A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Oregon Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

If you require extensive, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site`s user-friendly and efficient search to find the documents you need.

Various templates for business and personal needs are organized by categories and states, or keywords.

Step 4. Once you find the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Oregon Promissory Note secured by Real Estate with a Fixed Interest Rate and Installment Payments related to a Business Purchase in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the Oregon Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

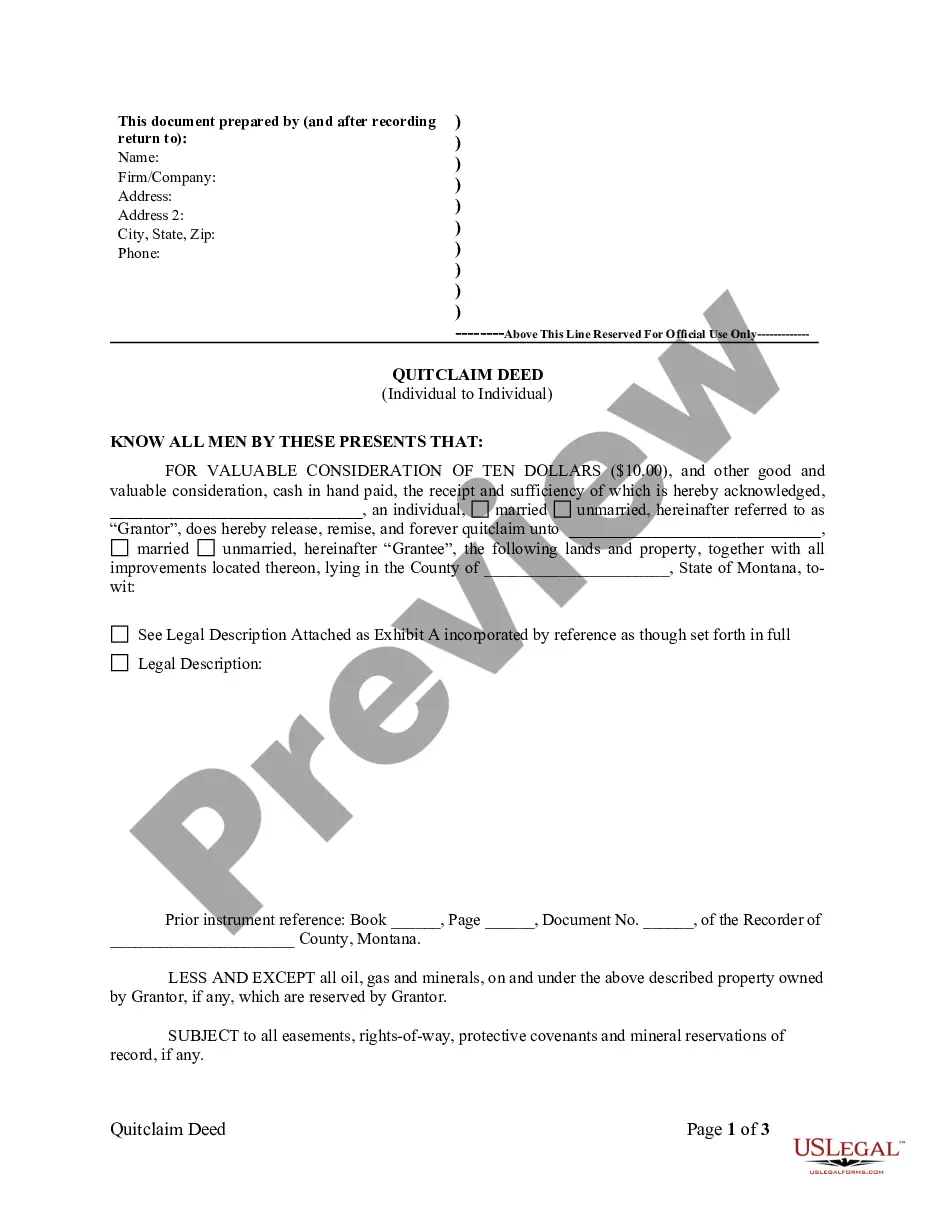

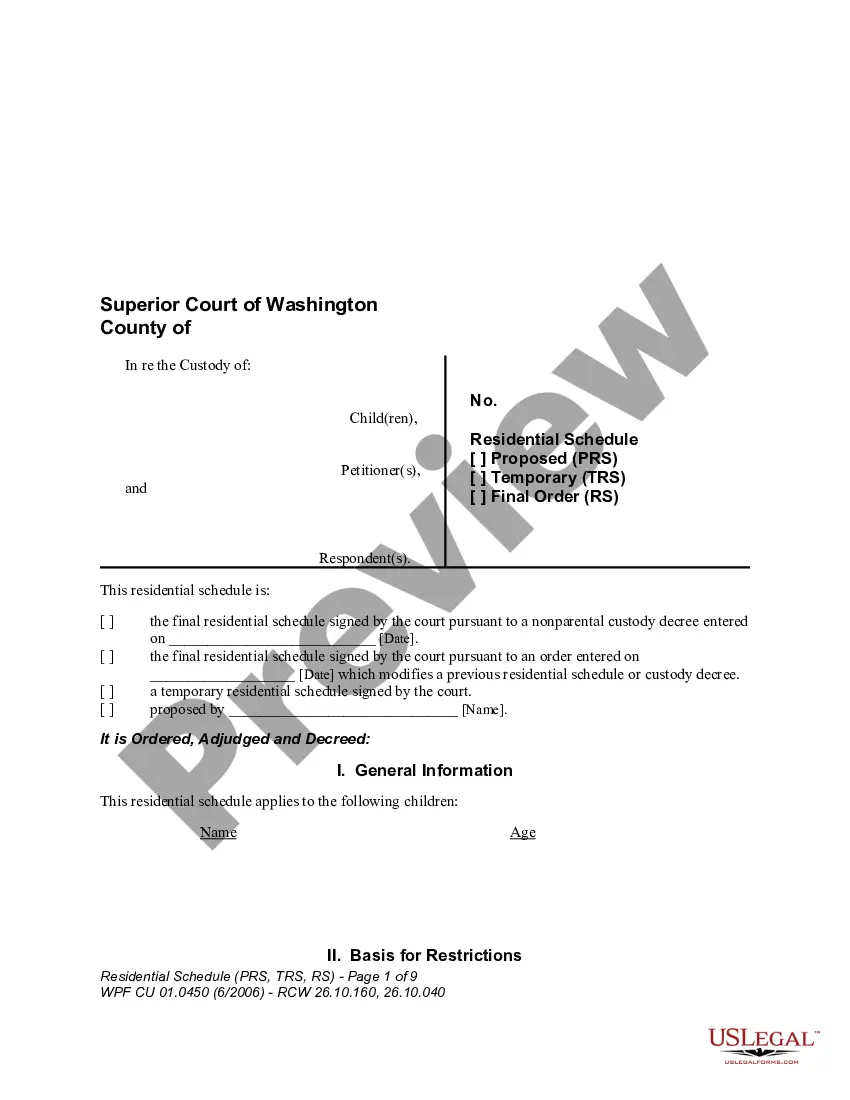

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal template.

Form popularity

FAQ

Writing a simple promissory note involves stating the borrower's name, the lender's name, the amount borrowed, and the payment terms. Specify the interest rate and repayment schedule, ensuring clarity on when payments are due. For added protection, indicate if the note is secured by real property, which can enhance the lender’s position. Uslegalforms offers user-friendly templates that simplify this writing process.

To write a secured promissory note, start by including the names of the parties involved, the amount being borrowed, and the interest rate. Clearly specify the repayment schedule, detailing fixed payments and the duration of the agreement. Additionally, mention that the note is secured by real property to provide assurance to the lender. You can use uslegalforms to access templates that guide you through this process efficiently.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

Many states have usury laws that cap the rate of interest a lender can charge for loansoften in the range of 10% to 20%.

The buyer doesn't want to have to pay interest, and the seller feels funny asking for it, so they agree, no interest. Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.