28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

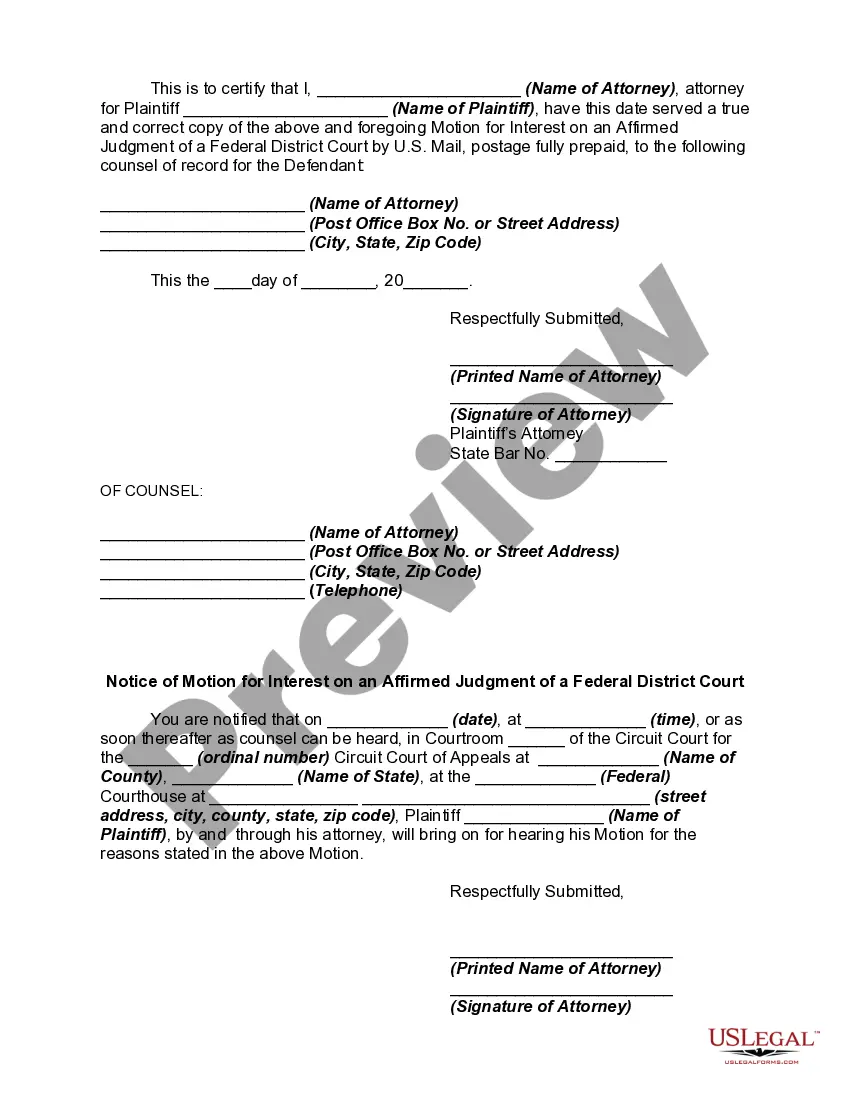

Oregon Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

Are you inside a position in which you require papers for either company or personal uses virtually every day time? There are a lot of authorized document themes available on the Internet, but finding ones you can trust is not effortless. US Legal Forms delivers 1000s of develop themes, such as the Oregon Motion for Interest on an Affirmed Judgment of a Federal District Court, which are published to fulfill federal and state requirements.

Should you be previously acquainted with US Legal Forms internet site and have your account, basically log in. Next, it is possible to down load the Oregon Motion for Interest on an Affirmed Judgment of a Federal District Court format.

Should you not offer an account and need to begin using US Legal Forms, follow these steps:

- Discover the develop you need and ensure it is for the right metropolis/region.

- Take advantage of the Review key to review the shape.

- Look at the outline to actually have chosen the appropriate develop.

- If the develop is not what you`re searching for, use the Lookup discipline to obtain the develop that suits you and requirements.

- Once you get the right develop, click on Buy now.

- Select the prices prepare you want, submit the necessary information to produce your bank account, and buy the order making use of your PayPal or charge card.

- Decide on a handy document format and down load your duplicate.

Find all the document themes you may have purchased in the My Forms menus. You may get a additional duplicate of Oregon Motion for Interest on an Affirmed Judgment of a Federal District Court anytime, if required. Just click on the necessary develop to down load or printing the document format.

Use US Legal Forms, one of the most extensive assortment of authorized varieties, to conserve time and prevent blunders. The services delivers expertly produced authorized document themes that can be used for a range of uses. Create your account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

Interest on Judgment. (a) When the Court Affirms. Unless the law provides otherwise, if a money judgment in a civil case is affirmed, whatever interest is allowed by law is payable from the date when the district court's judgment was entered.

