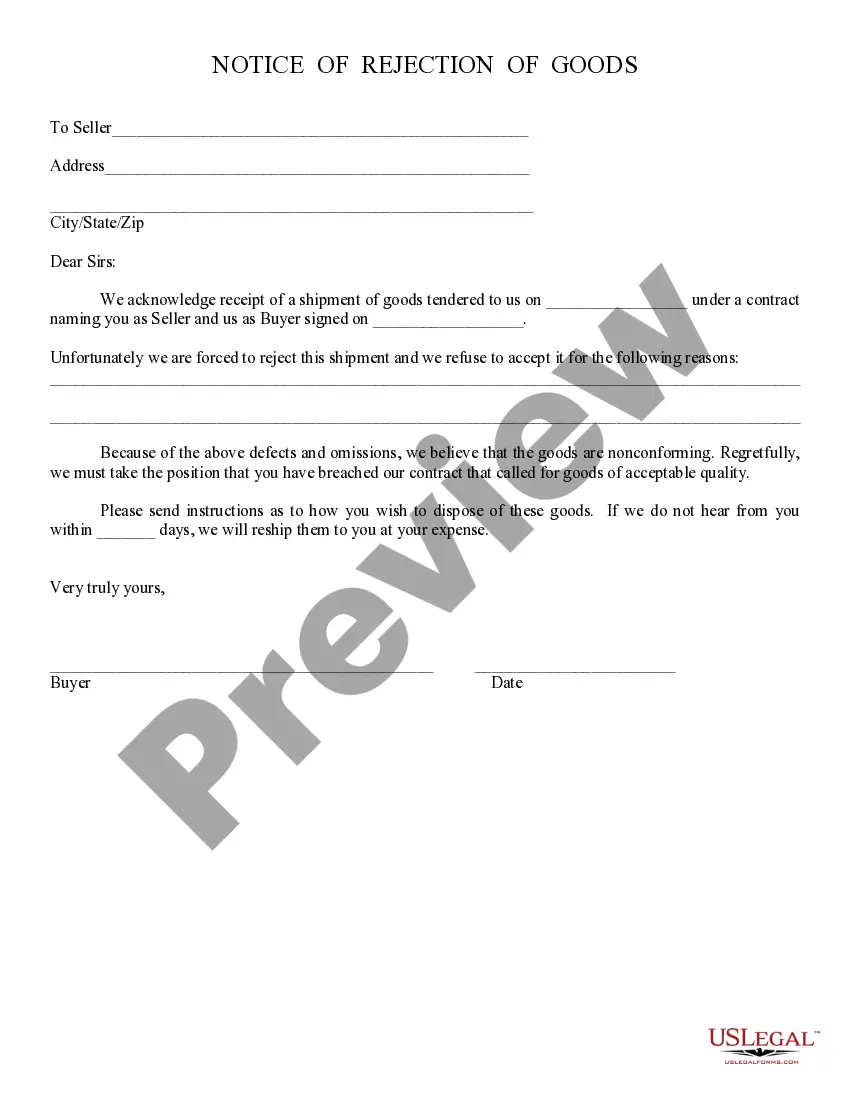

Oregon Rejection of Goods

Description

How to fill out Rejection Of Goods?

If you want to be thorough, obtain, or create official document templates, utilize US Legal Forms, the largest selection of legal forms, which are available online.

Employ the website's simple and effective search to locate the documents you need. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Oregon Rejection of Goods in just a few clicks.

Every legal document template you obtain is exclusively yours permanently. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Oregon Rejection of Goods with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Oregon Rejection of Goods.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps listed below.

- Step 1. Ensure that you have selected the form for the correct state/country.

