Oregon Instructions to Clients - Short

Description

How to fill out Instructions To Clients - Short?

If you need to total, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms, available on the web.

Employ the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to get the Oregon Instructions to Clients - Short in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Oregon Instructions to Clients - Short. Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Click on the My documents section and choose a form to print or download again. Compete and obtain, and print the Oregon Instructions to Clients - Short with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- When you are currently a US Legal Forms user, Log In to your account and click on the Acquire button to locate the Oregon Instructions to Clients - Short.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for your appropriate city/state.

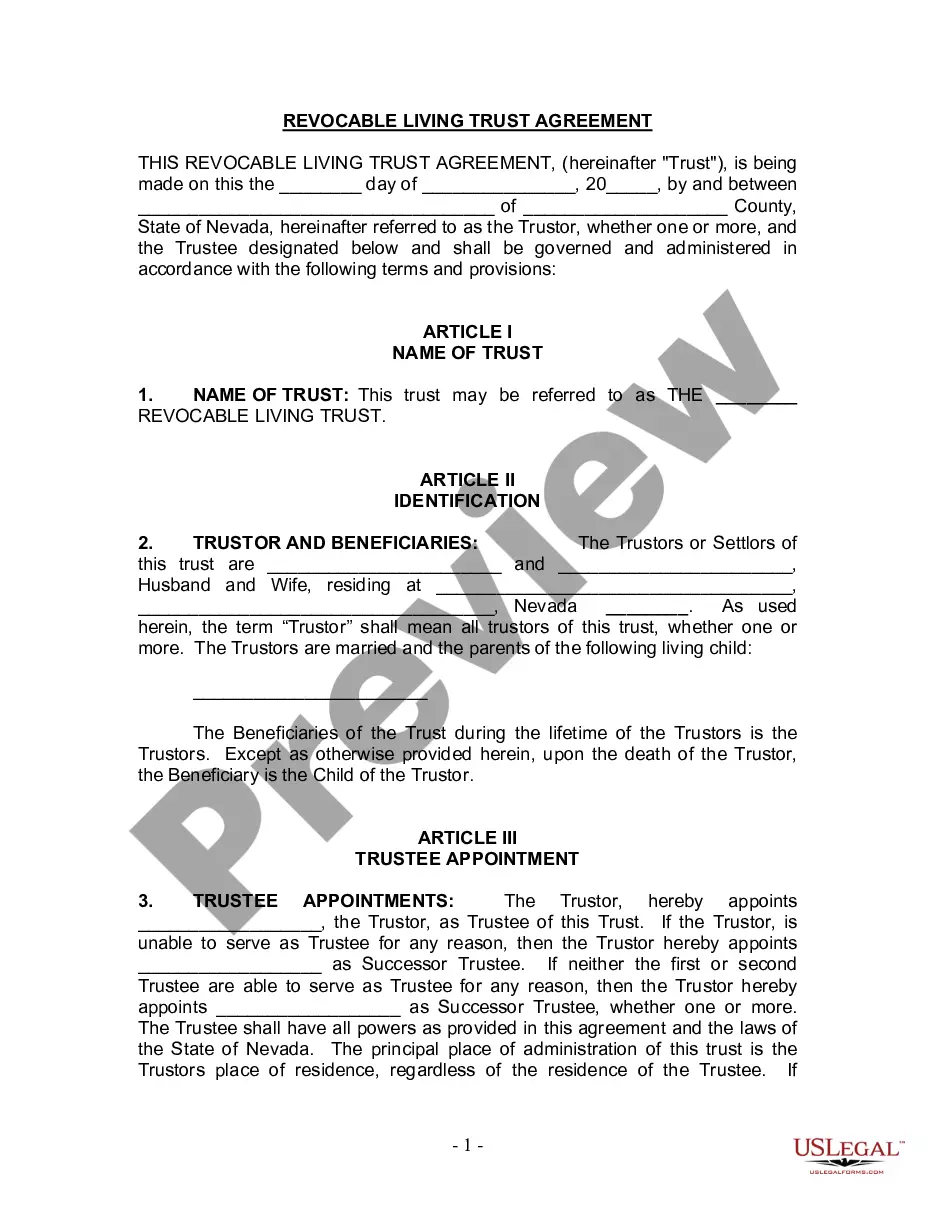

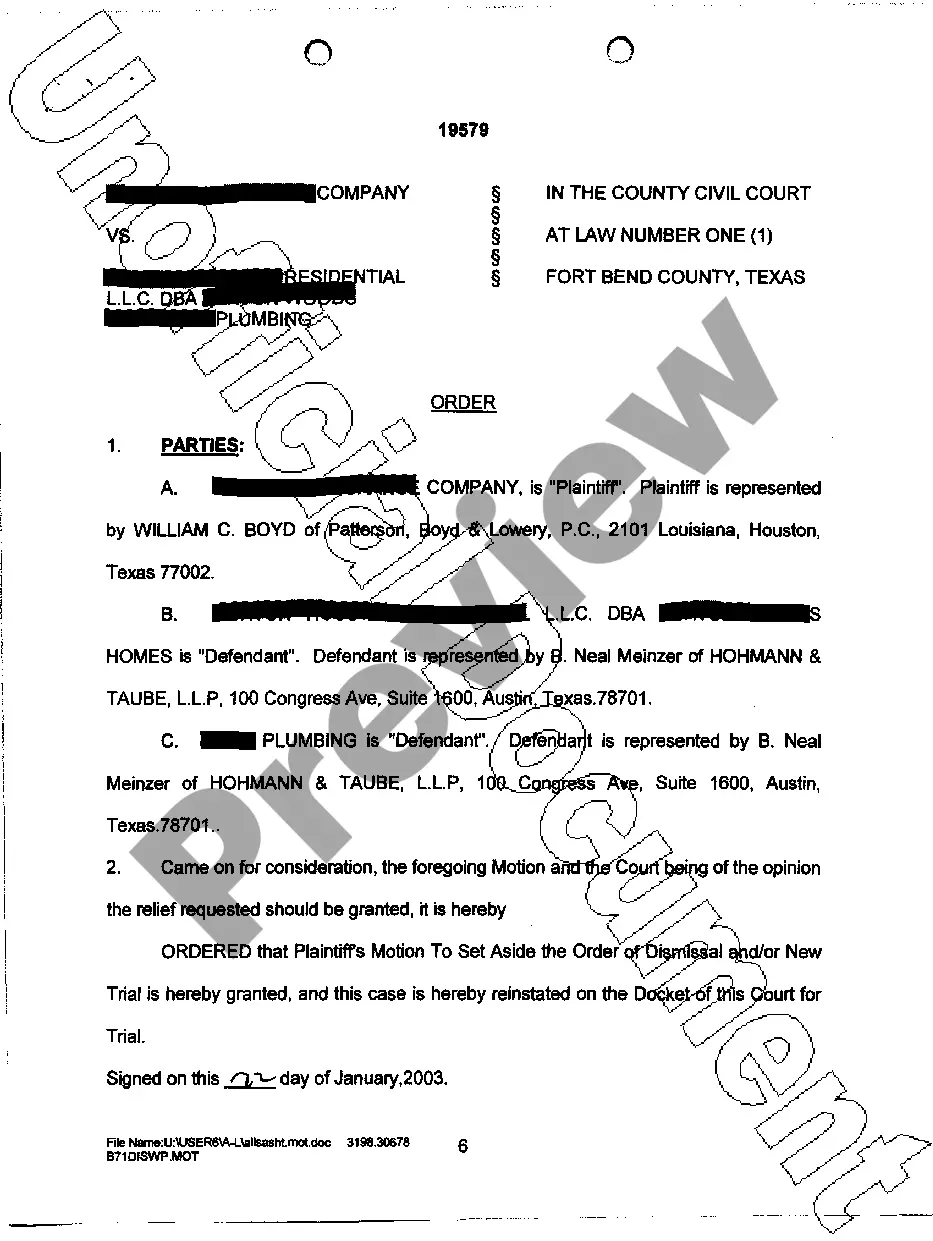

- Step 2. Utilize the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Use Form 40 to change (amend) your full-year resident return. Check the amended return box in the upper left corner of the form. You must also complete and include the Oregon Amended Schedule with your amended return. For prior year tax booklets or the Oregon Amended Schedule, please visit our website or contact us.

