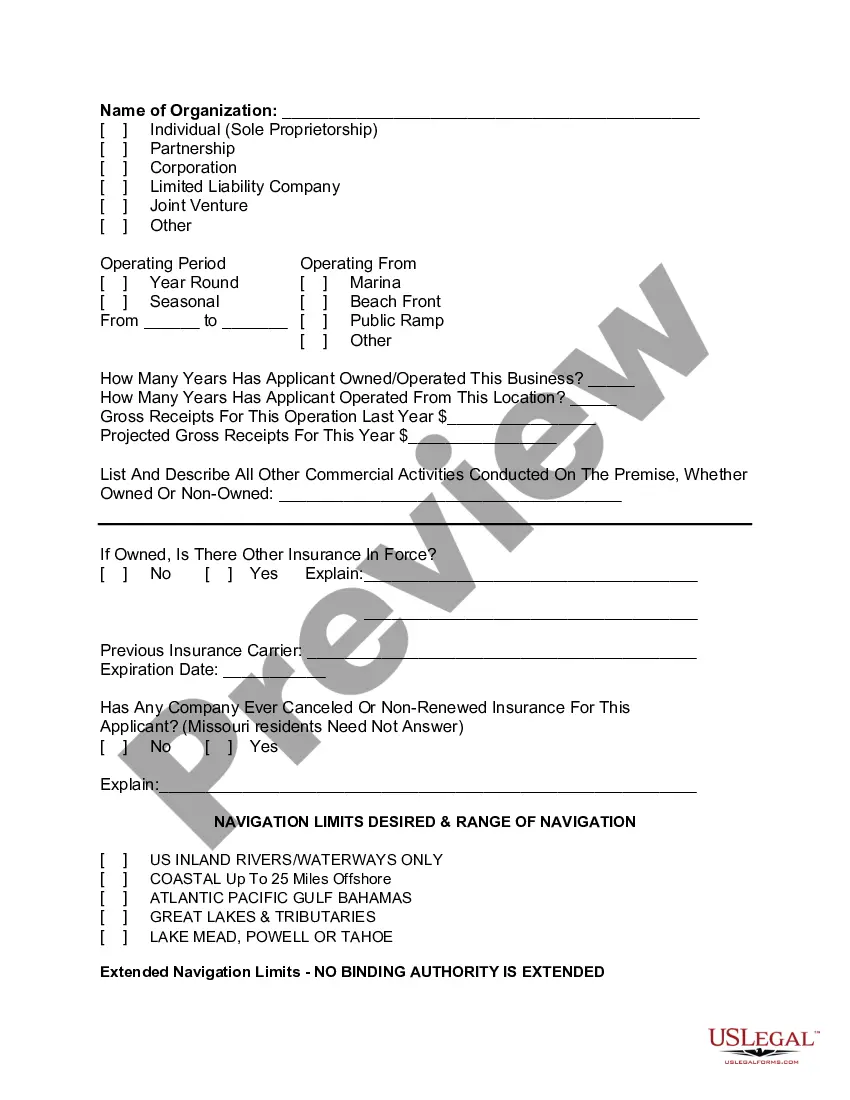

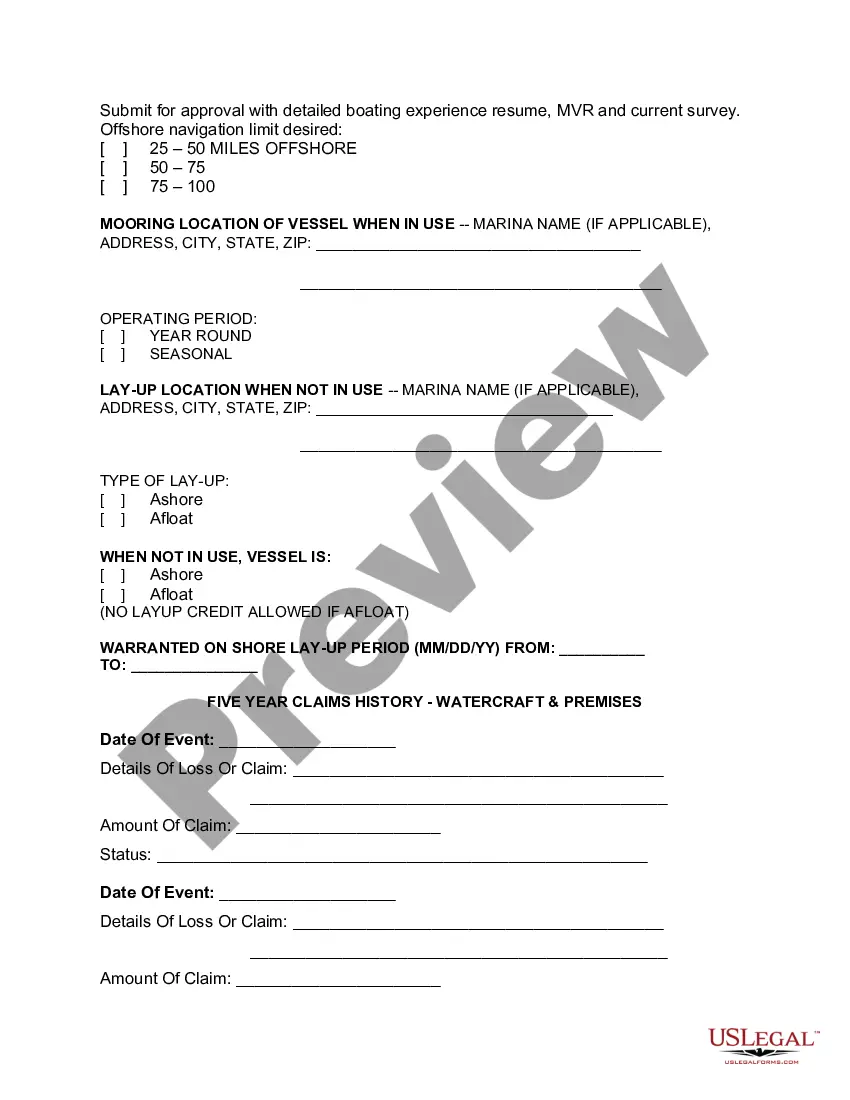

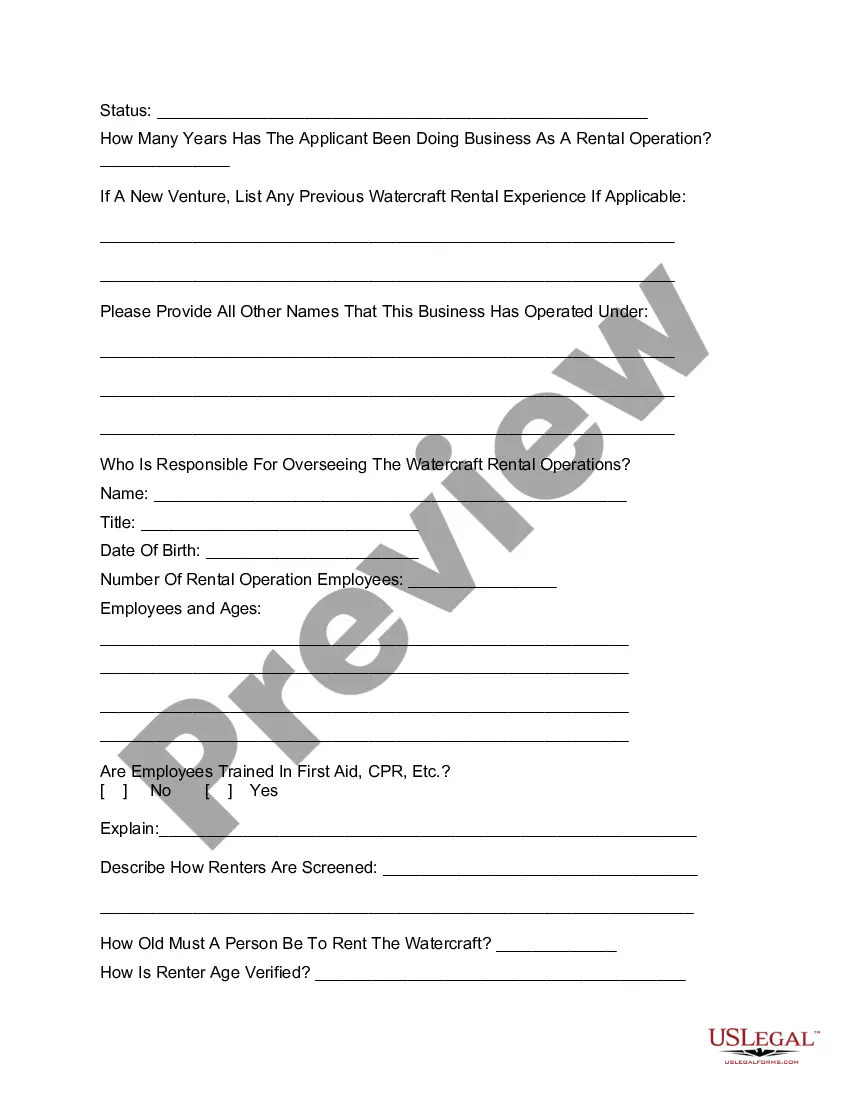

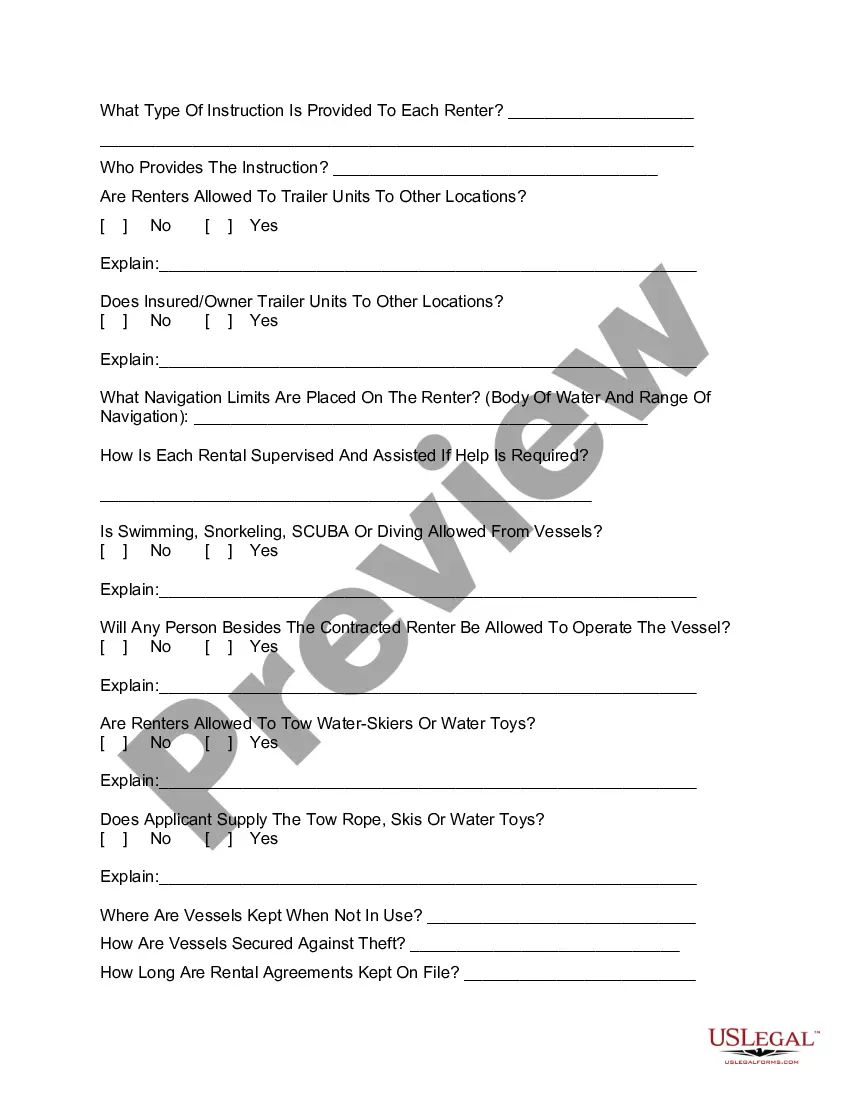

Oregon Commercial Watercraft Rental Insurance Application

Description

How to fill out Commercial Watercraft Rental Insurance Application?

US Legal Forms - one of the biggest libraries of legitimate forms in America - delivers a wide array of legitimate record web templates you may download or print out. Using the web site, you can get thousands of forms for organization and individual purposes, categorized by categories, claims, or key phrases.You can find the most up-to-date types of forms such as the Oregon Commercial Watercraft Rental Insurance Application in seconds.

If you already have a membership, log in and download Oregon Commercial Watercraft Rental Insurance Application in the US Legal Forms collection. The Down load button will appear on each and every develop you view. You have access to all in the past downloaded forms in the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, listed below are easy instructions to help you began:

