Oklahoma Log of Records Retention Requirements

Description

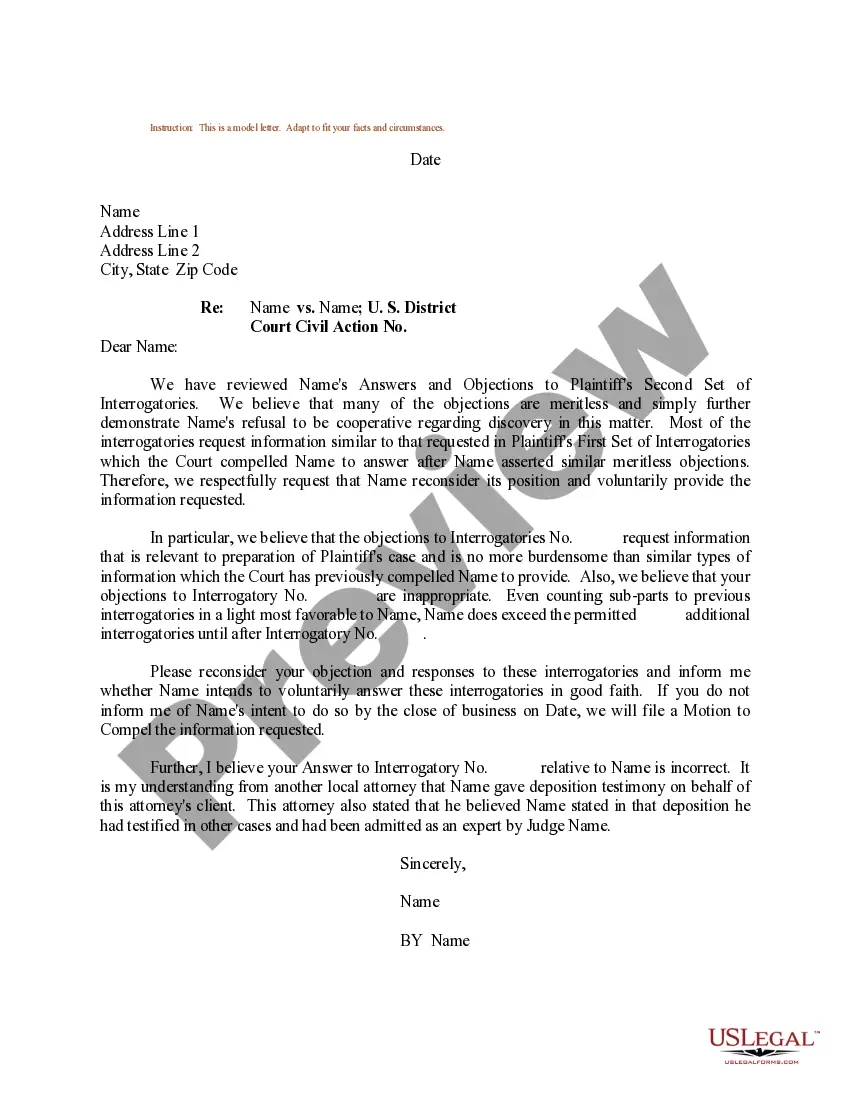

How to fill out Log Of Records Retention Requirements?

You can spend countless hours on the web searching for the official document template that meets the federal and state requirements you need.

US Legal Forms offers a vast selection of legal forms that are vetted by experts.

It's easy to download or print the Oklahoma Log of Records Retention Requirements from their services.

