Oregon Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

You may spend time online looking for the legal document format that meets the state and federal regulations you need.

US Legal Forms offers a wide variety of legal templates that can be reviewed by professionals.

It is easy to obtain or print the Oregon Sample Letter for Insufficient Amount to Reinstate Loan from my service.

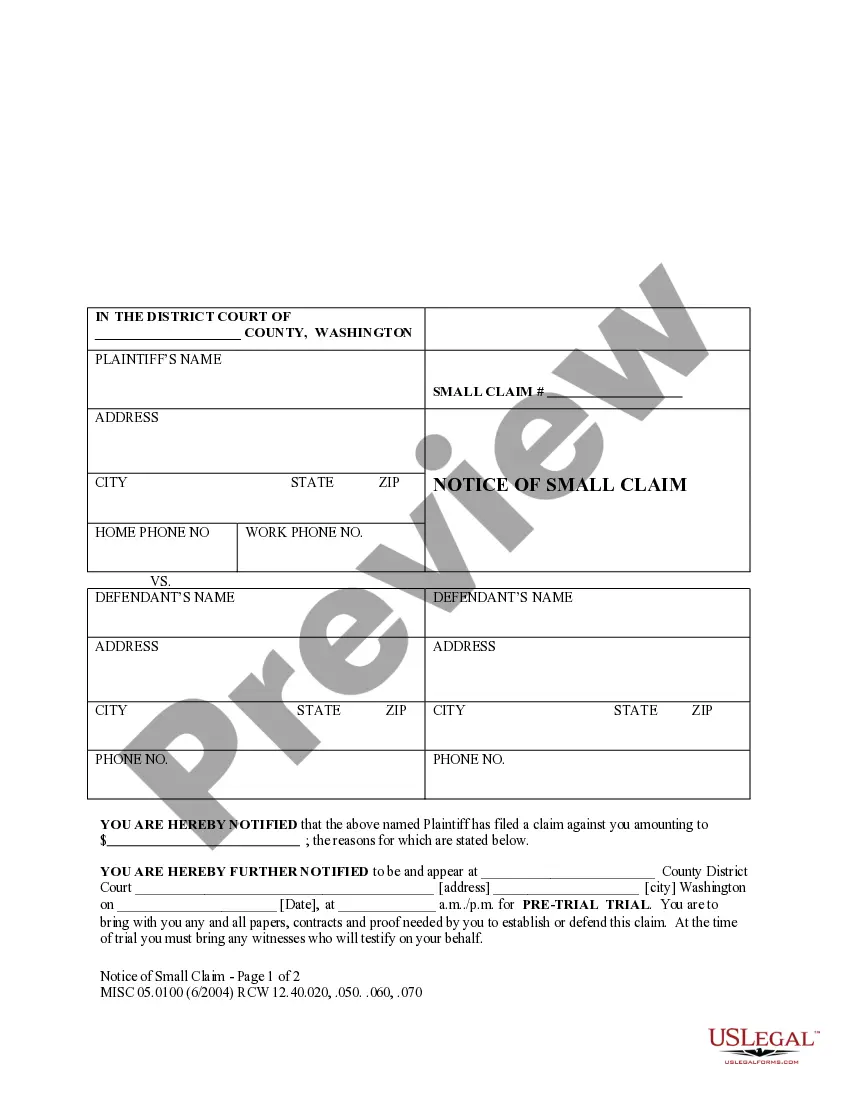

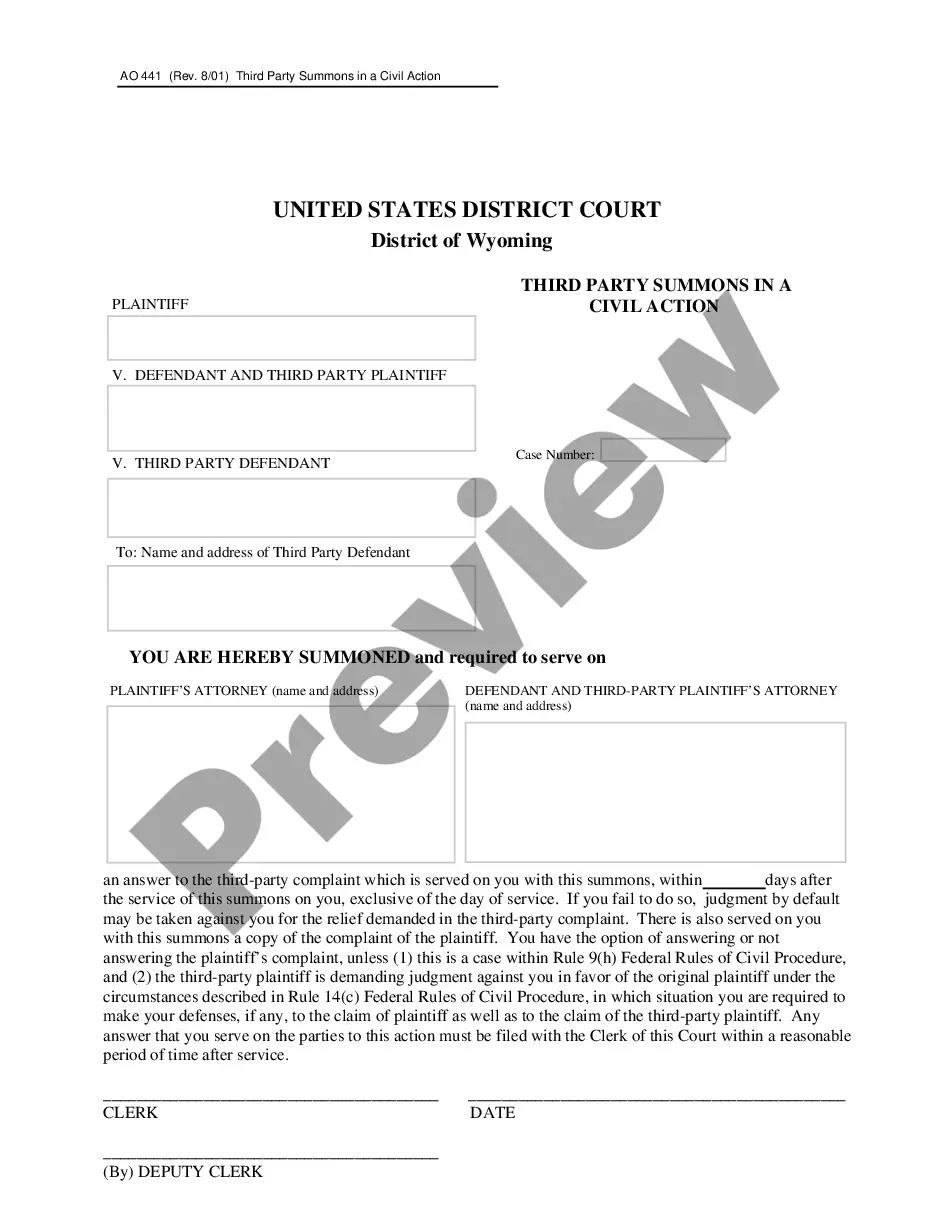

If available, utilize the Preview button to review the format simultaneously.

- If you possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the Oregon Sample Letter for Insufficient Amount to Reinstate Loan.

- Each legal document format you purchase belongs to you forever.

- To retrieve an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the region or area of your choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

Mortgage lenders operating without a license in Oregon may face severe penalties, including fines and potential legal actions. This regulatory framework helps protect consumers from predatory lending practices. If you find yourself in a challenging situation with an unlicensed lender, addressing your concerns with necessary documentation, such as an Oregon Sample Letter for Insufficient Amount to Reinstate Loan, can support your case.

The Oregon Trust Deed Act governs the use of trust deeds in real estate transactions in Oregon. It outlines the rights and responsibilities of all parties involved in the transaction. Understanding this act helps homeowners navigate foreclosure issues, and utilizing resources like an Oregon Sample Letter for Insufficient Amount to Reinstate Loan could improve your position.

A notice of intent to foreclose is a formal document notifying you that the lender plans to initiate foreclosure due to non-payment. It often outlines the reasons for the foreclosure and provides a timeline for resolution. Responding promptly, perhaps with an Oregon Sample Letter for Insufficient Amount to Reinstate Loan, can be crucial in contesting the action.

