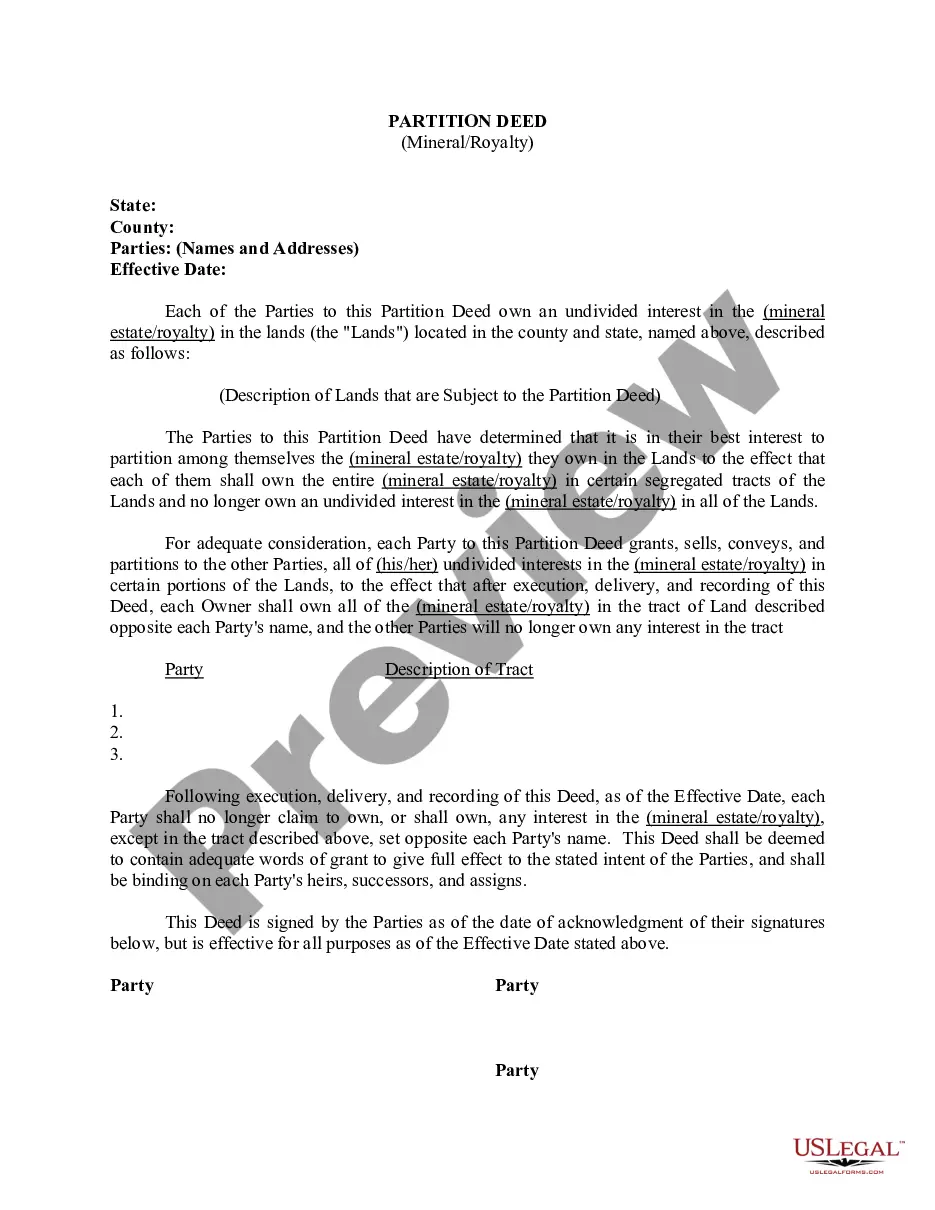

Oklahoma Partition Deed for Mineral / Royalty Interests

Description

How to fill out Partition Deed For Mineral / Royalty Interests?

You are able to devote hours on-line searching for the authorized file design which fits the state and federal requirements you need. US Legal Forms offers a huge number of authorized varieties that happen to be analyzed by pros. You can easily acquire or printing the Oklahoma Partition Deed for Mineral / Royalty Interests from the support.

