Oregon Sample Letter for Corporate Annual Report

Description

How to fill out Sample Letter For Corporate Annual Report?

It is possible to devote time on-line attempting to find the legal document web template that fits the federal and state requirements you require. US Legal Forms supplies 1000s of legal types that are reviewed by specialists. It is simple to obtain or print out the Oregon Sample Letter for Corporate Annual Report from your services.

If you already have a US Legal Forms accounts, you can log in and click on the Acquire option. After that, you can complete, revise, print out, or indication the Oregon Sample Letter for Corporate Annual Report. Every legal document web template you get is yours permanently. To acquire another duplicate of any obtained develop, go to the My Forms tab and click on the related option.

If you are using the US Legal Forms site for the first time, follow the straightforward guidelines below:

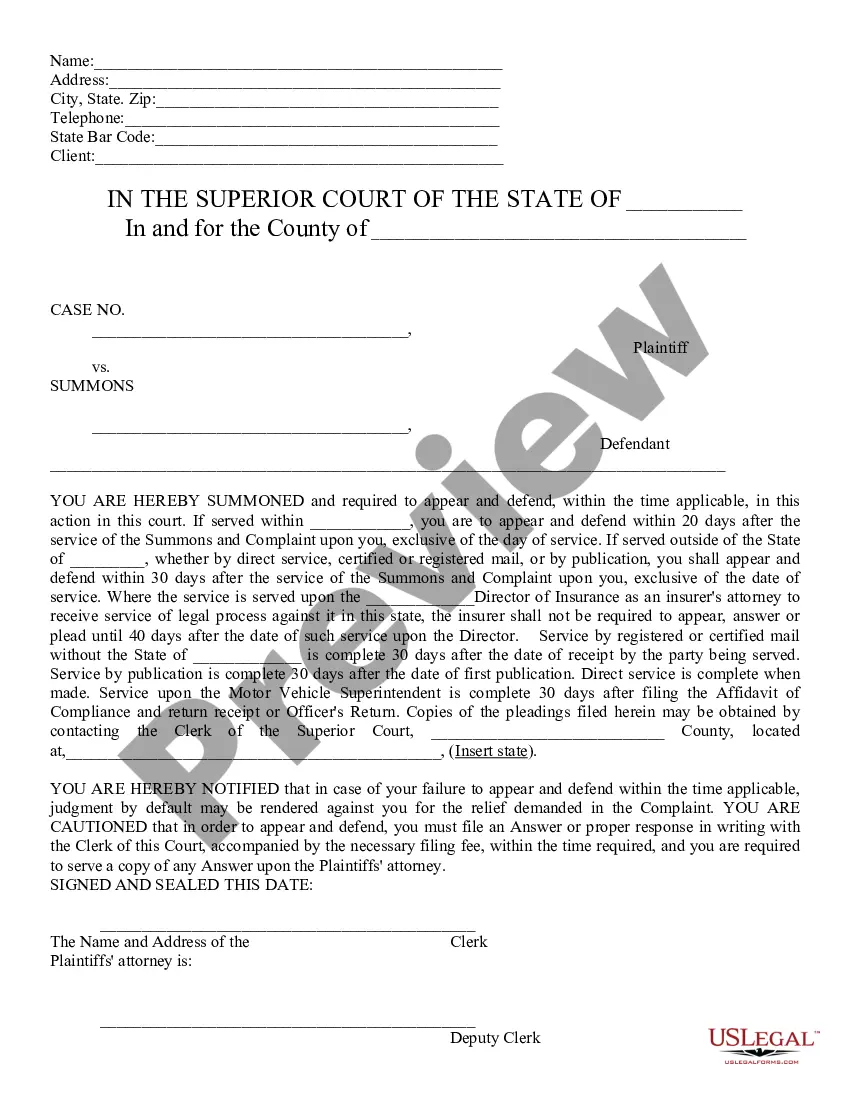

- Initial, be sure that you have chosen the proper document web template for that area/metropolis of your choosing. Read the develop outline to ensure you have selected the appropriate develop. If readily available, make use of the Review option to appear with the document web template at the same time.

- If you would like discover another model in the develop, make use of the Research discipline to get the web template that fits your needs and requirements.

- When you have discovered the web template you would like, click Acquire now to move forward.

- Select the prices plan you would like, type your accreditations, and register for your account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal accounts to cover the legal develop.

- Select the file format in the document and obtain it to your product.

- Make adjustments to your document if possible. It is possible to complete, revise and indication and print out Oregon Sample Letter for Corporate Annual Report.

Acquire and print out 1000s of document themes using the US Legal Forms site, which provides the most important assortment of legal types. Use skilled and express-distinct themes to handle your organization or specific needs.

Form popularity

FAQ

How much does an LLC in Oregon cost per year? All Oregon LLCs need to pay $100 per year for the Oregon Annual Report fee. These state fees are paid to the Secretary of State. And this is the only state-required annual fee.

How do you write an annual report? Start off with the shareholder's letter. ... Add a general description of the industry. ... Include audited statements of income. ... State your financial position. ... Give details about cash flow. ... Provide notes to the statements for line items.

Also, if you do not file the Annual Report in a timely manner, the Secretary of State can administratively dissolve your company. If your company is administratively dissolved, your company is no longer in good standing with the State, though it may still be sued.

The Oregon Annual Report must be filed online through the Oregon Business Registry page. On the state website, you'll be prompted to enter your contact email address and Oregon Registry Number. Don't know your registry number? You can easily find it by searching the Oregon Business Database.

A typical annual report for a public company must have the following sections: A letter from the CEO. Corporate financial data. Operations and impact. Market segment information. Plans for new products. Subsidiary activities. Research and development activities.

What to include in your annual report A letter from the CEO or Board Chair. ... Navigation help, such as a menu or table of contents. ... Your mission statement. ... Data showcasing your impact. ... Testimonials. ... Profiles. ... Donor list. ... Fundraising highlights.

Filing Fee and Due Date Filing fees and due dates for the Annual Report vary by state. Filing fees can range from $9/year up to $800/year. Due dates also vary: Some Annual Reports are due every year.

Your annual report should include four main components: the chairman's letter, a profile of your business, an analysis of your management strategies, and your financial statements.