Oklahoma Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

You can spend numerous hours online looking for the legal form template that meets the federal and state requirements you seek.

US Legal Forms offers a plethora of legal templates that are vetted by professionals.

You can effortlessly obtain or print the Oklahoma Unrestricted Charitable Contribution of Cash from our platform.

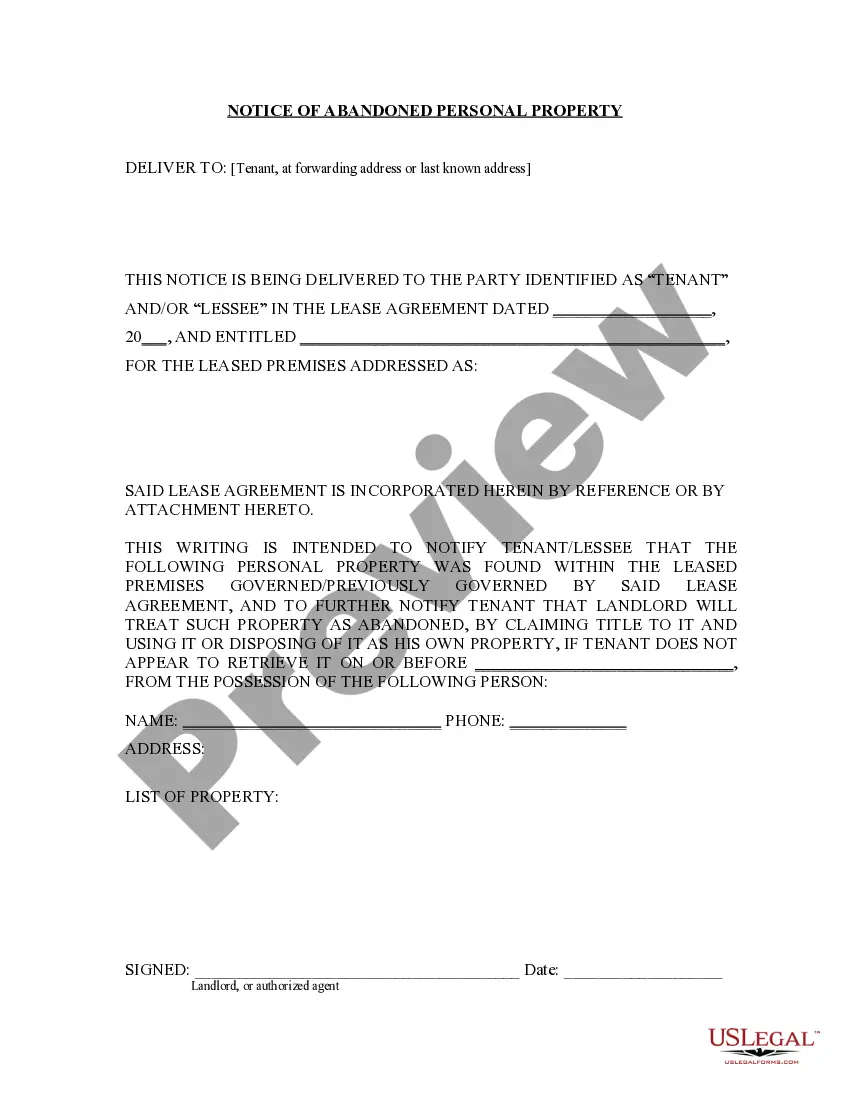

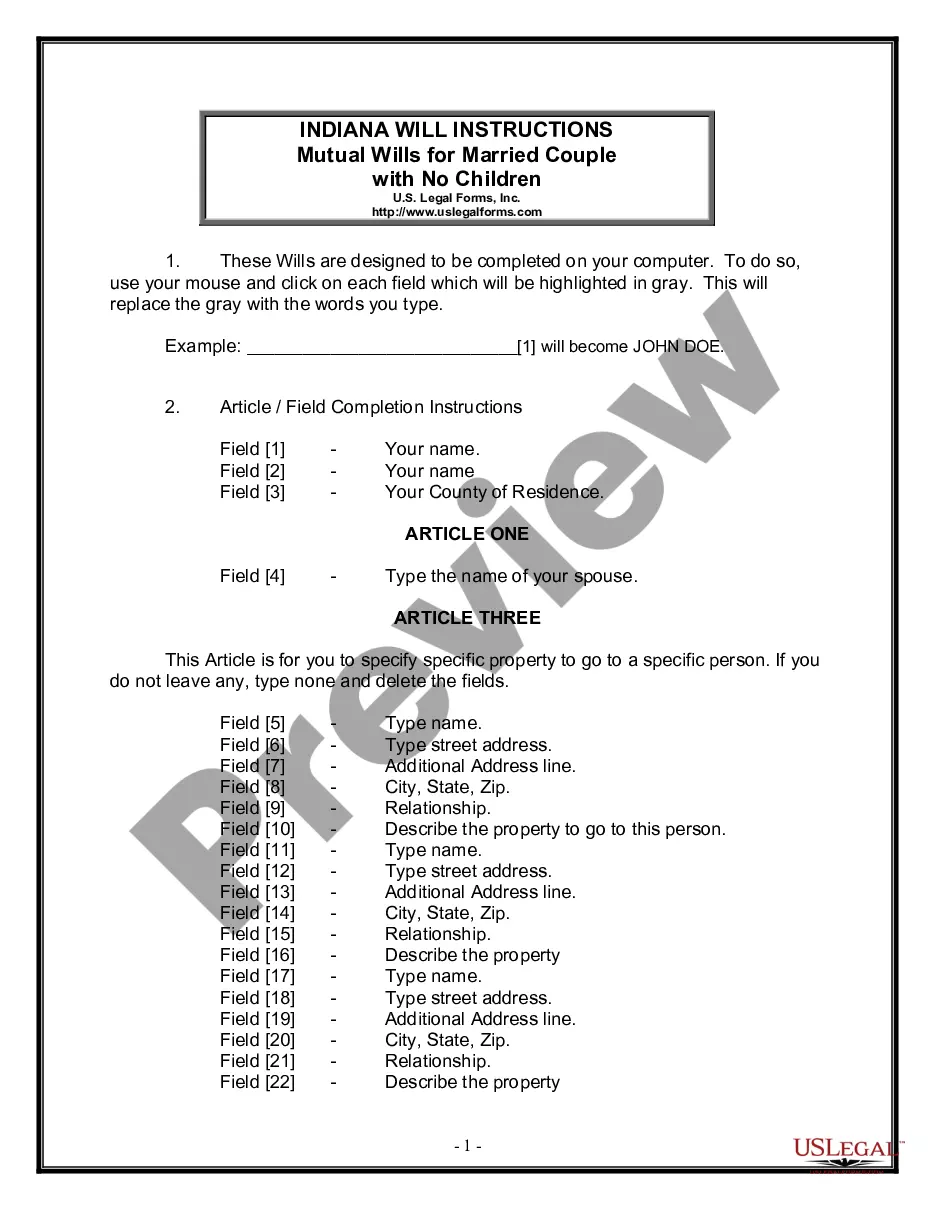

If available, utilize the Review option to peruse through the form template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Acquire button.

- Subsequently, you may complete, modify, print, or sign the Oklahoma Unrestricted Charitable Contribution of Cash.

- Every legal form template you purchase is yours indefinitely.

- To obtain another copy of the bought document, visit the My documents section and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct form template for the state/region of your choice. Review the form description to confirm you have selected the accurate document.

Form popularity

FAQ

A deductible charitable contribution typically includes cash donations to qualified nonprofits, the value of donated goods, and certain expenses related to volunteering. When you make an Oklahoma Unrestricted Charitable Contribution of Cash, it directly enhances your ability to deduct the donation on your taxes. Make sure the organization is recognized by the IRS to ensure your contribution qualifies. For more information, consider using the services provided by uslegalforms, which can guide you through the requirements.

The highest amount you can deduct for charitable donations varies based on your income and the type of charity. Generally, you can deduct up to 60% of your adjusted gross income for cash contributions to qualified charitable organizations. This means contributions classified as an Oklahoma Unrestricted Charitable Contribution of Cash are included in this percentage. It's important to keep accurate records of your donations to ensure you maximize your deductions.

Claiming charitable contributions involves filling out the appropriate sections on your tax return. For an Oklahoma Unrestricted Charitable Contribution of Cash, be sure to list your donations on Schedule A if you are itemizing deductions. For clear guidance and easy access to the necessary forms, consider using US Legal Forms to streamline the claiming process effectively.

To deduct charitable contributions, you must itemize your deductions on your tax return. When claiming an Oklahoma Unrestricted Charitable Contribution of Cash, ensure you keep proper records, such as receipts and bank statements. You can use platforms like US Legal Forms to find resources that guide you in documenting your contributions accurately.

