Oregon Subrogation Agreement in Favor of Medical Provider

Description

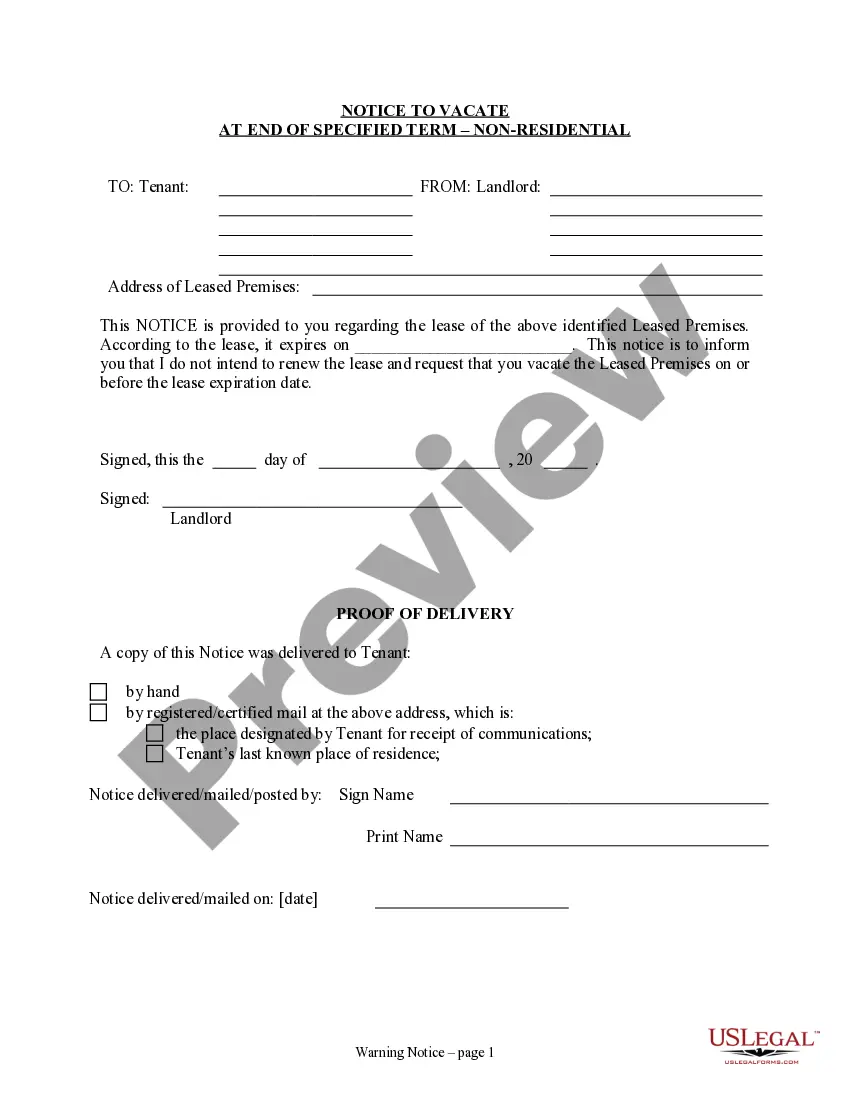

How to fill out Subrogation Agreement In Favor Of Medical Provider?