If you already have a US Legal Forms account, you are able to log in and then click the Down load button. Afterward, you are able to full, revise, printing, or sign the Oklahoma Partition Deed for Mineral / Royalty Interests. Each and every authorized file design you purchase is your own property permanently. To obtain an additional duplicate associated with a bought develop, visit the My Forms tab and then click the corresponding button.

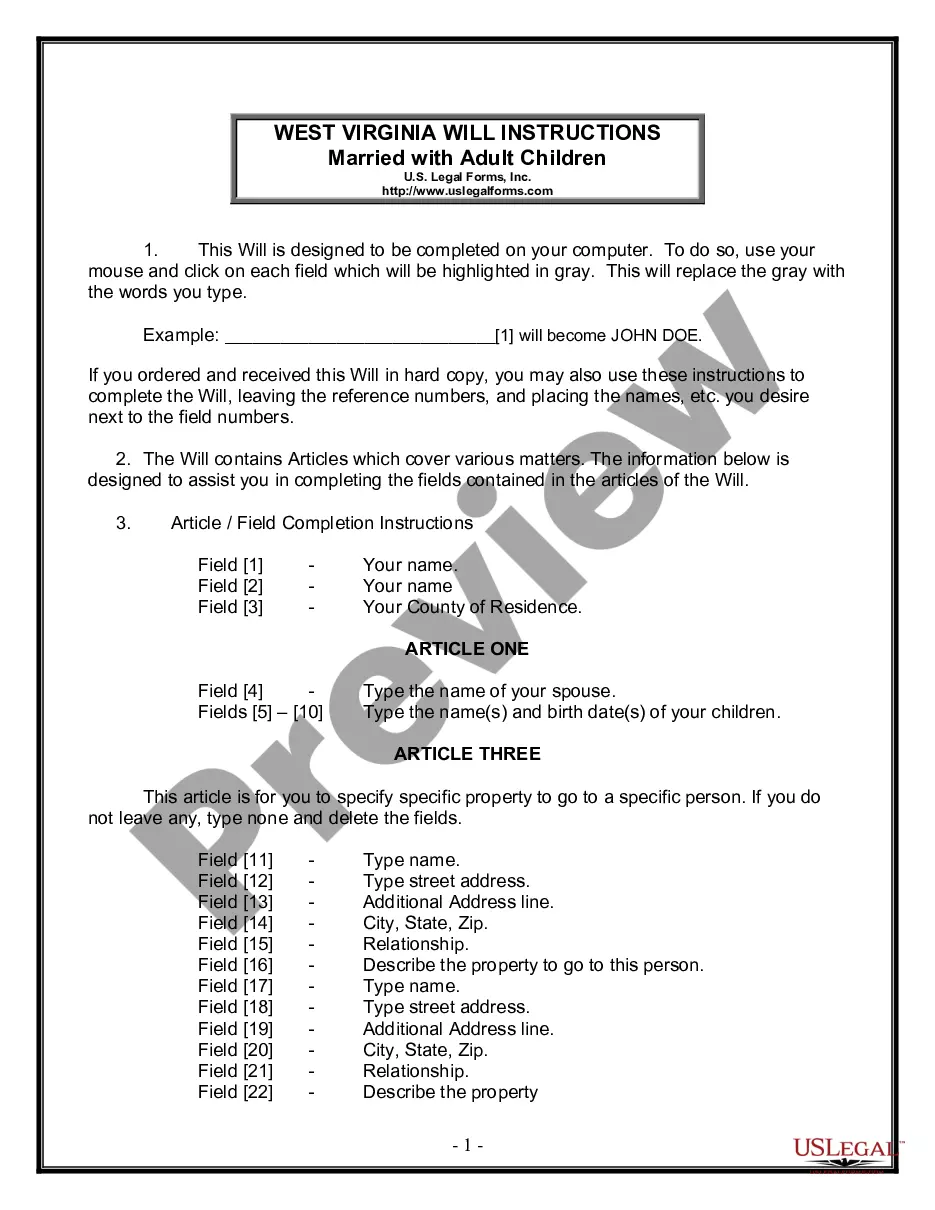

If you are using the US Legal Forms web site for the first time, stick to the straightforward guidelines below:

- Initially, make sure that you have chosen the proper file design for your county/city of your liking. Look at the develop explanation to make sure you have selected the proper develop. If available, utilize the Review button to look from the file design also.

