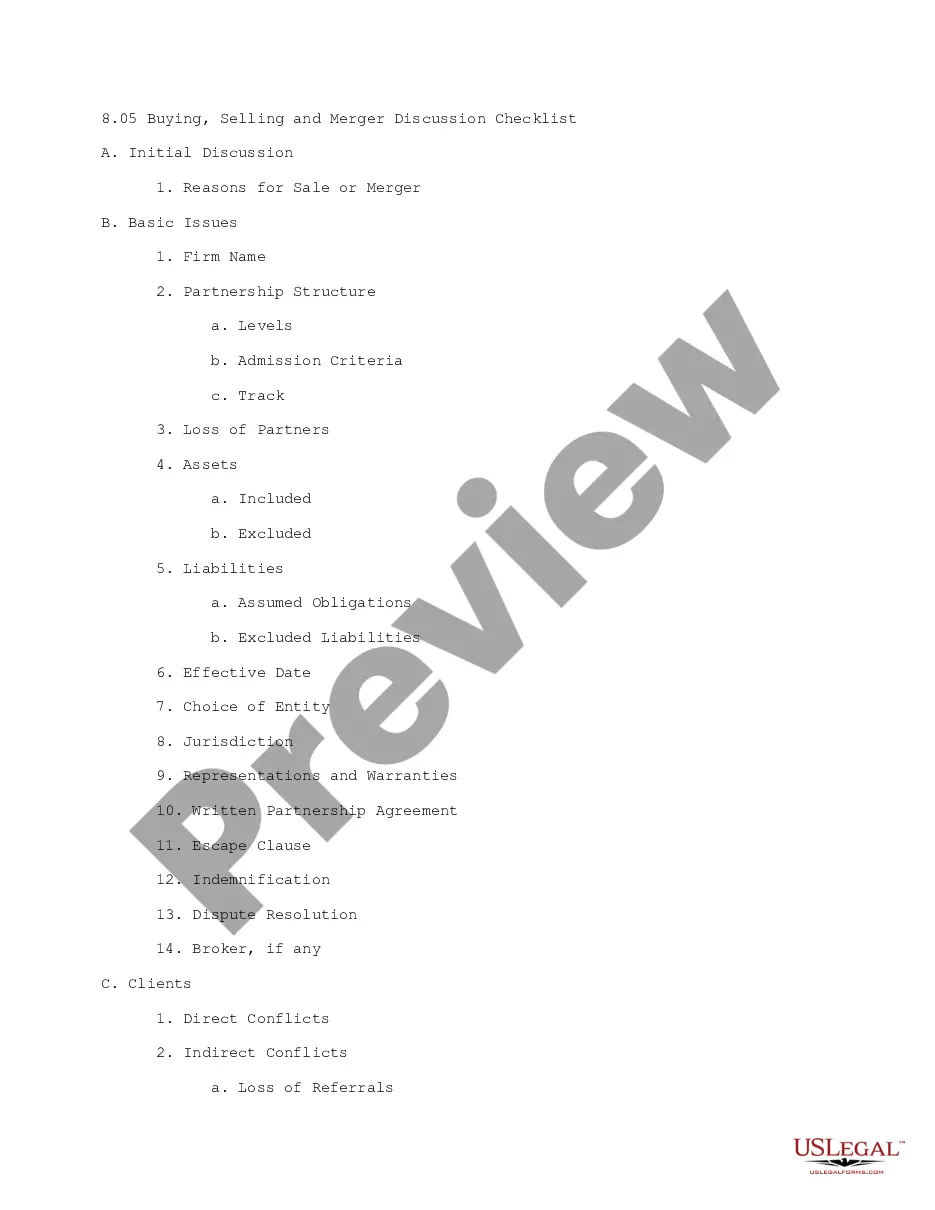

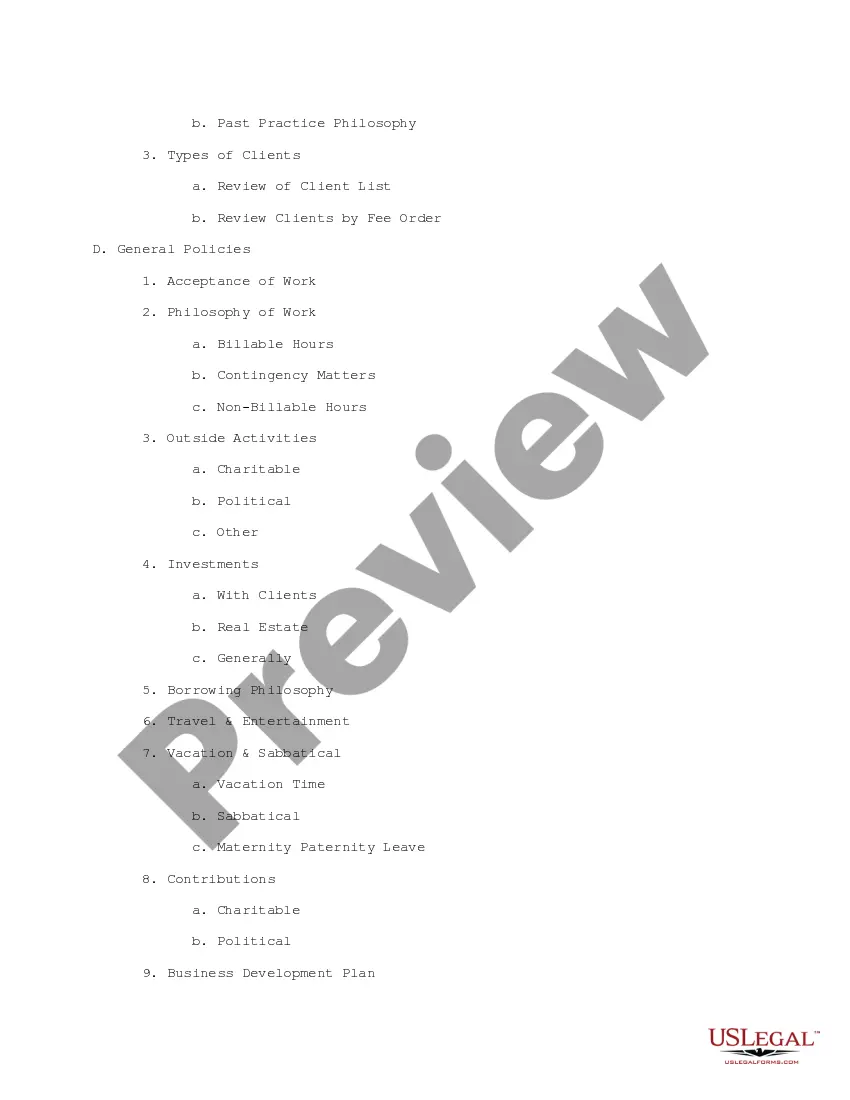

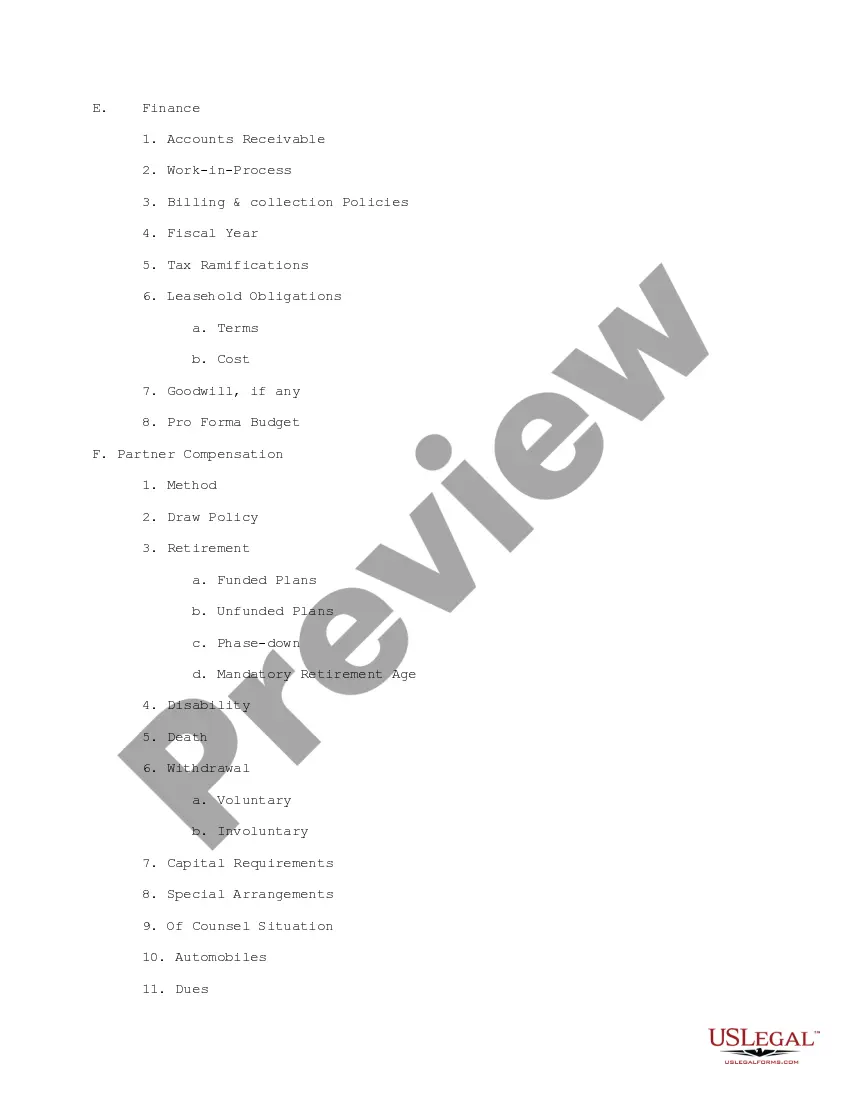

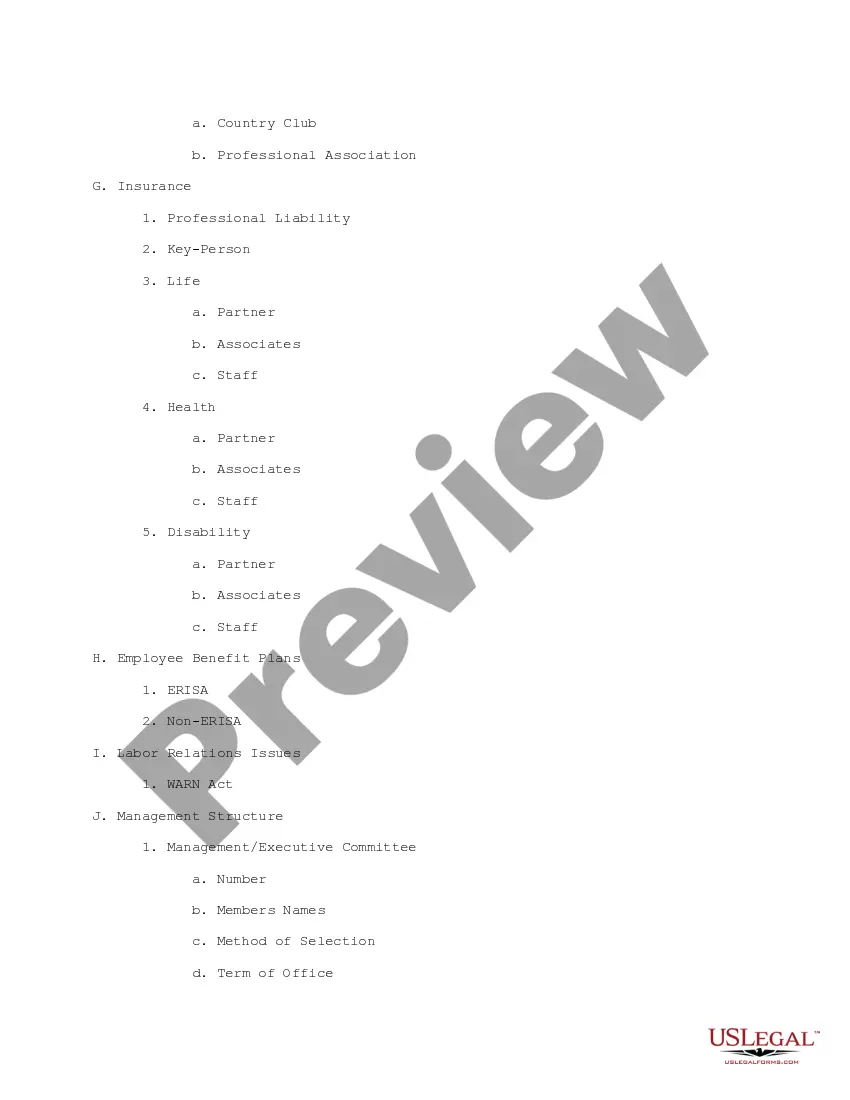

