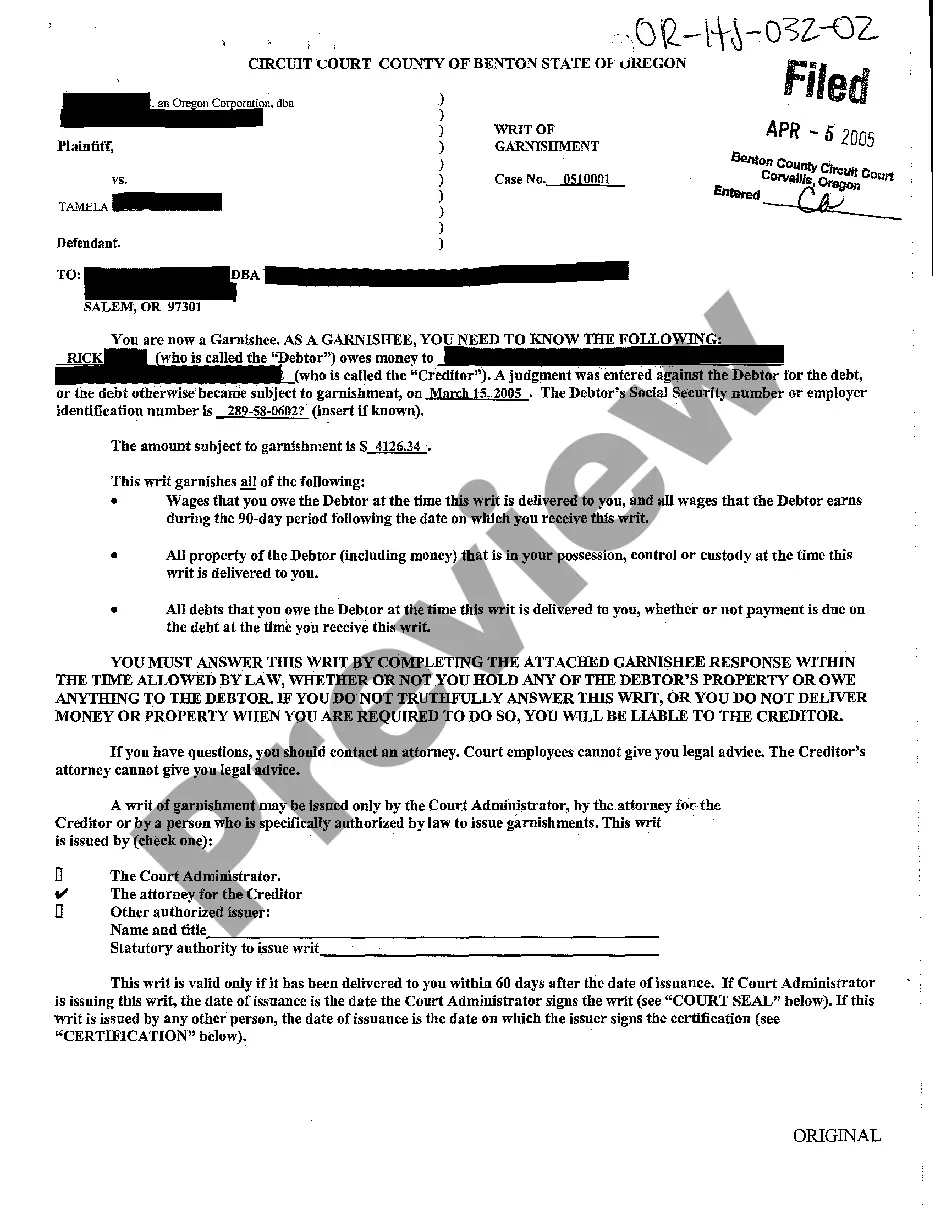

Oregon Writ of Garnishment

Description

- A11 Writ of Garnishment: This is a legal tool used in the United States to enforce judgments by requiring a third party, like an employer or bank, to withhold assets or wages from an individual (the debtor) to pay a creditor.

- Wage Garnishment: A common form of garnishment where an employer withholds a portion of an employee's compensation to satisfy a debt or judgment.

- Garnishment Laws: These laws vary by state and dictate the procedures and limitations for executing a garnishment order.

- Stop Wage Garnishment: Legal strategies and options available to individuals to halt or alter the garnishment process.

- Review the Garnishment Order: Understand the details of the garnishment, verifying its validity and the amount specified.

- Consult a Legal Expert: Get advice specific to your state and situation, particularly in areas like the Arkansas order, bankruptcy defense, or if a debt involves name change, real estate, or landlord-tenant issues.

- File an Objection: If you believe the garnishment is flawed, filing a legal objection could either stop or adjust the terms of the garnishment.

- Consider Bankruptcy: Filing for bankruptcy can halt most garnishments immediately through an automatic stay.

- Explore Exemptions: Understand if certain state-specific exemptions can protect a portion of your wages from garnishment.