- In order to discover an additional version of your develop, utilize the Research discipline to discover the design that fits your needs and requirements.

- When you have found the design you would like, simply click Purchase now to carry on.

- Select the rates prepare you would like, type your accreditations, and register for an account on US Legal Forms.

- Full the purchase. You should use your charge card or PayPal account to fund the authorized develop.

- Select the format of your file and acquire it to your product.

- Make alterations to your file if needed. You are able to full, revise and sign and printing Oklahoma Partition Deed for Mineral / Royalty Interests.

Down load and printing a huge number of file web templates using the US Legal Forms Internet site, which provides the most important collection of authorized varieties. Use skilled and state-distinct web templates to handle your business or person demands.

Form popularity

FAQ

The record owner must: TITLE: Title the property "Transfer-on-death" by making a new deed. NAME: Name the person to get the land, home or mineral interest when the record owner dies on the new deed. This person is called the "beneficiary." SIGN: Sign the deed before two witnesses and a notary.

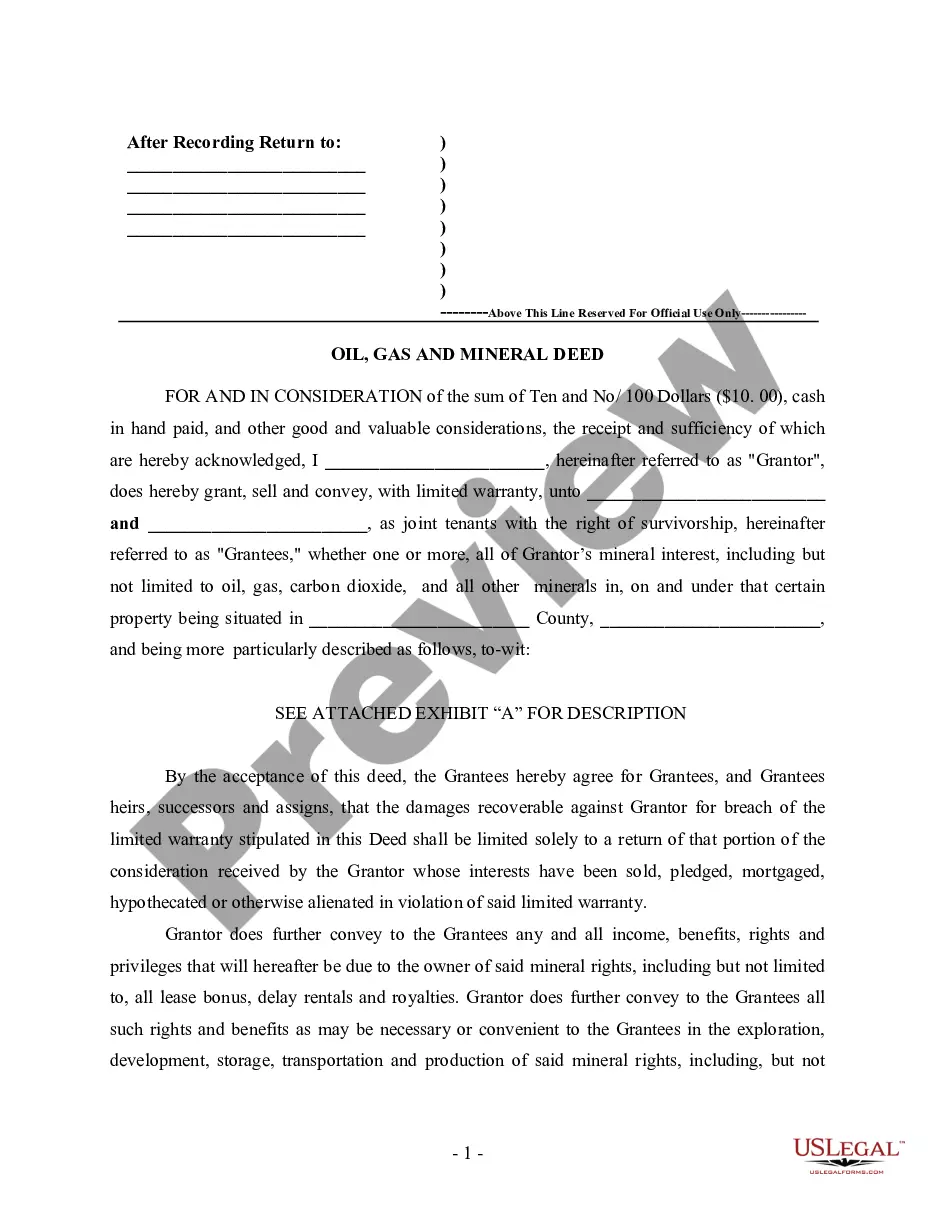

With a mineral deed, the holder usually has responsibility for development and production of the extraction on the property. That risk comes with the potential reward of the majority of the profit that comes from it. With a royalty deed, the holder does not usually bear the risk of the development and production.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

The only way to determine mineral rights ownership in Oklahoma is to do a title search at the courthouse where the property is located. To do this, you must review all deeds and other legal conveyances pertaining to the subject tract back to 1907. Mineral ownership information is not available online from any website.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

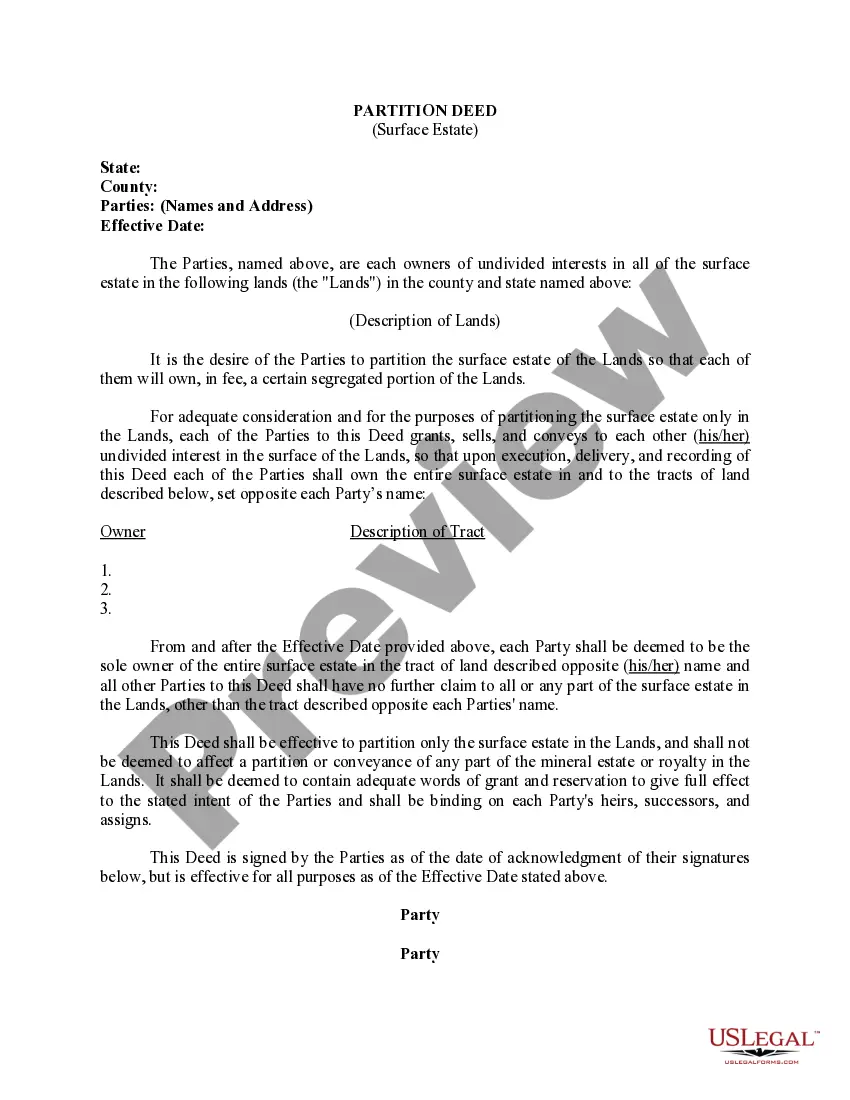

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate.

Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

There are 6 types of mineral rights, including mineral interest (MI), royalty interest (RI), overriding royalty interest (ORRI), working Interest (WI), non-operated working interest, and net profits interest.