Oklahoma Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp.

Description

How to fill out Sample Redemption Agreement - Executive Stock Purchase Agreement Of Pic N Save Corp.?

US Legal Forms - one of several most significant libraries of authorized kinds in the United States - provides a wide array of authorized record themes you can download or printing. Making use of the website, you can get a large number of kinds for company and individual functions, sorted by groups, states, or keywords.You will discover the latest models of kinds like the Oklahoma Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp. within minutes.

If you currently have a membership, log in and download Oklahoma Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp. through the US Legal Forms catalogue. The Obtain key can look on each form you view. You have accessibility to all formerly downloaded kinds within the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, listed here are straightforward directions to help you get started out:

- Ensure you have selected the correct form for your metropolis/area. Click on the Preview key to check the form`s content material. See the form explanation to ensure that you have selected the right form.

- In case the form does not match your demands, take advantage of the Search field near the top of the screen to obtain the one who does.

- In case you are pleased with the shape, validate your choice by clicking on the Get now key. Then, choose the rates prepare you like and provide your references to sign up on an accounts.

- Method the financial transaction. Use your Visa or Mastercard or PayPal accounts to complete the financial transaction.

- Pick the file format and download the shape on the gadget.

- Make alterations. Load, revise and printing and indicator the downloaded Oklahoma Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp..

Each and every web template you included with your bank account lacks an expiration date and is also yours for a long time. So, if you want to download or printing one more copy, just proceed to the My Forms section and click around the form you require.

Get access to the Oklahoma Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp. with US Legal Forms, probably the most extensive catalogue of authorized record themes. Use a large number of specialist and state-distinct themes that meet up with your small business or individual demands and demands.

Form popularity

FAQ

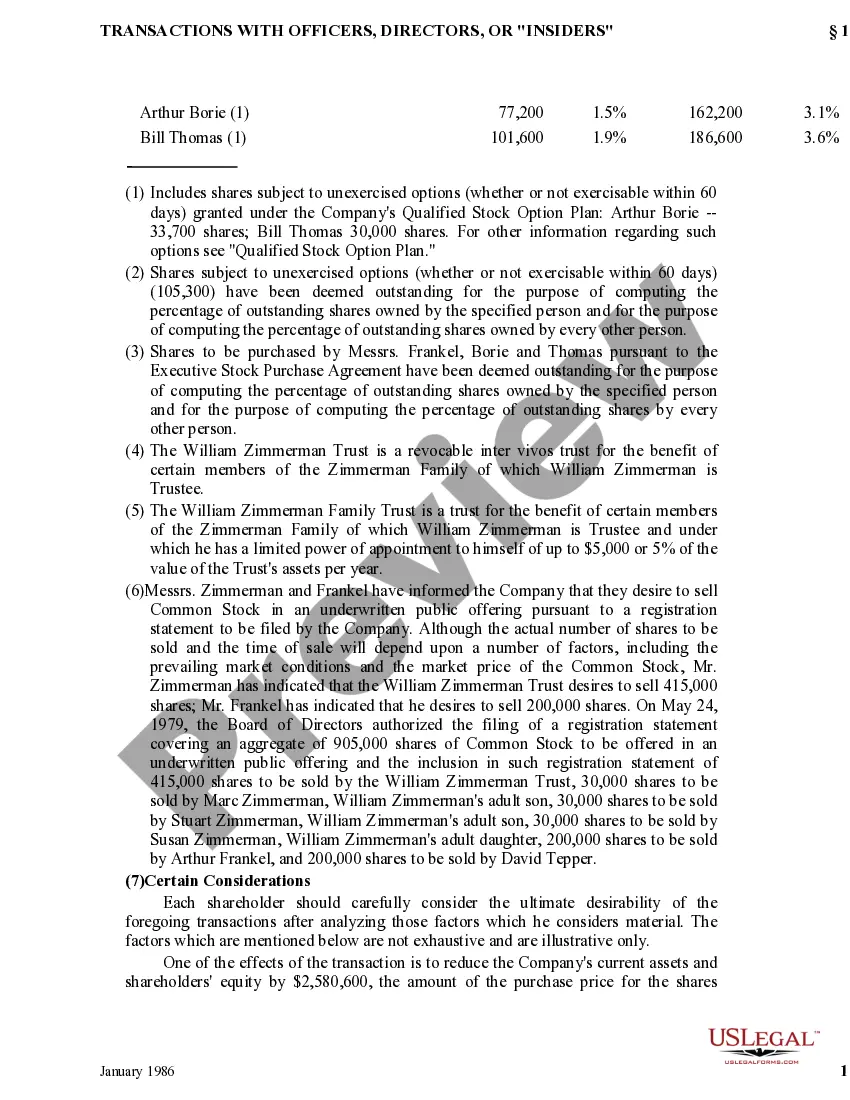

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

Unlike a redemption, which is compulsory, selling shares back to the company with a repurchase is voluntary. However, a redemption typically pays investors a premium built into the call price, partly compensating them for the risk of having their shares redeemed.

When a corporation purchases the stock of a departing shareholder, it's called a ?redemption.? When the other stockholders purchase the stock, it's called a cross-purchase. Typically, the redemption versus cross-purchase decision doesn't impact the ultimate control results.

Most importantly, a stock redemption plan provides tax-free, cash resources to pay a deceased owner's surviving family for their share of the business. Without extra funds available, a business might otherwise have to liquidate or sell assets in order to stay afloat during such a challenging time.