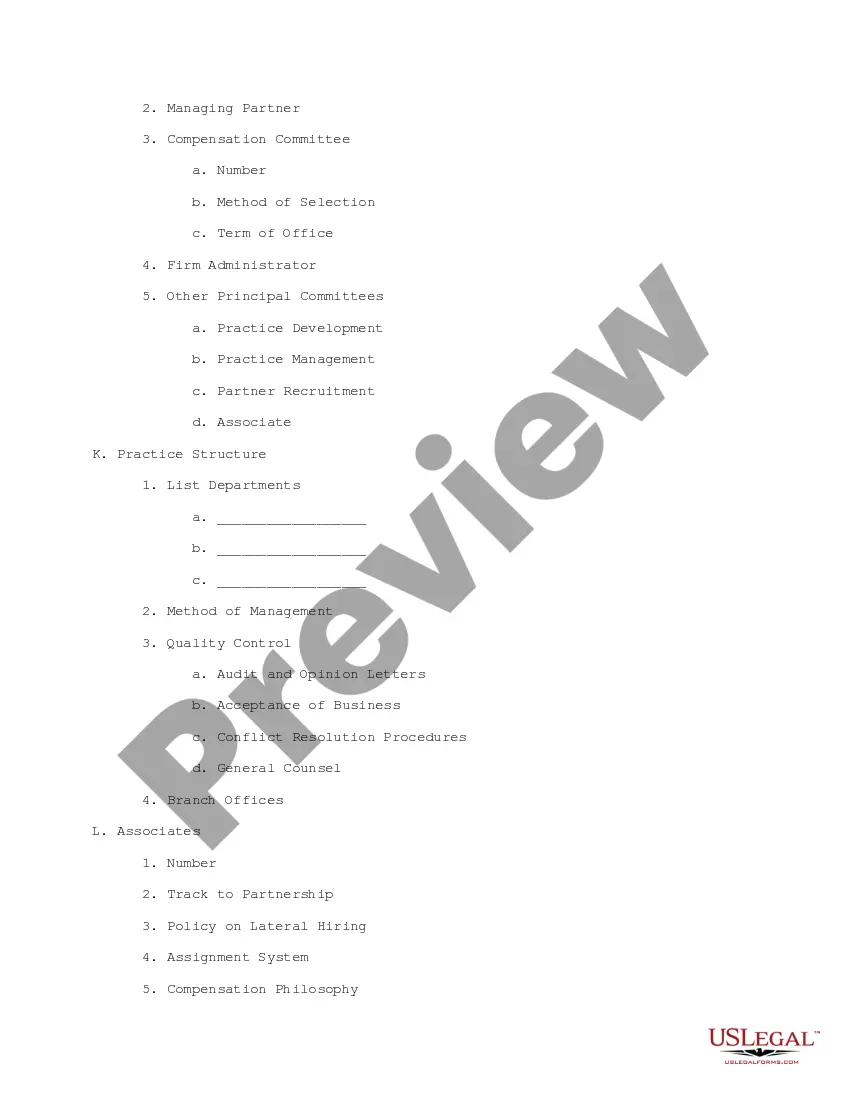

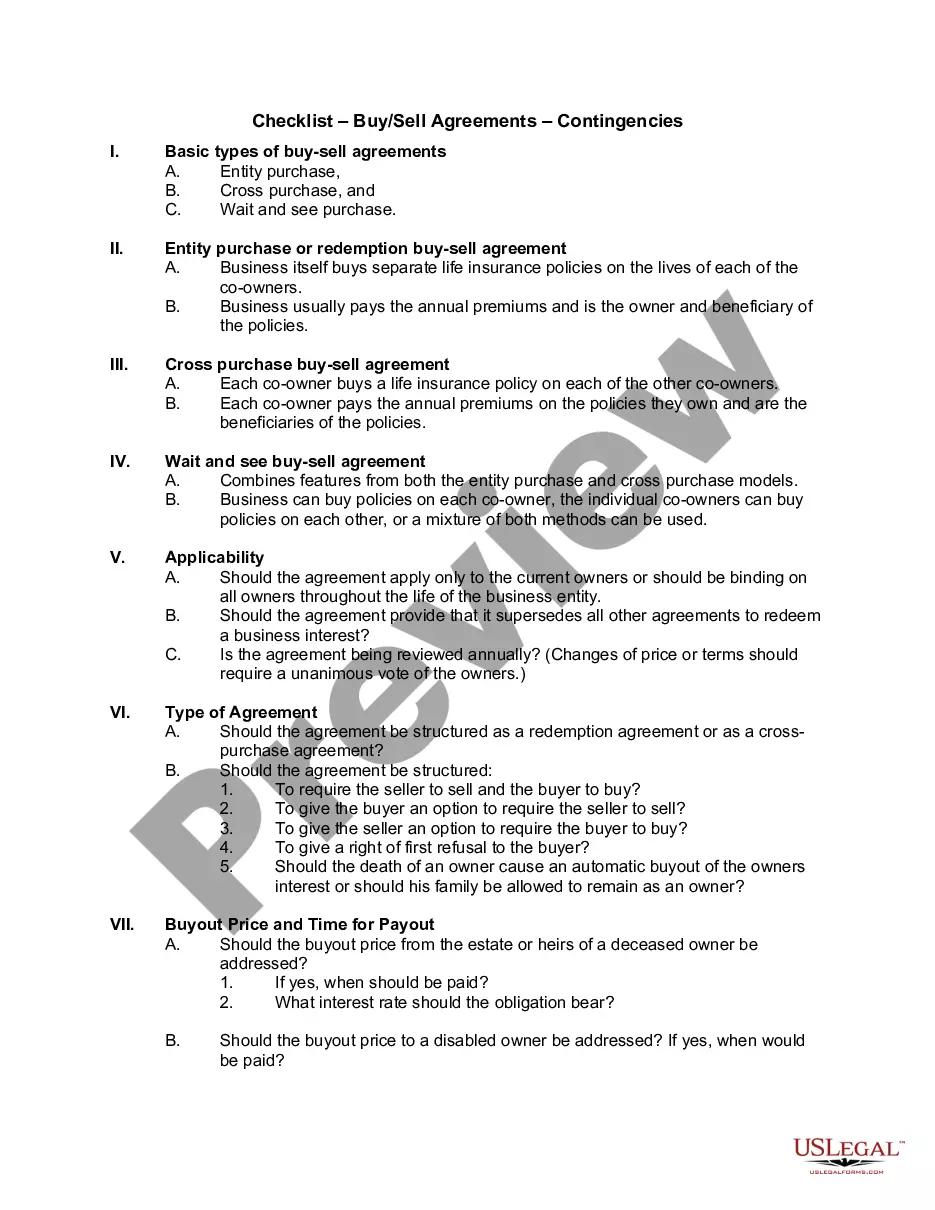

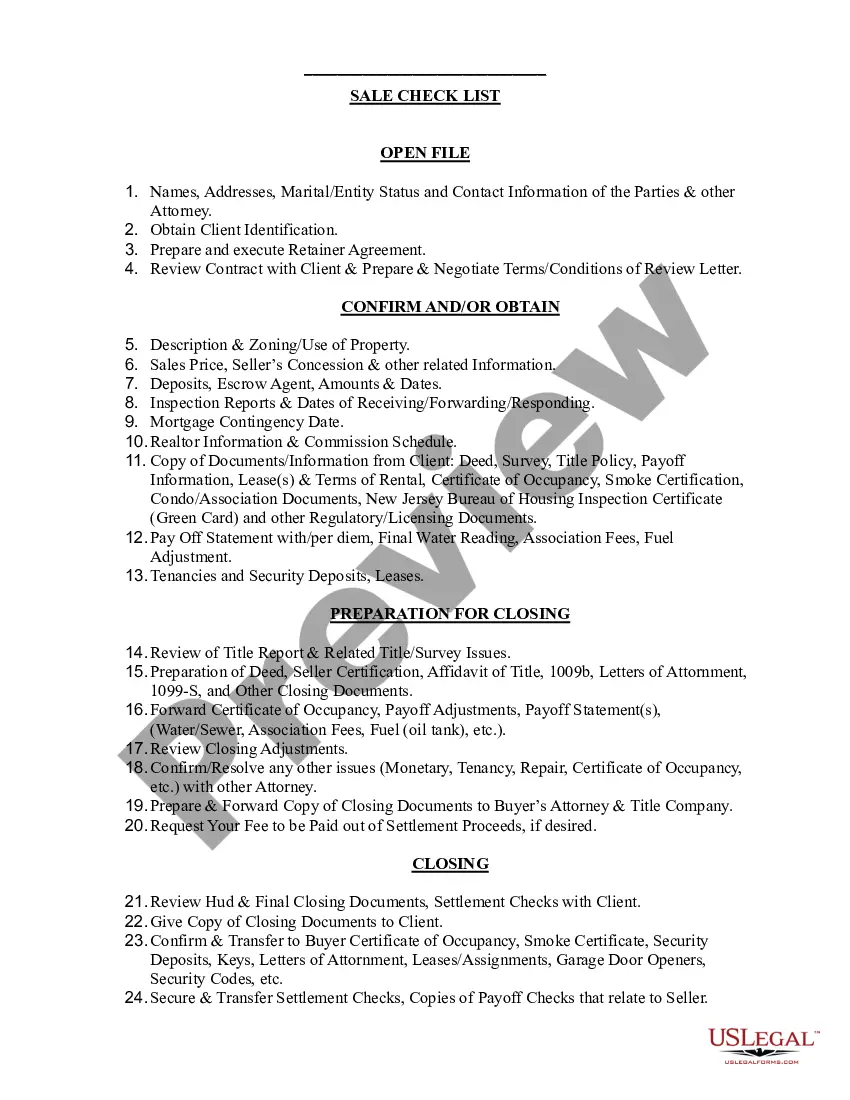

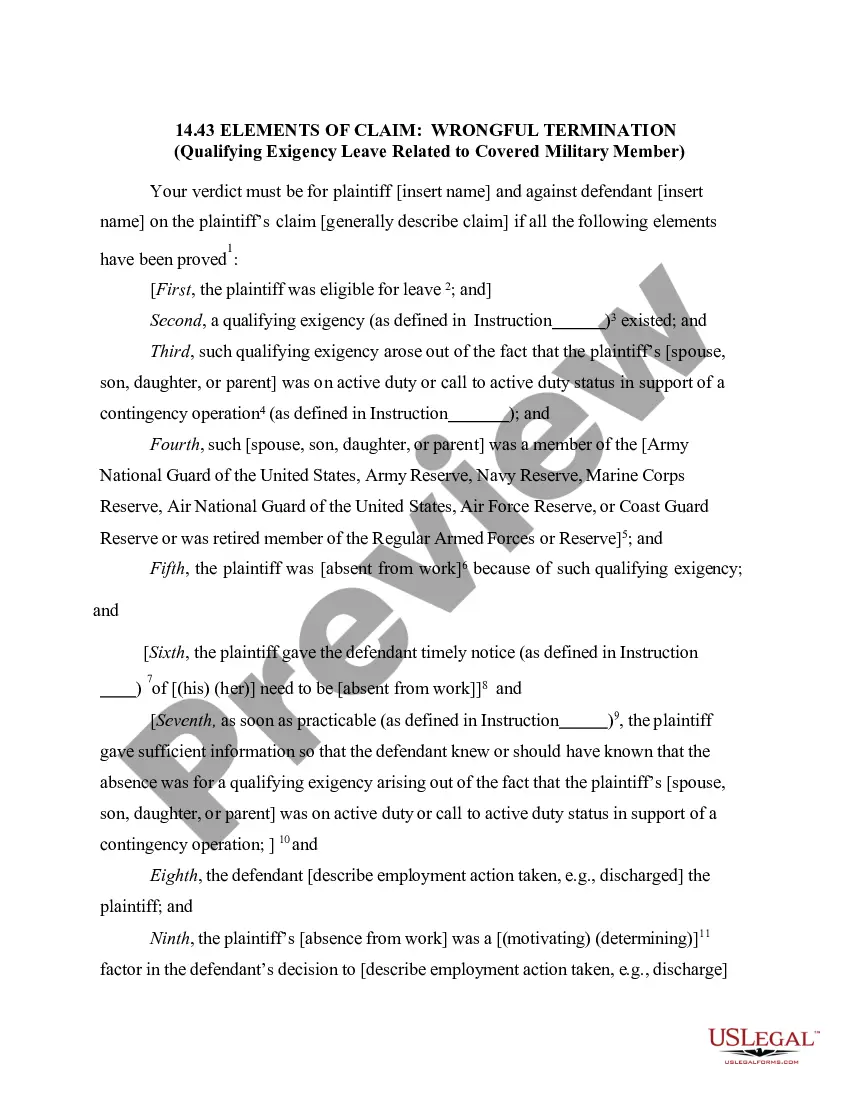

This is a checklist for the discussion of buying, selling, or merger of a law firm. Each category (clients, finance, partner compensation, etc.) is broken into sub-categories as a way of bringing to mind all issues to be discussed.

Oklahoma Buying, Selling and Merger Discussion Checklist

Description

How to fill out Buying, Selling And Merger Discussion Checklist?

If you want to full, down load, or printing legal papers templates, use US Legal Forms, the most important variety of legal forms, which can be found on the Internet. Utilize the site`s simple and easy practical lookup to find the documents you need. A variety of templates for company and personal functions are categorized by groups and suggests, or keywords. Use US Legal Forms to find the Oklahoma Buying, Selling and Merger Discussion Checklist within a couple of clicks.

