Oregon Presentation of Stock Notice

Description

How to fill out Presentation Of Stock Notice?

You are able to commit hours on-line attempting to find the legitimate document format that meets the federal and state specifications you will need. US Legal Forms provides a large number of legitimate varieties which are reviewed by specialists. You can easily down load or print the Oregon Presentation of Stock Notice from your assistance.

If you already possess a US Legal Forms accounts, you may log in and then click the Download key. Following that, you may full, change, print, or indication the Oregon Presentation of Stock Notice. Every legitimate document format you buy is your own property for a long time. To acquire another copy associated with a bought kind, check out the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms site the very first time, stick to the straightforward directions below:

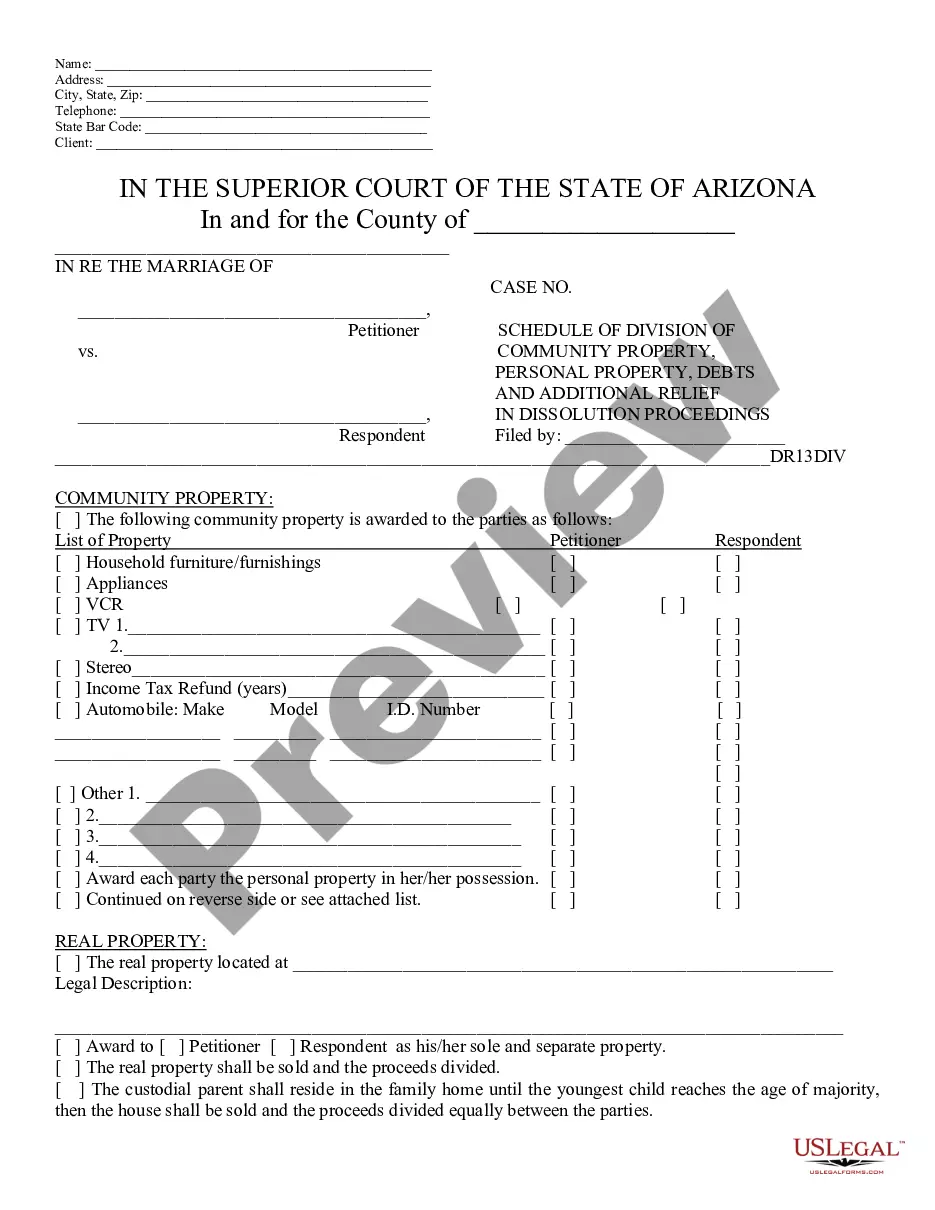

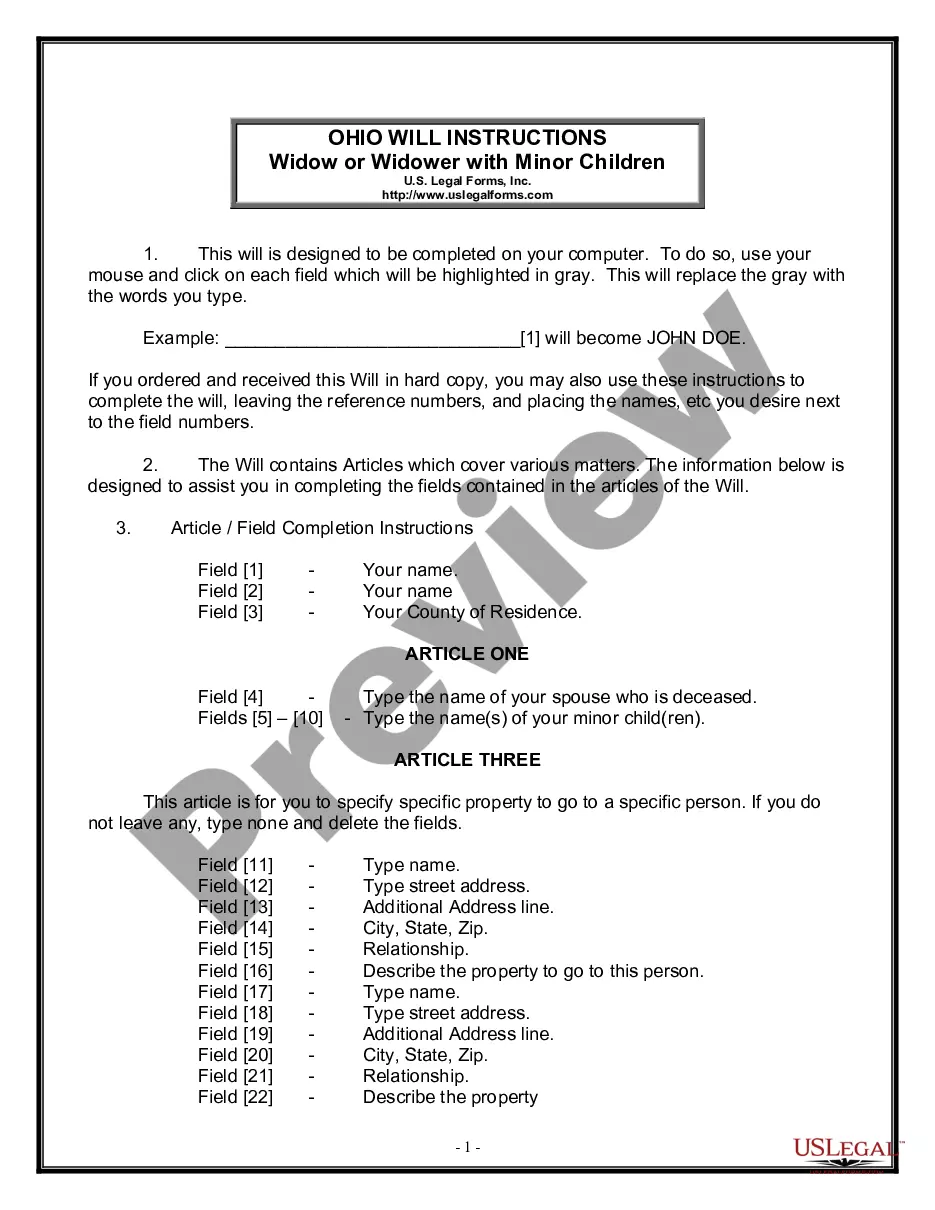

- Very first, ensure that you have chosen the proper document format for your area/city of your choosing. Browse the kind information to ensure you have chosen the proper kind. If offered, make use of the Review key to search through the document format too.

- If you want to locate another edition of the kind, make use of the Research discipline to discover the format that suits you and specifications.

- Upon having found the format you would like, just click Buy now to carry on.

- Choose the costs strategy you would like, type your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal accounts to pay for the legitimate kind.

- Choose the structure of the document and down load it to the device.

- Make changes to the document if necessary. You are able to full, change and indication and print Oregon Presentation of Stock Notice.

Download and print a large number of document templates utilizing the US Legal Forms website, that provides the largest collection of legitimate varieties. Use skilled and condition-specific templates to handle your business or individual demands.

Form popularity

FAQ

