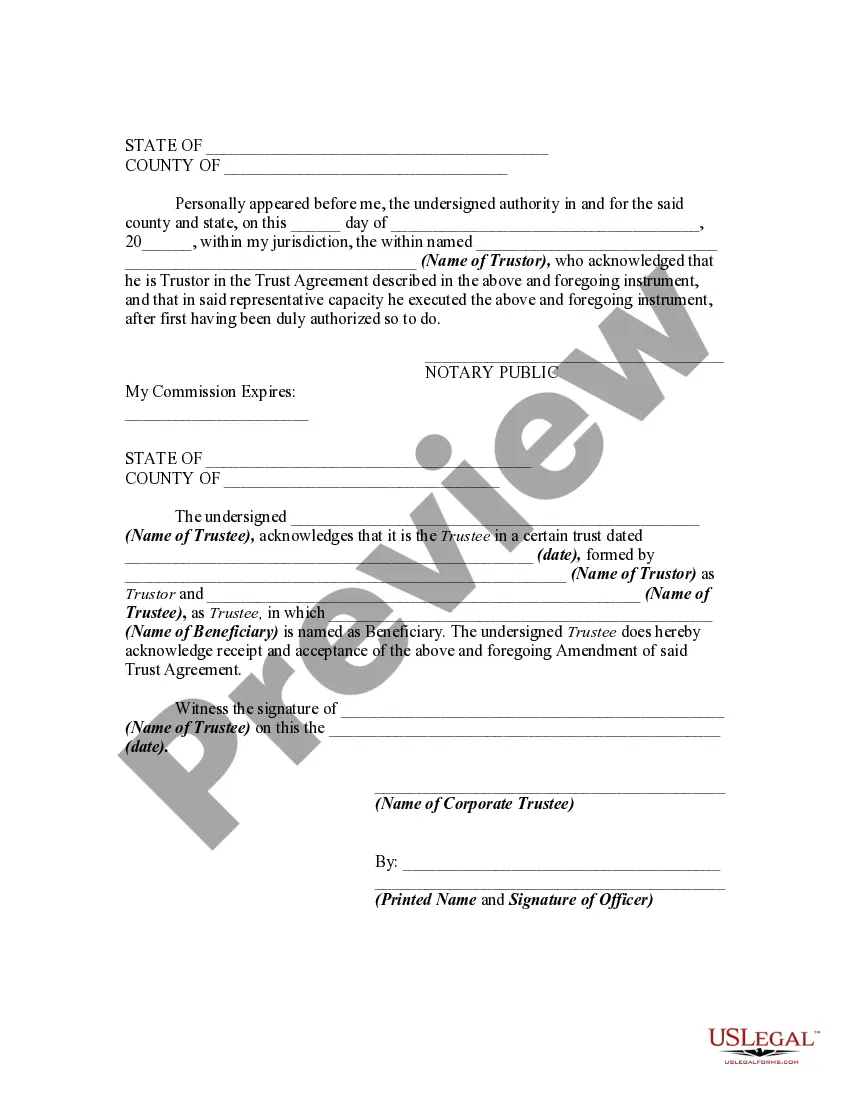

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee

Description

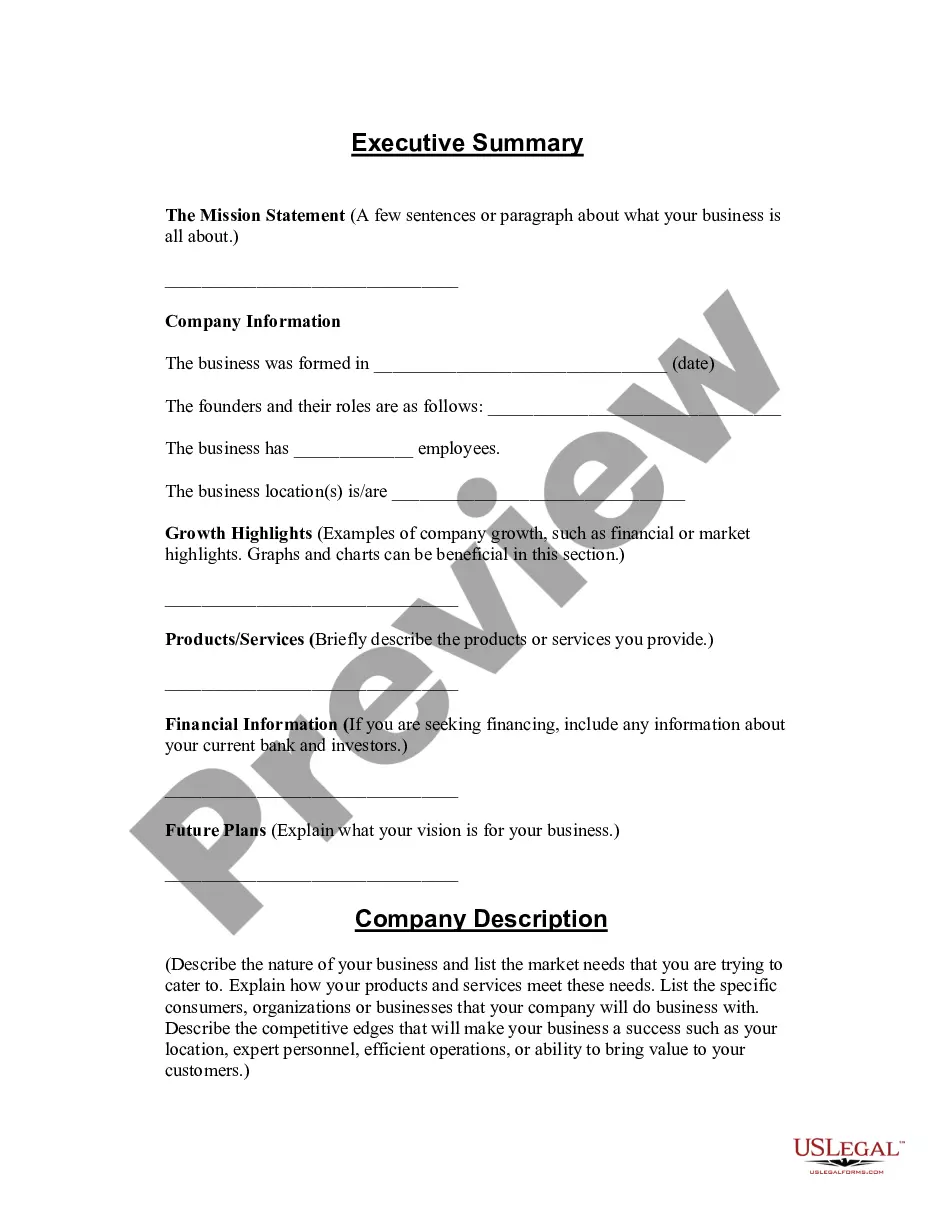

How to fill out Amendment Of Declaration Of Trust With Cancellation And Addition Of Sections And The Consent Of Trustee?

If you need to finish, acquire, or create valid document templates, utilize US Legal Forms, the largest variety of legitimate documents available online.

Take advantage of the site's straightforward and user-friendly search feature to find the forms you require.

Various templates for business and personal uses are divided by categories and states, or keywords. Use US Legal Forms to access the Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee in just a few clicks.

Every legal document template you obtain is yours indefinitely. You can access every form you purchased in your account. Go to the My documents section and choose a form to print or retrieve again.

Compete and acquire, and print the Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your personal business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to receive the Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee.

- You can also access forms you previously obtained in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions in the legal form template.

- Step 4. Once you have identified the form you require, click the Purchase now button. Choose the payment plan you prefer and input your details to register for the account.

- Step 5. Process the purchase. You can use your Credit or Debit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee.

Form popularity

FAQ

To amend and restate a trust means to comprehensively update the trust document by incorporating all previous changes into a single, new document. This method simplifies the management of the trust and ensures clarity. In the case of an Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, this approach helps clarify intentions and consolidates information for easier reference. It's a smart option when dealing with complex arrangements.

Yes, a trust can be amended, provided it is revocable. Amendments allow the trust to adapt to new circumstances, such as changes in family dynamics or financial situations. With an Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, you can effectively make these adjustments. Consulting with your legal advisor ensures that these amendments are legally sound.

A trust can be revoked in various ways, including through written notice by the grantor or by following specific procedures outlined in the original trust document. If you have a revocable trust, you can simply create a new document to replace it. Understanding the specific terms of an Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee can clarify this process for you. Each method has its implications, so careful consideration is essential.

Amending a trust is generally straightforward, especially when done with guidance. This process can often be completed with the help of legal professionals who specialize in estate planning. For example, an Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee can be drafted to ensure compliance with state laws. With the right resources, you can efficiently implement necessary changes.

An amended trust document includes specific changes made to the original agreement but retains the original format. Conversely, a restated trust consolidates all changes into a new document, effectively superseding the original. This distinction is key when dealing with an Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, as it determines how you present the updated trust terms. Choosing between the two depends on how comprehensive your changes need to be.

