Oregon Employment Application for Model

Description

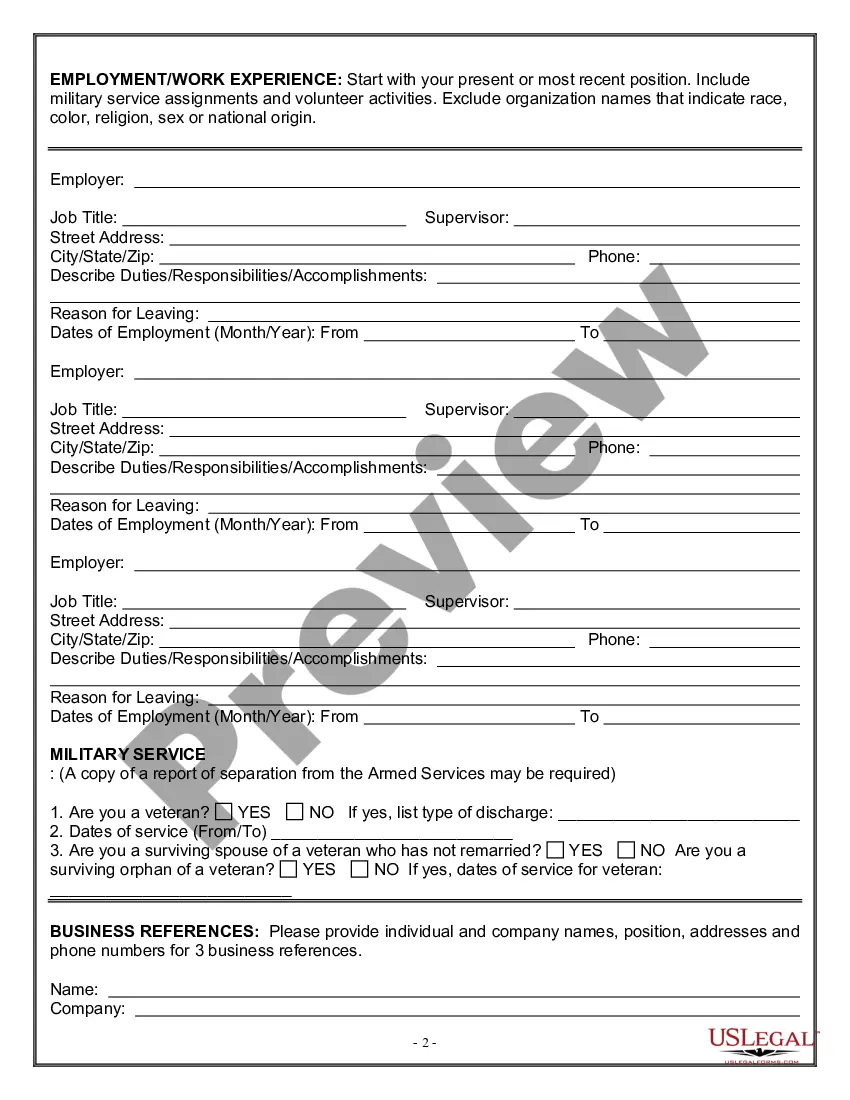

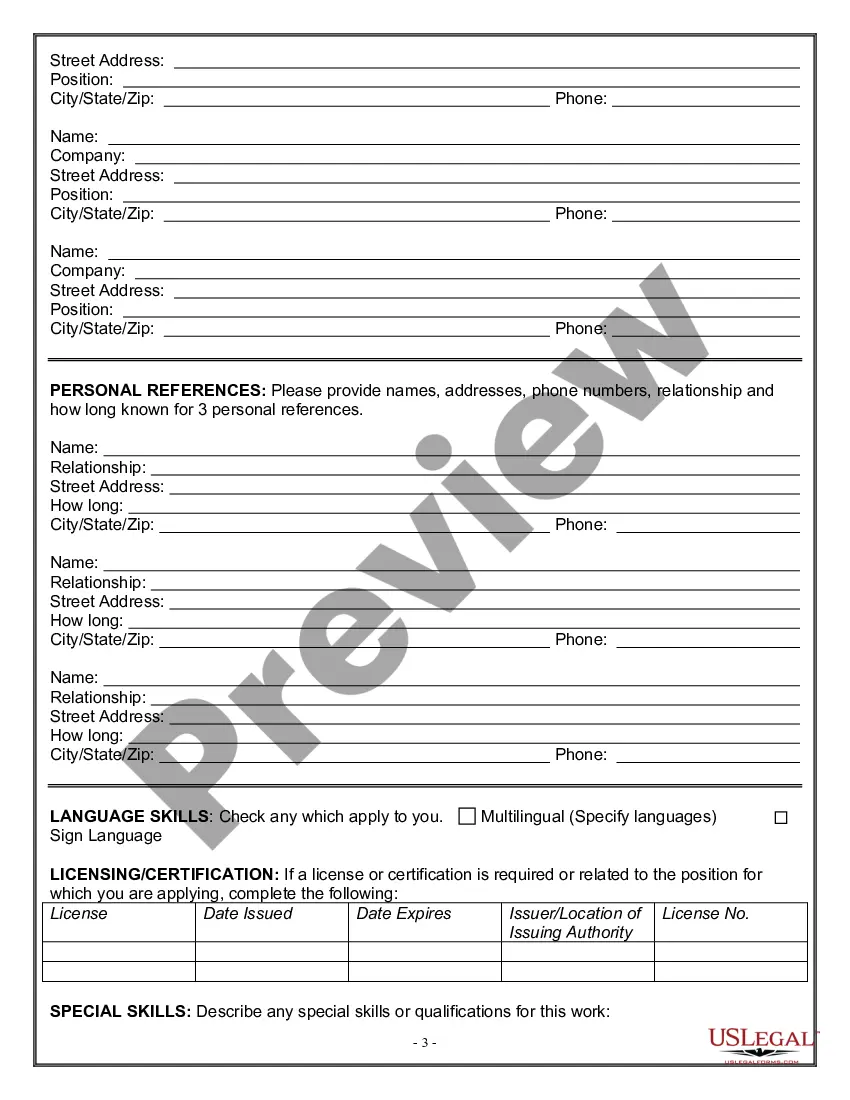

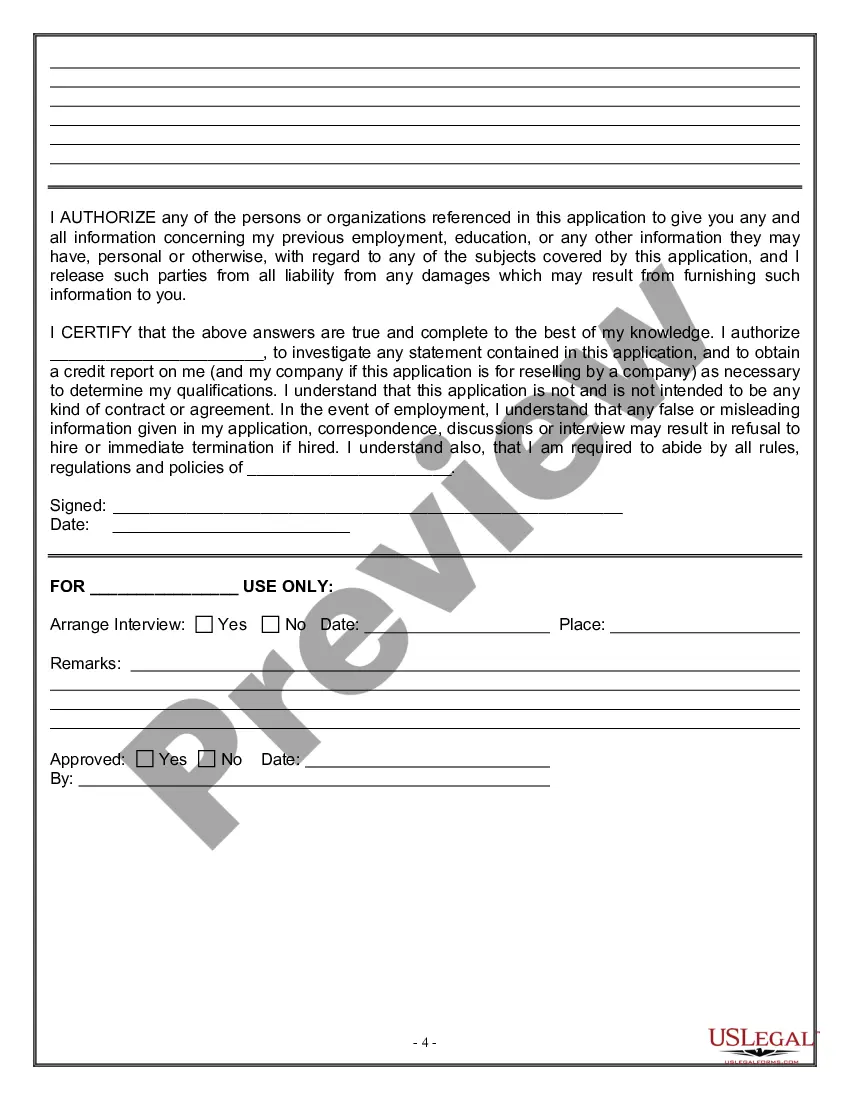

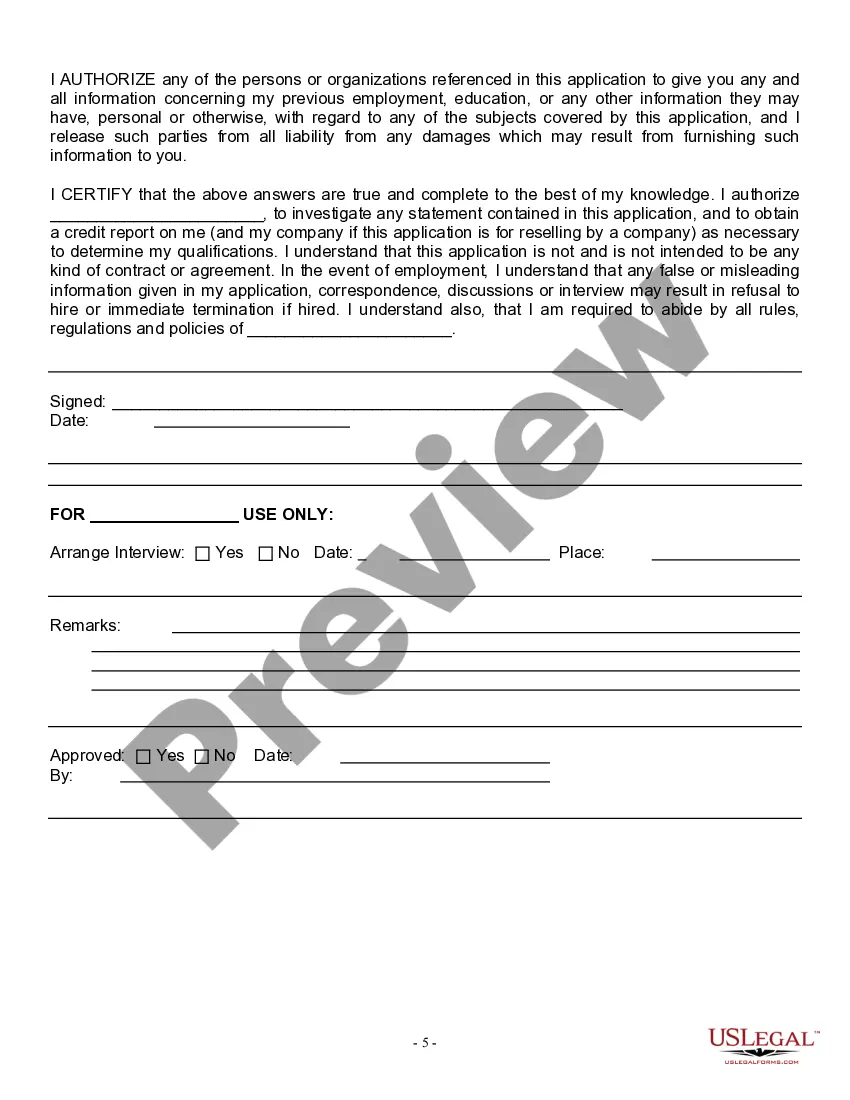

How to fill out Employment Application For Model?

It is feasible to devote numerous hours online searching for the authorized document template that aligns with the state and federal requirements you require.

US Legal Forms provides a vast array of legal forms that have been evaluated by professionals.

You can readily obtain or generate the Oregon Employment Application for Model from my assistance.

Should you wish to acquire another version of your form, use the Research field to find the template that fits your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and select the Acquire button.

- Subsequently, you can complete, modify, print, or sign the Oregon Employment Application for Model.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your desired area/town. Read the form description to confirm you have selected the right form.

