Are you currently in a location where you frequently require documents for either business or personal purposes.

There are numerous legitimate document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides an extensive selection of template documents, including the Oregon Right to rescind when a security interest in a consumer's primary residence is involved - Rescission, which are designed to comply with state and federal regulations.

Choose a convenient file format and download your version.

Access all the document templates you have purchased in the My documents list. You can download another copy of the Oregon Right to rescind when security interest in consumer's principal dwelling is involved - Rescission at any time, if required. Simply click on the desired form to download or print the document template.

Utilize US Legal Forms, the most comprehensive repository of legitimate forms, to save time and prevent errors. This service offers expertly crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Oregon Right to rescind when security interest in consumer's principal dwelling is involved - Rescission template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

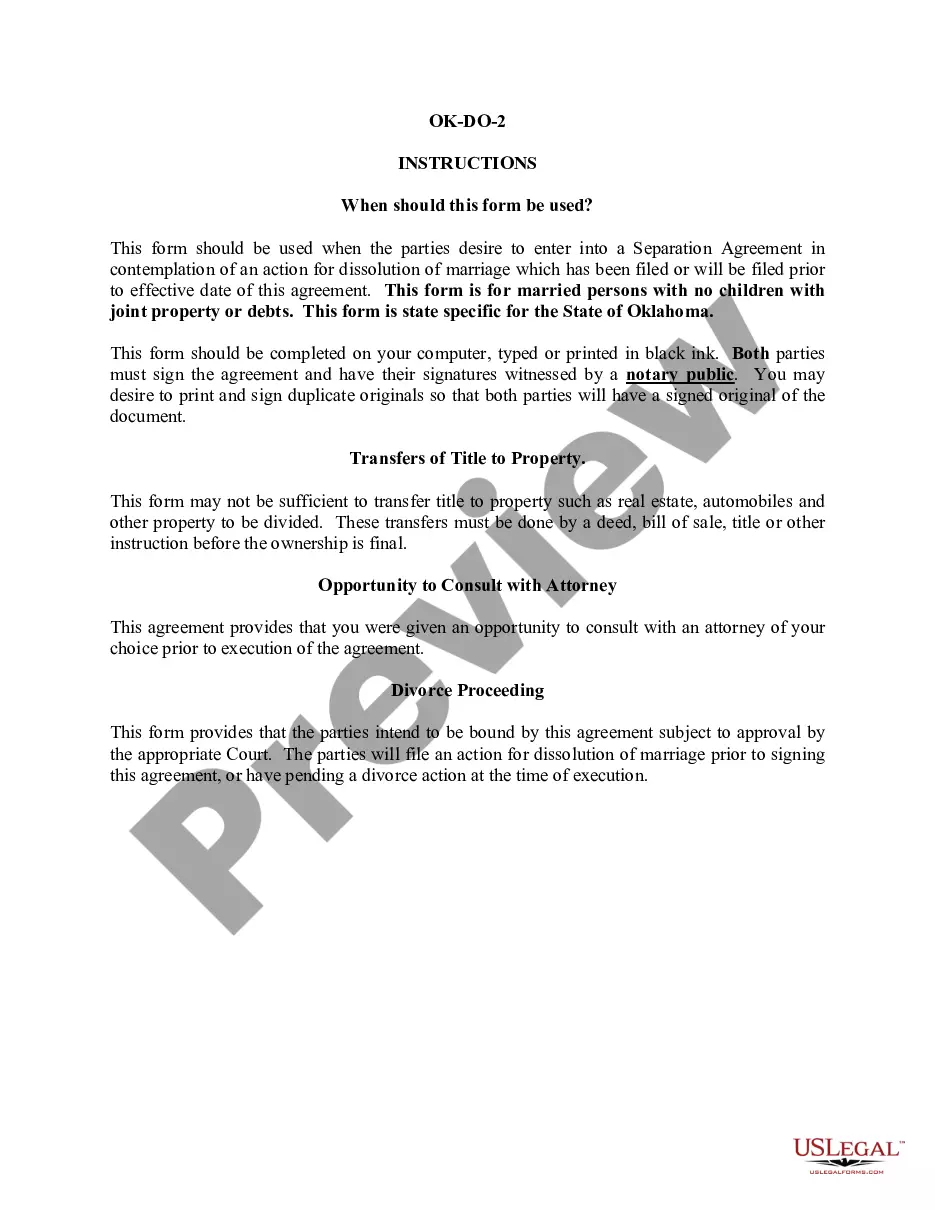

- Utilize the Preview button to review the document.

- Read the description to ensure you have selected the right form.

- If the document is not what you are looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.