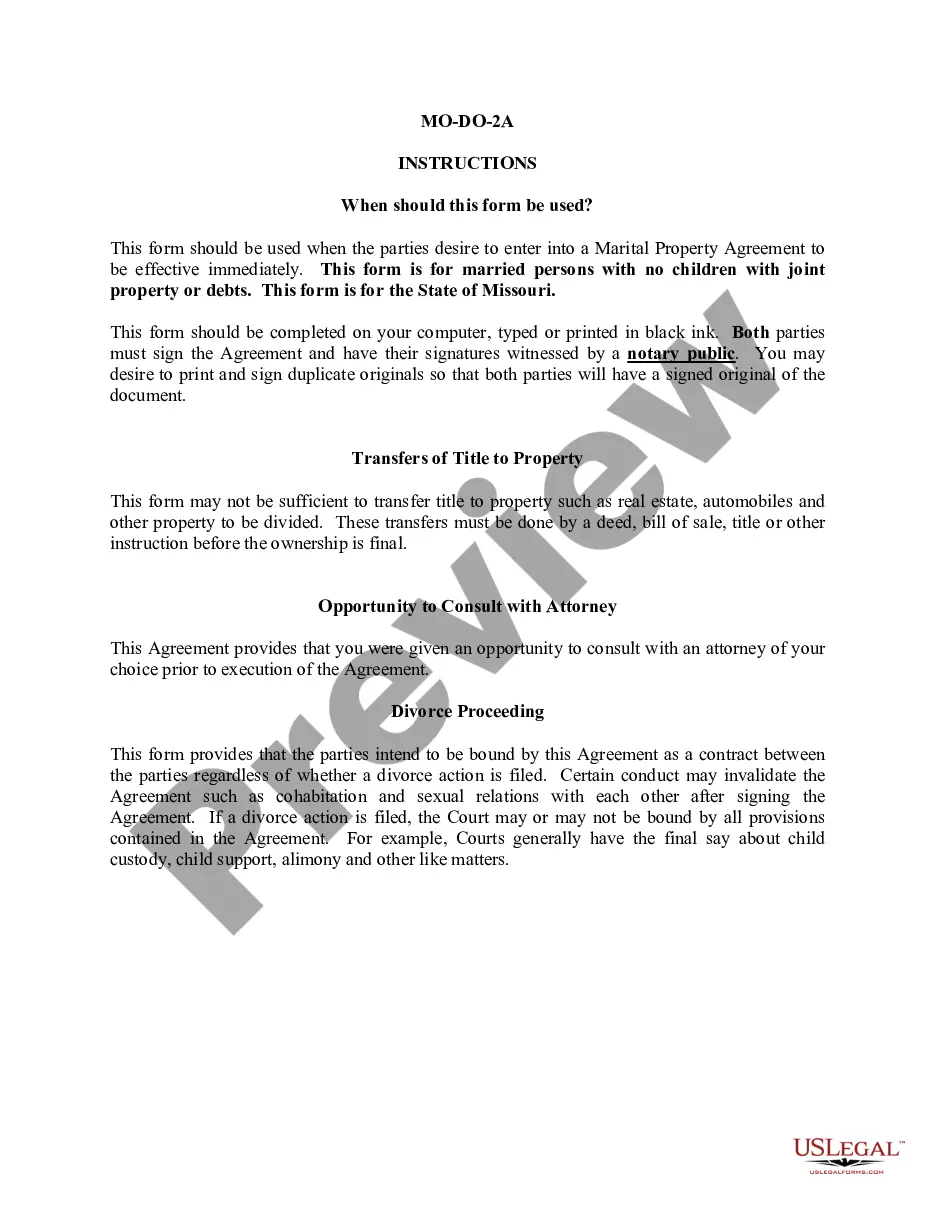

You are able to invest hours on the web attempting to find the legitimate document design that suits the federal and state specifications you will need. US Legal Forms gives a large number of legitimate varieties which can be analyzed by experts. You can easily acquire or printing the Oregon Subrogation Agreement in Favor of Medical Provider from our services.

If you currently have a US Legal Forms account, it is possible to log in and click the Download switch. Following that, it is possible to complete, revise, printing, or sign the Oregon Subrogation Agreement in Favor of Medical Provider. Each and every legitimate document design you buy is yours permanently. To have yet another copy of any bought develop, proceed to the My Forms tab and click the related switch.

If you are using the US Legal Forms web site the very first time, follow the easy instructions listed below:

- Initial, ensure that you have selected the correct document design for that county/city that you pick. Look at the develop explanation to make sure you have selected the right develop. If offered, utilize the Review switch to appear from the document design at the same time.

- If you would like find yet another edition of the develop, utilize the Research field to get the design that meets your needs and specifications.

- When you have located the design you need, just click Get now to carry on.

- Choose the rates program you need, key in your qualifications, and register for a free account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal account to purchase the legitimate develop.

- Choose the format of the document and acquire it for your system.

- Make changes for your document if required. You are able to complete, revise and sign and printing Oregon Subrogation Agreement in Favor of Medical Provider.

Download and printing a large number of document templates using the US Legal Forms website, that provides the most important assortment of legitimate varieties. Use specialist and express-specific templates to tackle your company or individual requirements.

Form popularity

FAQ

In this case, the court advised that under Oregon law, an insurer who makes an outright payment to its insured is subrogated to the insured's claims arising from the loss for which payment was made. A subrogated insurer becomes the owner of the claim and is the real party in interest in any action to enforce the claim.

When factoring comparative negligence and improper referrals, the recovery rate should be somewhere in the range of 85-90%. This requires adjusters properly identifying subrogation, assessing comparative negligence and pursuing only what they are entitled to.

This right is called subrogation and is an equitable doctrine. A person can satisfy his/her loss that is created by the wrongful act or omission of another person by stepping into the shoes of another and recovering on the claim from the wrongdoer.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.