Oregon Non-Exclusive Online Affiliate Program Agreement

Description

How to fill out Non-Exclusive Online Affiliate Program Agreement?

Are you presently in a position where you require files for both corporate and specific tasks almost every day.

There are numerous legal document formats available online, but finding ones you can rely on is not straightforward.

US Legal Forms offers a multitude of templates, such as the Oregon Non-Exclusive Online Affiliate Program Agreement, which are crafted to comply with both federal and state regulations.

Once you find the correct template, click Get now.

Select the payment plan you desire, enter the required information to set up your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Oregon Non-Exclusive Online Affiliate Program Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the document you need and confirm it is for the correct city/county.

- Use the Preview feature to view the document.

- Check the description to ensure you have selected the right template.

- If the document is not what you are looking for, use the Search field to find the template that suits your needs.

Form popularity

FAQ

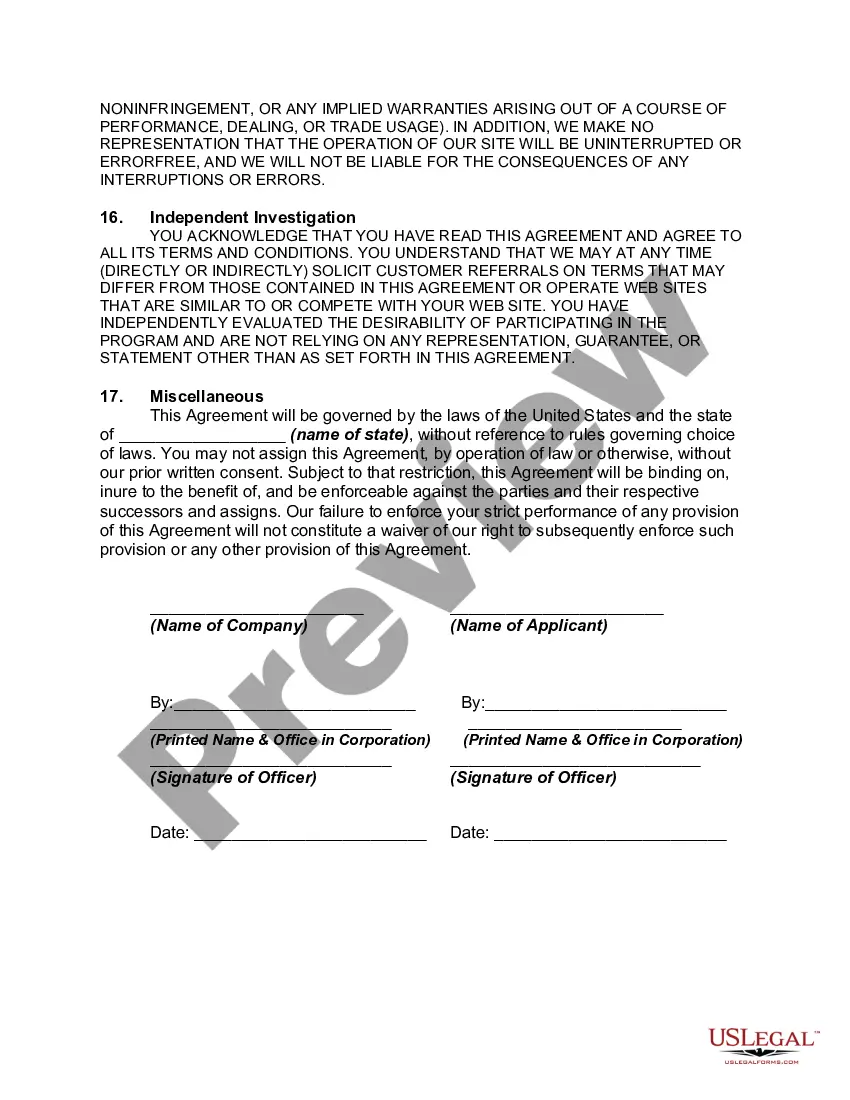

The affiliate agreement, specifically the Oregon Non-Exclusive Online Affiliate Program Agreement, is a contract between a business and an affiliate. It outlines the responsibilities, payment structure, and terms of the affiliate's promotional activities. This agreement clarifies the relationship, ensuring that affiliates know how they can earn commissions while promoting the business. If you want clarity in your affiliate endeavors, consider using the Oregon Non-Exclusive Online Affiliate Program Agreement for a well-defined partnership.

Yes, an independent contractor can serve as an affiliate under the Oregon Non-Exclusive Online Affiliate Program Agreement. This agreement allows independent contractors to promote products or services on behalf of a business, often earning commissions on sales. It's crucial for both parties to understand the terms outlined in the agreement to ensure a successful collaboration. Hence, if you are an independent contractor considering this opportunity, the Oregon Non-Exclusive Online Affiliate Program Agreement is a suitable framework.

Setting up a partnership in Oregon involves several important steps, including selecting a business name, filing the necessary formation documents, and creating an agreement among partners. Having a clear Oregon Non-Exclusive Online Affiliate Program Agreement can help outline roles, responsibilities, and profit sharing. Consulting with a legal platform like uslegalforms can streamline this process and ensure compliance.

Filing CAT taxes late in Oregon incurs a penalty that is typically a percentage of the owed tax amount. Along with penalties, interest is assessed on the unpaid tax, which can quickly add up. To prevent burdensome penalties, familiarize yourself with the terms of agreements like the Oregon Non-Exclusive Online Affiliate Program Agreement, which may offer guidance on tax compliance.

Submitting taxes late can result in a significant penalty, which varies depending on the tax type and amount owed. The longer you wait to file, the steeper the penalties become. To avoid any complications, consider keeping track of your deadlines and reviewing relevant agreements, such as the Oregon Non-Exclusive Online Affiliate Program Agreement.

Yes, Oregon accepts federal extensions for partnerships, but there are specific requirements. You must file your federal extension by the original deadline to qualify. Staying compliant with state regulations can simplify financial management, especially when navigating agreements like the Oregon Non-Exclusive Online Affiliate Program Agreement.

When you file your taxes late in Oregon, you face a penalty based on the amount of tax due. This penalty can accumulate quickly, leading to increased financial strain. To minimize such risks, you may find value in organizing your tax filings alongside your agreements, including the Oregon Non-Exclusive Online Affiliate Program Agreement, ensuring timely submissions.

The 200 day rule in Oregon refers to the timeframe in which a business can collect and report income for tax purposes. It helps determine if a business operates in the state based on its engagement level. Understanding this rule can be vital when managing partnerships and agreements, such as the Oregon Non-Exclusive Online Affiliate Program Agreement.

In the context of an agreement, an affiliate refers to an individual or entity that promotes a business's products or services to earn a commission. Affiliates use various marketing strategies to drive customers to the business, and their success depends on the terms outlined in the agreement. The Oregon Non-Exclusive Online Affiliate Program Agreement precisely defines these roles, ensuring that all parties understand their rights and responsibilities.

A participating affiliate agreement is a specific type of contract that allows affiliates to join a marketing program and earn commissions based on their performance. This agreement typically includes details on product promotion, commission rates, and reporting requirements. Utilizing the Oregon Non-Exclusive Online Affiliate Program Agreement helps streamline this process, making it easier for affiliates to understand their obligations and rewards.