Oregon Promissory Note - Balloon Note

Description

How to fill out Promissory Note - Balloon Note?

It is feasible to invest hours online searching for the legal document template that meets the state and federal criteria you require.

US Legal Forms provides an extensive collection of legal forms that are reviewed by professionals.

You can easily download or print the Oregon Promissory Note - Balloon Note from our services.

If available, use the Preview option to look through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download option.

- After that, you may complete, modify, print, or sign the Oregon Promissory Note - Balloon Note.

- Every legal document template you obtain is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, make sure you have selected the correct document template for your area/city of choice.

- Check the form description to ensure you have selected the right form.

Form popularity

FAQ

To fill out a promissory demand note, start by entering the borrower's details, followed by the lender's information. Specify the total amount borrowed and the terms for repayment, which may include interest and any required collateral. This type of note allows lenders to request payment at any time, making it crucial to be clear about your rights and obligations. Resources like uslegalforms provide templates that can guide you through this process.

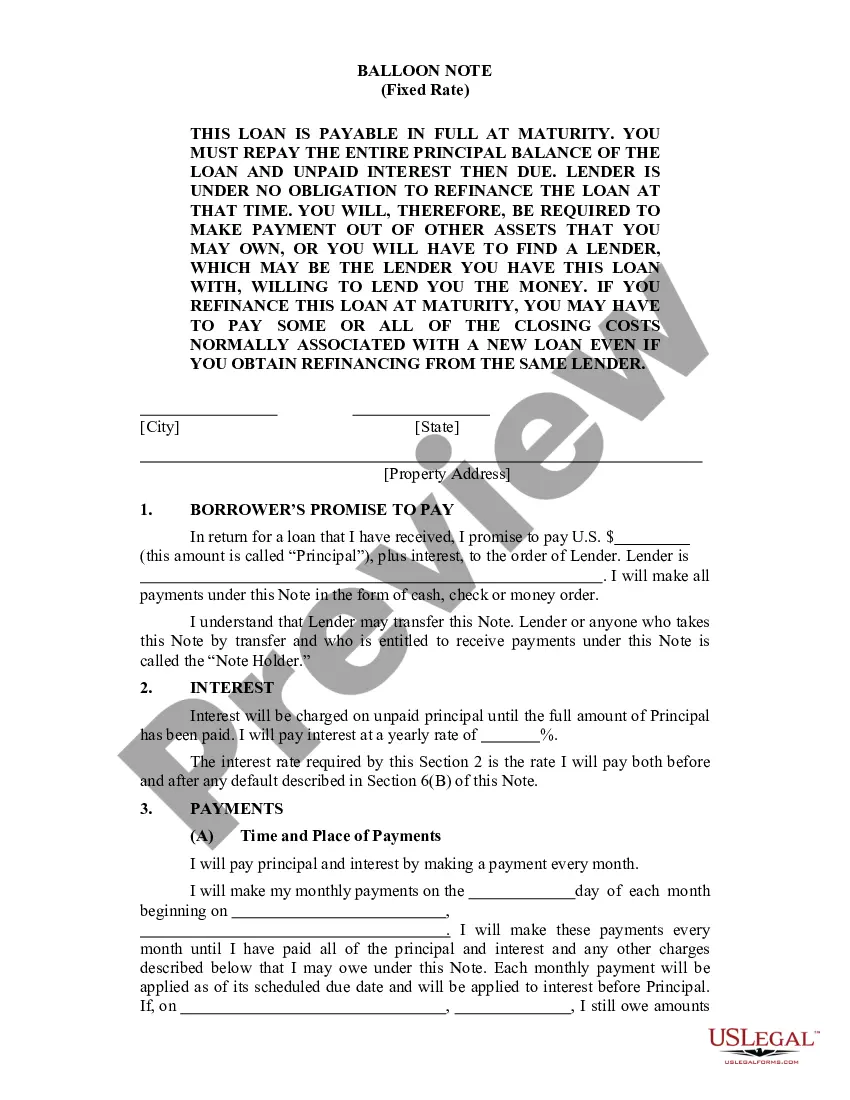

Many people avoid balloon mortgages due to the risk associated with the large final payment. This payment can place significant financial pressure on borrowers who may not have the funds ready when the time comes. Additionally, unexpected life changes can disrupt repayment plans, leading to potential financial hardship. Considering options like the Oregon Promissory Note - Balloon Note can provide clarity and planning strategies to mitigate these risks.

