Oregon Sample Letter for Acknowledgment of Benefactors is a formal document that aims to express gratitude and acknowledge the contributions made by benefactors in the state of Oregon. This type of letter is commonly used by non-profit organizations, educational institutions, and other entities that rely on donations and support from individuals or businesses. The letter usually begins with a polite salutation, addressing the benefactors by their proper names or titles. It is essential to personalize the letter to make the benefactors feel valued and recognized for their generosity. The first paragraph of the letter typically expresses gratitude and appreciation for the benefactor's support and outlines the purpose of the organization or cause. It is important to clearly state how the donations or contributions have made a positive impact on the organization or the community it serves, using keywords such as "support," "generosity," "contribution," and "impact." The second paragraph of the letter often mentions specific projects or initiatives that have been made possible by the benefactor's donation. This part should be detailed and specific, mentioning any achievements, progress, or milestones related to the cause or organization. Key phrases like "without your donation," "thanks to your support," and "your contribution has allowed us to" help emphasize the significance of their involvement. In the following paragraph, the letter may highlight any plans or future projects that the organization intends to pursue. By doing this, the organization shows that the benefactor's donations will continue to be used effectively and go towards making a difference. Mentioning the potential impact of future projects can encourage benefactors to continue their support. The letter then concludes with a final expression of gratitude and thanks, along with reiterating the importance of the benefactor's involvement. It may also include contact information, such as phone numbers or email addresses, for the benefactor to reach out for further inquiries or discussions. Different types of Oregon Sample Letter for Acknowledgment of Benefactors may include variations in formatting, content, and tone, depending on the specific circumstances. For instance, there could be separate letters for individual benefactors, corporate benefactors, or recurring donors to convey a more personalized message. Overall, the Oregon Sample Letter for Acknowledgment of Benefactors aims to establish a long-lasting relationship between the organization and the benefactors, ensuring ongoing support and engagement for the cause.

Oregon Sample Letter for Acknowledgment of Benefactors

Description

How to fill out Oregon Sample Letter For Acknowledgment Of Benefactors?

If you require detailed, obtain, or print sanctioned document templates, utilize US Legal Forms, the foremost selection of legal documents, accessible online.

Utilize the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are categorized by type and state, or keywords.

Every legal document template you acquire is yours indefinitely.

You have access to every document you downloaded within your account. Select the My documents section and choose a document to print or download again.

- Utilize US Legal Forms to obtain the Oregon Sample Letter for Acknowledgment of Benefactors in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Retrieve button to access the Oregon Sample Letter for Acknowledgment of Benefactors.