A person will be deemed to have taxable nexus with Oregon for purposes of the CAT if they have property in Oregon with an original cost greater than $50,000, payroll in Oregon of greater than $50,000, their commercial activity in Oregon is greater than $750,000, if 25% of their property, payroll, or commercial activity ...

Oregon Gross Receipts (Taxable Commercial Activity) A full list of exclusions can be found in H.B. 3247, Section 58(1)(b). Note that Rental Activities are not excluded from the CAT tax. Once a taxpayer exceeds $750,000 in Oregon Taxable Commercial Activity, they must register with the Oregon Department of Revenue.

The CAT is imposed on the entity doing business in Oregon and is considered part of the business' expenses. A business may include the CAT with other business expenses when setting the total price charged to customers.

For more information and instructions on setting up your Revenue Online account, visit .oregon.gov/dor. As updates or changes are made to these instructions, they will also be posted to our website. Note: The CAT return may not be filed through Revenue Online.

Designated CAT entity This includes all business entity types, such as C and S corporations, partnerships, sole proprietorships, and other entities. Unitary groups must designate a single member of the unitary group with substantial nexus in this state to register, file and pay the tax on behalf of the group.

Cat tax (plural cat taxes) (Internet slang) An image or video of one's pet cat posted online, seen as a duty to be fulfilled upon introduction to a forum or social media platform.

The CAT is applied to taxable Oregon commercial activity more than $1 million. The tax is computed as $250 plus 0.57 percent of taxable Oregon commercial activity of more than $1 million. Only taxpayers with more than $1 million of taxable Oregon commercial activity will have a payment obligation.

?Any person, business, or unitary group of businesses doing business in Oregon may have obligations under the CAT. This includes such business entities as C and S corporations, partnerships, sole proprietorships, and other entities.