Oregon Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

It is feasible to spend hours online searching for the legal document format that complies with the state and federal requirements you need.

US Legal Forms offers a plethora of legal templates that have been evaluated by experts.

You can easily download or print the Oregon Telecommuting Worksheet from my service.

If available, use the Review button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Oregon Telecommuting Worksheet.

- Every legal document template you obtain is yours permanently.

- To get an additional copy of any purchased form, go to the My documents section and click the appropriate button.

- If you’re using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Check the form description to ensure you have chosen the right form.

Form popularity

FAQ

If you want to know if a job can be done remotely, use technology as a guide in determining if that job can be done virtually. A run through FlexJobs' list of 100 Top Companies with Remote Jobs can give you a sense of the broad landscape for jobs that can be done from home.

You must withhold tax from all wages paid to Oregon resident employees working in Oregon, regardless of whether they work out of your physical location in Oregon or work/telecommute from their residence.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Positions that can be regularly performed remotely are those that: o Don't require a traditional office or clinical space to interact with internal and external customers. o Have access to required systems and software associated with the position responsibilities. o Have remote access to files. o Have supervisors who

Telework: Working from home, a satellite office, or shared space rather than commuting to a nearby office. Remote Work: Working from home, a satellite office, or shared space regardless if an office exists in close proximity to you.

Employers must withhold Oregon state income tax from all wages paid to Oregon resident employees working in Oregon (including teleworkers), regardless of whether they work out of the employer's physical location in Oregon or work/telecommute from their residence.

Remote workers do not have to file nonresident state tax returns unless they physically travel to another state and perform work while they are there. In certain cases, a reciprocity agreement may protect workers from taxes in different states. Not all states levy a state income tax.

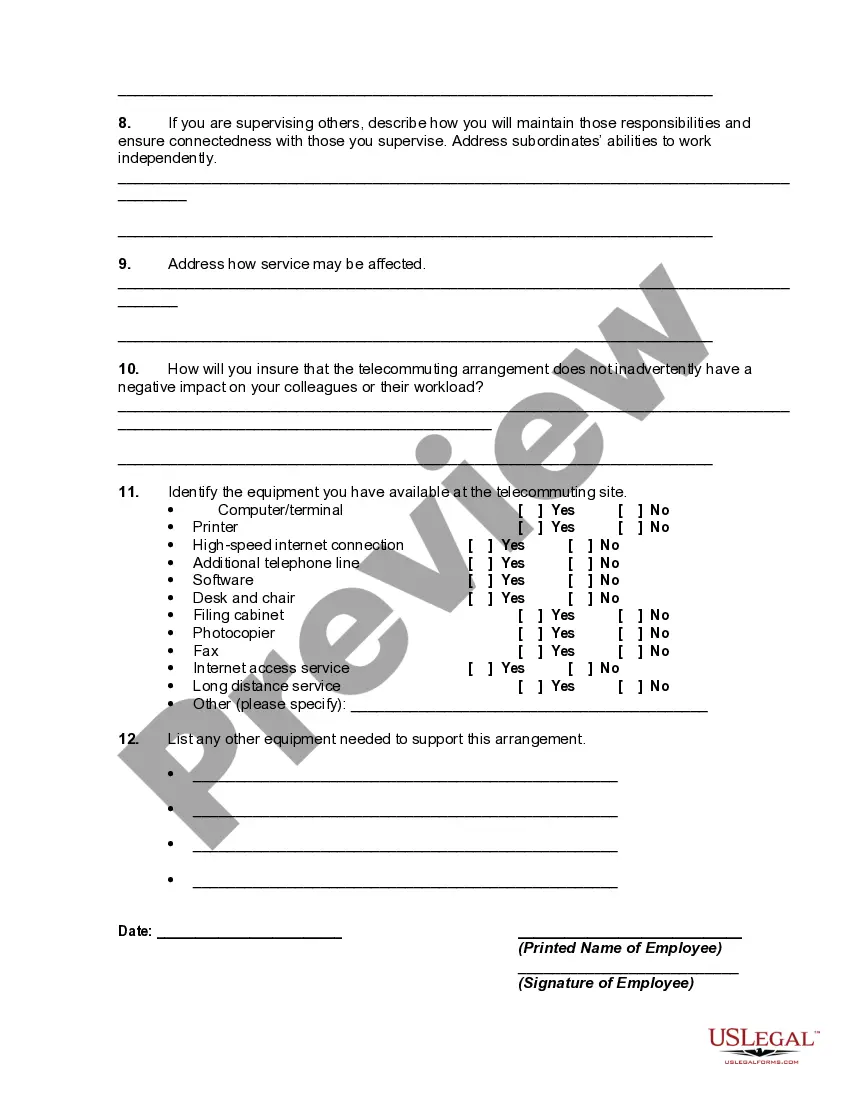

For instance, remote workers may need:Computer/laptop.Internet connection.Mobile device and service.Apps or software (particularly for timekeeping and scheduling).Printers (if documents cannot be utilized virtually for the position).Supplies (pens, paper, scanner).Transportation (to visit clients, etc.)

Employees' state of residence and the state where they work affect which state and local taxes they pay. Sometimes, if employees live in one state but have been working in another, they'll receive a credit on their resident tax return to offset the nonresident state tax liability.

The self-employed do not qualify as telecommuters because they lack employee status.