Should you be currently a US Legal Forms client, log in to your account and click the Acquire button to find the Oklahoma Buying, Selling and Merger Discussion Checklist. You can even gain access to forms you previously saved within the My Forms tab of your own account.

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for your appropriate area/region.

- Step 2. Make use of the Review option to check out the form`s articles. Never neglect to learn the outline.

- Step 3. Should you be unhappy with the form, make use of the Look for area on top of the monitor to discover other types of your legal form design.

- Step 4. Upon having found the shape you need, go through the Get now button. Choose the prices program you prefer and include your qualifications to sign up on an account.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal account to accomplish the financial transaction.

- Step 6. Select the file format of your legal form and down load it in your product.

- Step 7. Comprehensive, revise and printing or sign the Oklahoma Buying, Selling and Merger Discussion Checklist.

Each and every legal papers design you get is the one you have for a long time. You possess acces to every single form you saved within your acccount. Click the My Forms section and pick a form to printing or down load once again.

Contend and down load, and printing the Oklahoma Buying, Selling and Merger Discussion Checklist with US Legal Forms. There are millions of skilled and express-specific forms you can use for your personal company or personal demands.

Form popularity

FAQ

What inconsistencies are there between management practices that should be changed? Which parts of the acquired company should be integrated? How should each part be integrated? Who will be responsible for business-critical decisions? M&A Integration Key Questions - DD Consulting ddavisconsulting.com ? maintegrationinsights ? m... ddavisconsulting.com ? maintegrationinsights ? m...

Some of the most famous and successful examples of M&A transactions that have occurred over the last few decades include: Google's acquisition of Android. Disney's acquisition of Pixar and Marvel. Exxon and Mobile merger (a great example of a successful horizontal merger).

Buy-Side M&A Process Steps Developing an M&A Strategy. Develop a search criteria. Develop a long list of companies for acquisition. Contact target companies. Perform valuation analysis. Negotiations. Letter of Intent sending. M&A Due Diligence.

10 Key Steps To Prepare Your Company For An M&A Sale Prepare an ?Overview? or ?Executive Summary? Slide Deck. ... Prepare for Extensive Due Diligence by the Buyer. ... Prepare an M&A Online Data Room. ... Prepare Draft Disclosure Schedules. ... Review the Seller's Financial Statements and Projections. 10 Key Steps To Prepare Your Company For An M&A Sale - Forbes forbes.com ? sites ? allbusiness ? 2022/02/15 forbes.com ? sites ? allbusiness ? 2022/02/15

Certifications & Education Formal education is non-negotiable. A bachelor's degree in business, accounting, finance, economics, or other related fields is essential to perform the job at the highest level. Other companies even require candidates with master's degrees in business management or finance. How to Get into Mergers and Acquisitions: 4 Insider Tips (for 2023) mascience.com ? basics ? steps-to-take-befor... mascience.com ? basics ? steps-to-take-befor...

Step 1 ? Determine the Offer Value Per Share (and Total Offer Value) Step 2 ? Structure the Purchase Consideration (i.e. Cash, Stock, or Mix) Step 3 ? Estimate the Financing Fee, Interest Expense, Number of New Share Issuances, Synergies, and Transaction Fee.

Analyzing Mergers and Acquisitions This usually involves two steps: valuing the target on a standalone basis and valuing the potential synergies of the deal. To learn more about valuing the M&A target see our free guide on DCF models. Mergers Acquisitions M&A Process - Corporate Finance Institute corporatefinanceinstitute.com ? valuation ? merge... corporatefinanceinstitute.com ? valuation ? merge...

Eight essential merger and acquisition methods Net Assets. In its simplest form, a net assets valuation involves adding up all of the company's assets and subtracting its liabilities. ... EBITDA. ... P/E Ratio (Price Earnings) ... Revenue Multiple. ... Comparable Analysis. ... "Football Field" Chart. ... Precedent Analysis. ... Dividend Yield.