Oregon LLC Operating Agreement for Rental Property

Description

How to fill out LLC Operating Agreement For Rental Property?

Have you ever found yourself in a situation where you require documents for both organizational or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast selection of form templates, such as the Oregon LLC Operating Agreement for Rental Property, designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Oregon LLC Operating Agreement for Rental Property anytime if needed. Just choose the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can utilize for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon LLC Operating Agreement for Rental Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/area.

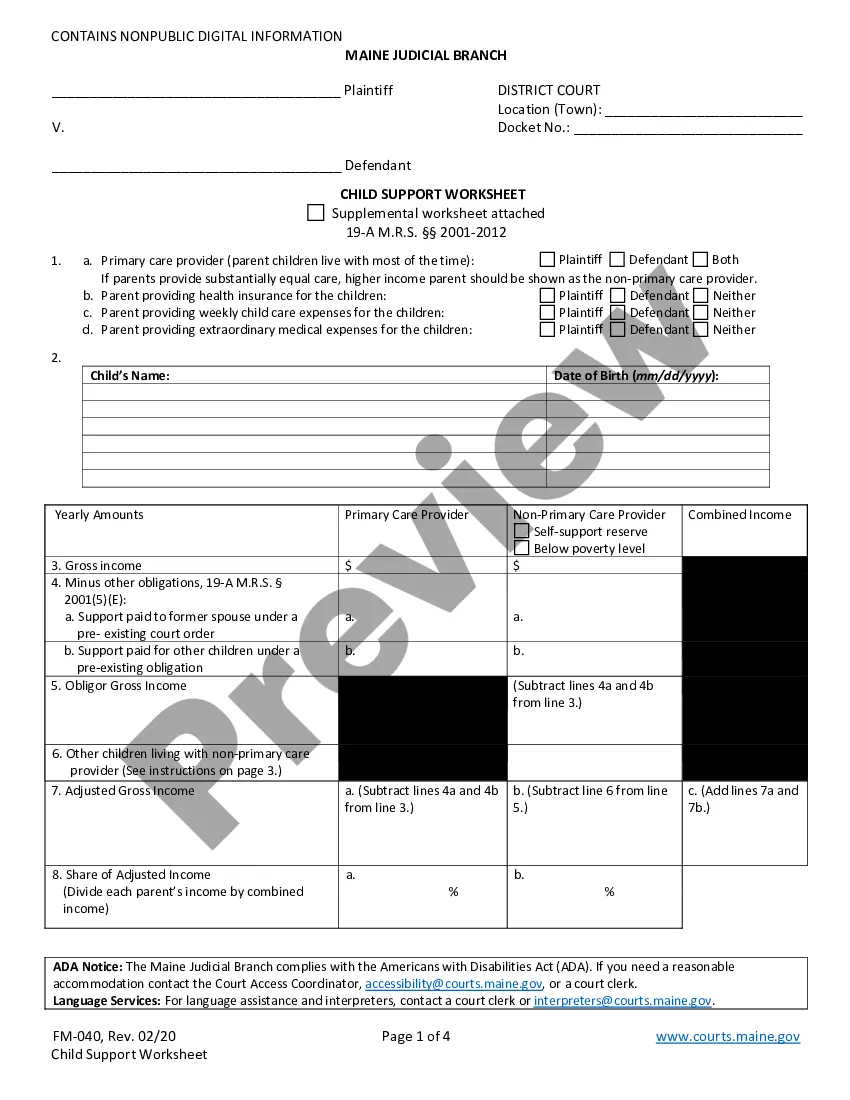

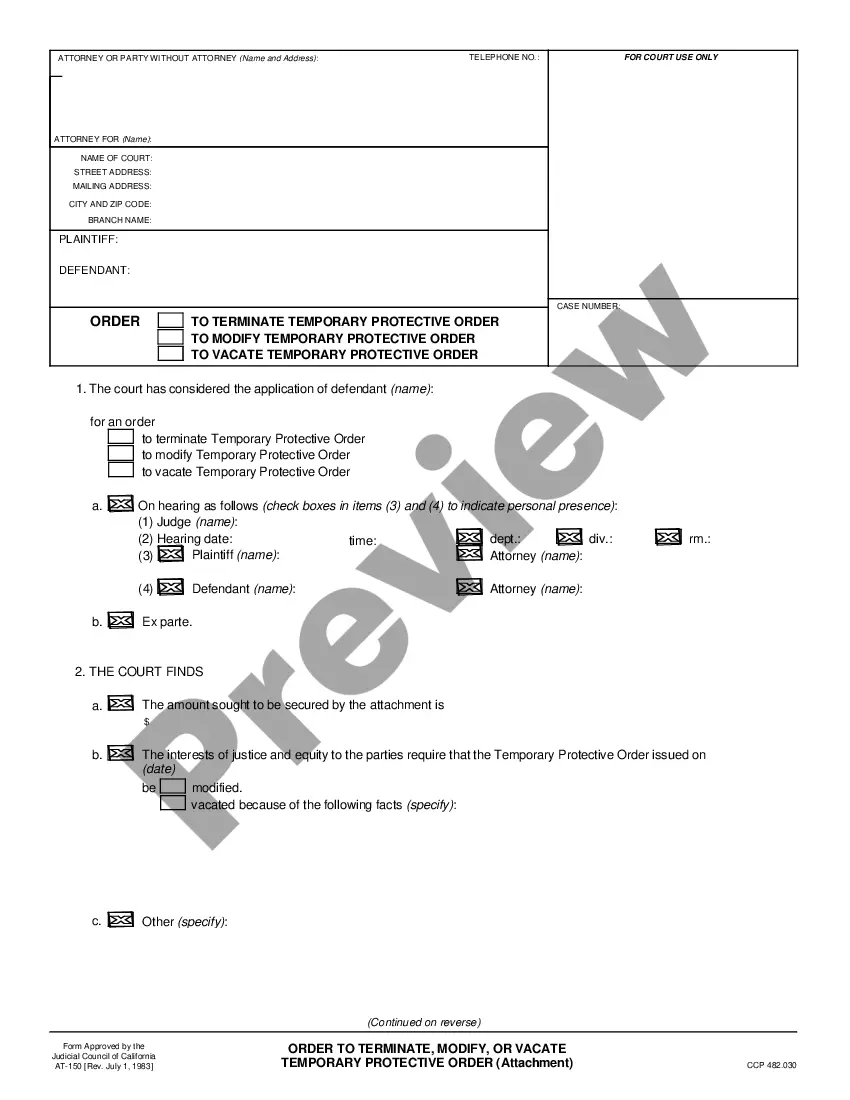

- Utilize the Preview button to view the form.

- Review the details to confirm that you have selected the appropriate form.

- If the form is not what you’re looking for, use the Search area to locate the form that satisfies your needs and requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, fill in the required information to set up your account, and purchase the order using your PayPal or credit card.

Form popularity

FAQ

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Oregon does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

An Oregon LLC operating agreement is a legal document that is used to provide the establishment of a company, of any size, their company policies, procedures, relationships among members (when applicable), and other vital aspects of the company. This document is not required in Oregon in order to do business.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.