Oregon Debt Adjustment Agreement with Creditor

Description

How to fill out Debt Adjustment Agreement With Creditor?

If you wish to aggregate, obtain, or print legal document templates, utilize US Legal Forms, the finest variety of legal forms that are accessible online.

Utilize the site’s simple and user-friendly search to find the documents you require. Various templates for business and personal purposes are categorized by types and claims, or keywords.

Employ US Legal Forms to locate the Oregon Debt Adjustment Agreement with Creditor in just a few clicks.

Every legal document template you purchase is your property permanently. You will have access to every form you acquired in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and acquire, and print the Oregon Debt Adjustment Agreement with Creditor using US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and select the Download option to retrieve the Oregon Debt Adjustment Agreement with Creditor.

- You can also access forms you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/country.

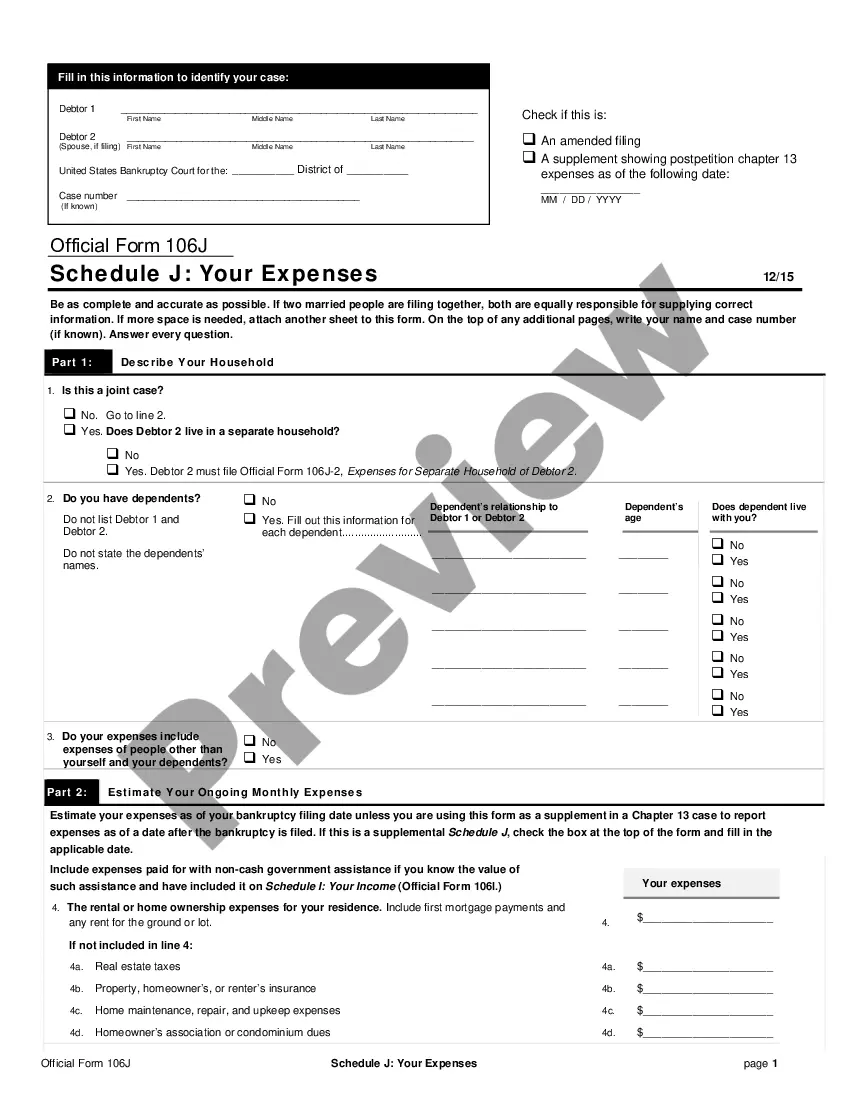

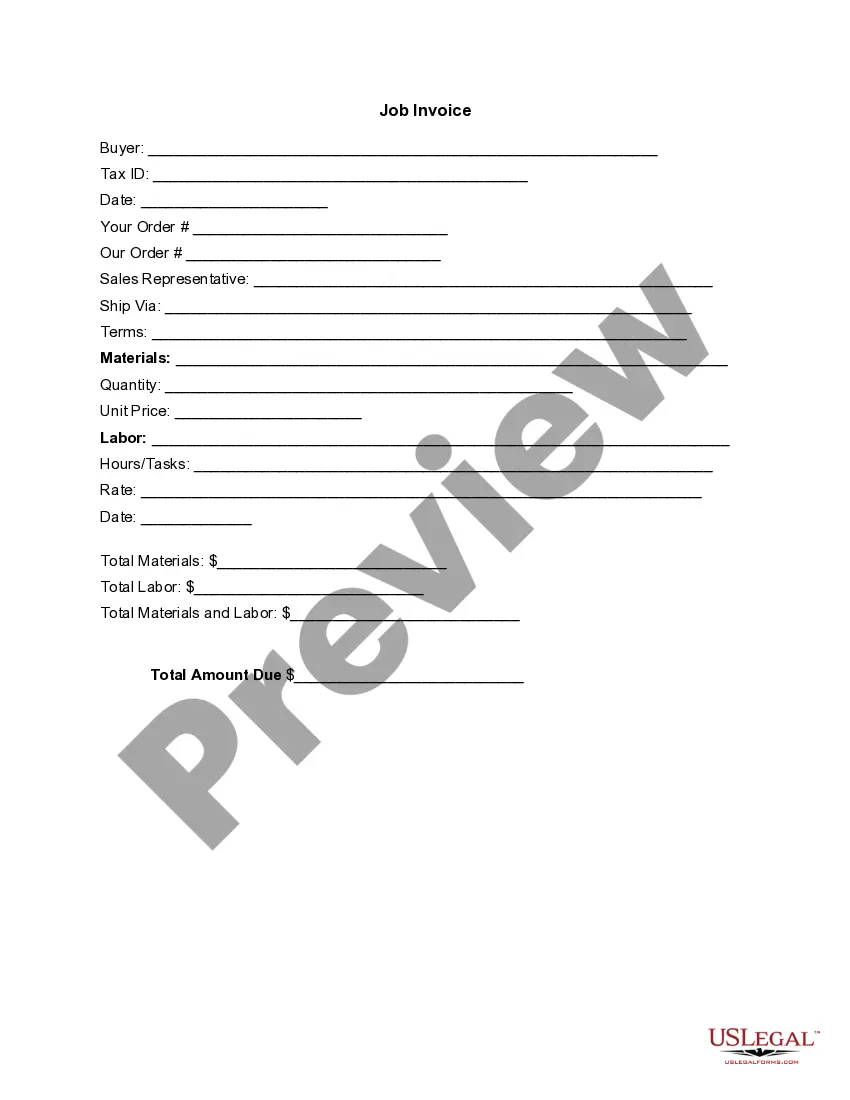

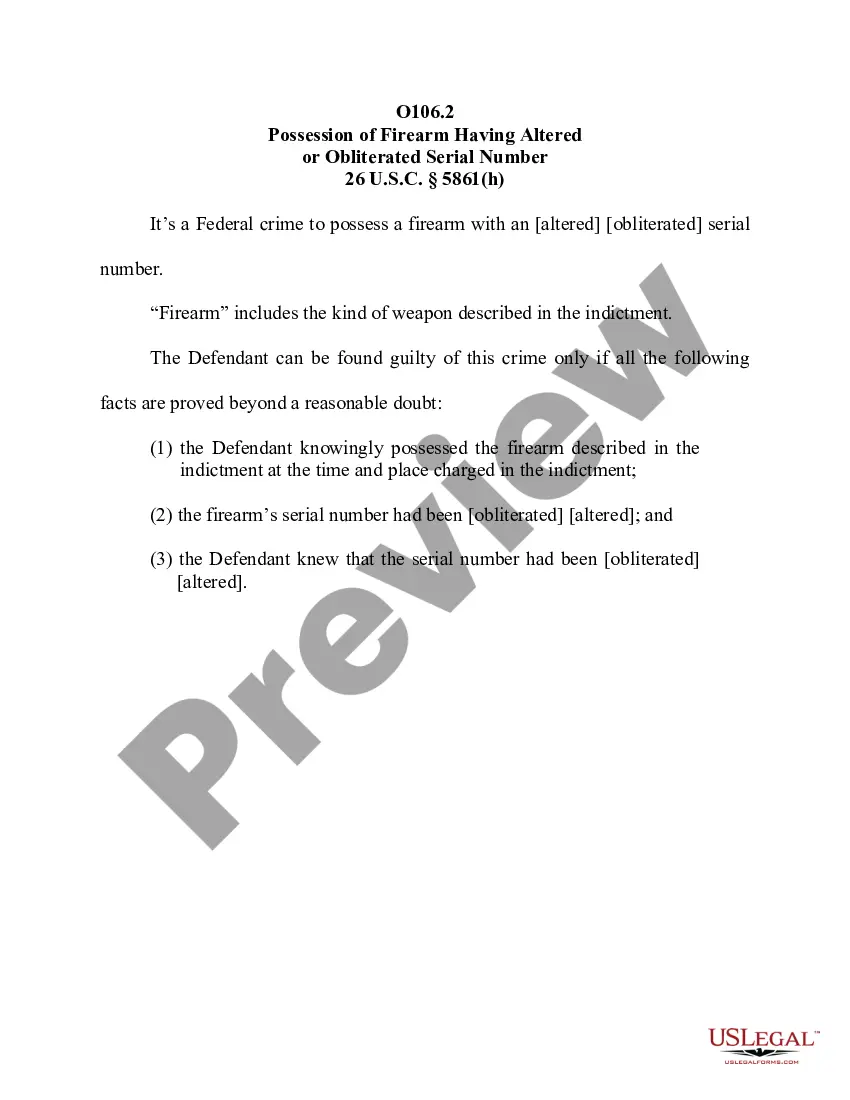

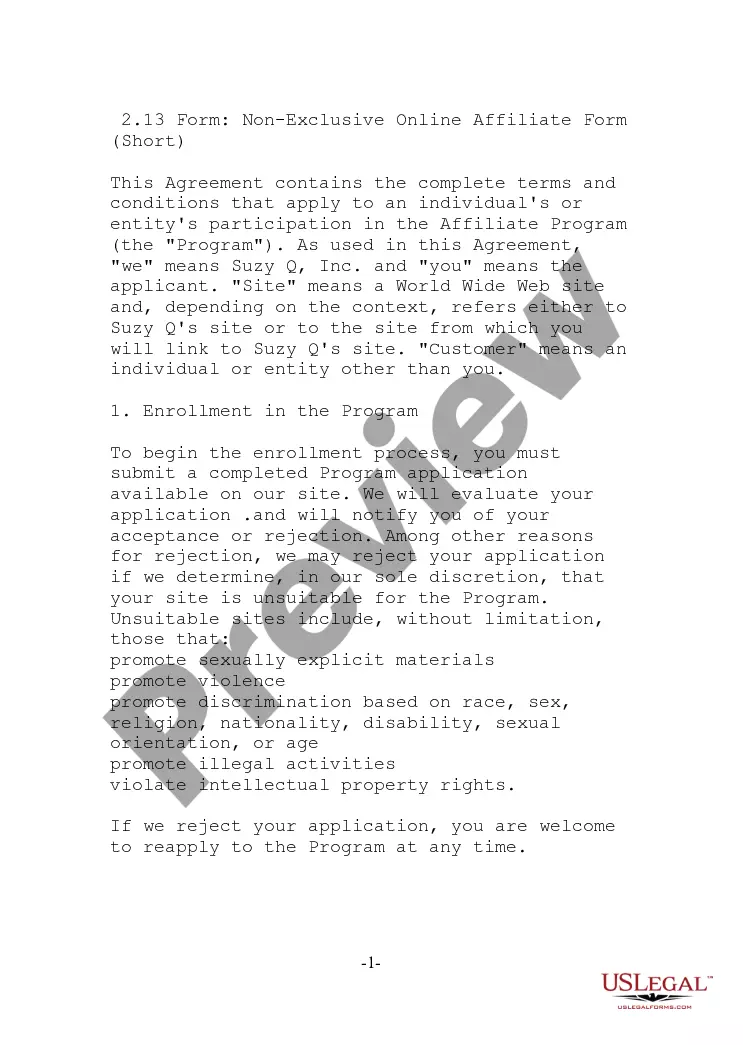

- Step 2. Use the Review option to inspect the form’s details. Do not forget to read the information.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now option. Select the pricing plan you prefer and enter your credentials to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oregon Debt Adjustment Agreement with Creditor.

Form popularity

FAQ

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

How long does a judgment lien last in Oregon? A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly.

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

In Oregon, the statute of limitations for debt is six years. This means a creditor has up to six years to file a lawsuit to collect on the debt. The six-year statute of limitations applies to medical debt, credit card debt, auto loan debt, etc.

Can creditors refuse your DMP? Yes. Creditors are not obliged to accept a debt solution but they could accept a Debt Management Plan if they feel this is the best way for them to recover the money owed to them.

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred - this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

Creditors are not obliged to accept a debt solution but they could accept a Debt Management Plan if they feel this is the best way for them to recover the money owed to them. You will have to put forward a firm and fair offer of payment to your creditors and outline how much you can afford to pay back each month.