In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Oregon Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

You might spend hours online looking for the authentic document template that meets the local and nationwide requirements you need.

US Legal Forms offers thousands of valid forms that have been reviewed by experts.

You can conveniently obtain or generate the Oregon Security Agreement with Farm Products as Collateral using my assistance.

If available, utilize the Preview function to review the document template as well. If you want to find another version of the form, use the Search bar to locate the template that fits your requirements and needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, print, or sign the Oregon Security Agreement with Farm Products as Collateral.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, verify that you have selected the correct document template for the area/city you choose.

- Review the form details to ensure you have selected the right document.

Form popularity

FAQ

A collateral security cession involves the transfer of rights to collateral assets to secure a debt. This process is crucial when establishing an Oregon Security Agreement with Farm Products as Collateral, as it clarifies ownership and repayment conditions. By ceding certain rights to your products, you create a legally binding relationship with your lender. This strengthens your position when seeking financing for your farming operations.

Under UCC §9-324(d), a creditor will have priority over an earlier-filed security interest in the same livestock if: (1) the creditor perfects their interest by filing a financing statement before the debtor receives possession of the livestock; (2) the purchase-money creditor provides a signed notice to the holder of

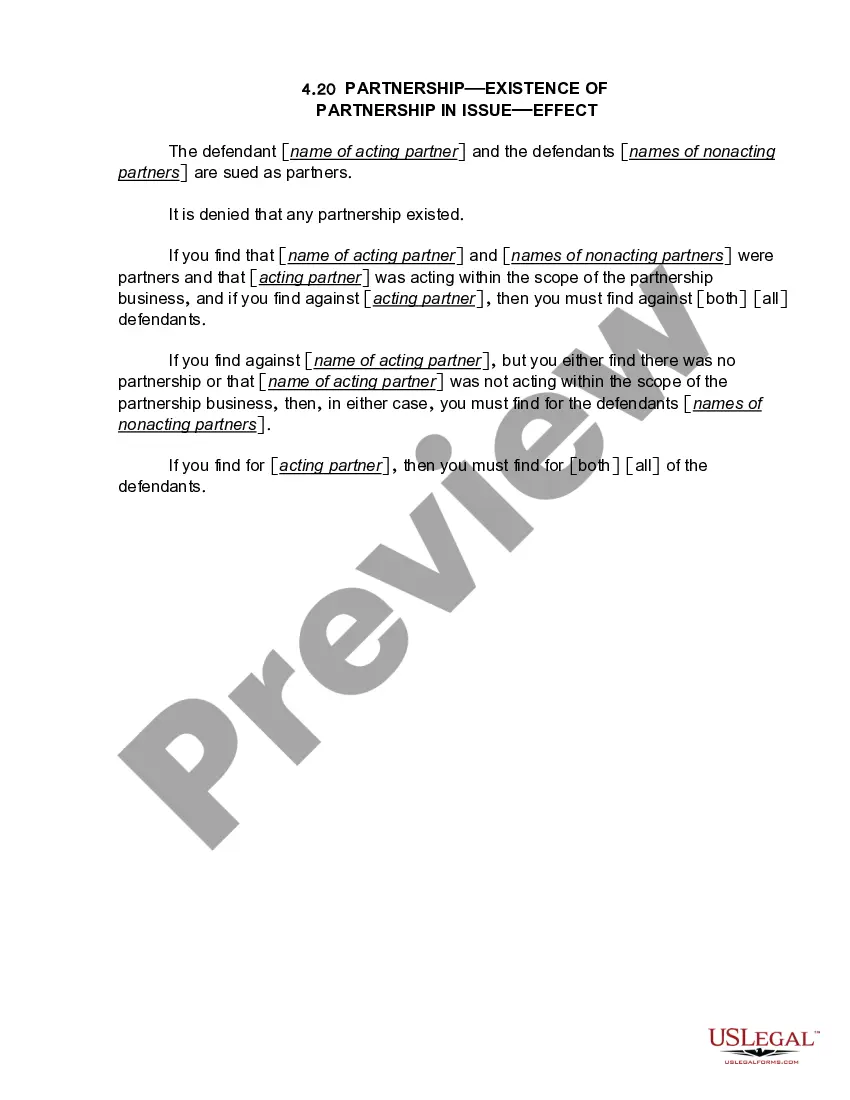

Under Article 9, a security interest is created by a security agreement, under which the debtor grants a security interest in the debtor's property as collateral for a loan or other obligation.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Absolutely. When securing a loan with livestock or any other farm product under the Uniform Commercial Code (the UCC), the statutory framework that underscores security interests and liens in agricultural financing can be confusing among lenders and secured parties.

