Oregon Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

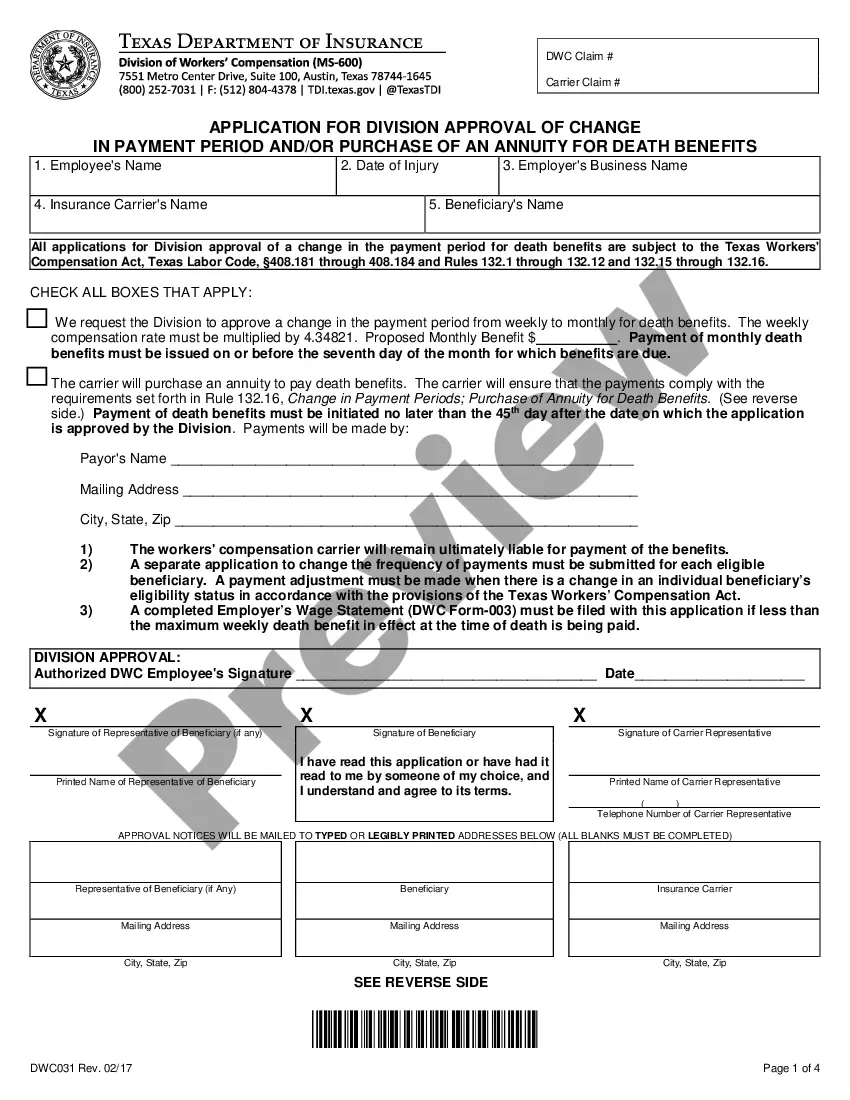

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Selecting the optimal legally approved document template can be somewhat of a challenge.

Naturally, there are numerous templates accessible online, but how can you acquire the legally approved template you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Oregon Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which can be utilized for business and personal purposes.

First, ensure that you have selected the correct form for your city/region. You can browse the form using the Preview button and read the form details to confirm this is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to locate the Oregon Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Use your account to verify the legally approved forms you have previously acquired.

- Navigate to the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

Form popularity

FAQ

If you do not receive a 1099-S after selling your home, it’s important to take action. You should contact your closing agent or attorney to verify whether the form was filed. Not receiving a 1099-S could lead to potential penalties for failing to report income. In instances involving the Oregon Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, ensure you are aware of your rights and reporting decisions.

Forms OR-40, OR-40-P and OR-40-N can be found at or you can contact us to order it.

Oregon Department of Revenue. 2020 Form OR-40. Oregon Individual Income Tax Return for Full-year Residents.

You can take the gain exclusion as long as you considered the home your "primary residence" for 2 of the last 5 years. If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income.

If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income. You may qualify to exclude up to $500,000 of that gain if you file a joint return with your spouse. See Sale of Your Home for more information on the exclusion.

Oregon does not have a sales tax exempt certificate. If you're an Oregon resident working or shopping in a state with a sales tax and want information about that state's sales tax policy regarding nonresidents, consult that state's taxation agency.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

This is taxed at the standard income tax rate. If you have owned your property for longer than one year it will be subjected to a different tax rate. This is a long-term capital gain. The rate can be anywhere between 0% to 20% but most often falls within the 15% range.

Download forms from the Oregon Department of Revenue website . Order forms by calling 1-800-356-4222. Contact your regional Oregon Department of Revenue office.

If you receive an informational income-reporting document such as Form 1099-S, Proceeds From Real Estate Transactions, you must report the sale of the home even if the gain from the sale is excludable. Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income.