Oklahoma Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks

Description

How to fill out Registration Rights Agreement Between ObjectSoft Corp. And Investors Regarding Sale And Purchase Of 6% Series G Convertible Preferred Stocks?

You are able to commit time on the Internet searching for the authorized document design that meets the federal and state demands you require. US Legal Forms gives 1000s of authorized forms which can be analyzed by specialists. It is possible to download or produce the Oklahoma Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks from our service.

If you have a US Legal Forms bank account, you can log in and then click the Download key. Next, you can total, revise, produce, or indicator the Oklahoma Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks. Every single authorized document design you buy is yours for a long time. To have one more backup of any purchased form, check out the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms site the first time, follow the basic instructions below:

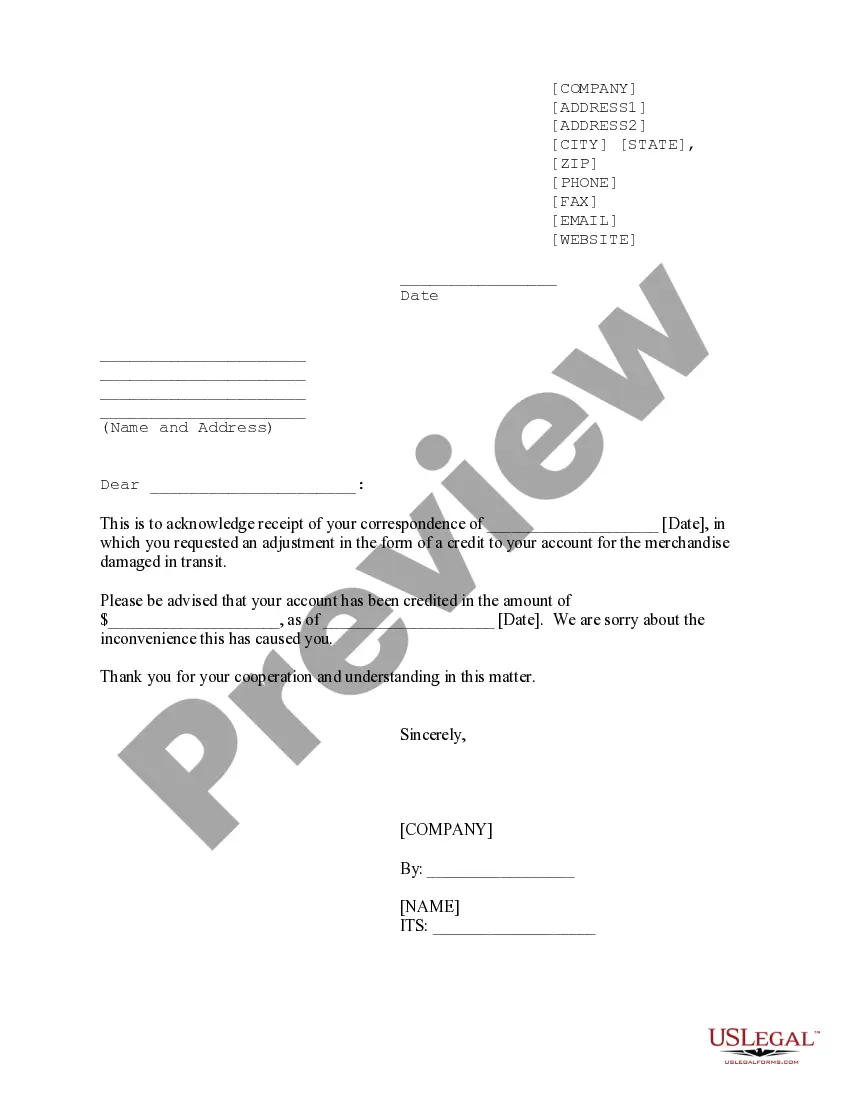

- Initially, be sure that you have selected the right document design to the state/town of your liking. Look at the form information to make sure you have selected the proper form. If readily available, use the Review key to search through the document design as well.

- If you wish to find one more model from the form, use the Search area to get the design that suits you and demands.

- When you have found the design you would like, click on Purchase now to move forward.

- Find the pricing strategy you would like, key in your references, and sign up for your account on US Legal Forms.

- Complete the deal. You should use your charge card or PayPal bank account to purchase the authorized form.

- Find the format from the document and download it to your system.

- Make adjustments to your document if required. You are able to total, revise and indicator and produce Oklahoma Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks.

Download and produce 1000s of document templates utilizing the US Legal Forms site, that provides the greatest variety of authorized forms. Use specialist and express-certain templates to deal with your organization or personal requires.

Form popularity

FAQ

Related Content. In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

?Definition? A registration rights provision in a term sheet allows an investor to require a company to register the investor's shares with the SEC when certain conditions are met, ensuring that the investor has the opportunity to sell their shares in the public market.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).