Oregon Sample Letter regarding Corrected Waiver of Process

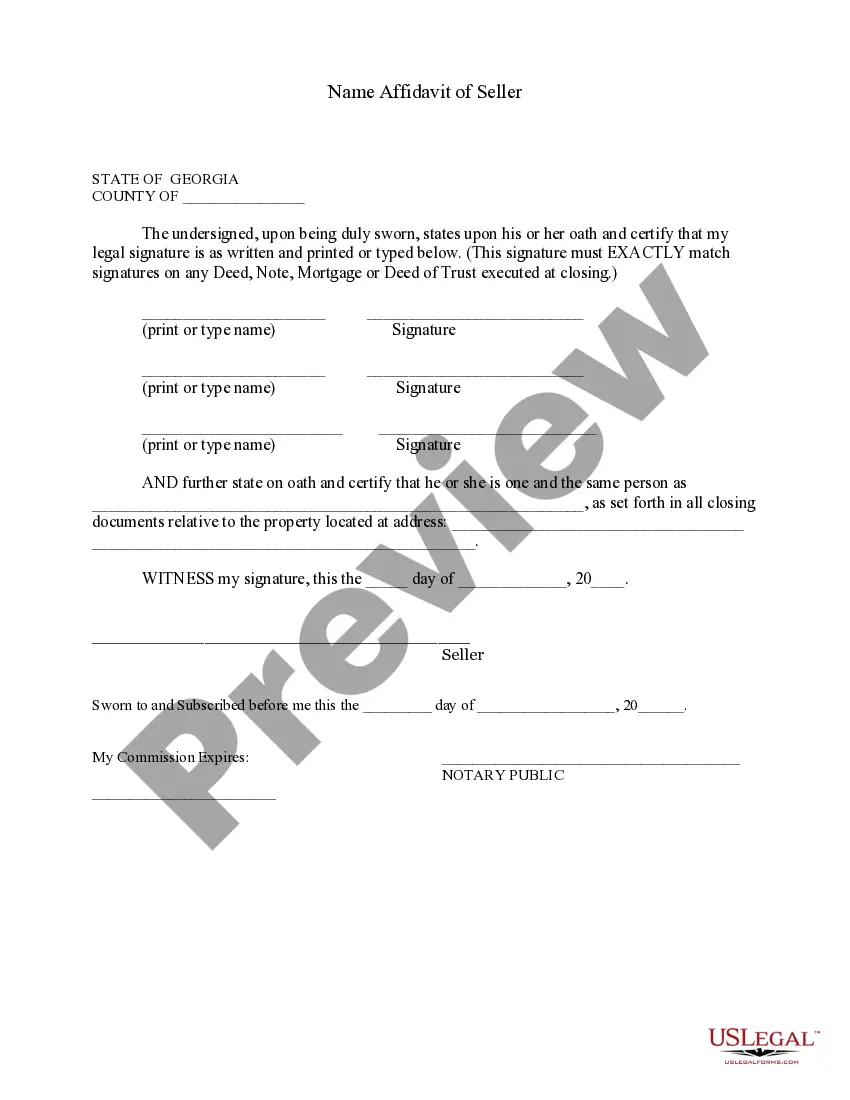

Description

How to fill out Sample Letter Regarding Corrected Waiver Of Process?

Are you currently inside a position the place you need to have documents for both business or personal reasons virtually every day? There are a variety of legal papers themes available online, but getting versions you can depend on is not easy. US Legal Forms gives a large number of form themes, much like the Oregon Sample Letter regarding Corrected Waiver of Process, that happen to be composed to meet state and federal requirements.

If you are presently informed about US Legal Forms internet site and possess an account, simply log in. After that, you are able to acquire the Oregon Sample Letter regarding Corrected Waiver of Process template.

Unless you come with an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the form you will need and make sure it is to the appropriate area/county.

- Make use of the Review button to examine the shape.

- Read the information to ensure that you have selected the proper form.

- When the form is not what you are trying to find, use the Look for area to get the form that meets your requirements and requirements.

- Whenever you get the appropriate form, click on Acquire now.

- Pick the rates prepare you need, complete the required details to make your account, and buy the order using your PayPal or Visa or Mastercard.

- Pick a convenient document format and acquire your version.

Discover each of the papers themes you possess bought in the My Forms menu. You can get a additional version of Oregon Sample Letter regarding Corrected Waiver of Process at any time, if required. Just select the needed form to acquire or print the papers template.

Use US Legal Forms, one of the most comprehensive variety of legal kinds, to save lots of time and prevent errors. The assistance gives skillfully created legal papers themes which you can use for a variety of reasons. Produce an account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

Rule 4.101 - Removal of No Contact Orders (1) A victim wishing to remove a no contact order imposed under ORS 135.250 or ORS 135.247 must submit a written petition for filing or appear personally at a hearing on the matter.

No statute of limitation runs on a tax self-assessed or additionally assessed by the Department in the time allowed by ORS 314.410 and collectible by warrant. However, the statute of 10 years limitation on judgment liens begins to run on a tax lien as soon as the tax warrant is filed pursuant to ORS 314.430.

You may appeal magistrate decisions to the Regular Division of the Oregon Tax Court. To appeal, file your complaint with the court clerk within 60 days (not two months) after the date of the magistrate's decision. The tax court clerk will notify you of the trial date and time.

The Oregon Tax Court has exclusive jurisdiction to hear tax appeals under state laws, including personal income tax, property tax, corporation excise tax, timber tax, local budget law, and property tax limitations. The Court has two divisions: the Magistrate Division and the Regular Division.

File an original notice of appeal with the Court of Appeals. You must attach to the notice of appeal a copy of the decision that you wish to have reviewed. and file it with the Court of Appeals. You can download the motion and instructions at .

If you disagree with our decision, you can appeal to an independent tribunal. You can also appeal against your Council Tax band or the date of a completion notice. Please choose the area your challenge relates to: liability.

Notice of Adjustment Oregon has changed the amount of interest this year on the underpayment of estimated tax shown on your 2020 tax return. Interest on underpayment of estimated tax is charged if you don't pay enough by the due date of withholding or by making estimated tax payments.

In most cases, appeal your property value by filing a petition with the Board of Property Tax Appeals (BOPTA) clerks in the county where the property is located. This must be done after you receive your tax statement, but before December 31, or the next business day if December 31 falls on a weekend or holiday.