Oklahoma Use of Company Equipment

Description

How to fill out Use Of Company Equipment?

Selecting the appropriate legal document format can be a challenge. Of course, there are numerous templates available online, but how do you locate the legal form you need.

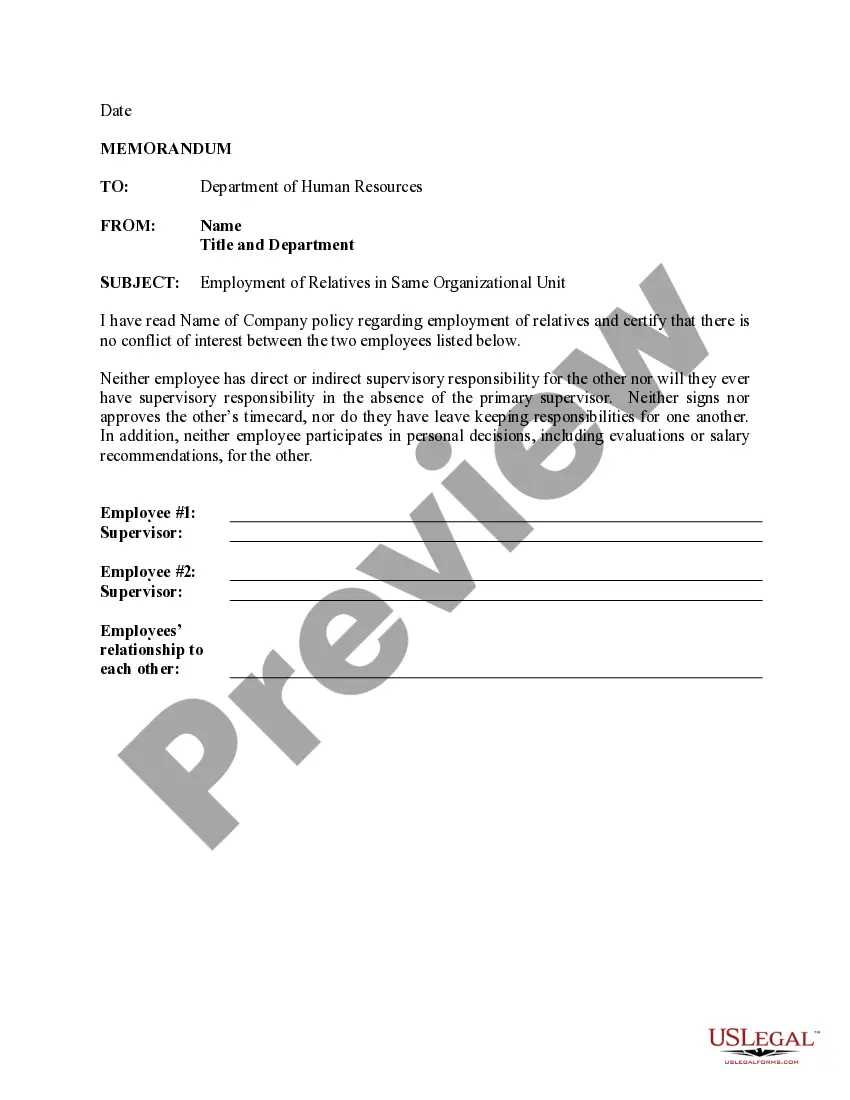

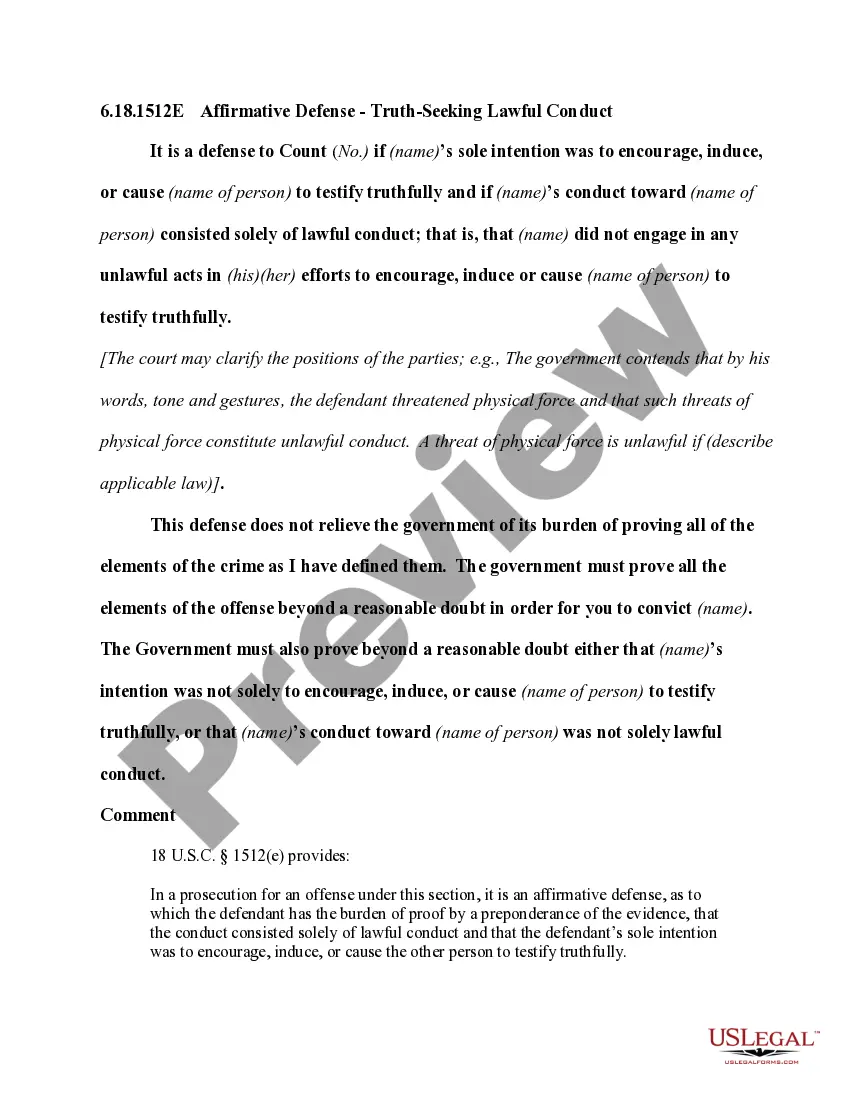

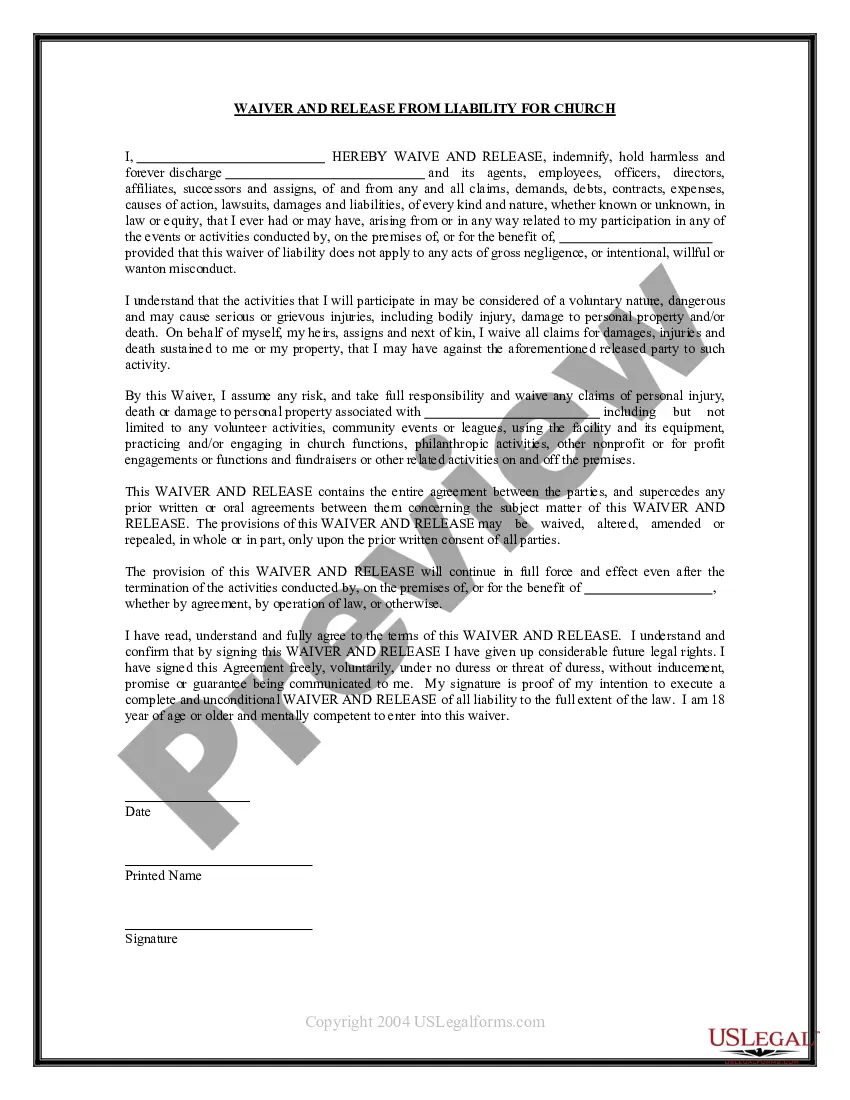

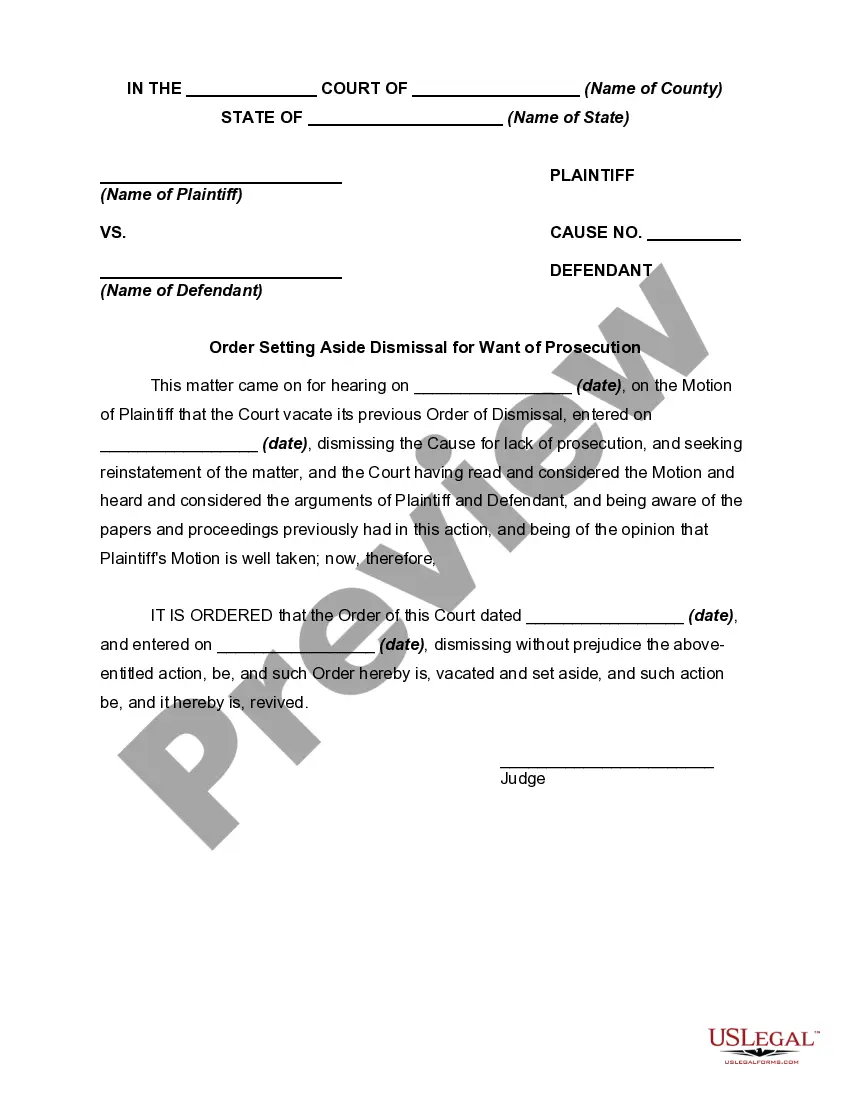

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Oklahoma Use of Company Equipment, suitable for both business and personal needs. All forms are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and then click on the Download button to retrieve the Oklahoma Use of Company Equipment. Use your account to review the legal forms you have previously acquired. Navigate to the My documents section of your account to obtain another copy of the file you need.

Select the file format and download the legal document template to your device. Complete, revise, and print, then sign the received Oklahoma Use of Company Equipment. US Legal Forms is the largest repository of legal documents where you can find various file templates. Use the service to download professionally crafted documents that adhere to state regulations.

- First, ensure you have selected the correct form for your location/state.