The Oklahoma Solicitation of Charitable Contributions Act regulates how charities can solicit donations in the state. This act aims to protect donors from fraudulent activities and promote transparency. Understanding these regulations is vital, especially when making an Oklahoma Unrestricted Charitable Contribution of Cash, as it ensures your contributions go to legitimate causes.

In general, the maximum you can write off for charitable donations depends on your income and the type of contribution. For Oklahoma Unrestricted Charitable Contribution of Cash, individuals can typically deduct cash donations up to 60% of their adjusted gross income. However, it's essential to review IRS guidelines and ensure you follow these rules for the best results during tax filing.

Charitable contributions can be classified based on their nature, such as direct cash donations, in-kind donations, and pledges. An Oklahoma Unrestricted Charitable Contribution of Cash falls under direct cash donations, which allows you to claim them easily on your tax return. Proper classification not only ensures compliance but also helps to provide insights into your charitable spending. Using uslegalforms can simplify this classification process through streamlined record-keeping.

To report noncash charitable contributions, you generally need to fill out Form 8283. This form details the descriptions and values of the items donated, and it's crucial for claiming deductions. If your Oklahoma Unrestricted Charitable Contribution of Cash includes noncash items, tracking them thoroughly will help ensure you meet IRS requirements. Platforms like uslegalforms can assist in generating the necessary forms and maintaining your records.

The journal entry for an Oklahoma Unrestricted Charitable Contribution of Cash typically involves debiting the charitable donation expense account and crediting your cash or bank account. This entry accurately reflects the outflow of cash and the expense incurred for charitable activities. Keeping precise records through an accounting platform like uslegalforms can simplify this process and ensure accuracy in your financial reporting.

Yes, with certain conditions, it is possible to deduct charitable contributions without itemizing. For example, during specific tax years, you may be eligible for a deduction of up to $300 for cash donations, including Oklahoma Unrestricted Charitable Contribution of Cash, even if you take the standard deduction. This provides a straightforward way to lower your taxable income while supporting organizations you care about. Always consult IRS guidelines or a tax professional for the latest rules.