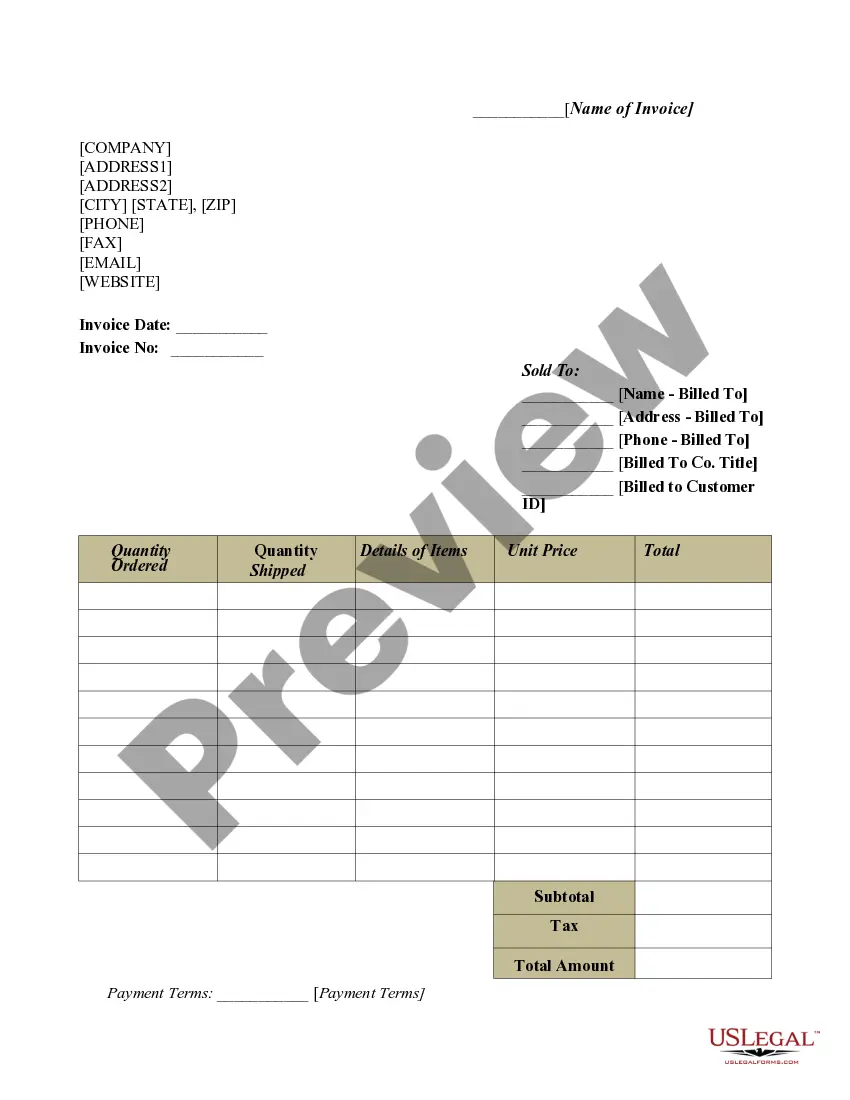

Oklahoma Balance Sheet Notes Payable

Description

How to fill out Balance Sheet Notes Payable?

