Oregon Renunciation And Disclaimer of Property from Will by Testate

What this document covers

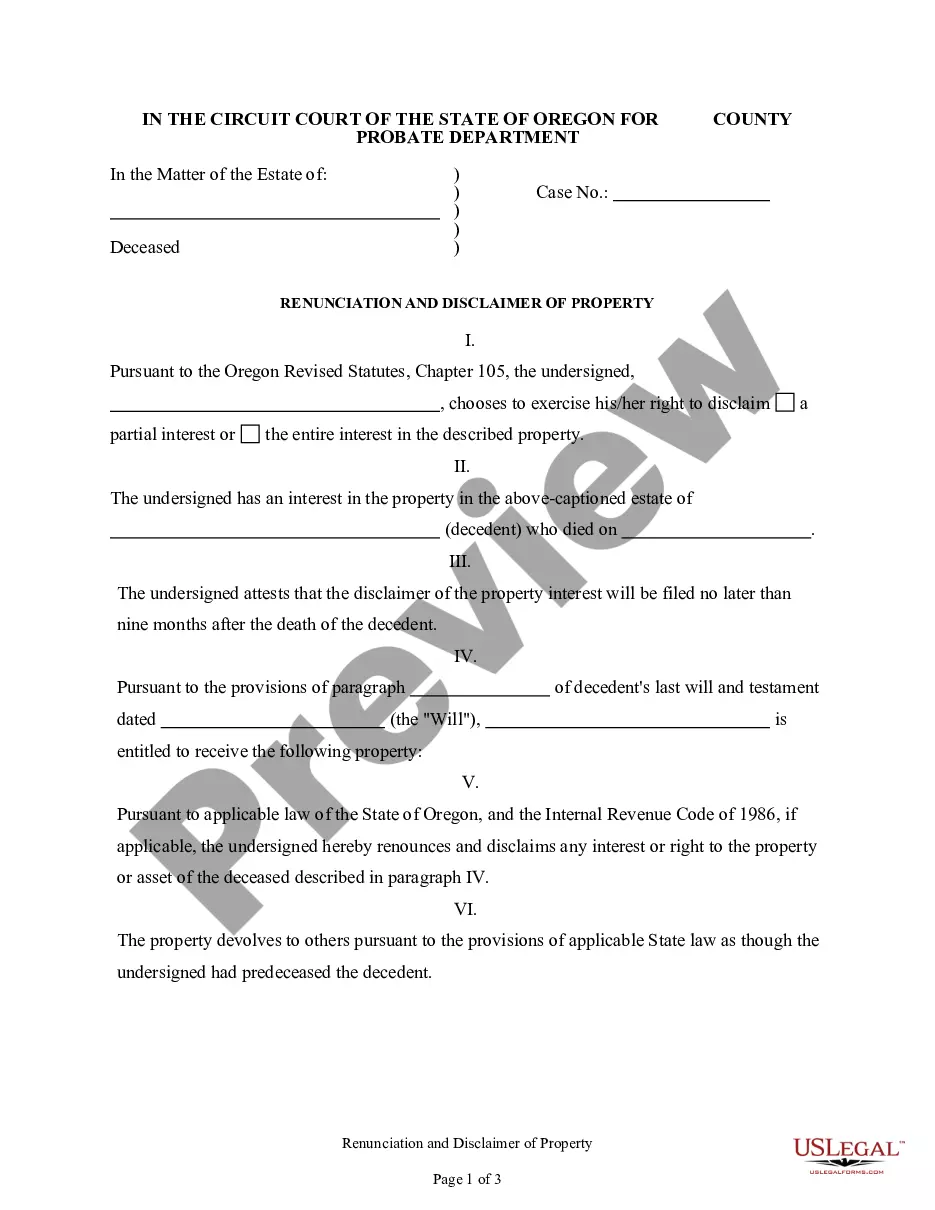

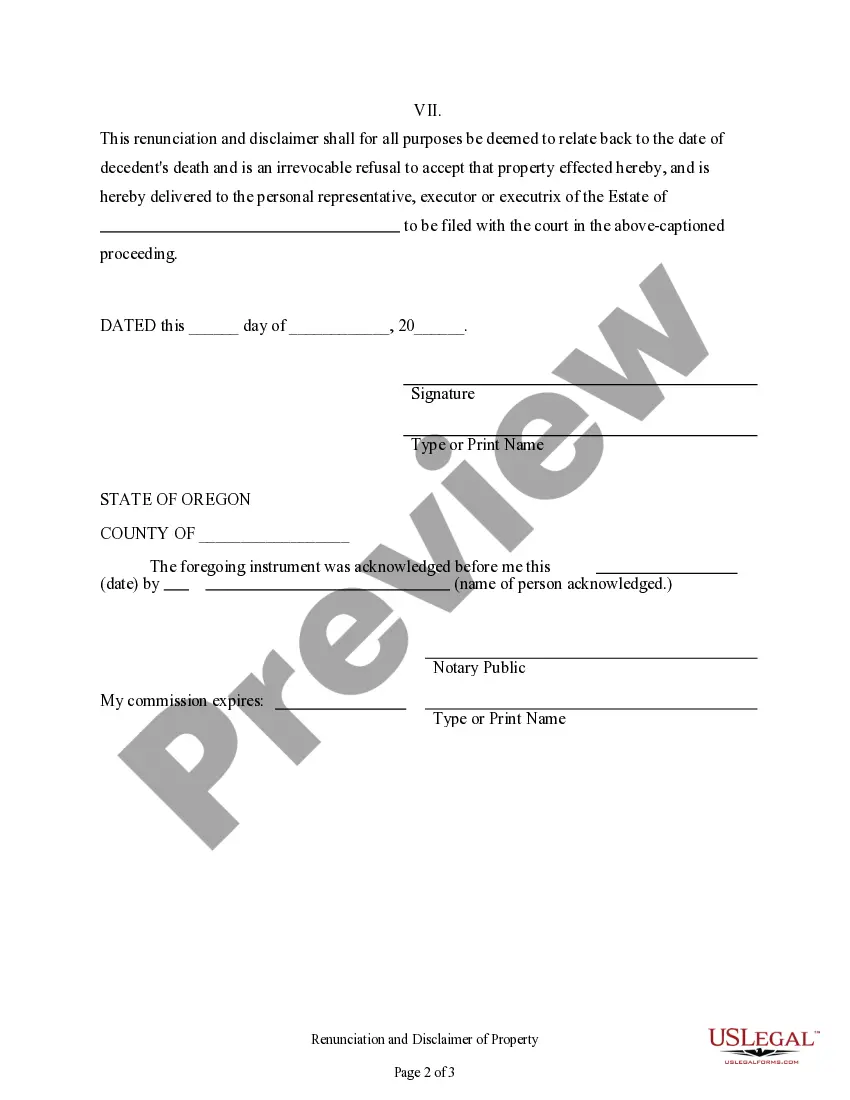

The Renunciation and Disclaimer of Property from Will by Testate is a legal document that allows a beneficiary to disclaim all or part of their interest in property inherited through a will. This form is essential for individuals who wish to refuse an inheritance, ensuring that the property is passed on to others as if the disclaiming beneficiary had predeceased the decedent. Unlike other estate planning forms, this document specifically addresses the rights related to a will and how to formally renounce them according to Oregon law.

Key components of this form

- Identification of the property being renounced.

- A statement of renouncement, detailing the beneficiary's choice to disclaim interest.

- Declaration of how the property will be distributed following the renouncement.

- State-specific acknowledgment section.