Security agreements can be used to specify a collateral that is already in possession of the debtor, an intangible collateral or an after-acquired property.

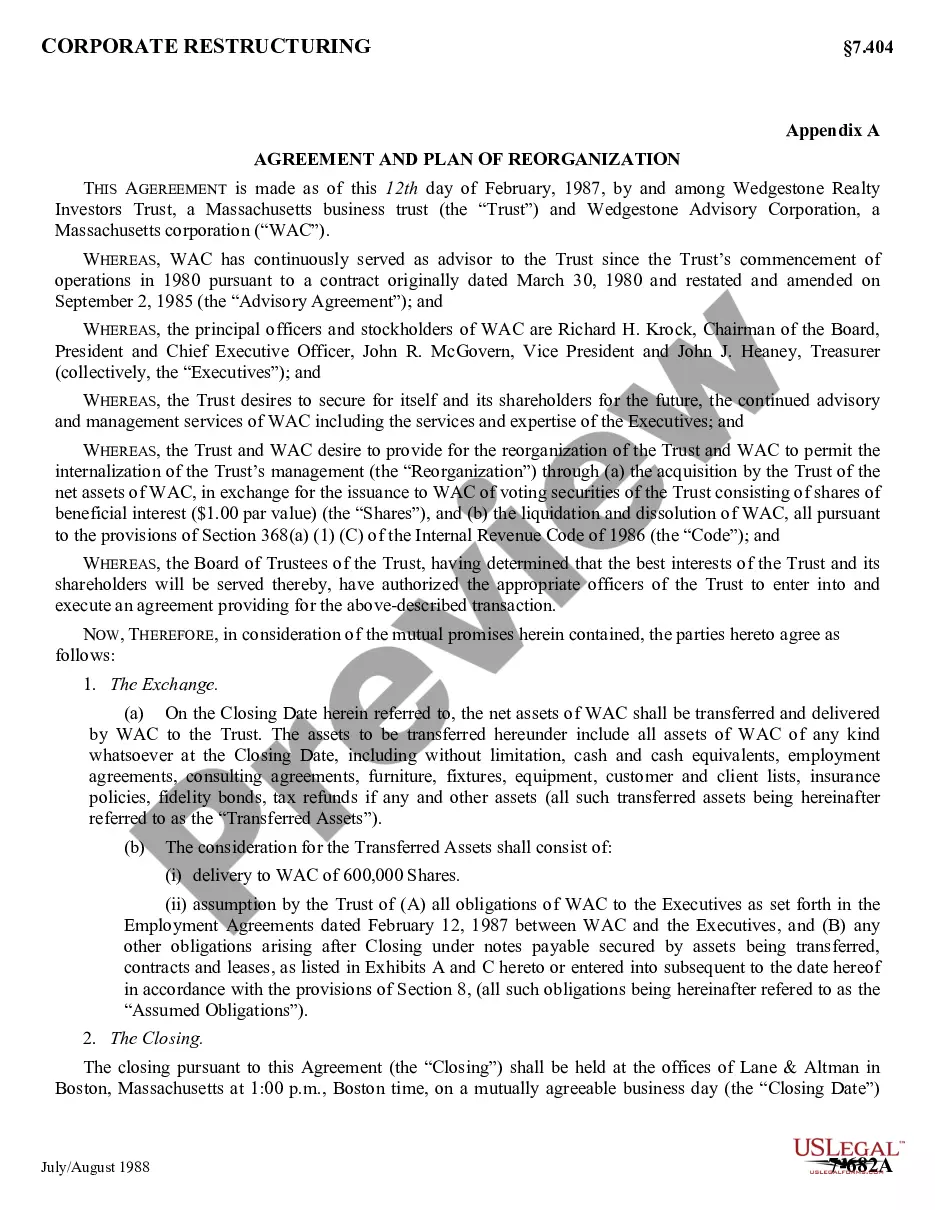

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.