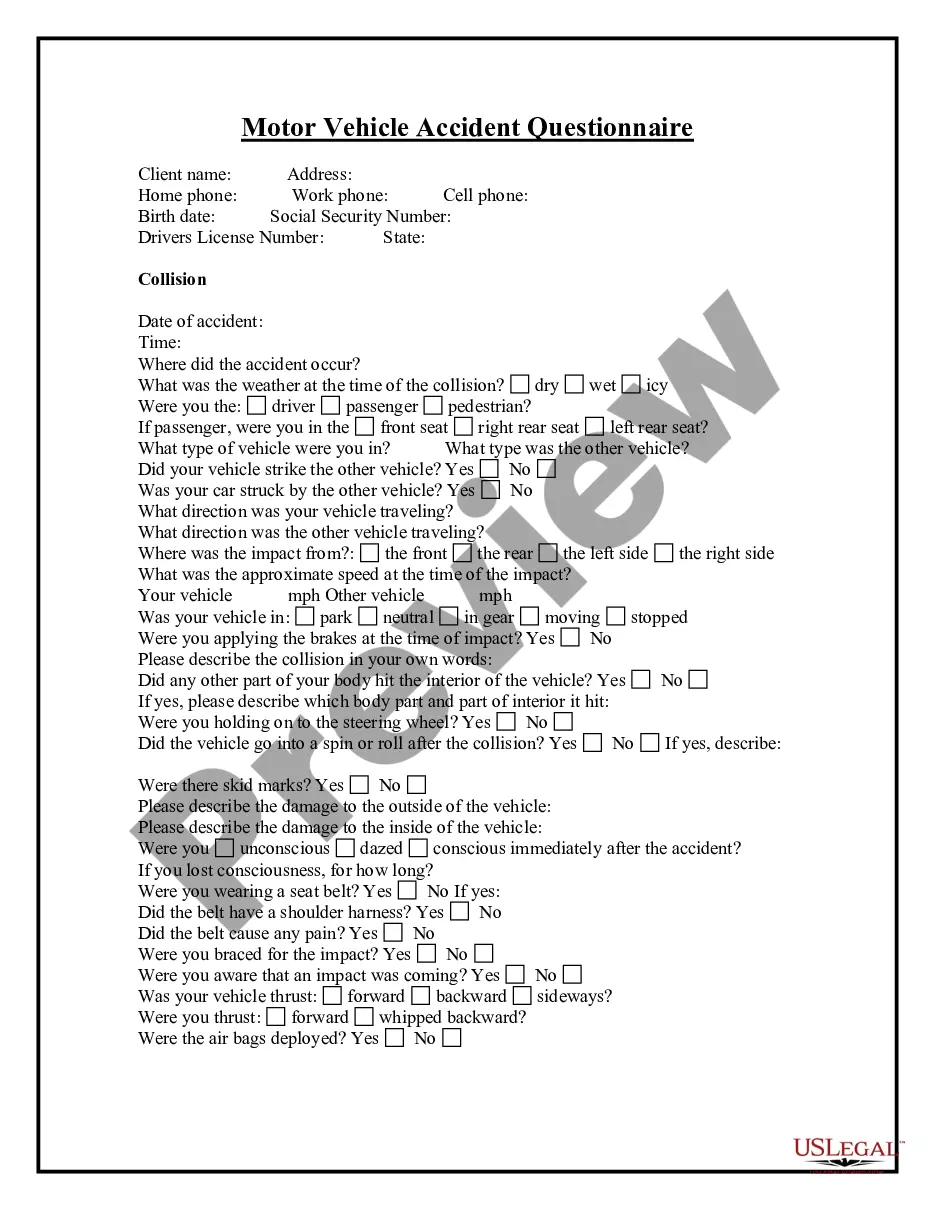

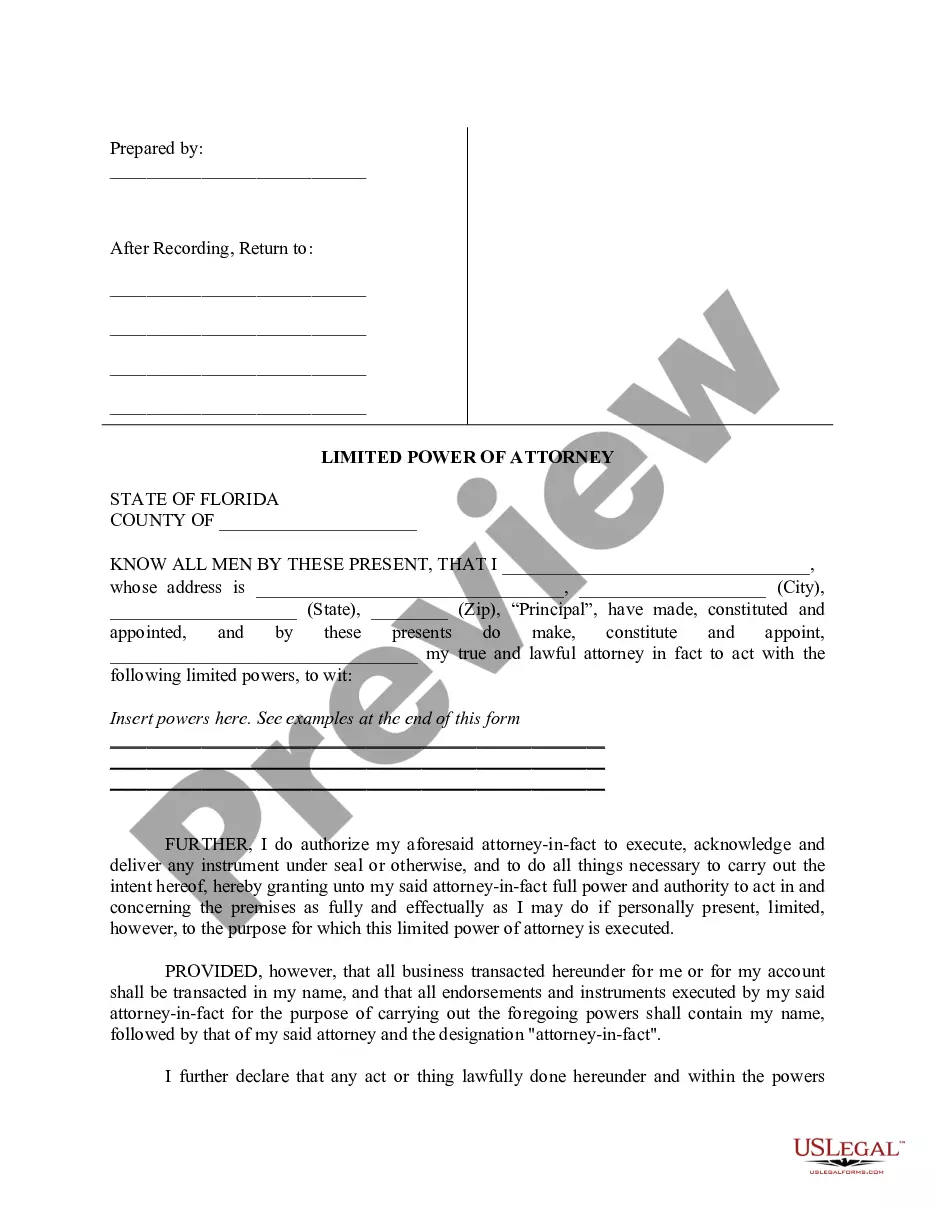

- You can view the form using the Preview button and read the form description to confirm this is the right one for you.

- If the form does not meet your requirements, utilize the Search field to locate the appropriate form.

- Once you are certain the form is correct, click on the Get now button to acquire the form.

- Choose the pricing plan you prefer and enter the necessary details.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Whether to claim 0 or 1 on your W-4 depends on your specific financial situation. Claiming 0 means more tax will be withheld, useful if you have multiple deductions or anticipate owing taxes. However, claiming 1 indicates fewer withholdings, potentially fitting those utilizing Oklahoma Use of Company Equipment, so evaluate what's best for your scenario.

To correctly fill out your W-4, first gather your personal information and review your tax situation. Include your filing status and any allowances, adjusting for any deductions linked to Oklahoma Use of Company Equipment, if applicable. This ensures your withholding aligns with your anticipated tax burden.