A key disadvantage of a balloon payment is the risk of not being able to make the large final payment. Borrowers may find themselves in financial trouble if they haven't arranged for the necessary funds in advance. With an Oregon Promissory Note - Balloon Note, it's vital to assess your future financial landscape to ensure you can meet this obligation.

Examples of balloon payments include car loans and mortgages where smaller monthly payments lead to a significant final payment. For instance, an Oregon Promissory Note - Balloon Note might involve consistent lower payments for a few years, followed by a substantial lump sum at maturity. Understanding these examples can help you better manage your financial commitments.

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

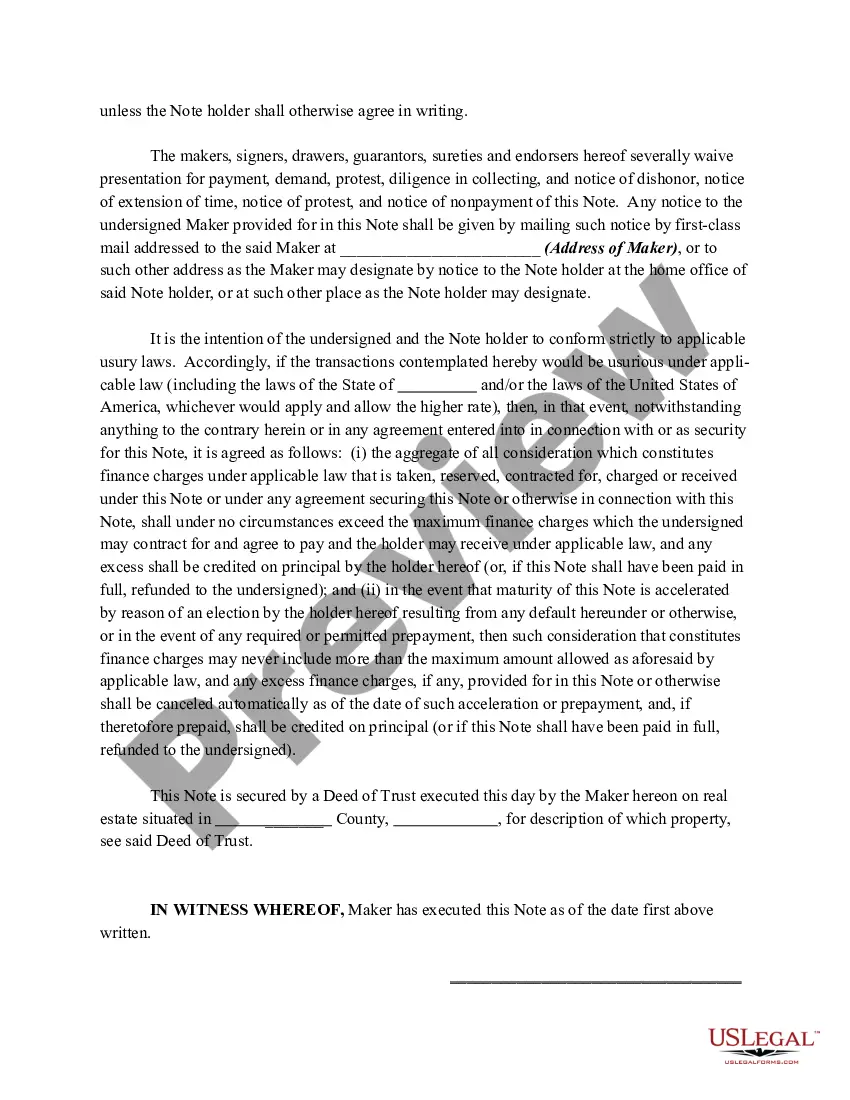

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.