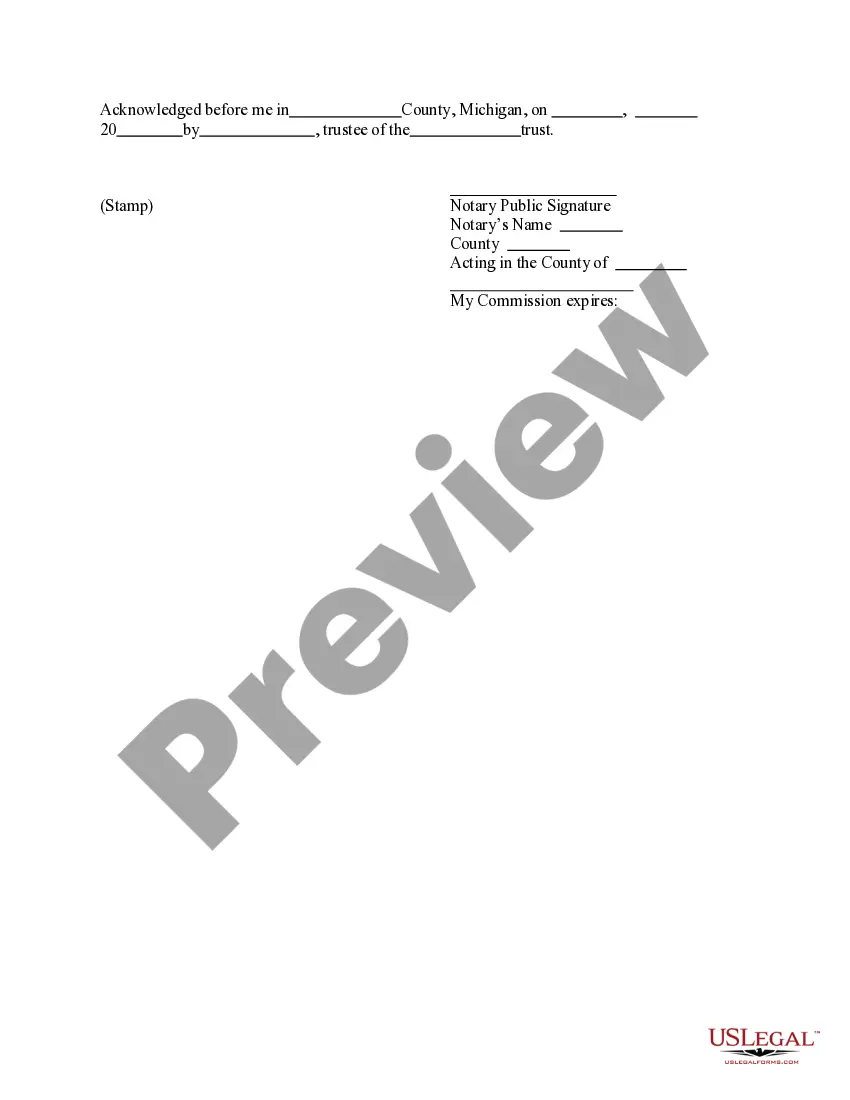

- Step 2. Use the Preview option to review the content of the form. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Download now button. Choose your payment plan and enter your information to register for an account.

- Step 5. Process the transaction. You can use your Misa, MasterCard, or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Oregon Payroll Deduction Authorization Form.

Form popularity

FAQ

Payroll authorization is a process through which employees give permission for their employers to withhold specific deductions from their paychecks. This often includes taxes and other contributions. An Oregon Payroll Deduction Authorization Form is essential for ensuring that these deductions follow state and federal guidelines, providing clarity and compliance for both employers and employees.

Taking money from wages without consent or contractual provision can result in a claim for unlawful deduction of wages, even if the individual has been employed for less than two years.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

For regular unemployment insurance (UI) benefits, you will need:Your name, Social Security number, birthdate and contact information.Your complete work history for the past 18 months including: employer name(s) address(es) phone number(s)Your bank account and routing number, if you want to sign up for direct deposit.

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

Mandatory Payroll Tax DeductionsFederal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding. Local tax withholdings such as city or county taxes, state disability or unemployment insurance.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

All Oregon employers who have an income tax with- holding and statewide transit tax account open with the Oregon Department of Revenue must file Form OR-WR, Oregon Annual Withholding Tax Reconciliation Report.