2 form from each employer. Other earning and interest statements (1099 and 1099INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other taxdeductible expenses if you are itemizing your return. How to file your federal income tax return | USAGov usa.gov ? filetaxes usa.gov ? filetaxes

Does Oregon require W-2 filing? Yes, the state of Oregon mandates the filing of the W2 forms only if there is a state tax withholding. Oregon Form W-2 & OR-WR Filing Requirements - TaxBandits taxbandits.com ? w2-forms ? oregon-state-fi... taxbandits.com ? w2-forms ? oregon-state-fi...

After you mail your tax return There may be a delay in processing your return if you did not attach your: Federal tax return. W-2. File by mail | FTB.ca.gov ca.gov ? file ? ways-to-file ? paper ca.gov ? file ? ways-to-file ? paper

Federal return. You must include a copy of your fed- eral Form 1040 or 1040-SR and Schedules 1 through 3 (if applicable), 1040-X, or 1040-NR with your Oregon return. Without this information, we may disallow or adjust items claimed on your Oregon return.

Wisconsin requires a complete copy of your federal return. Begin by putting the four pages of Form 1 in numerical order. Then, attach, using a paper clip, the following in the order listed. Note: If filing Form 804, Claim for Decedent's Wisconsin Income Tax Refund, with the return, place Form 804 on top of Form 1. Do I need to include my 1040 with my WI state return? - TurboTax Support intuit.com ? state-taxes ? discussion ? do-i-nee... intuit.com ? state-taxes ? discussion ? do-i-nee...