Oklahoma Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options

Description

How to fill out Stock Option Plan Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options, And Exchange Options?

Have you been in a place where you will need documents for either enterprise or personal uses just about every working day? There are a lot of legal papers web templates available on the Internet, but discovering ones you can depend on isn`t straightforward. US Legal Forms provides 1000s of type web templates, just like the Oklahoma Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options, which can be composed in order to meet state and federal requirements.

In case you are already acquainted with US Legal Forms internet site and have a merchant account, simply log in. After that, you may obtain the Oklahoma Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options design.

Unless you offer an bank account and wish to start using US Legal Forms, follow these steps:

- Get the type you require and ensure it is to the appropriate city/region.

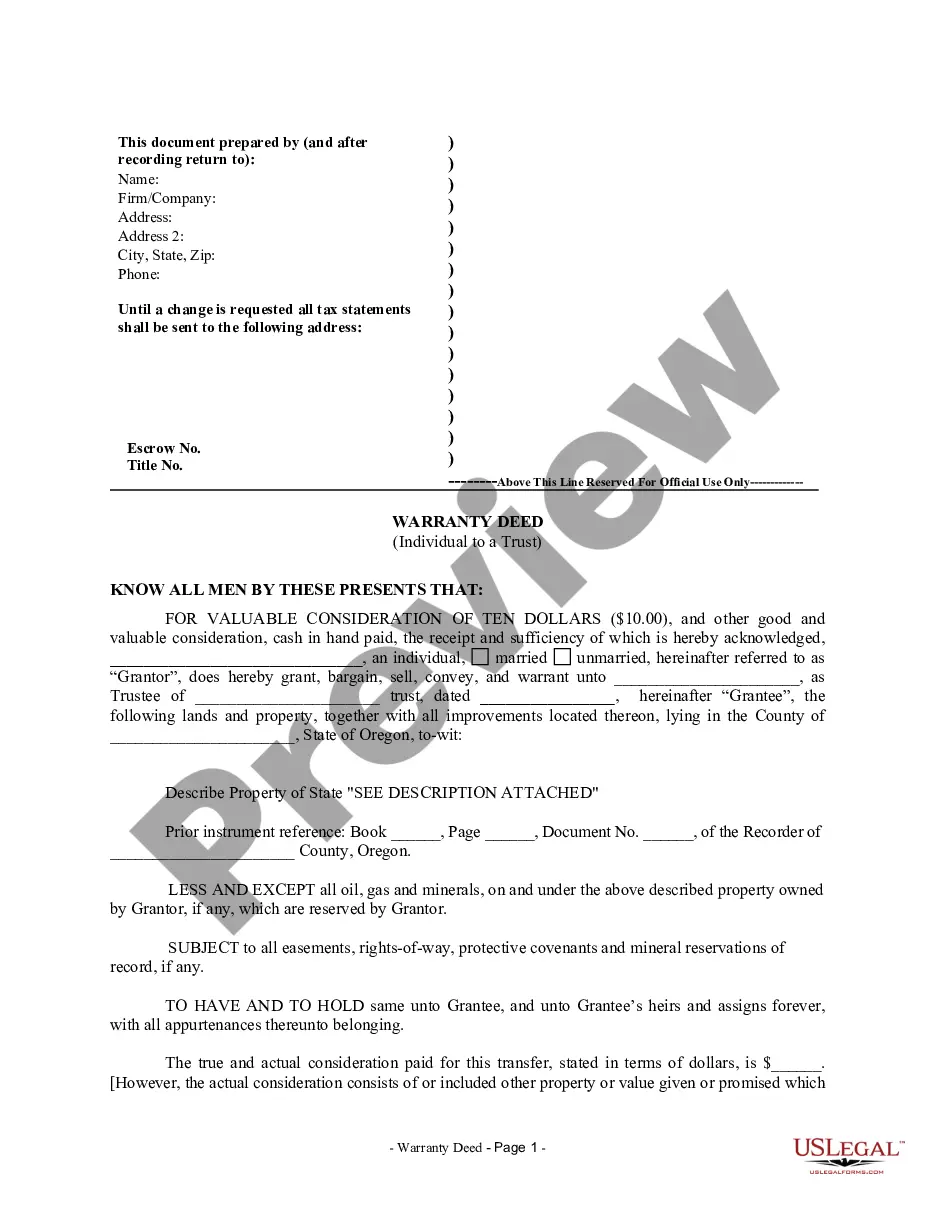

- Utilize the Preview option to check the form.

- See the information to actually have chosen the right type.

- When the type isn`t what you are looking for, make use of the Research area to find the type that fits your needs and requirements.

- Whenever you obtain the appropriate type, simply click Purchase now.

- Opt for the rates strategy you would like, submit the necessary information to make your account, and buy your order using your PayPal or Visa or Mastercard.

- Pick a hassle-free file structure and obtain your copy.

Discover all the papers web templates you possess purchased in the My Forms menu. You can aquire a additional copy of Oklahoma Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options, and Exchange Options any time, if needed. Just click on the essential type to obtain or print the papers design.

Use US Legal Forms, one of the most substantial collection of legal varieties, to save time as well as avoid mistakes. The assistance provides expertly manufactured legal papers web templates which can be used for an array of uses. Produce a merchant account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

First things first: You don't have to pay any tax when you're granted those options. If you are given an option agreement that allows you to purchase 1,000 shares of company stock, you have been granted the option to purchase stock. This grant by itself isn't taxable.

The grant price is the price at which you can purchase shares, and the grant date is the day the stock options are given to you. Vesting is the process of fulfilling the grant (promise). The vesting schedule determines the vesting date - the date when you can begin purchasing stock and using your options.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

NQSOs can be offered to employees and others, such as contractors, advisors, etc. ISOs are only available to employees. Your ability to exercise remaining vested options will be subject to the terms in your employment agreement, which may offer a post-termination exercise window or options expiration date.

There are two types, each with different taxation: nonqualified stock options (NQSOs) and incentive stock options (ISOs). Since the exercise price is nearly always the company's stock price on the grant date, stock options become valuable only if the stock price rises.

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can't exercise your option.

Generally, ISO stock is awarded only to top management and highly-valued employees. ISOs also are called statutory or qualified stock options.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.