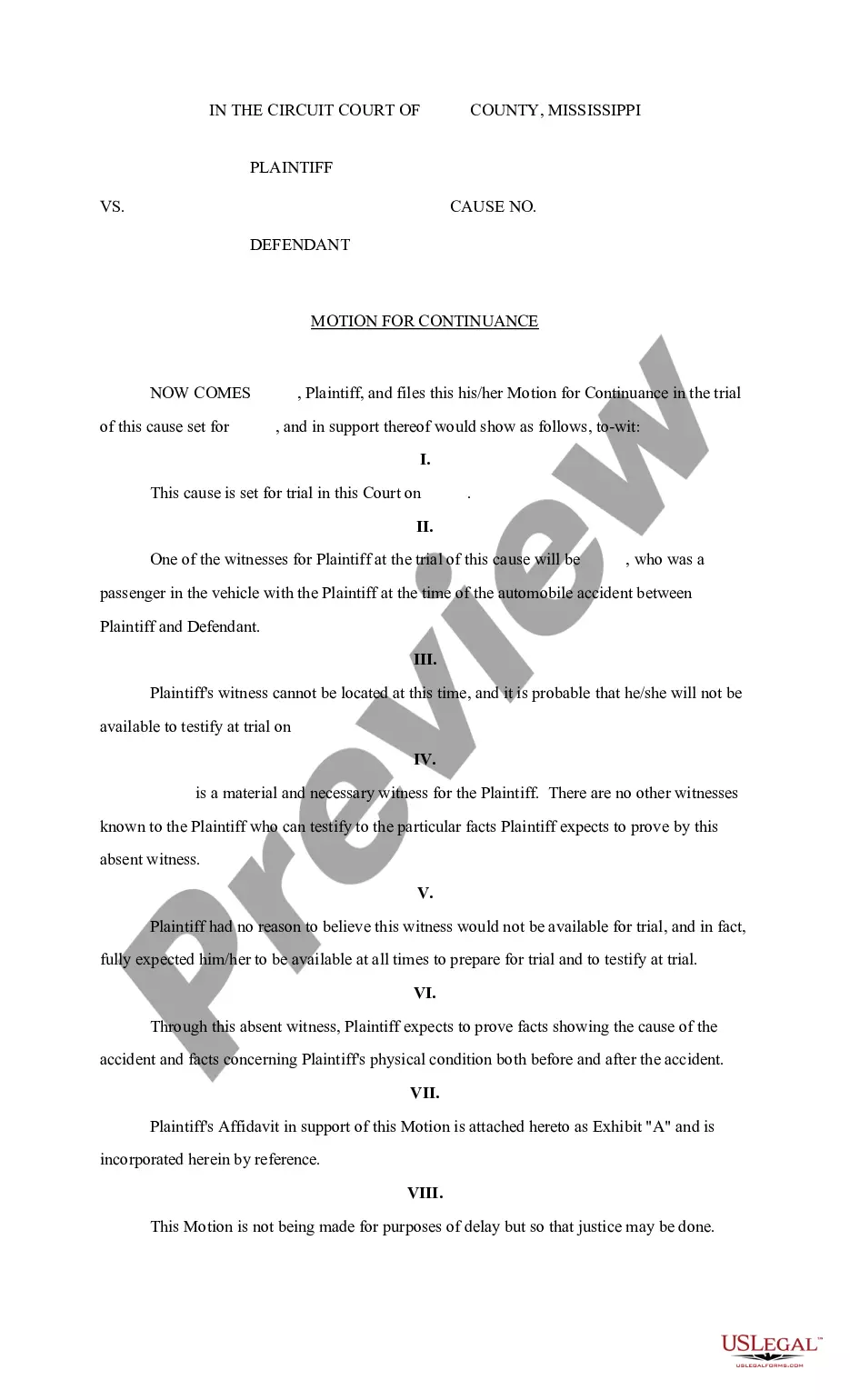

Selecting the optimal legal documents format can be challenging. Obviously, there are numerous templates accessible online, but how can you locate the legal type you require.

Take advantage of the US Legal Forms website. This service offers thousands of templates, such as the Oklahoma Balance Sheet Notes Payable, which can be utilized for business and personal purposes. All documents have been reviewed by professionals and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Oklahoma Balance Sheet Notes Payable. Use your account to browse through the legal forms you have previously acquired. Go to the My documents tab in your account to get another copy of the document you require.

Select the file format and download the legal document format to your device. Complete, edit, print, and sign the obtained Oklahoma Balance Sheet Notes Payable. US Legal Forms is the largest collection of legal documents where you can discover a range of paper templates. Utilize the service to download well-crafted documents that adhere to state regulations.

- First, ensure you have selected the correct type for your city/county.

- You can review the document by using the Review button and check the form details to confirm it is suitable for you.

- If the document does not meet your needs, utilize the Search field to find the appropriate form.

- Once you are convinced that the form is correct, click the Get now button to acquire it.