- You can also view forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

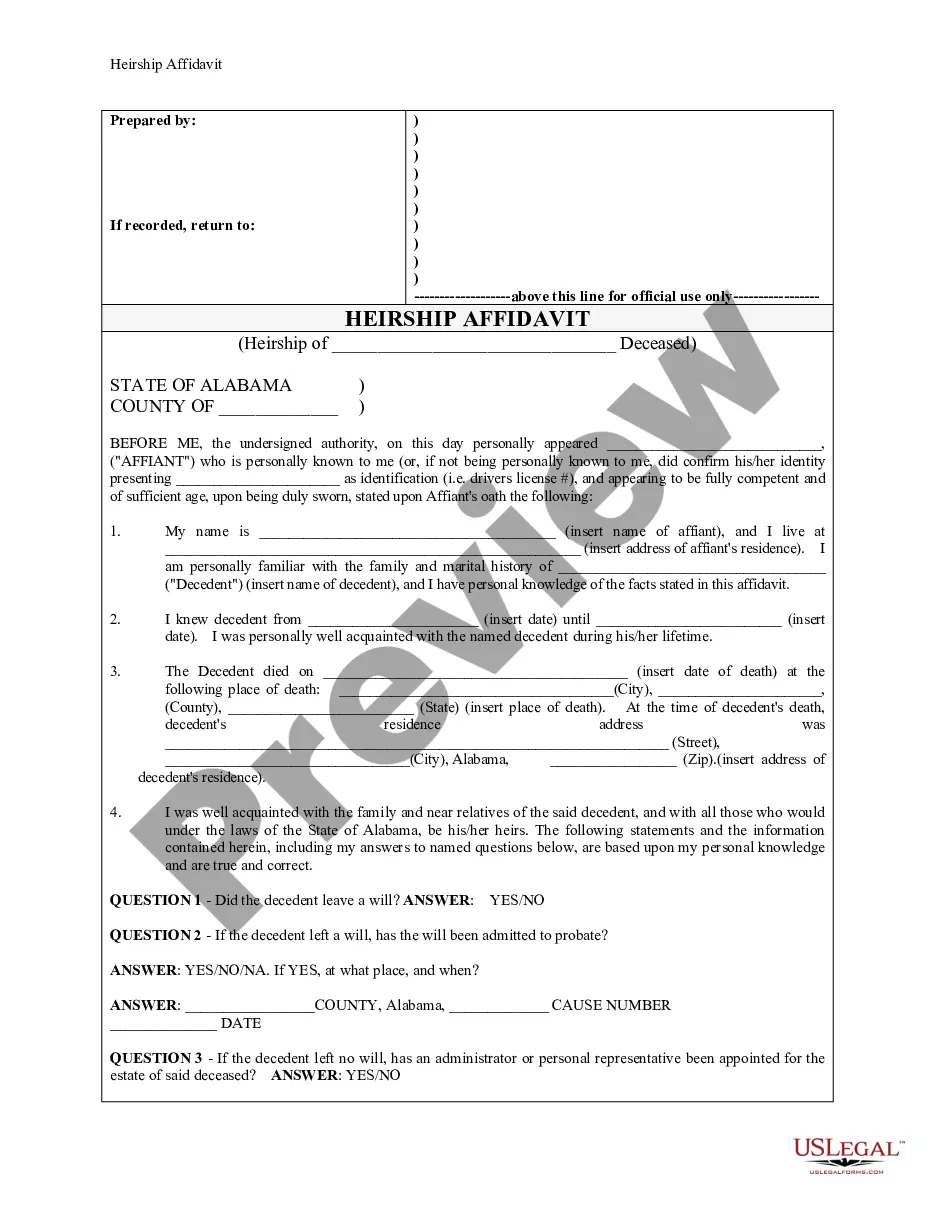

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the contents of the form. Do not forget to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search box at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have found the form you want, click on the Download now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Oregon Sample Letter for Acknowledgment of Benefactors.

