Oklahoma Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

Finding the appropriate authorized document format can be challenging. Naturally, there are numerous templates accessible online, but how will you identify the authorized version you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Oklahoma Demand for Payment of Account by Business to Debtor, suitable for both business and personal purposes. All forms are reviewed by experts and comply with both state and federal requirements.

If you are already a registered user, Log In to your account and click the Obtain button to access the Oklahoma Demand for Payment of Account by Business to Debtor. Use your account to browse through the legal forms you have previously acquired. Visit the My documents section of your account to obtain another copy of the document you need.

Choose the file format and download the authorized document format to your device. Complete, edit, print, and sign the received Oklahoma Demand for Payment of Account by Business to Debtor. US Legal Forms is the largest repository of legal forms, where you can discover a variety of document templates. Take advantage of this service to download professionally crafted documents that meet state regulations.

- First, ensure you have selected the correct form for your town/county.

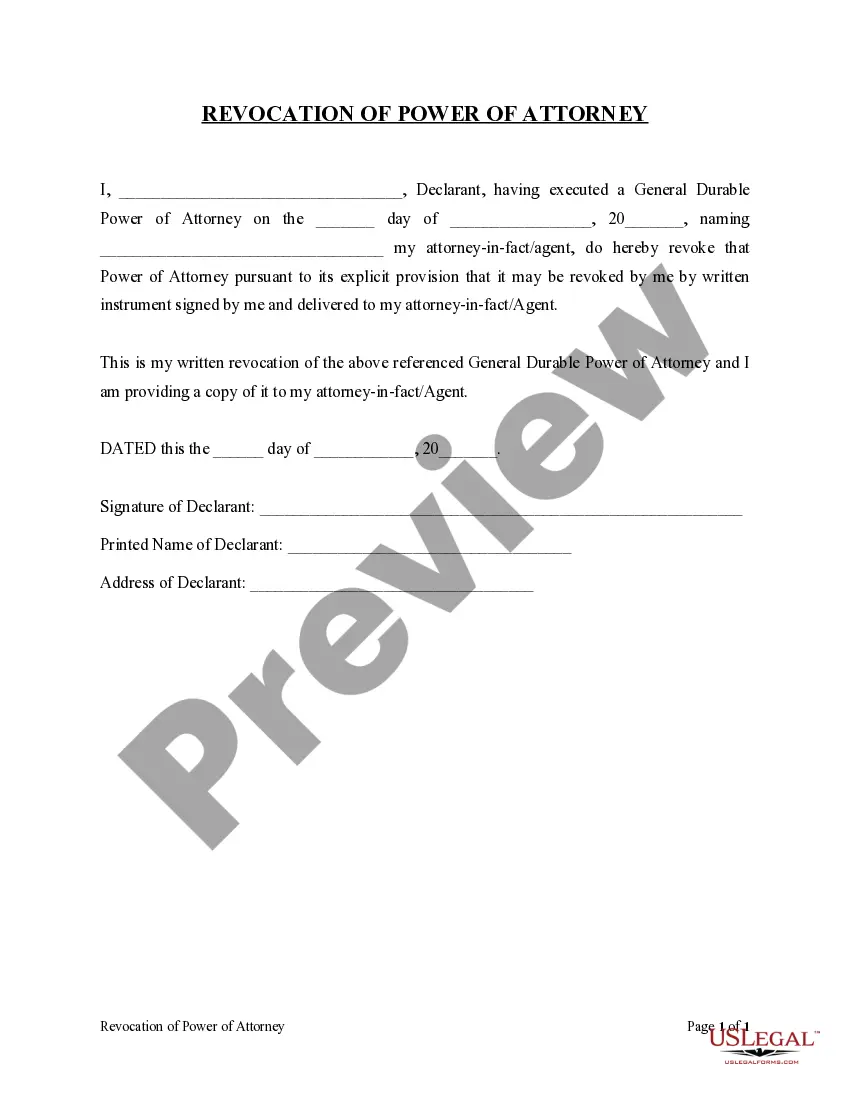

- You may view the form using the Preview option and read the form description to ensure it is suitable for you.

- If the form does not meet your needs, use the Search field to find the right one.

- Once you are certain that the form is appropriate, click the Purchase now button to acquire the form.

- Select the pricing plan you desire and input the required information.

- Create your account and finalize the payment using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

Florida, Texas and Iowa are considered to be the most "debtor-friendly" states, said Robert Fishman, president of the American Bankruptcy Institute. Illinois, by contrast, is considered to have "creditor-friendly" bankruptcy laws.

In Oklahoma, for most debts, a creditor is afforded five years to take legal action on a debt. After the statute of limitations has expired, a creditor or debt collector can no longer sue you for the debt.

Oklahoma allows two types of garnishment: continuing or wage garnishment, and non-continuing, which is bank account levy.

Know your rights. You cannot go to jail for not paying a consumer debt, even if a judgment is entered. Your house, social security, and most pensions cannot be foreclosed upon or garnished to pay consumer debts.

As is true in many states across the country, collections laws in Oklahoma have become increasingly debtor-friendly. As a result, it is more important now than ever for creditors and lenders to remain cognizant of the laws that will govern their future collections efforts even before accounts go into default.

If a debt collector does sue you in Oklahoma, a few things can happen, assuming the judge rules against you. A judge can issue a court order for a debt collector to garnish your wages, up to 25% of your after-tax pay).

How long does a judgment lien last in Oklahoma? A judgment lien in Oklahoma will remain attached to the debtor's property (even if the property changes hands) for five years.

Statute of Limitations and Your Credit ReportCollection accounts can remain on your report for seven years and 180 days from the original delinquency. Depending on the type of account and your location, this can be more than or less than the statute of limitations.

Garnishment Laws in OklahomaGarnishing a Bank Account. One method is to request the court issue a garnishment summons to a financial institution that is in possession of the debtor's funds.Continuing Garnishment of Wages.Other forms of Garnishment.