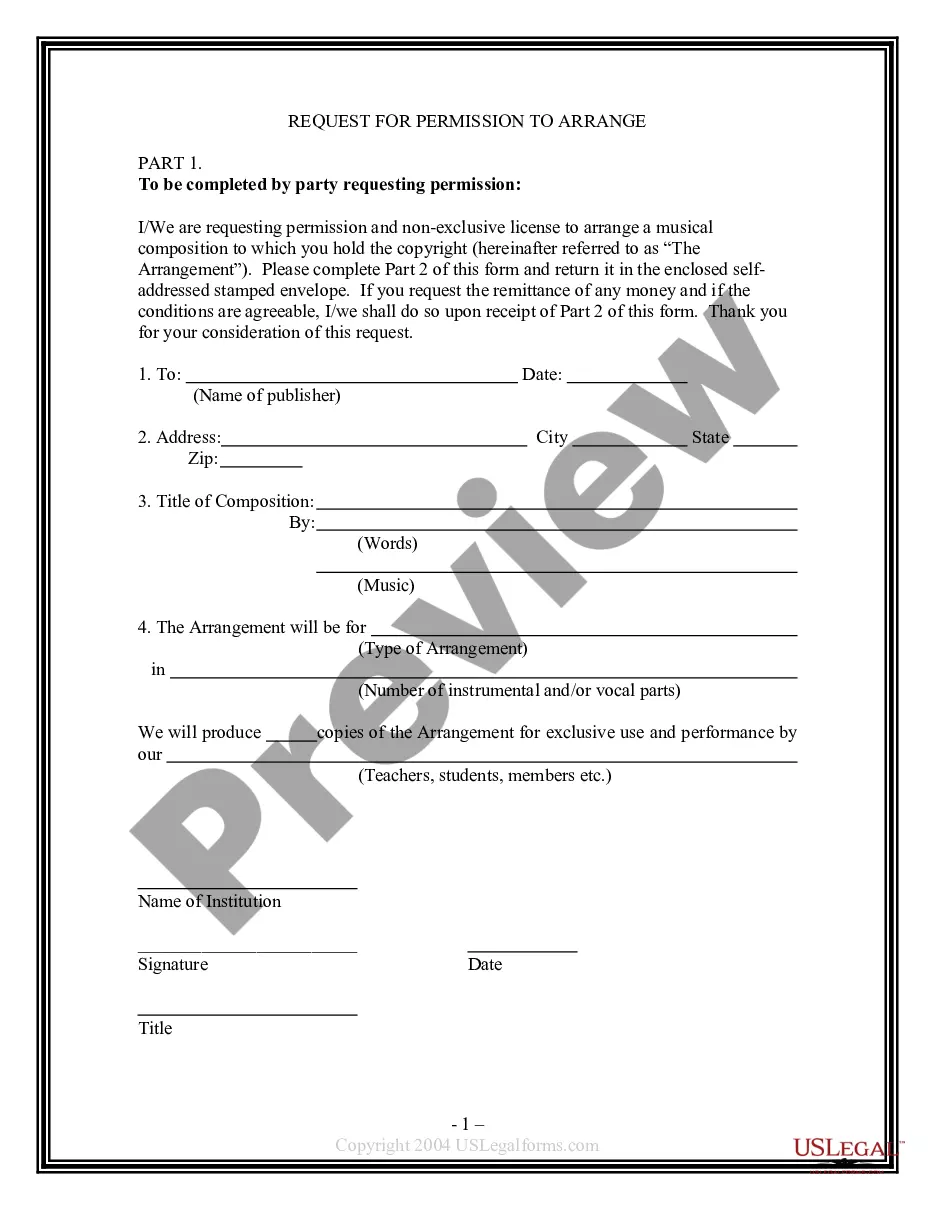

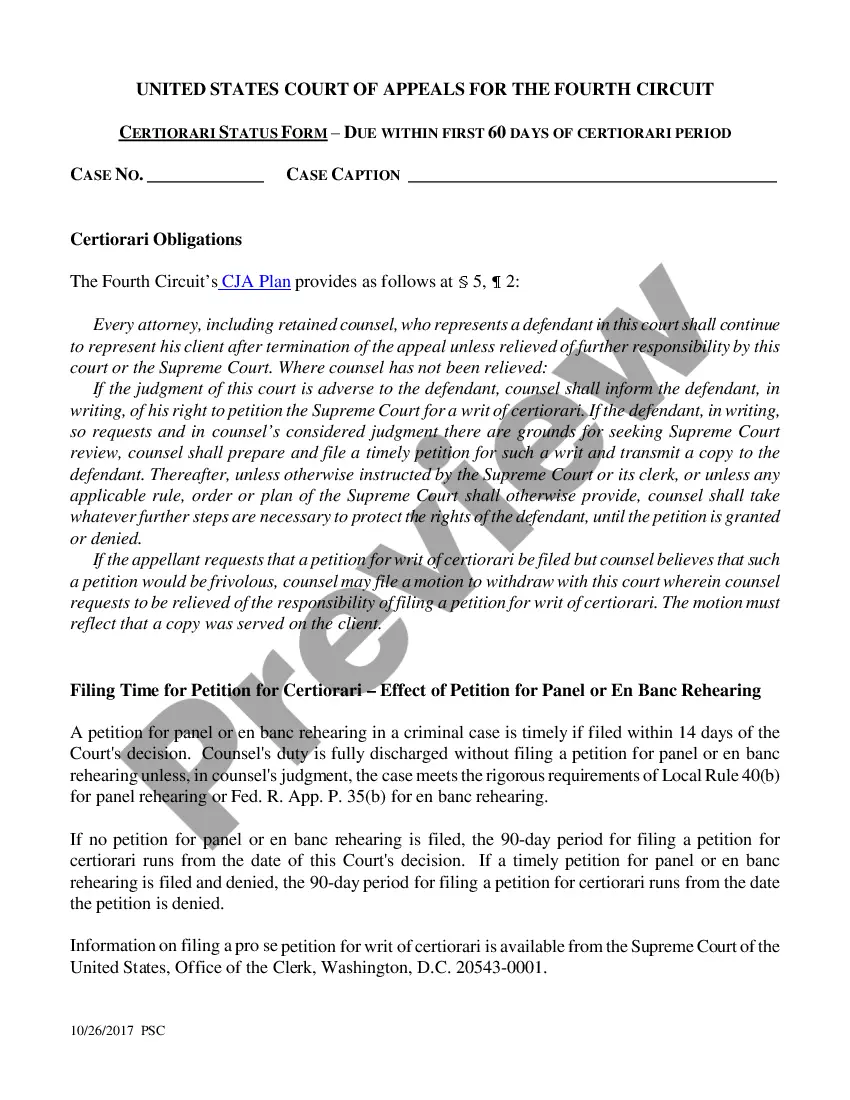

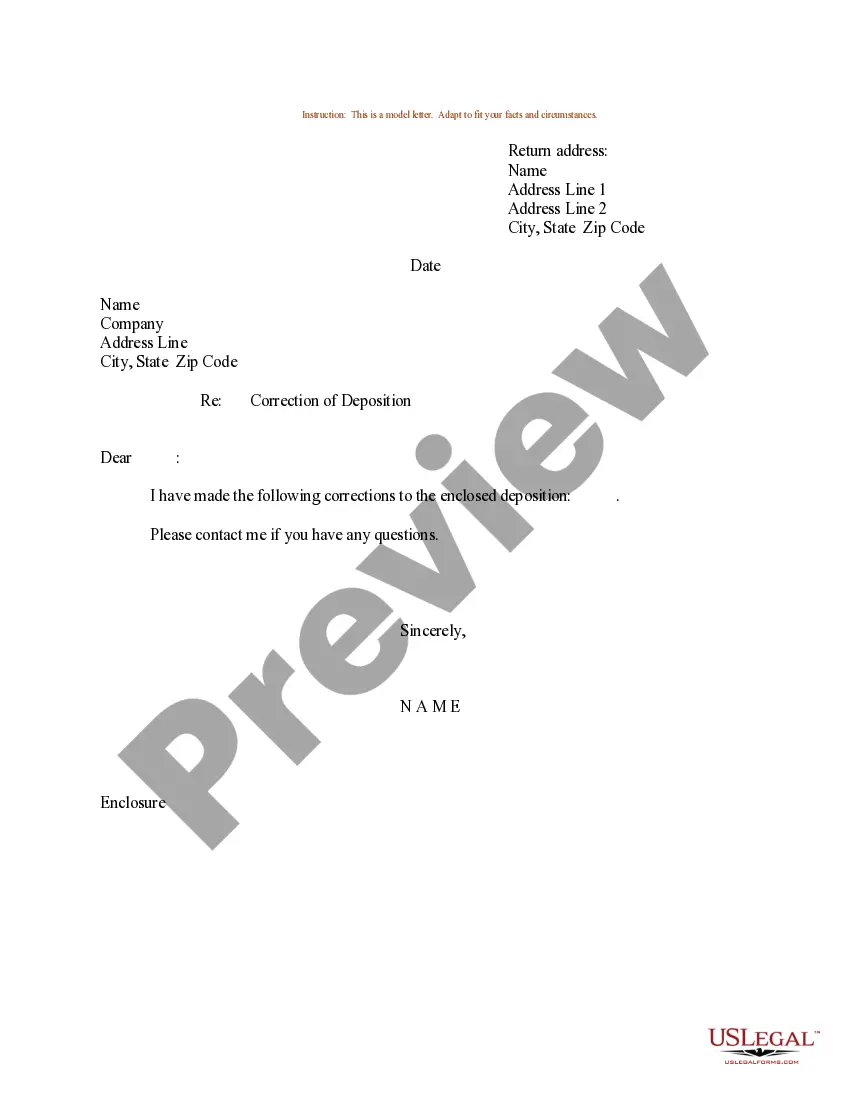

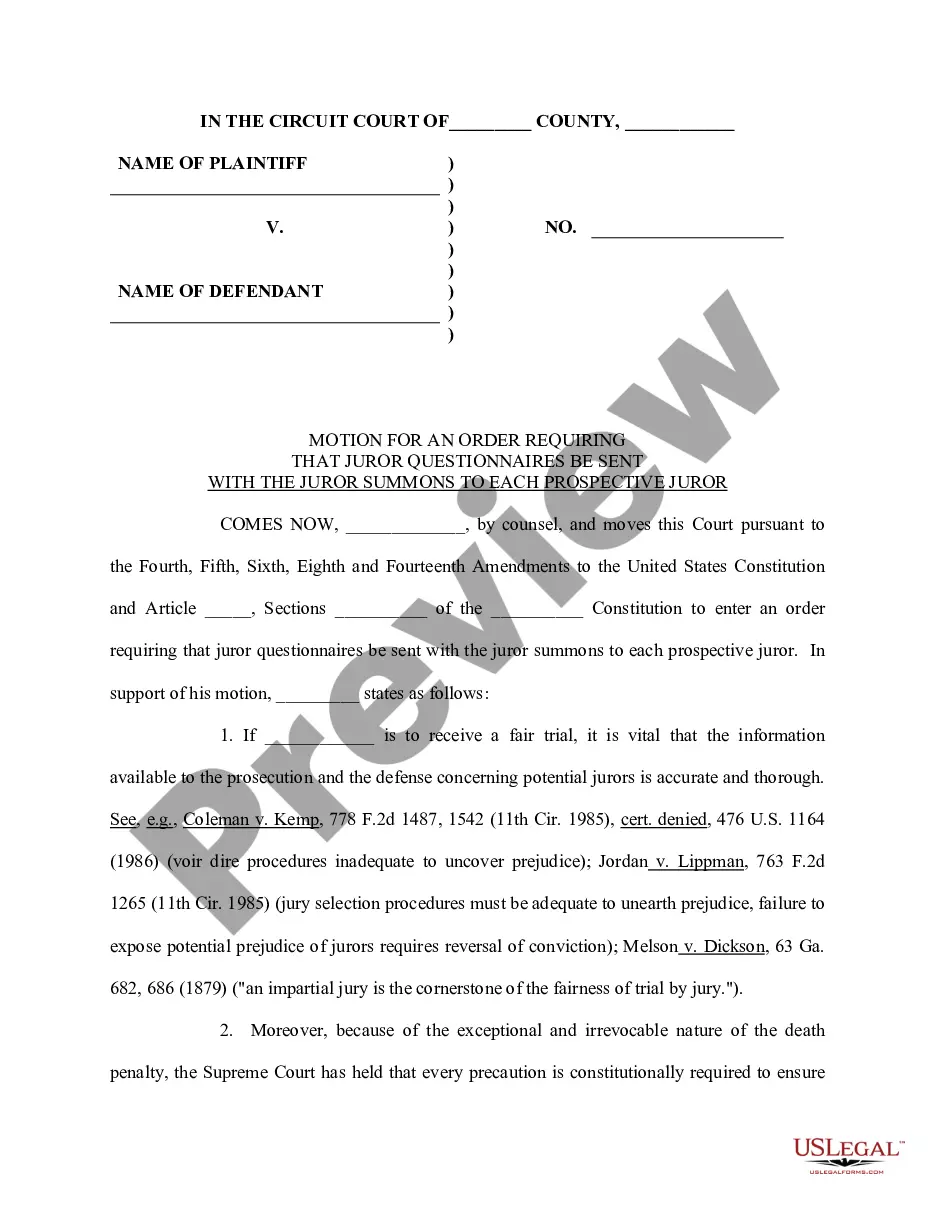

If available, use the Preview button to view the document template at the same time.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, print, or sign the Oklahoma Log of Records Retention Requirements.

- Every legal document template you purchase is yours indefinitely.

- To get an additional copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/region of your choice.

- Check the form description to confirm that you have selected the right form.

Form popularity

FAQ

KEEP 3 TO 7 YEARS Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

Federal regulations require research records to be retained for at least 3 years after the completion of the research (45 CFR 46) and UVA regulations require that data are kept for at least 5 years. Additional standards from your discipline may also be applicable to your data storage plan.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Period of Limitations that apply to income tax returns Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer and state record-keeping agency may provide guidance.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

Different records are kept for different lengths of time. Most records are destroyed after a certain period of time. Generally most health and care records are kept for eight years after your last treatment. GP records are kept for much longer.