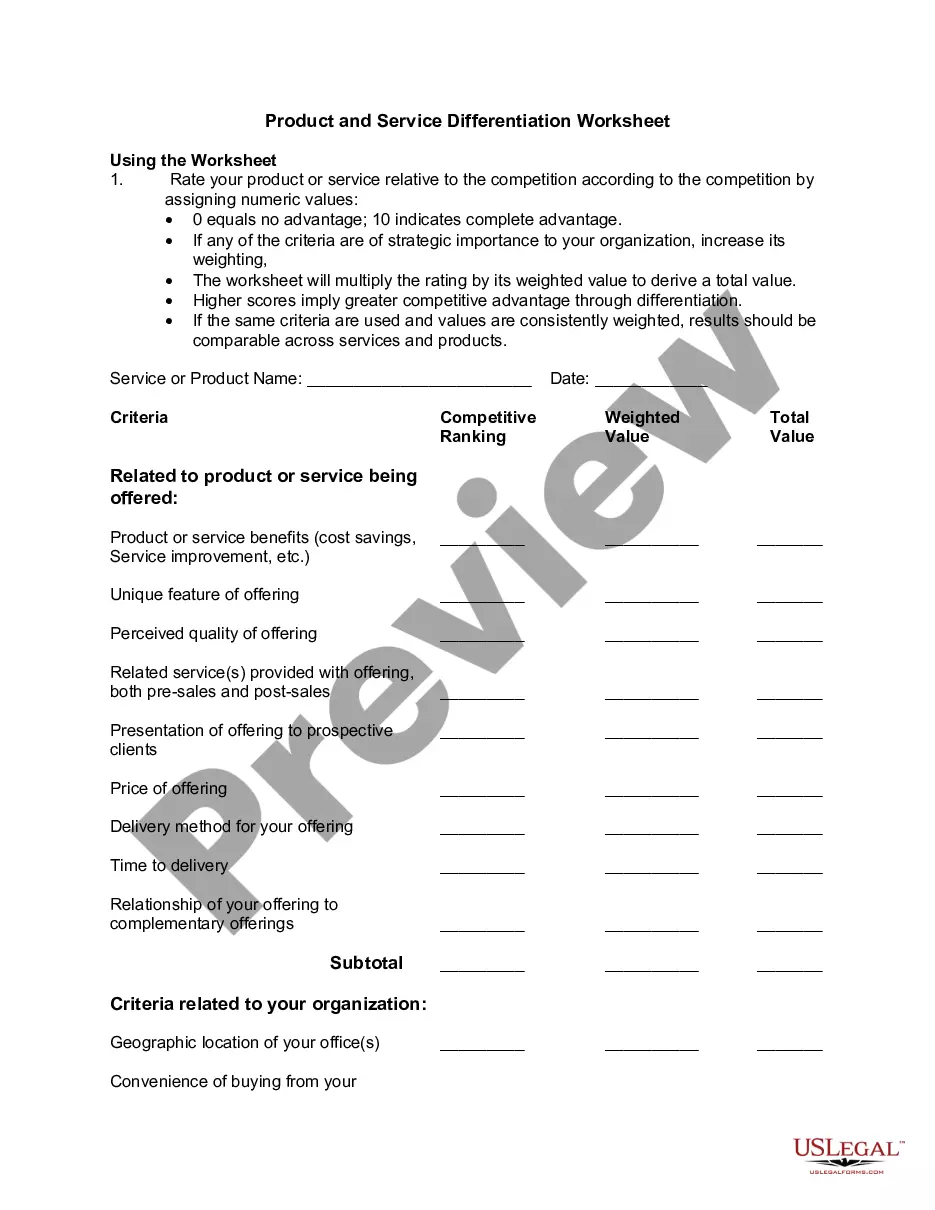

Oregon Worksheet - New Product or Service

Description

How to fill out Worksheet - New Product Or Service?

Are you currently in the location where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but obtaining ones you can trust isn’t easy.

US Legal Forms provides thousands of form templates, such as the Oregon Worksheet - New Product or Service, which are designed to meet federal and state requirements.

Choose the pricing plan you desire, complete the required information to create your account, and finalize the transaction using your PayPal or credit card.

Select a convenient document format and download your copy. You can access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Oregon Worksheet - New Product or Service at any time, if necessary. Just click the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Worksheet - New Product or Service template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to examine the form.

- Check the description to make sure that you have selected the right form.

- If the form isn’t what you’re looking for, use the Lookup section to find the form that fulfills your needs and requirements.

- Once you have the correct form, click on Purchase now.

Form popularity

FAQ

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Oregon employers must withhold 0.1% (0.001) from each employee's gross pay.

Should I 0 or 1 on a Form W4 for Tax Withholding Allowance being a dependent? If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

To claim the surplus "Kicker" credit on your 2021 Oregon return, please follow the steps listed below.Log into the account.Edit the Oregon return.Credits.Refundable Credits.Surplus Credit (Kicker)Complete the necessary information from your 2020 return to have the credit applied to your 2021 return.

Oregon income tax withholding refers to the amount of Oregon personal income taxes that are withheld from your paychecks to cover your anticipated Oregon tax liability for the year. By law, your employer must withhold a portion of your wages based on your allowances and send the funds to the Department of Revenue.

Box 14 Employers can use W-2 box 14 to report information like:A member of the clergy's parsonage allowance and utilities.Any charitable contribution made through payroll deductions.Educational assistance payments.Health insurance premium deductions.Nontaxable income.State disability insurance taxes withheld.More items...?

The code "ORSTTW" designates the Oregon State Transit Tax Withholding. This is a component of your total state taxes paid for the year, but not part of your income tax withholding.

Q: What is a withholding allowance? A: An allowance represents a portion of your income that is exempt from tax. On your Oregon tax return, this portion can take the form of a credit against tax, a deduction, or a subtraction. The more allowances you claim on Form OR-W-4, the less tax your employer will withhold.