Form popularity

FAQ

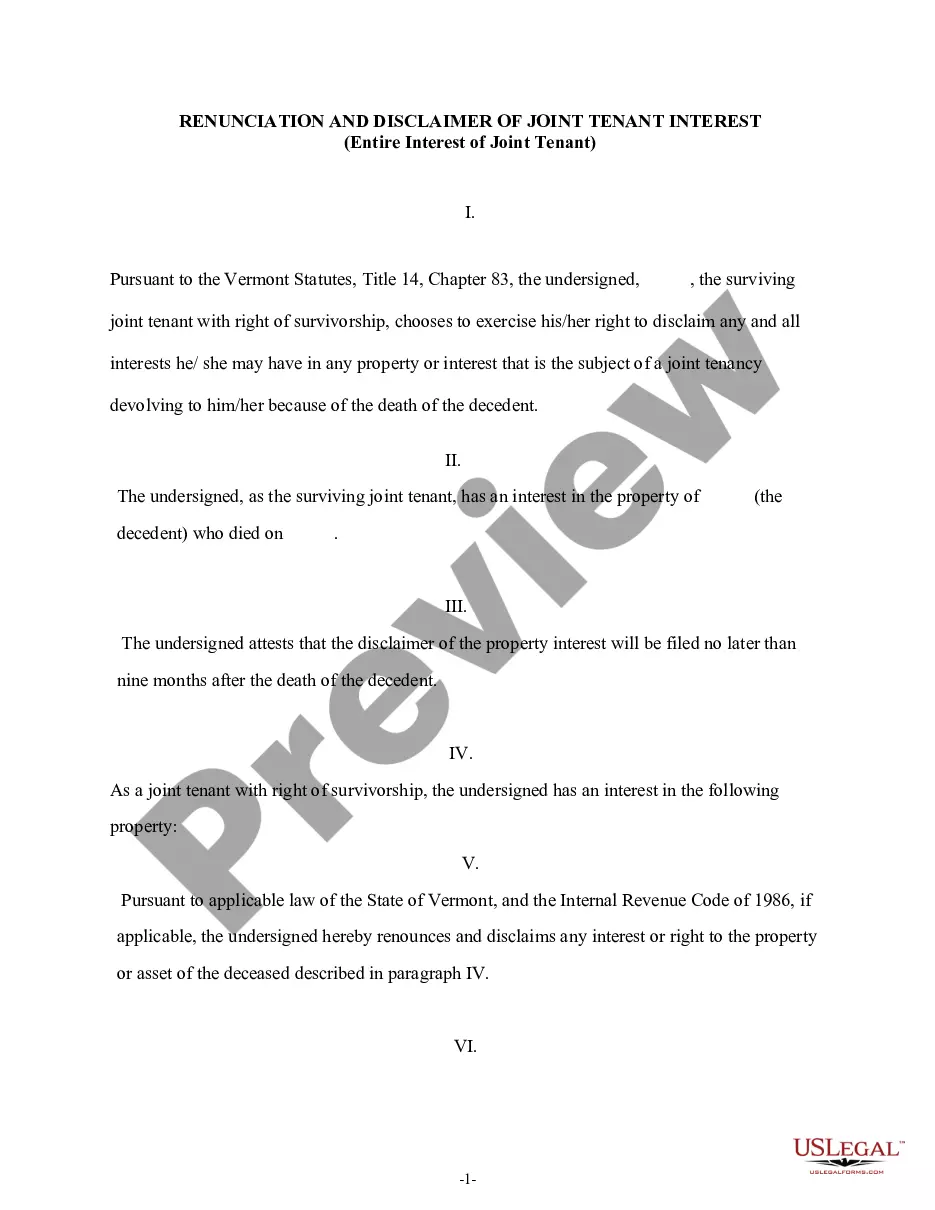

Along with the basics, such as your nonprofit's name, the amount and date of the donation, make sure your acknowledgment letters state whether donors received anything in exchange for their gifts. For example, you might state that no goods or services were provided to the donor.

This is an acknowledgement that the Trustee has been advised of his or her duty as Trustee to contact the trust beneficiaries and provide all beneficiaries with a copy of the Living Trust. It holds you and your law firm harmless should a beneficiary bring some kind of action due to the failure of such duties.

What do you need to include in your donation acknowledgment letter?The name of your donor.The full legal name of your organization.A declaration of your organization's tax-exempt status.Your organization's employer identification number.The date the gift was received.A description of the gift and the amount received.More items...?

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

For the written acknowledgment to be considered contemporaneous with the contribution, a donor must receive the acknowledgment by the earlier of: the date on which the donor actually files his or her individual federal income tax return for the year of the contribution; or the due date (including extensions) of the

Name and details of the person/company to whom the letter is been sent (recipient) Date of sending the acknowledgement letter. The subject of the letter stating the reason for writing it. Statement of confirmation of receipt of the item.

Name and details of the person/company to whom the letter is been sent (recipient) Date of sending the acknowledgement letter. The subject of the letter stating the reason for writing it. Statement of confirmation of receipt of the item.

Thank you for your generous gift to name of organization. We are thrilled to have your support. Through your donation we have been able to accomplish goal and continue working towards purpose of organization. You truly make the difference for us, and we are extremely grateful!

I'm writing to ask you to support me and my cause/project/etc.. Just a small donation of amount can help me accomplish task/reach a goal/etc. Your donation will go toward describe exactly what the contribution will be used for. When possible, add a personal connection to tie the donor to the cause.

A way to do this is by acknowledging the gift. The nonprofit may desire to state something like: Thank you for your contribution of insert detailed description of goods/services donated that your charitable organization received on dates.

Interesting Questions

More info

Class Next Class View All | View All Search.