A revocable trust is designed to be flexible and can be changed as needed. In contrast, an irrevocable trust cannot be modified without the consent of all beneficiaries or a court decree. Such trusts are often used for specific purposes like asset protection or tax planning. Understanding this distinction can help you make informed decisions about the type of trust that best suits your needs.

An amendment to the trust agreement allows changes to be made to the original terms of the trust. This process is crucial when circumstances change or when new objectives arise. In the context of an Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, you can modify specific sections to reflect evolving needs. Many individuals find that such amendments can enhance the efficiency and effectiveness of their trust.

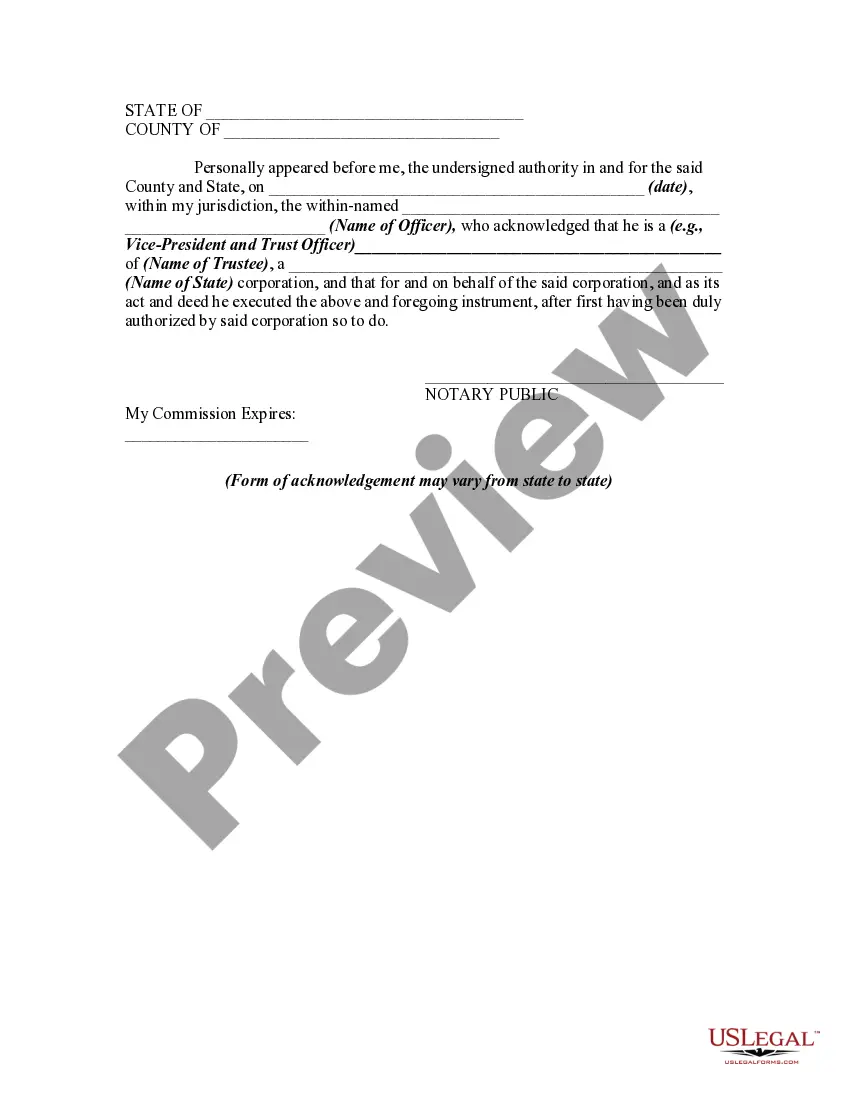

To amend and restate a trust, you begin by drafting a new document that outlines the changes you wish to make. This process often includes the Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. After completion, it's essential to have all trustees sign the new document, ensuring they consent to the changes. Additionally, consider working with a legal professional or using platforms like uslegalforms to simplify the process and ensure compliance with state laws.

To amend a trust in Oregon, you will need to follow the legal procedures set forth in your trust document. Typically, this involves creating a written amendment that specifies the changes, particularly if you are addressing the Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Consulting with legal experts can also streamline the process and ensure compliance with state laws.

A trust amendment is considered valid when it meets specific legal requirements outlined in Oregon law. This includes the proper execution of the Oregon Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, appropriate signatures, and, if recommended, notarization. Always ensure that the amendment is clear and unambiguous to prevent future disputes.