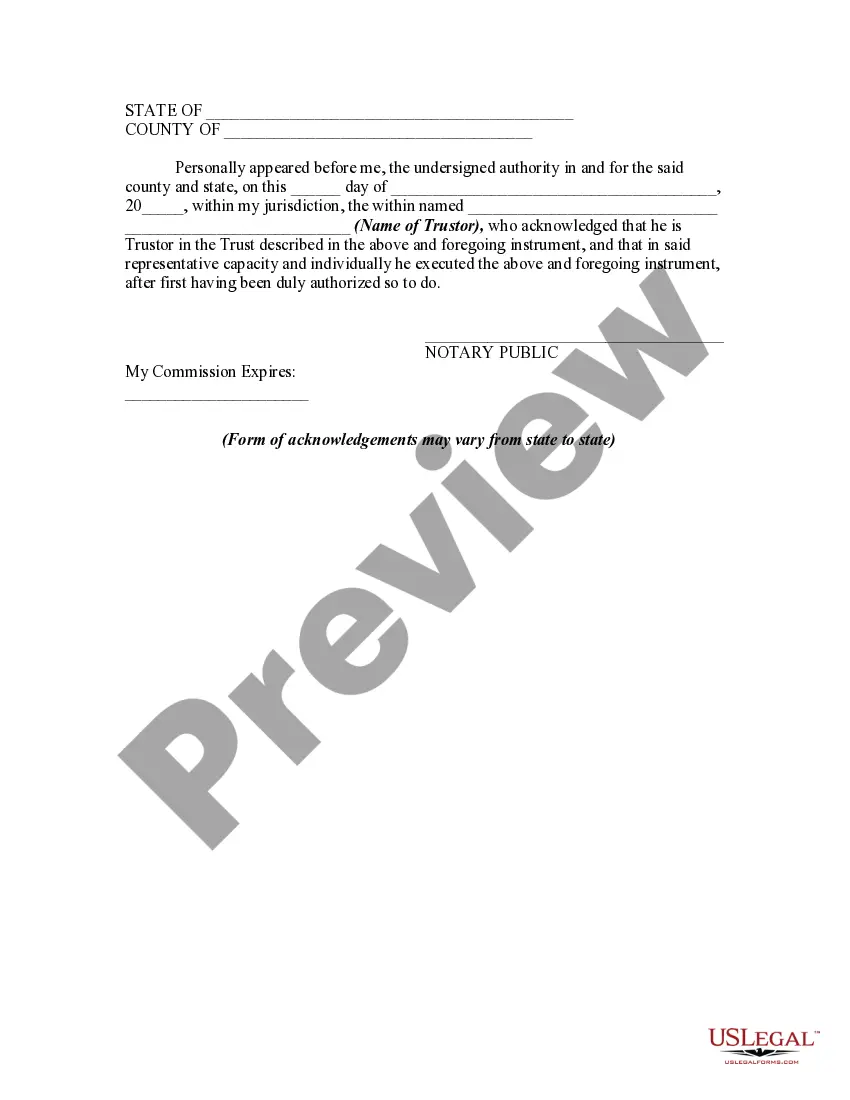

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

You might spend hours online searching for the suitable legal document format that meets the federal and state guidelines you require. US Legal Forms offers thousands of legal templates that are vetted by professionals.

It is easy to obtain or print the Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust from your service.

If you already possess a US Legal Forms account, you can Log In and click the Download button. You can then complete, edit, print, or sign the Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust. Each legal document format you purchase is yours indefinitely.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format from the document and download it to your device. Make changes to your document if necessary. You may complete, edit, sign, and print the Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust. Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire another copy of the purchased form, visit the My documents tab and click the relevant button.

- If it's your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, make sure to select the correct document format for the county/region of your choice. Review the form description to confirm you have chosen the right one.

- If available, use the Review button to browse through the document format as well.

- If you wish to find another version of the form, utilize the Search field to locate the format that meets your needs and specifications.

- Once you have located the format you want, click Buy now to proceed.

- Choose the pricing plan you wish, enter your details, and create your account on US Legal Forms.

Form popularity

FAQ

A trust becomes revoked when the trustor formally communicates their intent to revoke it, typically through a written document. This revocation needs to comply with Oregon laws to ensure its validity. It’s advisable to document the revocation carefully, particularly in connection with the Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust, to protect everyone’s interests.

A trust can be terminated in several ways, including the expiration of its terms, mutual agreement of the parties involved, or through a judicial decree. Each method has its requirements and potential implications for the involved parties. Understanding these processes is crucial, especially when dealing with an Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust.

Terminating an irrevocable trust in Oregon can be complex and often requires the consent of all beneficiaries. Alternatively, if the trust documents allow for modification or termination under specific circumstances, that may provide a path. Legal counsel can assist in navigating these complexities, especially in relation to the Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust.

A trust can become null and void if it lacks valid creation elements, such as proper intent or legal capacity of the trustor. Additionally, if the trust is found to have been created under duress or fraud, it may also be invalid. It’s essential to understand the legal requirements to ensure that your trust remains effective, particularly in light of the Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust.

In Oregon, beneficiaries often receive a copy of the trust document after the trustor's death or if the trust is revoked. This transparency helps beneficiaries understand their rights and the distribution of assets. If you need assistance with the legal aspects, using platforms like uslegalforms can simplify the process, allowing beneficiaries to access the Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust when necessary.

