Oklahoma Accredited Investor Self-Certification Attachment D

Description

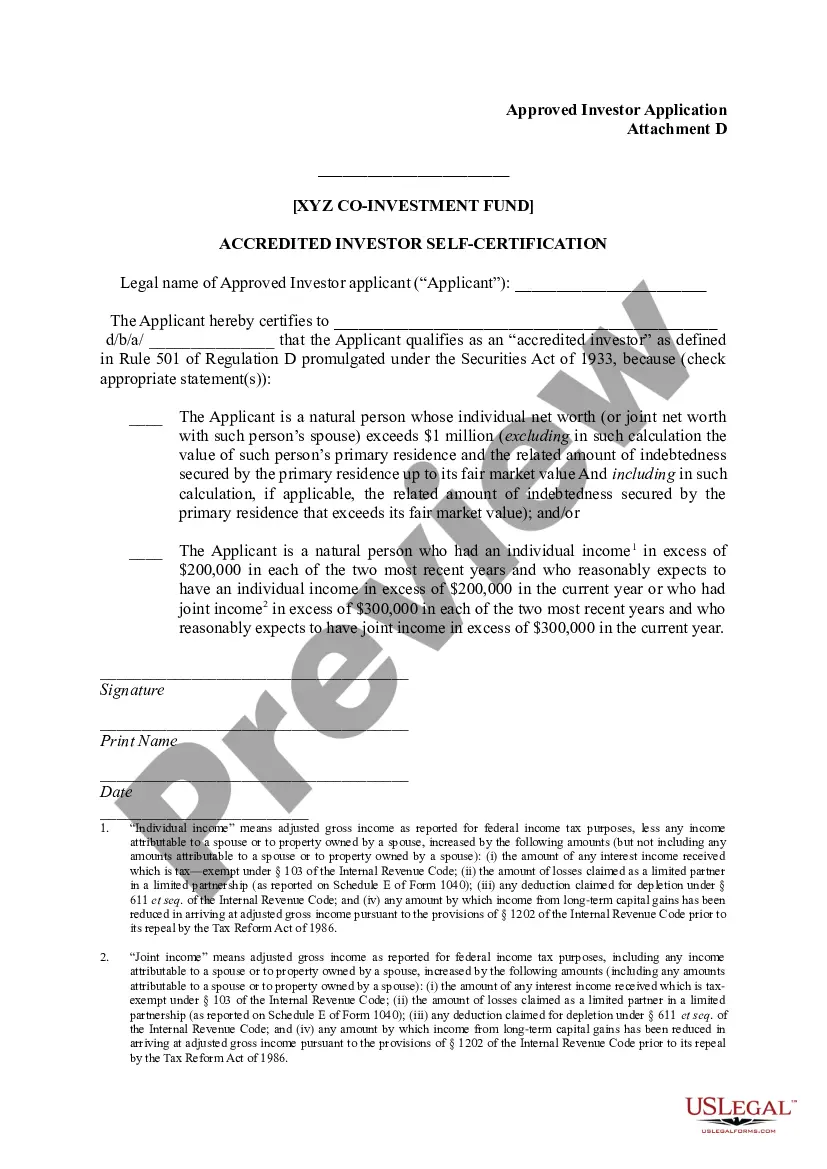

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Self-Certification Attachment D?

Choosing the right authorized papers design could be a struggle. Of course, there are plenty of templates available on the net, but how will you obtain the authorized develop you need? Utilize the US Legal Forms site. The services delivers thousands of templates, such as the Oklahoma Accredited Investor Self-Certification Attachment D, that you can use for business and private demands. Each of the kinds are checked out by experts and meet federal and state needs.

If you are previously signed up, log in in your account and click on the Obtain key to obtain the Oklahoma Accredited Investor Self-Certification Attachment D. Utilize your account to appear from the authorized kinds you possess ordered earlier. Go to the My Forms tab of the account and get another copy in the papers you need.

If you are a brand new end user of US Legal Forms, listed here are basic directions that you should stick to:

- Initial, make sure you have chosen the proper develop for the city/county. You can check out the form making use of the Preview key and study the form description to make sure this is the right one for you.

- In case the develop does not meet your needs, make use of the Seach industry to discover the appropriate develop.

- When you are certain the form is suitable, click on the Purchase now key to obtain the develop.

- Select the pricing prepare you would like and type in the necessary information. Create your account and buy the transaction with your PayPal account or charge card.

- Opt for the document formatting and obtain the authorized papers design in your gadget.

- Complete, change and print out and signal the attained Oklahoma Accredited Investor Self-Certification Attachment D.

US Legal Forms is definitely the biggest collection of authorized kinds in which you can discover different papers templates. Utilize the service to obtain expertly-manufactured papers that stick to status needs.

Form popularity

FAQ

Investor types: Reg A is open to both accredited and non-accredited investors, whereas Reg D offerings are primarily targeted at accredited investors. Rule 506(b) of Reg D allows a limited number of non-accredited investors, but they must meet specific sophistication requirements.

An accredited investor can take different forms; an individual with a net worth, excluding the value of the principal residence, greater than $1 million (the $1 million can be joint with spouse); an individual whose yearly income for the past two years exceeded $200,000 ($300,000 joint with spouse) with a reasonable ...

Form D requires that companies provide their principal place of business addresses and telephone number. Item 3 ? Related Persons Disclosure. Form D Item 3 requires that Company's disclose ?related persons? to the extent such persons are promoters or are the company's executive officers and directors.

Ing to the Securities and Exchange Commission, an individual accredited investor is anyone who: Earned income of more than $200,000 (or $300,000 together with a spouse) in each of the last two years and reasonably expects to earn the same for the current year.

In the U.S., the term accredited investor is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings.

Form D is a brief notice that includes basic information about the company and the offering, such as the names and addresses of the company's executive officers, the size of the offering and the date of first sale.

Which of the following is defined as "accredited investors" under Regulation D? There is no limit on the number of accredited investors that can purchase a private placement under Regulation D. Regarding institutional investors, any investment company, insurance company, bank, or savings and loan is accredited.

SEC Form D is a filing with the Securities and Exchange Commission (SEC). It is required for some companies selling securities in a Regulation (Reg) D exemption or with Section 4(a)(5) exemption provisions.