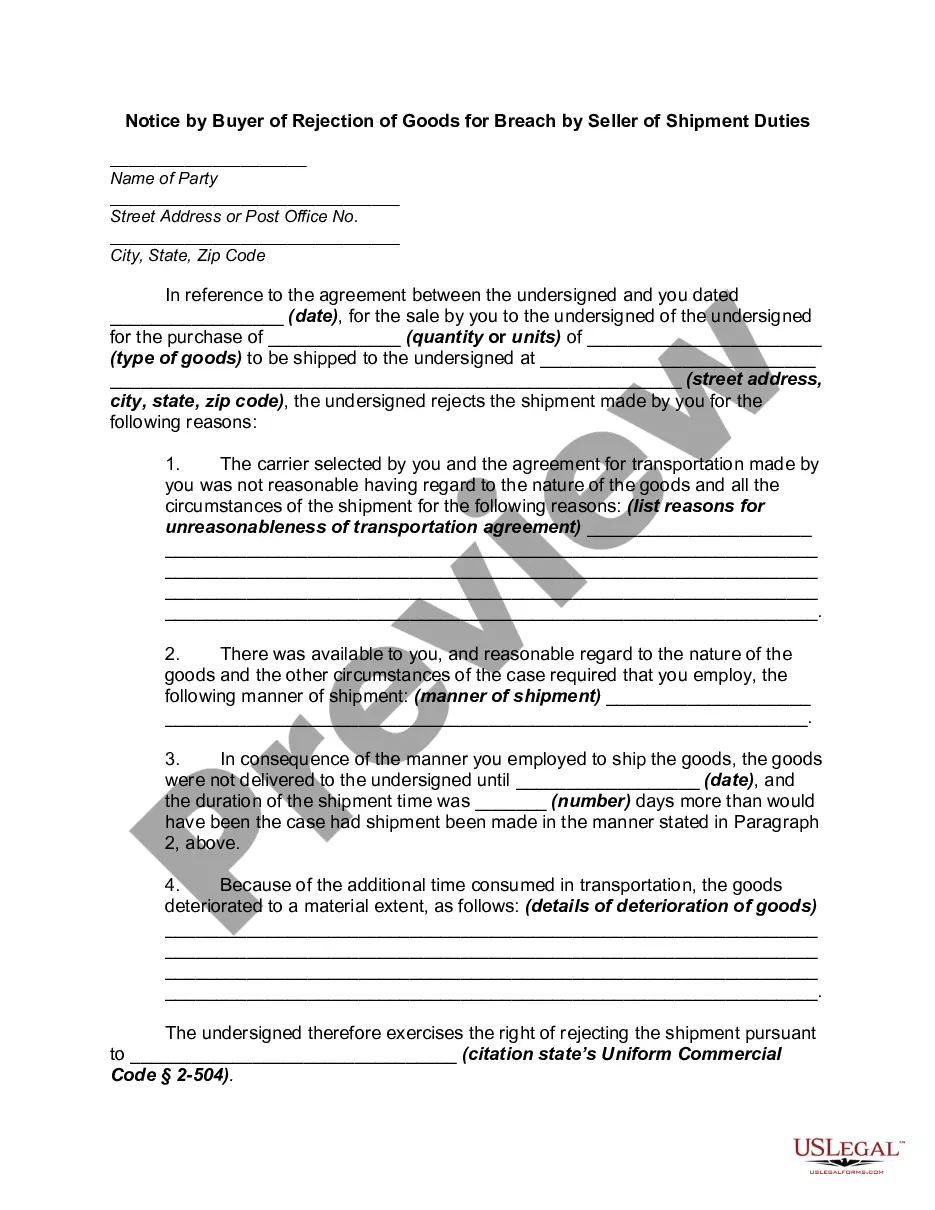

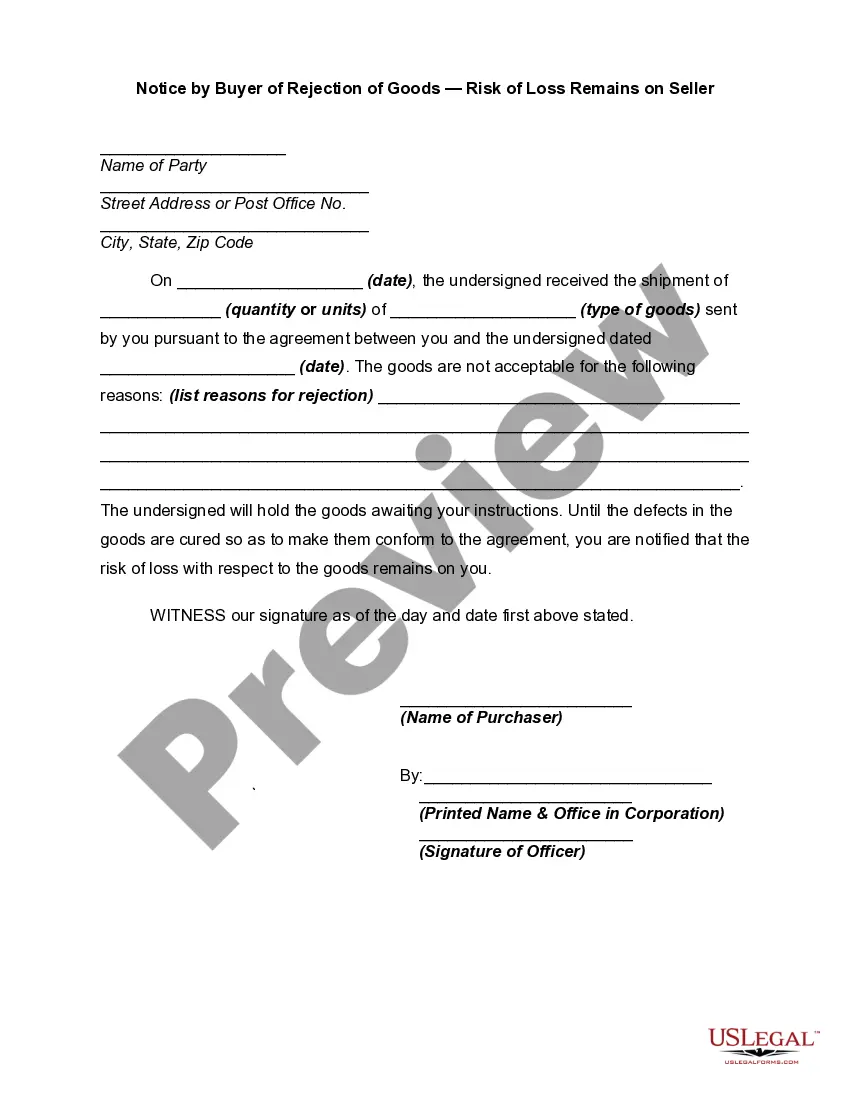

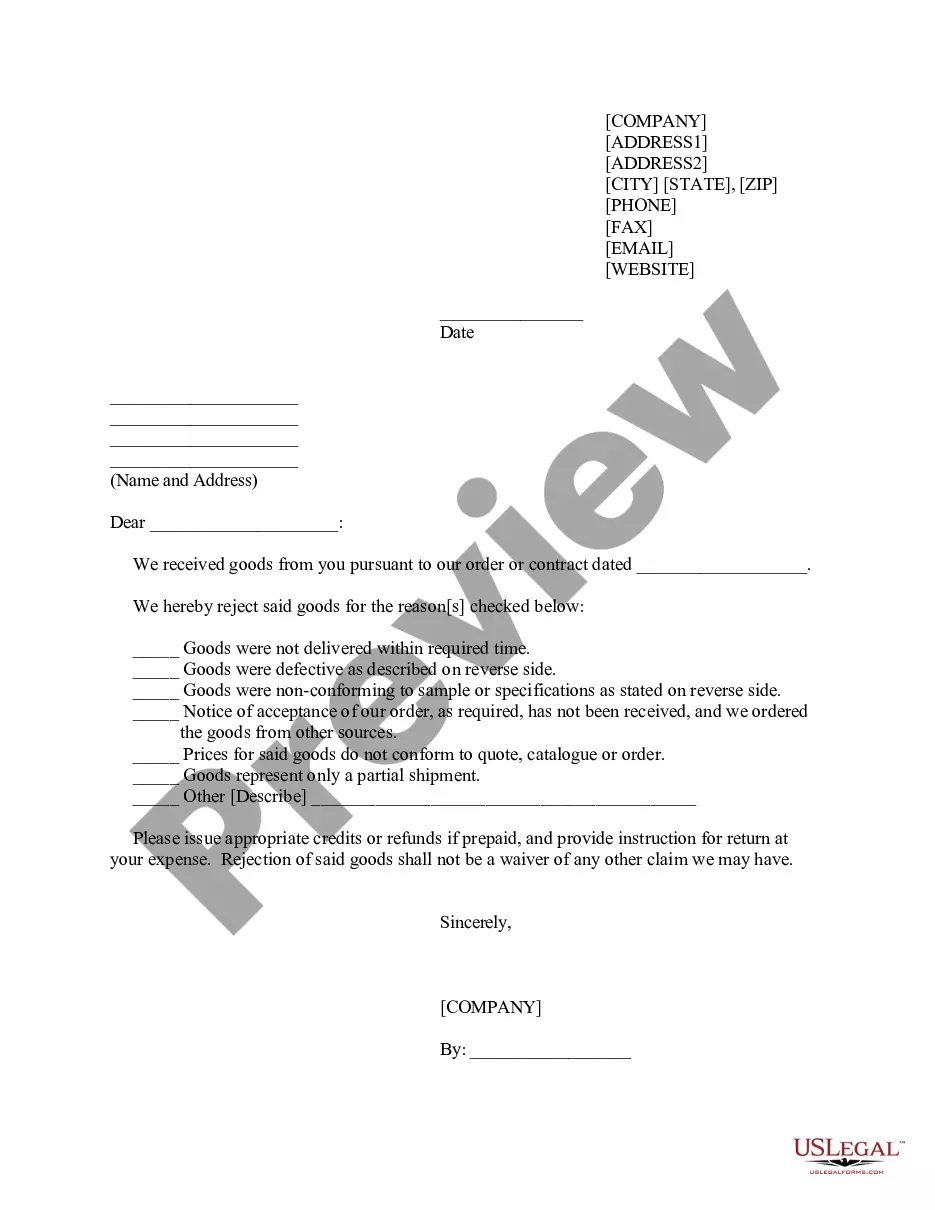

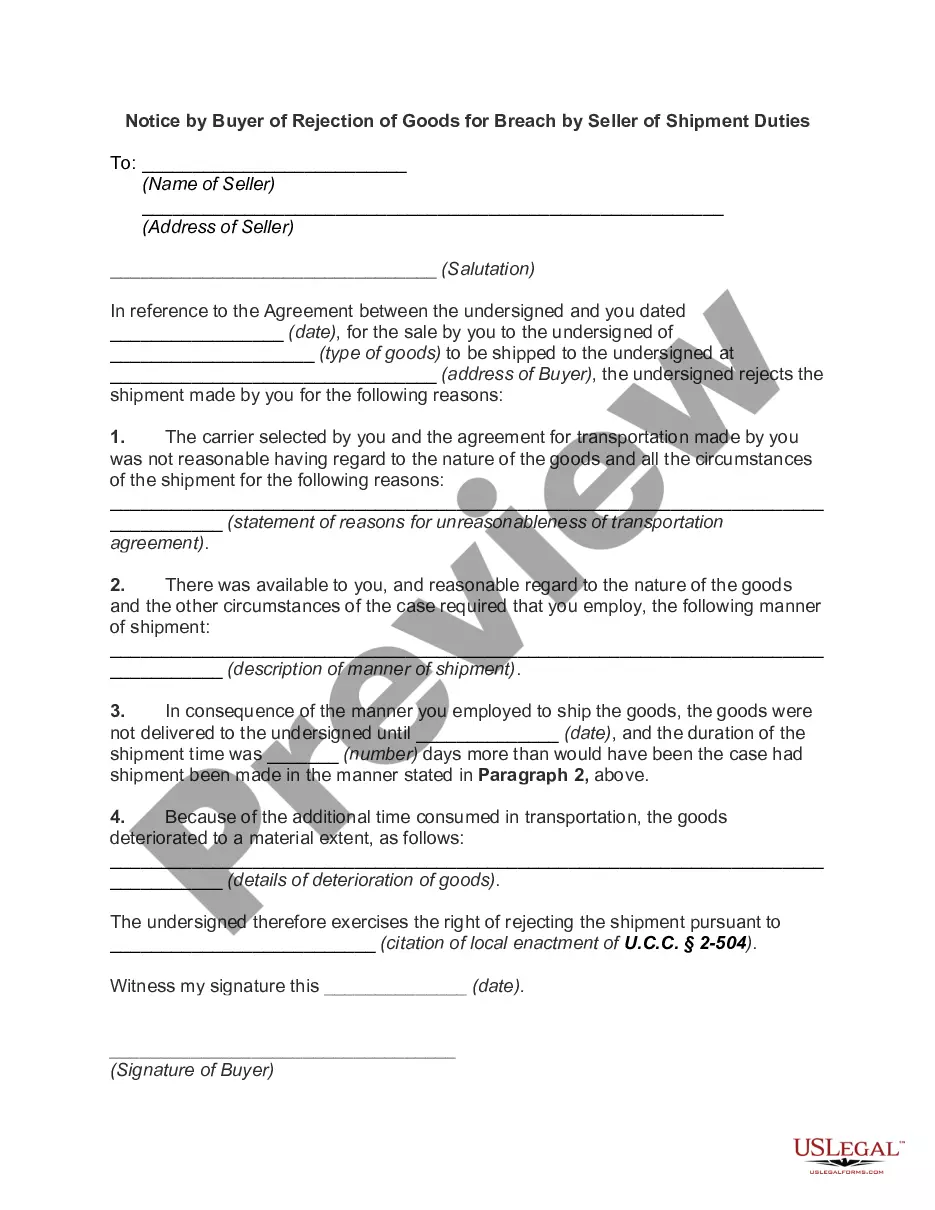

- Step 2. Use the Review option to examine the form's content. Don’t forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, customize, and print or sign the Oregon Rejection of Goods.

Form popularity

FAQ

To fix this, all you need is an e e-file PIN or your Adjusted Gross Income from the prior year. Request an e-filing PIN from the IRS, enter this PIN into the e-filing software, and resubmit your return for review.

File Form 40 if you don't meet the listed requirements. Nonresidents stationed in Oregon. Oregon does not