An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Verification of an Account for Services and Supplies to a Public Entity

Description

How to fill out Verification Of An Account For Services And Supplies To A Public Entity?

Are you within a situation that you need to have paperwork for both organization or personal reasons virtually every working day? There are plenty of lawful file layouts available on the Internet, but locating ones you can depend on is not effortless. US Legal Forms offers 1000s of develop layouts, just like the Oregon Verification of an Account for Services and Supplies to a Public Entity, that happen to be published in order to meet federal and state specifications.

In case you are presently informed about US Legal Forms internet site and also have a merchant account, just log in. Afterward, you are able to download the Oregon Verification of an Account for Services and Supplies to a Public Entity template.

Unless you provide an accounts and wish to begin to use US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for the appropriate area/area.

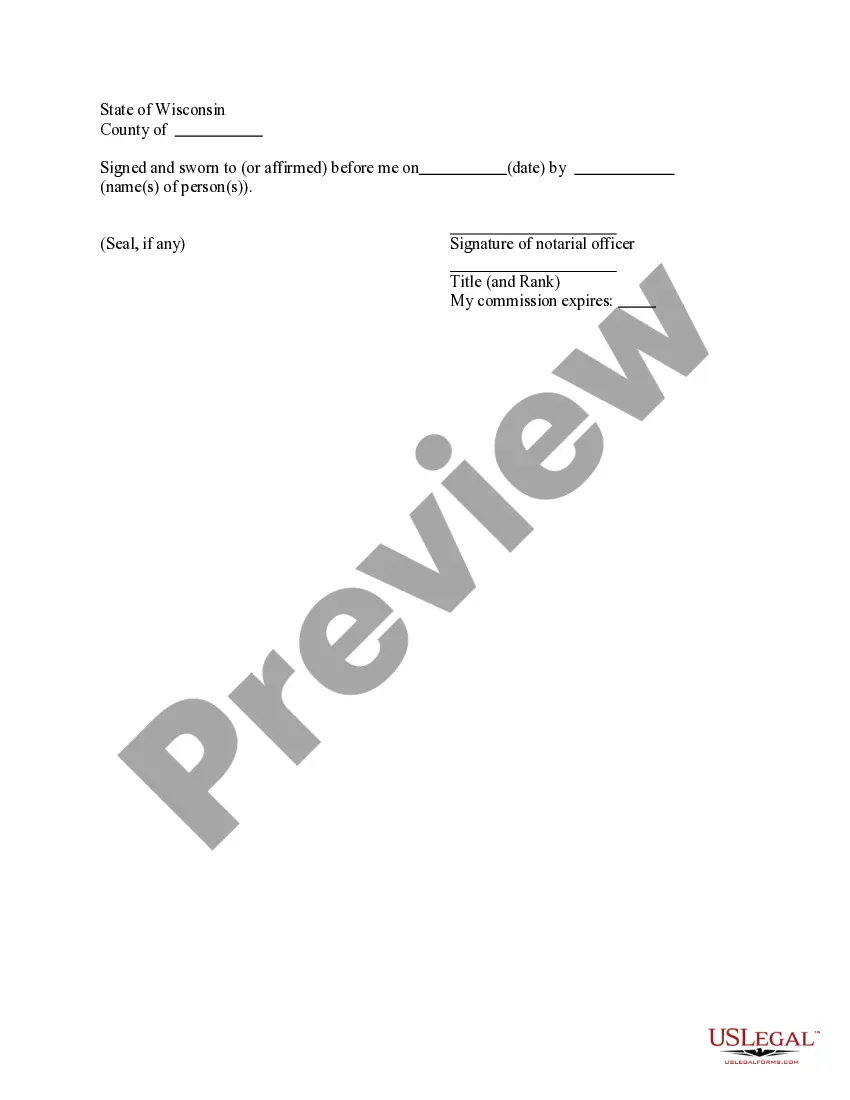

- Utilize the Preview option to examine the form.

- Look at the explanation to ensure that you have selected the correct develop.

- In case the develop is not what you`re seeking, take advantage of the Search industry to obtain the develop that meets your requirements and specifications.

- Once you obtain the appropriate develop, simply click Acquire now.

- Choose the pricing program you would like, fill out the required info to produce your money, and buy the transaction with your PayPal or charge card.

- Select a practical document formatting and download your duplicate.

Get all the file layouts you might have bought in the My Forms menus. You can obtain a more duplicate of Oregon Verification of an Account for Services and Supplies to a Public Entity whenever, if necessary. Just select the essential develop to download or print the file template.

Use US Legal Forms, one of the most extensive collection of lawful varieties, in order to save efforts and stay away from errors. The service offers expertly manufactured lawful file layouts which you can use for a range of reasons. Produce a merchant account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

Aims of regulation market confidence ? to maintain confidence in the financial system. financial stability ? contributing to the protection and enhancement of stability of the financial system. consumer protection ? securing the appropriate degree of protection for consumers. reduce financial crime.

In order to send verification of your Oregon registration or examination information to another state board or entity, please submit the Request for Verification form and verification fee. You may submit this form and payment to the Board office by mail or email at osbeels.info@osbeels.oregon.gov.

The Department of Administrative Services is the central administrative agency of Oregon state government. Our mission is to support state government to serve the people of Oregon.

Financial regulation and government guarantees, such as deposit insurance, are intended to protect consumers and investors and to ensure that the financial system remains stable and continues to make funding available for investments that support the economy.

Legislation. Oregon's banking laws are contained in Volume 16 of the Oregon Revised Statutes. This volume establishes requirements for financial institutions and confers regulatory authority upon the Department of Consumer and Business Services and its divisions.

An Oregon foreign LLC was not formed in Oregon but plans to do business there. Registering a foreign LLC in Oregon involves submitting an Application for Authority to Transact Business to Oregon's Secretary of State and paying a $275 state filing fee.

The Division of Financial Regulation regulates producers, insurance institutions, and nearly a dozen other specialized programs or businesses, ranging from discount medical plans to life settlement providers.

The Division of Financial Regulation protects consumers and regulates insurance, depository institutions, trust companies, securities, and consumer financial products and services. It is part of the Department of Consumer and Business Services, Oregon's largest consumer protection agency.