A deed in lieu of foreclosure is a legal process where you voluntarily transfer your property to the lender to avoid foreclosure proceedings. This option can be beneficial for homeowners who want to minimize the damage to their credit score. If you are considering this path, ensure that you have a solid understanding of the implications, possibly using an Oregon Sample Letter for Insufficient Amount to Reinstate Loan in negotiations.

To stop a foreclosure in Oregon, you can explore several options, including loan modification, repayment plans, or filing for bankruptcy. It is essential to communicate with your lender as soon as possible. Utilizing an Oregon Sample Letter for Insufficient Amount to Reinstate Loan can effectively express your intent to resolve the situation and keep your home.

The primary individual who suffers the most in a foreclosure is often the homeowner, who faces loss of property and financial ruin. Additionally, families and communities feel the impact due to decreased property values and neighborhood stability. It’s crucial to explore options like an Oregon Sample Letter for Insufficient Amount to Reinstate Loan to prevent this situation.

A danger notice in Oregon foreclosure is a document that informs the homeowner of the impending foreclosure process. It serves to alert you that your mortgage is in default and that legal action may follow if the issues are not resolved. Responding appropriately, potentially with an Oregon Sample Letter for Insufficient Amount to Reinstate Loan, can help mitigate risks of losing your home.

Foreclosure in Oregon typically takes around six months to a year, depending on the circumstances. The timeline can vary based on the complexity of the case and whether the homeowner contests the foreclosure. If you receive an Oregon Sample Letter for Insufficient Amount to Reinstate Loan, it may indicate a critical point in this timeline, urging you to act quickly.