The allowance for yourself on the W-4 in Oklahoma is determined by your personal tax situation. As a general guideline, you may claim one allowance if you are not a dependent and have no significant tax credits. If you utilize Oklahoma Use of Company Equipment, assess whether it impacts your deductions before making your claim.

Don't allow employees to use company equipment for personal purposes, whether on their own time or company time. But if you do offer this benefit to your employees, try to protect your business in your employee handbook.

Use of Company Resources for Personal Purposes All employees should protect the company's assets and ensure their efficient use. Company equipment should not be used for non-company business although incidental and limited use, from time to time, may be acceptable if properly authorized in advance.

Brief and occasional personal use of the electronic mail system or the Internet is acceptable as long as it is not excessive or inappropriate, occurs during personal time (lunch or other breaks), and does not result in expense or harm to the Company or otherwise violate this policy.

Even when off of the clock, you should not use a work-owned device for any personal business, as it can all be monitored. If you are using your own device/computer, laws are in place to provide you some semblance of privacy, but most likely, you have agreed to waive those protections as a condition of employment.

The unauthorised use of company property may be a form of theft, however, the offence is wider than theft in the technical sense because it does not require the employee to have actually taken possession of the employer's property or alternatively deprived the employer of use of that property.

Again, the general rule is that limited personal use" of HUD's office equipment including IT resources must be restricted to non-work time, and must not detract from an employee's performance of official duties.

This section of the Tax Code states that businesses may deduct up to the full purchase price of qualified business equipment from their taxes within the same tax year. Equipment can range from heavy machinery like backhoes to computers and certain software programs for your business.