This form is pursuant to The Act of February 25, 1920, as amended and supplemented, authorizes communitization or drilling agreements communitizing or pooling all or a portion of a Federal oil and gas lease, with other lands, whether or not owned by the United States, when separate tracts under the Federal lease cannot be independently developed and operated in conformity with an established well-spacing program for the field or area.

Oklahoma Communitization Agreement

Description

How to fill out Communitization Agreement?

Are you currently inside a position in which you need to have documents for both company or personal functions almost every working day? There are plenty of lawful file web templates available on the Internet, but locating kinds you can rely on isn`t simple. US Legal Forms provides a huge number of form web templates, much like the Oklahoma Communitization Agreement, which can be written in order to meet state and federal requirements.

When you are previously knowledgeable about US Legal Forms website and have an account, simply log in. After that, it is possible to acquire the Oklahoma Communitization Agreement design.

Should you not provide an profile and wish to begin to use US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for your appropriate area/state.

- Make use of the Review switch to review the form.

- Browse the information to ensure that you have selected the correct form.

- In the event the form isn`t what you are looking for, utilize the Lookup area to obtain the form that suits you and requirements.

- Once you get the appropriate form, click Purchase now.

- Pick the prices program you would like, submit the required information to produce your bank account, and buy the order using your PayPal or credit card.

- Select a convenient data file format and acquire your backup.

Find every one of the file web templates you have purchased in the My Forms menu. You can obtain a extra backup of Oklahoma Communitization Agreement anytime, if possible. Just click on the necessary form to acquire or produce the file design.

Use US Legal Forms, by far the most comprehensive variety of lawful types, to conserve time as well as stay away from mistakes. The service provides appropriately created lawful file web templates which you can use for a selection of functions. Create an account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Mineral ownership constitutes the right to explore for and produce oil and gas. The mineral owner has the right to: Enter onto the property to explore for oil & gas. Authorize another entity to enter the property and explore production opportunities by granting an oil & gas lease.

On average, a single acre's mineral rights can range from as low as $200 to over $10,000+ on the high end. As you might expect, the prices will vary depending on the mineral in question, the number of wells currently drilled, the current production rate, the existence of pipeline infrastructure, and much more.

Are Mineral Rights and Royalties Taxable? Any income you earn from the sale or lease of your land's mineral rights is taxable. Income, severance and ad valorem taxes are some of the taxes you might need to pay. Each type comes from a different entity.

Effect of Property Taxes on Mineral Rights Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

The Internal Revenue Service (IRS) classifies all royalties earned from oil, gas, and mineral properties as taxable income. Most often, taxpayers will report royalty income on Schedule E, either as rents and royalties or working interest. Sometimes, they may opt to report it as both and do so on Schedule C.

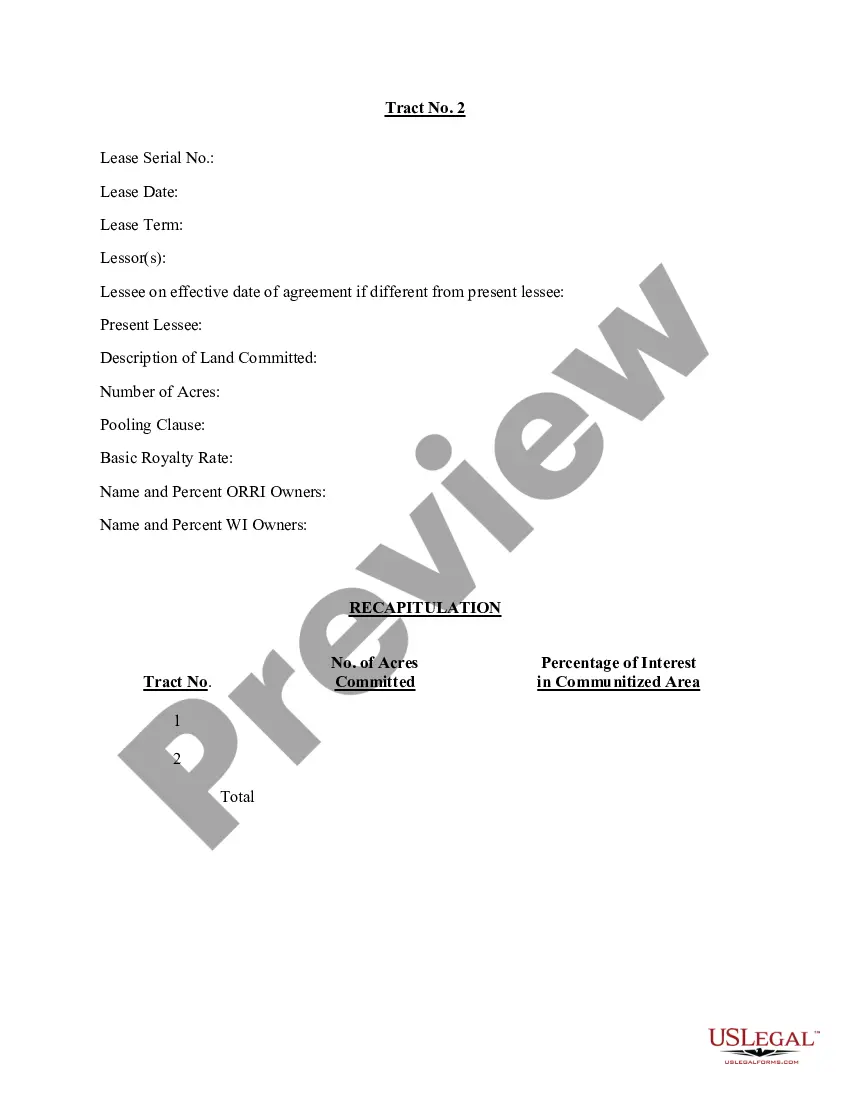

§ 3217.11 What are communitization agreements? Under communitization agreements (also called drilling agreements), operators who cannot independently develop separate tracts due to well-spacing or well development programs may cooperatively develop such tracts.

Value of Non-Producing Mineral Rights Without any royalty income it comes down to what buyers think the future income might be. For non-producing properties, the Mineral Rights Value in Oklahoma could be anywhere from a few hundred dollars per acre to $5,000+/acre.

The statutory minimum is 1/8th or 12.5%, but it may be as high as 1/4th, or 25%. Since the 1990s, Oklahoma royalties have typically been at least 18.75 percent, but 20 to 25 percent is not unheard of for Oklahoma mineral owners.