tax your military pay while you are stationed in Oregon. File Form 40N if you had other income from Oregon sources, or to claim a refund of Oregon tax withheld from your military pay.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Oregon taxpayers will receive 'kicker' rebate on 2021 tax returns thanks to $1.9 billion surplus. SALEM, Ore. Many state taxpayers will receive a surplus tax credit from Oregon's idiosyncratic "kicker" program, the Oregon Department of Revenue confirmed on Tuesday, thanks to a tax surplus of nearly $1.9 billion.

PORTLAND, Ore. With a nearly $1.9 billion tax surplus, Oregon taxpayers will be seeing a kicker credit on their taxes in the 2021 year. Instead of checks, the state Office of Economic Analysis says the surplus will go back to Oregonians through a credit on their 2021 state personal income taxes filed in 2022.

Who Must File a Form 40 Every person who holds or controls a reportable position must file a CFTC Form 40, Statement of Reporting Trader. (See section 18.04 of the regulations under the Commodity Exchange Act.)

Oregon Department of Revenue. 2020 Form OR-40. Oregon Individual Income Tax Return for Full-year Residents.

To claim the surplus "Kicker" credit on your 2021 Oregon return, please follow the steps listed below.Log into the account.Edit the Oregon return.Credits.Refundable Credits.Surplus Credit (Kicker)Complete the necessary information from your 2020 return to have the credit applied to your 2021 return.

To electronically sign a federal tax return, taxpayers must use federal Form 8879, IRS e-file Signature Authorization, and generate a federal personal identification number (PIN). Oregon accepts the use of a federal PIN signature as signing the Oregon return. Don't use Form OR-EF if using a federal PIN signature.

To claim the surplus "Kicker" credit on your 2021 Oregon return, please follow the steps listed below.Log into the account.Edit the Oregon return.Credits.Refundable Credits.Surplus Credit (Kicker)Complete the necessary information from your 2020 return to have the credit applied to your 2021 return.