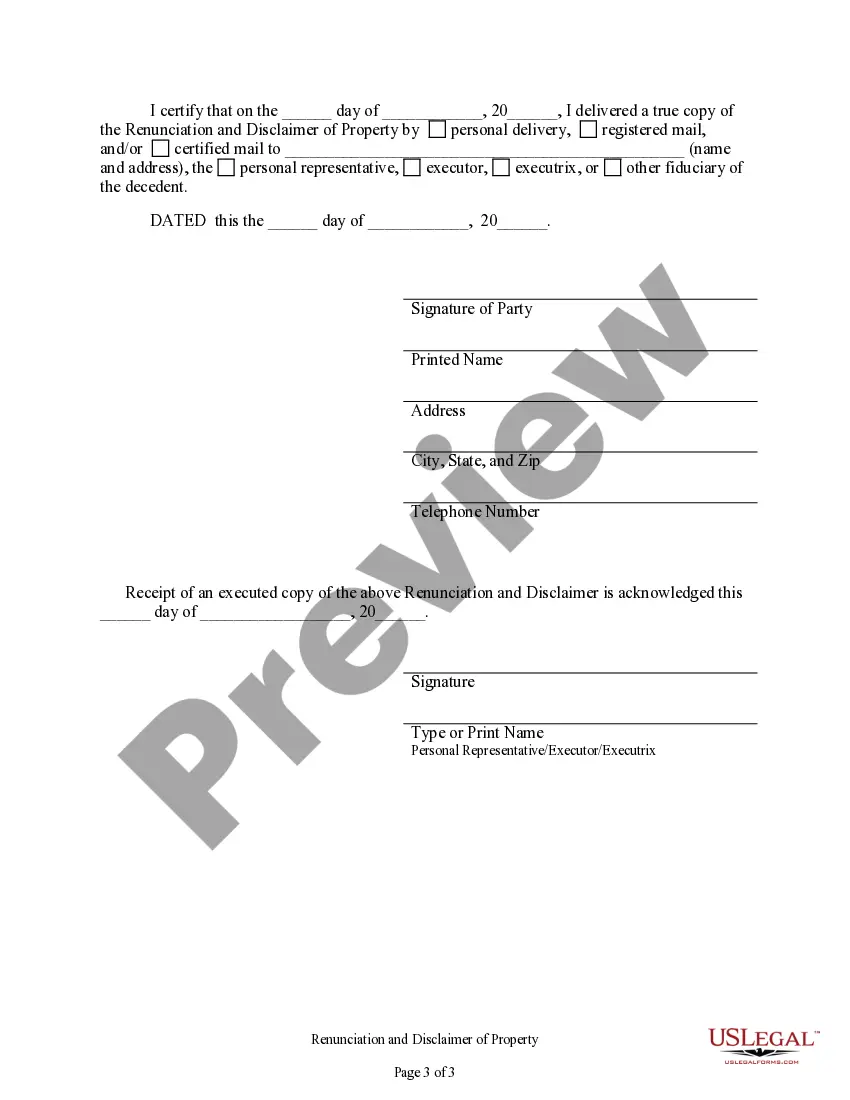

- Certificate for verifying the delivery of the document.

Common use cases

This form is appropriate to use when a beneficiary of a will decides to renounce their inheritance for various reasons, such as financial planning, tax implications, or personal choice. It is particularly useful in situations where retaining interest in the property may lead to complications or unwanted responsibilities. By using this form, the beneficiary can ensure that the property will be redistributed according to state law.

Who can use this document

- Beneficiaries named in a decedent's will in the state of Oregon.

- Individuals wishing to reject their inherited property or rights.

- Those who want to clarify their decision legally to avoid disputes or tax liabilities.

- Heirs with alternative estate-planning strategies that do not include the inherited property.

How to prepare this document

- Identify the property described in the decedent's will that you wish to renounce.

- Clearly state your intention to disclaim your interest in the property.

- Complete any state-specific acknowledgment sections included in the form.

- Provide the necessary signature and date to validate the renunciation.

- Ensure proper delivery of the form as per legal requirements to verify its receipt.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Typical mistakes to avoid

- Failing to clearly identify the property being disclaimed.

- Not signing or dating the document, which can render it invalid.

- Neglecting to include the state-specific acknowledgment.

- Assuming the renunciation is automatic without proper documentation.

Advantages of online completion

- Easy and efficient access to the form, eliminating the need for in-person visits.

- Editable templates that allow you to customize the document to your specific situation.

- Reliable legal language drafted by licensed professionals to ensure compliance.

- Instant downloads that provide immediate use without waiting for mail delivery.

Quick recap

- The form allows beneficiaries to formally decline property inherited through a will.

- It ensures that the property is passed on according to state law as if the beneficiary had predeceased the decedent.

- Completed correctly, it prevents future disputes and clarifies intent regarding inheritance.

Form popularity

FAQ

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

The beneficiary can disclaim only a portion of an inherited IRA or asset, allowing some to flow to the contingent beneficiary(s). Partial disclaiming is either a specific dollar or percentage amount as of the date of death.The balance will go to the next beneficiary(s).

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

You can head off an inheritance by renouncing or disclaiming it. This involves notifying the executor or personal representative of the estate the individual charged with guiding it through the probate process and settling it that you don't want the gift. You must do so in writing, and it's an irrevocable decision.