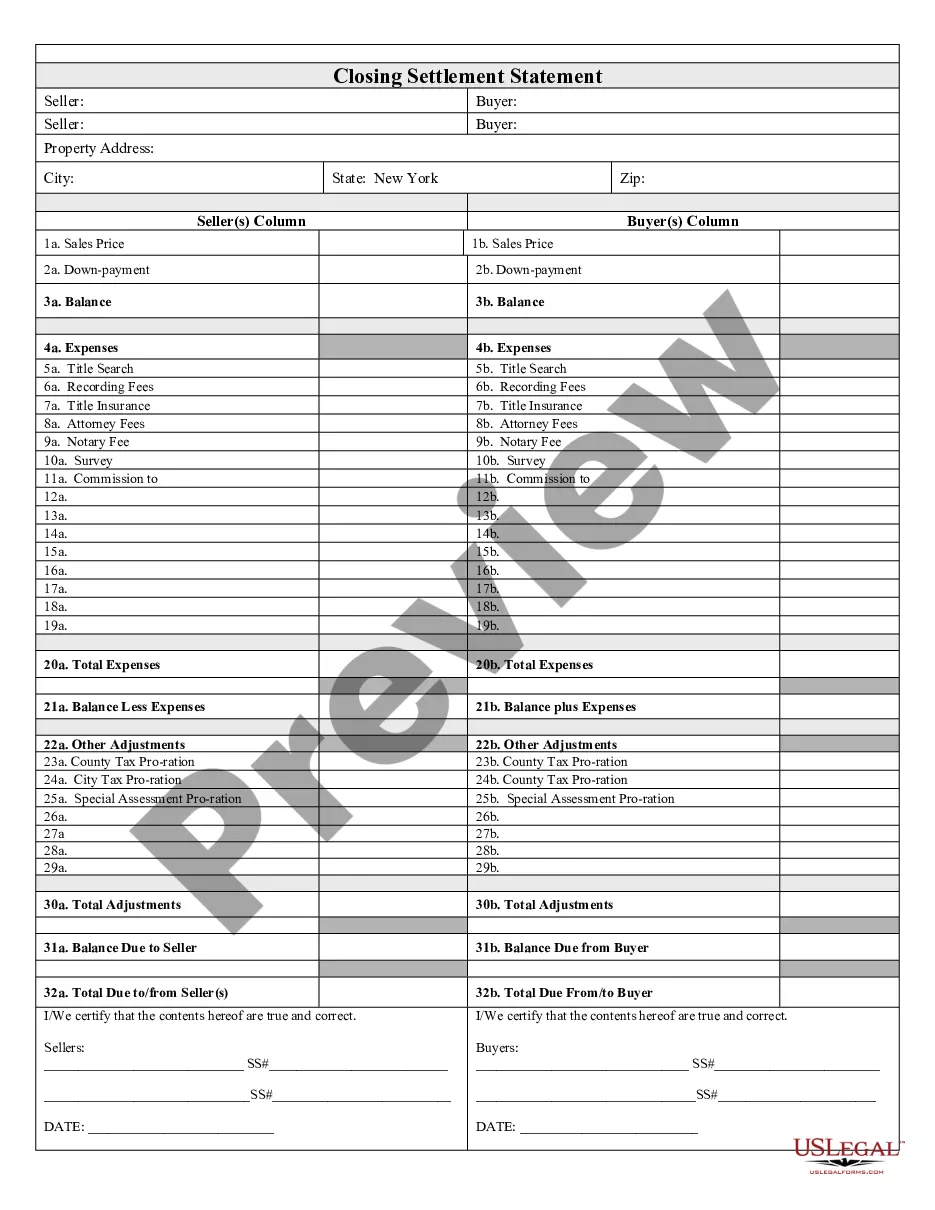

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

Interest accrues on an unpaid judgment amount at the legal rate of 10% per year (7% if the judgment debtor is a state or local government entity) generally from the date of entry of the judgment.

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

Affirmed - the judgment of the lower court is correct and should stand. Affirmed in part - a portion of the judgment of the lower court was affirmed. Dismissed - an order that disposes of the matter without a trial of the issues involved on their merits.

Example: Judgment of $2000; interest rate of 6% per year; 280 days since the date the small claims petition was filed. $2000 x .06 = $120 annual interest. $120/365 = $.329 per day. $. 329 x 280 days = $92.05 interest owed.

Prejudgment interest, which stems from the damages suffered by the victorious party, is meant to fully compensate the injured party for the use of funds to which he is entitled but does not enjoy because the defendant has maintained control over the funds during the pendency of the action.

Post-judgment interest rate: 10.10% (the amount of post judgment interest is set by Rule 36.7 of the Uniform Civil Procedure Rules 2005).