Garnishment can severely impact an individual's financial stability. Risks include potential job loss due to employer's policies against garnishment, deeper debt from inability to meet other financial obligations, and significant stress and distress affecting personal and work life. For small businesses, garnishments can consume administrative resources and affect employee relations.

| State | Maximum Garnishable Percentage | Unique Provisions |

|---|---|---|

| Arkansas | 25% | Allows for broader exemptions in specific situations like head of household. |

| California | 25% | Stronger protections against extreme financial hardship. |

| Texas | None (except for child support, spousal maintenance, taxes, or student loans) | Very debtor-friendly, minimal wage garnishment circumstances. |

- Ignoring the Garnishment Notice: Failing to respond to garnishment notices can lead to maximum garnishment by default. Always respond and explore available legal options.

- Lacking Legal Representation: Navigating garnishment laws can be complex, and professional help can avoid costly errors and provide potential defenses like exemption claims or bankruptcy filings.

How to fill out Oregon Writ Of Garnishment?

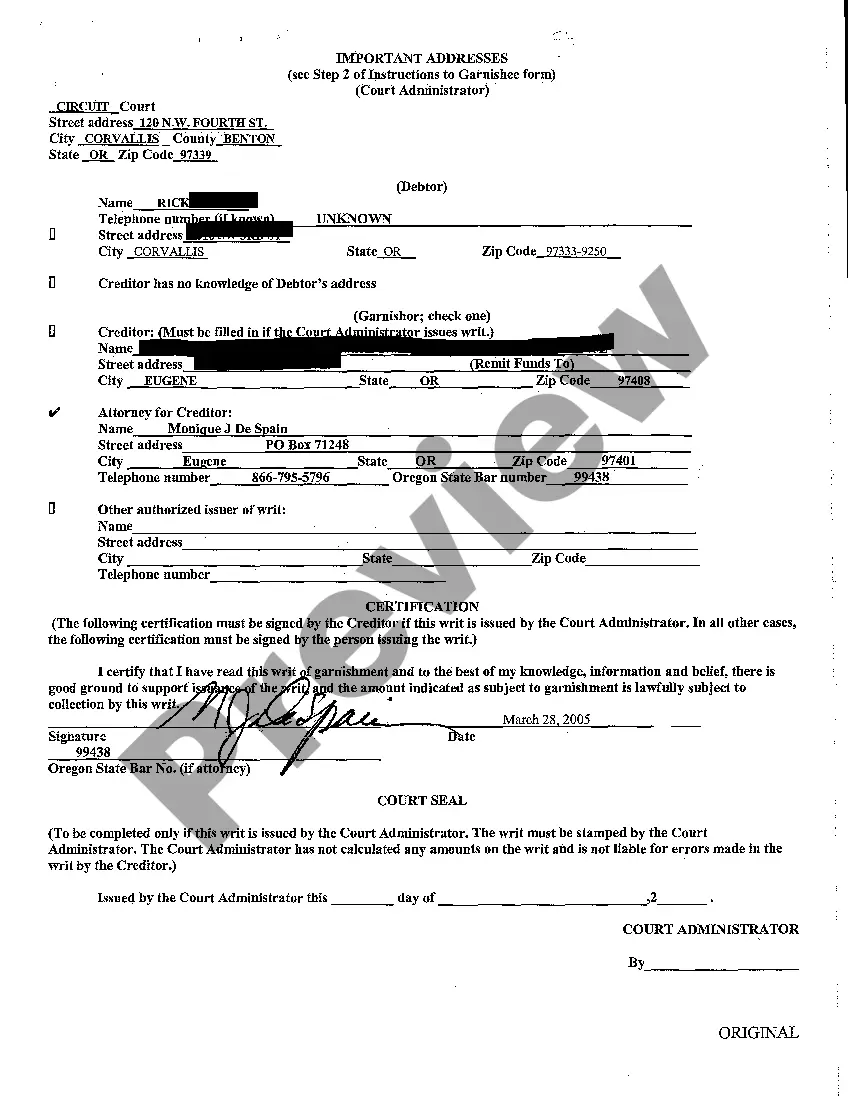

When it comes to filling out Oregon Writ of Garnishment, you most likely imagine an extensive procedure that involves choosing a appropriate sample among numerous very similar ones and then having to pay out a lawyer to fill it out to suit your needs. In general, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific form within clicks.

In case you have a subscription, just log in and click Download to get the Oregon Writ of Garnishment template.

If you don’t have an account yet but want one, keep to the step-by-step guideline below:

- Make sure the file you’re downloading applies in your state (or the state it’s required in).

- Do this by reading the form’s description and through clicking the Preview option (if offered) to find out the form’s information.

- Click Buy Now.

- Choose the proper plan for your budget.

- Sign up for an account and choose how you want to pay: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional legal professionals work on drawing up our templates so that after downloading, you don't have to worry about editing content outside of your personal info or your business’s information. Join US Legal Forms and receive your Oregon Writ of Garnishment example now.

Form popularity

FAQ

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

Option 1) Challenge the Wage Garnishments. Option 2) Negotiate a Payment Plan. Option 3) Contact a Credit Counseling Service. Option 4) Consider a Debt Consolidation Loan. Option 5) Look into a Debt Settlement Program.

A wage garnishment lasts for 90 days and can be renewed by the creditor multiple times until the entire debt you owe is satisfied. A garnishment can intercept 25% of your net paycheck so long as you retain a certain minimum amount of money about $220 per week of work.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.