Upon the dissolution of a trust, the assets are distributed according to the trustor's wishes or returned to the trustor if they have revoked the trust. The trustor must document this transfer with an Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust. Proper documentation is crucial to avoid disputes and ensure a smooth transfer of ownership. Remember, keeping detailed records aids in upholding your intentions.

When a trust is revoked, the trustor, or creator of the trust, officially terminates the trust agreement. As a result, the trust assets return to the trustor, and they regain control over these assets. This process often requires an Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust to confirm the transfer of assets. It's essential to follow this protocol to ensure all legal and financial obligations are met.

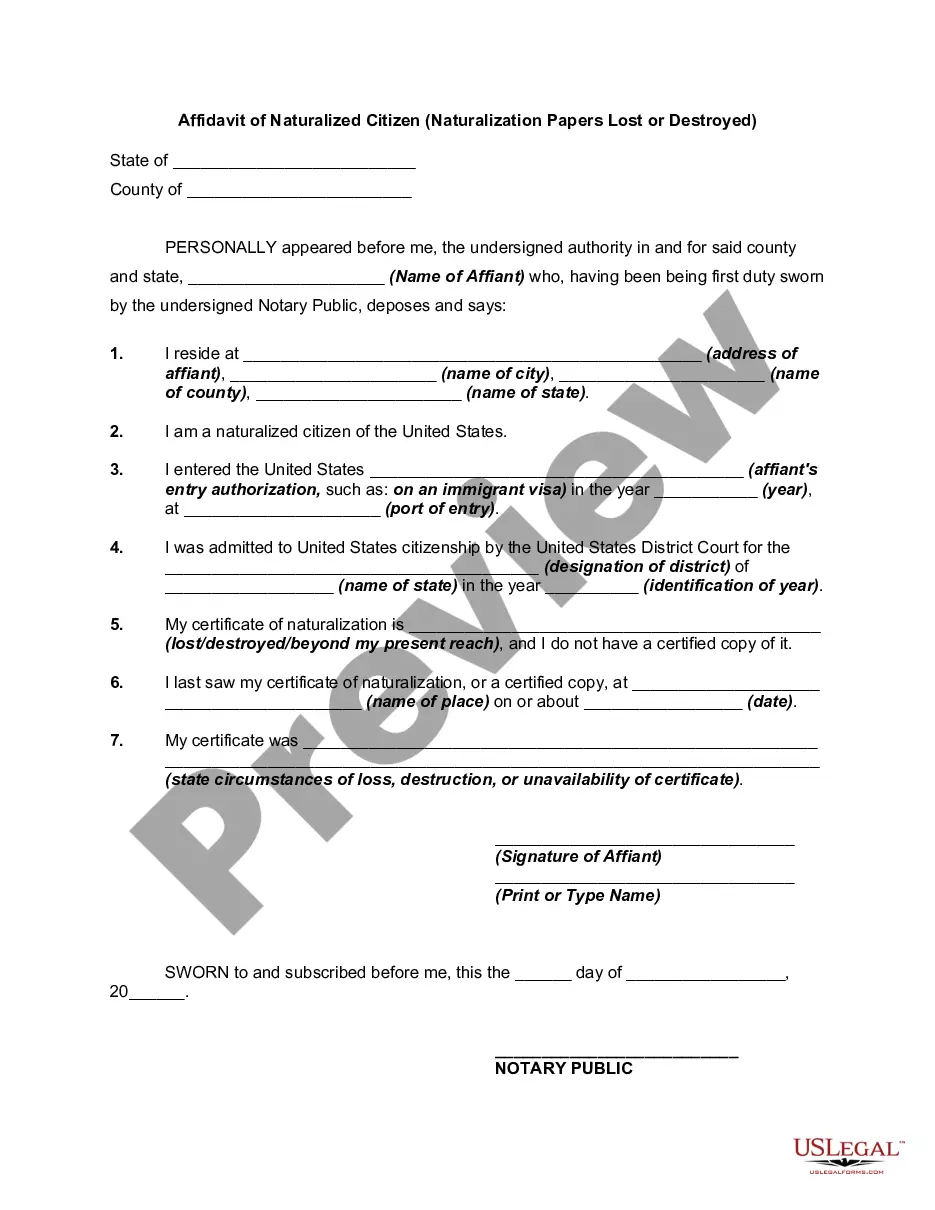

To obtain proof of trust, you should request a copy of the trust document from the trustee. This document outlines the trust's structure and details, serving as a legal proof of its existence. If you encounter difficulties, consulting with a legal expert may help clarify your rights. Additionally, securing an Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust could simplify the verification process.

One of the biggest mistakes parents make is failing to properly fund the trust. A trust can only provide benefits if it is filled with assets; otherwise, it holds no value. Parents often overlook the importance of updating their trust documentation and transferring their assets. That’s crucial for obtaining an Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust if needed.

In Oregon, trusts serve as legal arrangements that hold assets for the benefit of designated beneficiaries. When you establish a trust, you assign a trustee to manage the assets according to your terms. It’s important to understand the responsibilities of the trustee and the rights of beneficiaries. Make sure to document everything, especially if you plan to issue an Oregon Receipt by Trustor for Trust Property Upon Revocation of Trust.