Oregon Release and Indemnification of Personal Representative by Heirs and Devisees

Description

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

Are you presently in a position where you frequently require documents for either organizational or personal purposes on a daily basis.

There is a multitude of legal document templates accessible online, but finding ones you can trust can be challenging.

US Legal Forms provides thousands of document templates, such as the Oregon Release and Indemnification of Personal Representative by Heirs and Devisees, which are designed to comply with state and federal regulations.

Once you locate the appropriate template, click Get now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Release and Indemnification of Personal Representative by Heirs and Devisees template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/state.

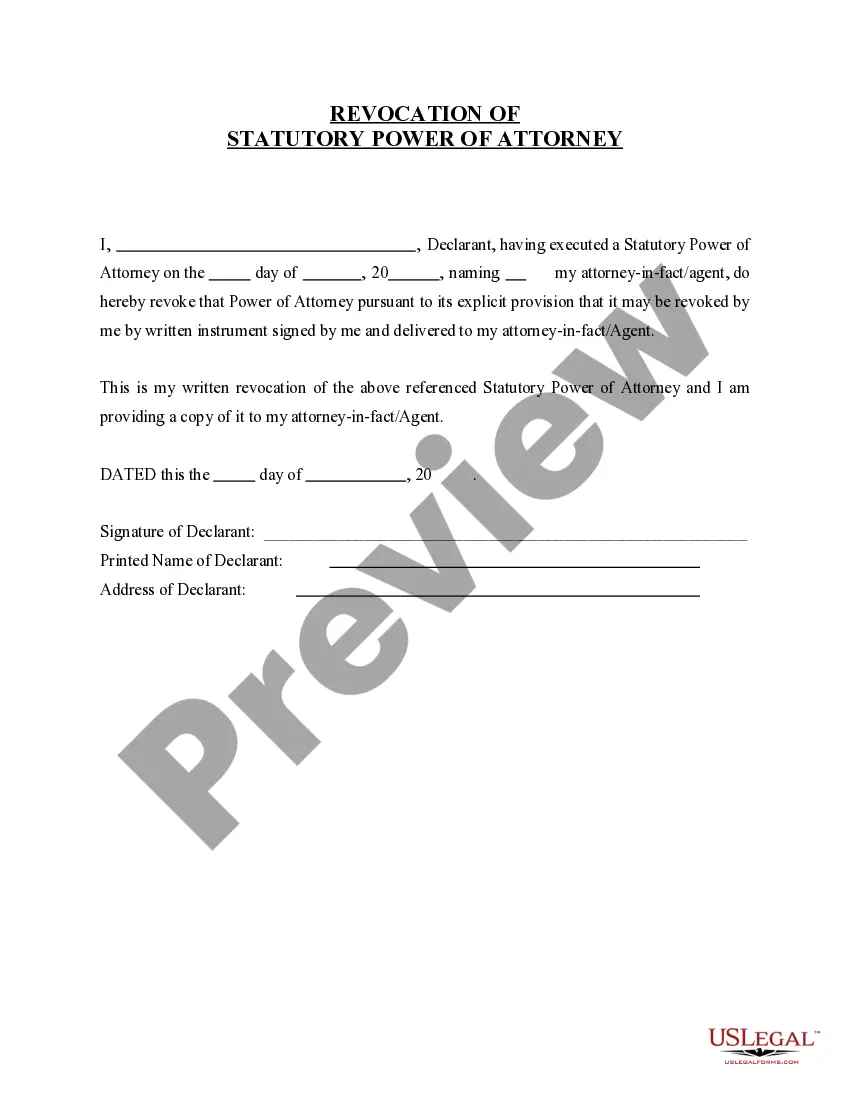

- Use the Review button to examine the document.

- Read the description to confirm that you have chosen the correct template.

- If the form is not what you're looking for, use the Search field to find the template that meets your requirements.

Form popularity

FAQ

When someone dies without a will in Oregon, their bank accounts typically become part of the estate. The court appoints a personal representative, who will manage the estate's assets, including bank accounts. Heirs and devisees may need an Oregon Release and Indemnification of Personal Representative to streamline the distribution process, ensuring clarity in asset management.

A small estate affidavit is just a written legal document you can get a small estate. affidavit from the county clerk's office or have an attorney prepare one. Administering the estate with an affidavit is one of the key ways to avoid probate.

(ORS 114.515) Estates that are eligible for a administration by affidavit are those that have probate assets: Less than $200,000 worth of real estate. Less than $75,000 worth of personal property.

The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.

Step 1 Wait Thirty (30) Days. The small estate affidavit can only be filed after thirty (30) days have passed since the decedent's death.Step 2 No Personal Representative.Step 3 Complete Forms.Step 4 File With Court.Step 5 Send to Estate Recipients.

The best method is by putting the estate in a revocable living trust. The person named as beneficiary would automatically receive everything in the trust when the owner passes away. In some cases, you may not be able to avoid probate entirely, but you can keep some assets out of it.

You can use the simplified small estate process in Oregon if the fair market value of the estate is $275,000 or less, and not more than $75,000 of the estate is personal property and not more than $200,000 is real estate.

Probate can be started immediately after death and takes a minimum of four months. If the estate includes property that takes a while to sell, or if there are complicated tax or other matters, probate can last much longer. A small estate proceeding cannot be filed until 30 days after death and is complete upon filing.

Do All Estates Have to Go Through Probate in Oregon? All estates must go through probate unless they meet one of the few exceptions. However, some estates may qualify for a simplified version or probate that is less complicated and time-consuming. It is known as a small estate proceeding.

An affidavit can be filed if the fair market value of the estate is $275,000 or less. Of that amount, no more than $200,000 can be attributable to real property and no more than $75,000 can be attributable to personal property.