Form popularity

FAQ

Please visit our website at: to submit your weekly claim report through the Online Claim System. From the homepage, select Use the Online Claim System. From the Online Claim System menu, please select Pandemic Unemployment Assistance.

Required Employment Forms in OregonSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?23-Feb-2018

To check on your claim, log in to our Online Claim System. Claims are updated during the night and are generally available in the morning. Frequently asked questions about claims, claims statuses, and what you can do. Right now, the time between applying and getting your first check is a minimum of four weeks.

For regular unemployment insurance (UI) benefits, you will need:Your name, Social Security number, birthdate and contact information.Your complete work history for the past 18 months including: employer name(s) address(es) phone number(s)Your bank account and routing number, if you want to sign up for direct deposit.

Typically, this happens when you skip a weekly claim in error or fail to restart/reopen a claim after weeks you intended to skip. You must call the UI Center to either restart or reopen your claim when this happens.

Definitions as they pertain to Oregon Employment Department Law. An employer is subject to unemployment insurance taxes when the employer pays wages of $1,000 or more in a calendar quarter, or employs one or more individuals in any part of 18 separate weeks during any calendar year.

Please visit our website at: to submit your weekly claim report through the Online Claim System. From the homepage, select Use the Online Claim System. From the Online Claim System menu, please select Pandemic Unemployment Assistance.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

This is part of the new CARES Act, and it's called Federal Pandemic Unemployment Compensation (FPUC). You don't have to take any action to get it. If you are eligible for PUA in a given week, we will automatically send you the extra $600 that week too.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.