- Choose the pricing plan that you prefer and input the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

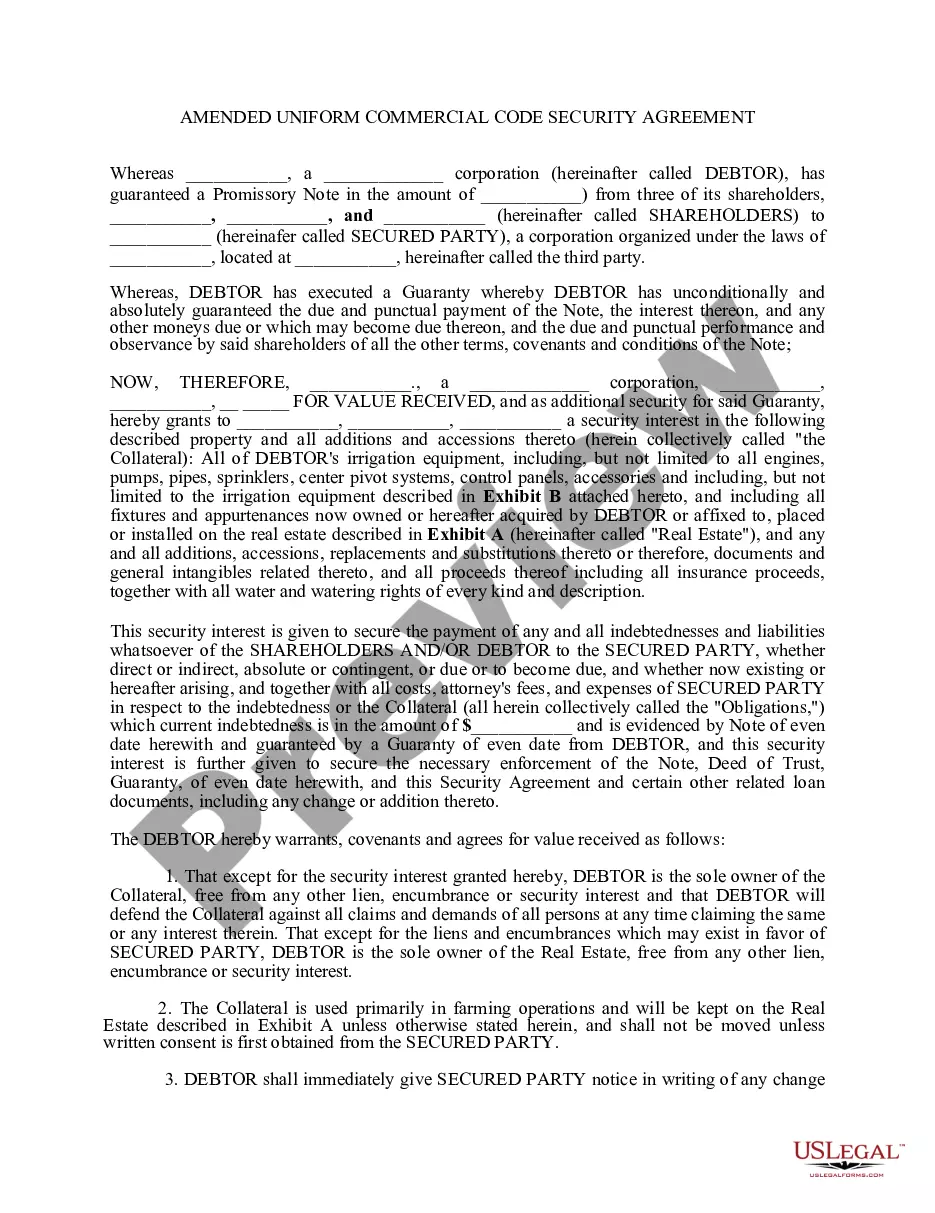

For most companies the amounts in Notes Payable and Interest Payable are reported on the balance sheet as follows: the amount due within one year of the balance sheet date will be a current liability, and. the amount not due within one year of the balance sheet date will be a noncurrent or long-term liability.

A company's total accounts payable balance at a specific point in time will appear on its balance sheet under the current liabilities section. Accounts payable are debts that must be paid off within a given period to avoid default. At the corporate level, AP refers to short-term debt payments due to suppliers.