- Be sure to have picked the best develop for your personal city/area. Click on the Preview button to analyze the form`s content. See the develop information to ensure that you have chosen the correct develop.

- If the develop doesn`t fit your demands, utilize the Research area near the top of the monitor to get the one that does.

- When you are pleased with the form, affirm your selection by visiting the Buy now button. Then, pick the rates strategy you like and supply your references to register to have an profile.

- Process the deal. Make use of Visa or Mastercard or PayPal profile to complete the deal.

- Select the formatting and download the form in your system.

- Make modifications. Load, change and print out and indication the downloaded Oregon Commercial Watercraft Rental Insurance Application.

Each format you put into your money lacks an expiration particular date which is your own property for a long time. So, if you want to download or print out an additional copy, just go to the My Forms section and click on on the develop you want.

Get access to the Oregon Commercial Watercraft Rental Insurance Application with US Legal Forms, by far the most substantial collection of legitimate record web templates. Use thousands of professional and express-distinct web templates that meet up with your organization or individual demands and demands.

Form popularity

FAQ

Your homeowners policy will have a coverage limit for personal property, typically 50% of your dwelling coverage limit. However, it's common for homeowners policies to have sub-limit of $1,500 for watercraft. Talk with your insurer if you need more coverage than your watercraft sub-limit allows.

A watercraft endorsement is a rider to a homeowner's insurance or liability policy that covers boats that the insured owns or uses. The insured must pay a premium to add this coverage to their policy.

What Watercraft coverage is available through the HO Policy? Under C (Personal Prop.): $1,500 on watercraft, BUT theft of watercraft off the insured's premises is NOT covered.

A plain vanilla ISO HO-3 homeowners policy references both physical damage and liability coverage for ?watercraft?. However, a home policy significantly limits coverage for losses to boats. PHYSICAL DAMAGE COVERAGE: A standard ISO Homeowner policy provides up to $1,500 coverage for an unendorsed ?watercraft?.

Damage to a watercraft is covered if caused by an insured peril but there is a sublimit of $1,500 for ?watercraft of all types, including their trailers, furnishings, equipment and outboard engines or motors.? You are limited to $1,500 of coverage for owned and non-owned watercraft for damage caused by a covered peril, ...

Jet ski insurance is not a requirement, but it is still a good idea to have your jet ski insured. Depending on your boat insurance provider, you can get jet ski insurance with several levels of coverage. When you have your jet ski insured, you can include it as part of a claim in the event of theft, loss or damage.

?The state does not require boat insurance; however, it is highly recommended because boat collisions, engine problems, or other situations can arise. Some insurance companies give up to a 15% discount to a boater who has a Boater Education Card.

Examples of the types of costs covered by watercraft insurance policies include physical loss or damage to the boat, theft of the boat, and towing.