Notes payable appear under liabilities on the balance sheet, separated into bank debt and other long-term notes payable. Payment details can be found in the notes to the financial statements.

Notes to the financial statements disclose the detailed assumptions made by accountants when preparing a company's: income statement, balance sheet, statement of changes of financial position or statement of retained earnings. The notes are essential to fully understanding these documents.

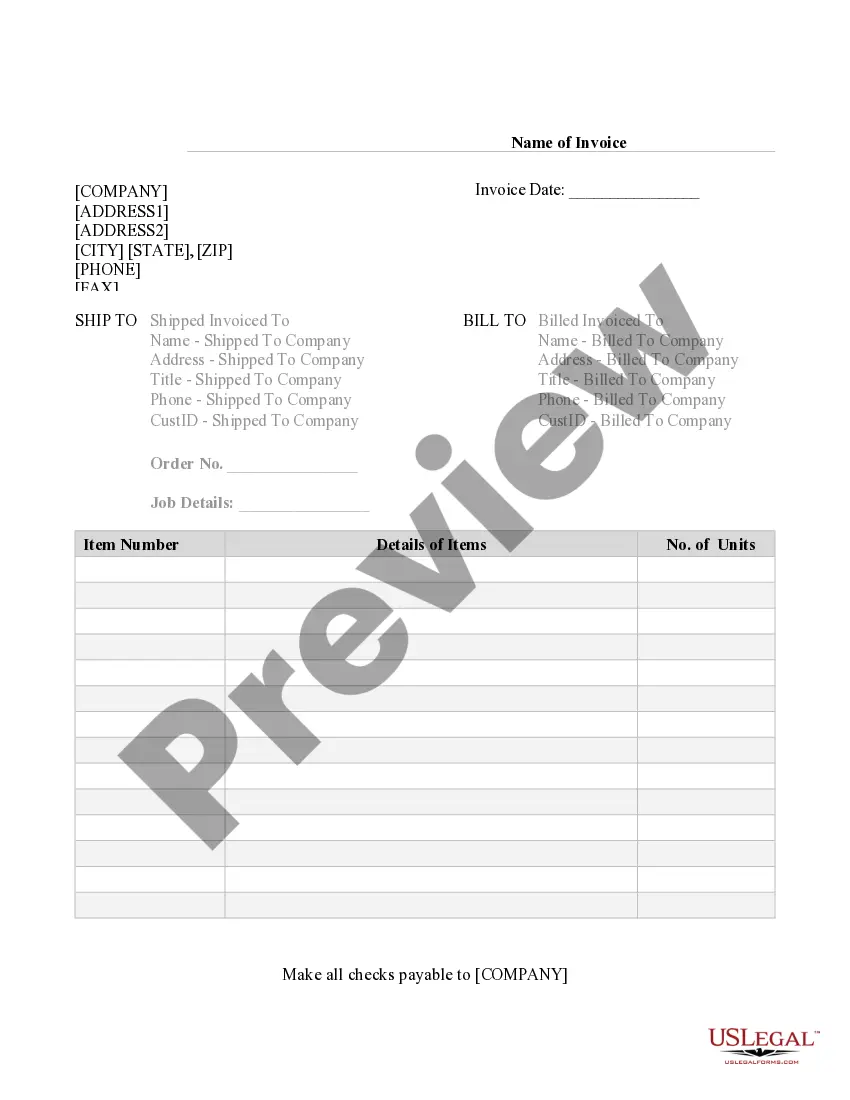

Accounts payable is located on the balance sheet, and expenses are recorded on the income statement.

Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date.

The payable is in default if the company does not pay the payable within the terms outlined by the supplier or creditor. Accounts payable is listed on a company's balance sheet. Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance sheet.

Both the items of Notes Payable and Notes Receivable can be found on the Balance Sheet of a business. While Notes Payable is a liability, Notes Receivable is an asset. Notes Receivable record the value of promissory notes that a business owns, and for that reason, they are recorded as an asset.

They're classified as either current, meaning they'll be paid off within the next 12 months, or noncurrent, which means they will be paid off in more than 12 months. These notes are part of the liabilities of the company, and, therefore, they appear on the balance sheet, not on the income statement.

When recording an account payable, debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit cash. Payroll entry.