Oklahoma Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest To A Corporation With Consent Of Remaining Partners?

Are you in the place where you need to have documents for sometimes company or personal uses almost every day time? There are tons of legal record layouts available on the Internet, but finding versions you can rely on isn`t easy. US Legal Forms offers 1000s of form layouts, much like the Oklahoma Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners, that are composed to fulfill state and federal needs.

If you are presently acquainted with US Legal Forms website and also have a merchant account, basically log in. Next, you can acquire the Oklahoma Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners format.

If you do not provide an account and wish to begin using US Legal Forms, follow these steps:

- Find the form you need and ensure it is to the proper town/county.

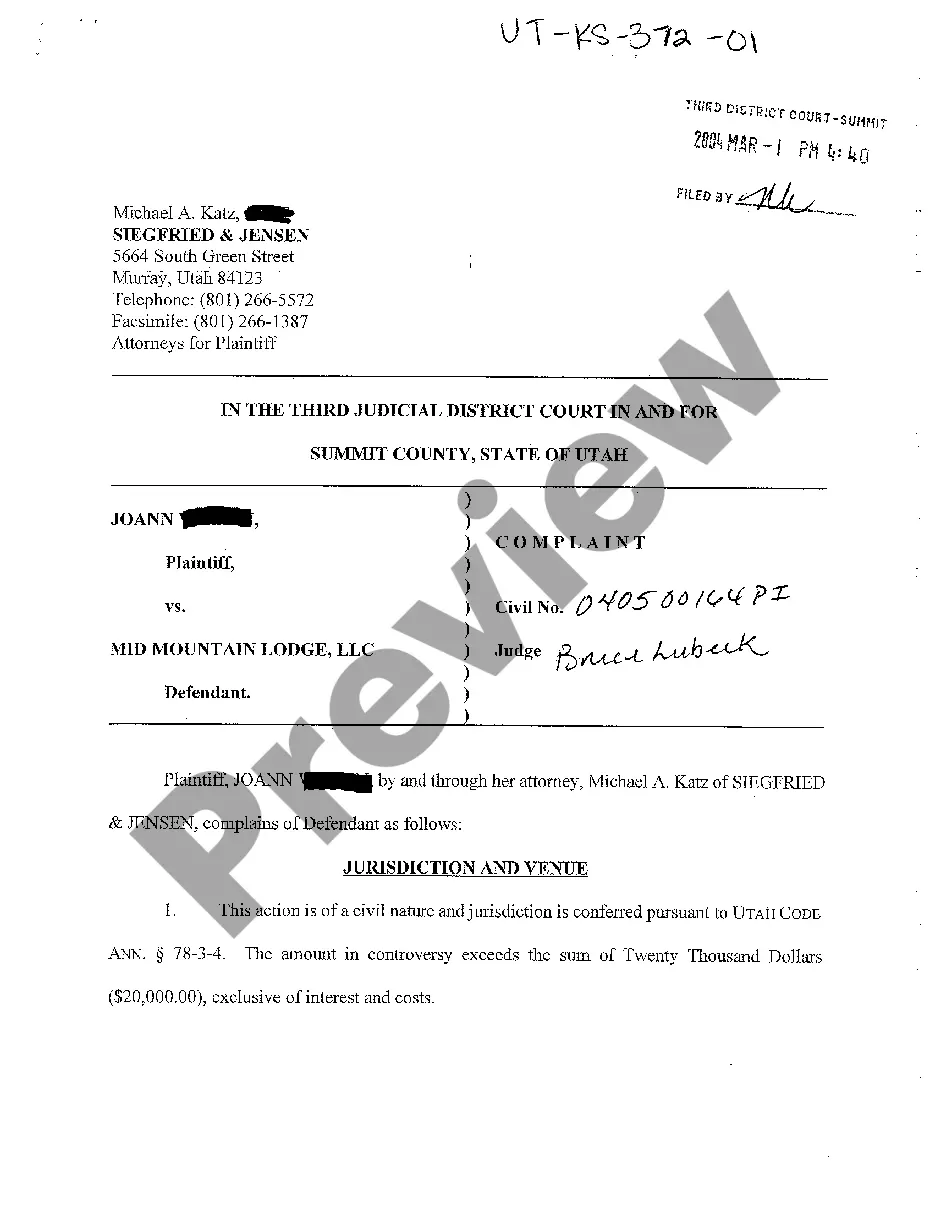

- Take advantage of the Review key to examine the shape.

- Browse the outline to ensure that you have chosen the proper form.

- If the form isn`t what you`re seeking, take advantage of the Search discipline to discover the form that meets your requirements and needs.

- Whenever you discover the proper form, simply click Get now.

- Opt for the rates program you want, fill out the specified info to produce your account, and buy an order with your PayPal or charge card.

- Choose a hassle-free document file format and acquire your backup.

Find each of the record layouts you might have purchased in the My Forms menu. You can obtain a further backup of Oklahoma Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners whenever, if necessary. Just click on the essential form to acquire or print out the record format.

Use US Legal Forms, by far the most comprehensive variety of legal varieties, in order to save time and steer clear of blunders. The service offers appropriately produced legal record layouts which can be used for a selection of uses. Generate a merchant account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

Answer and Explanation: In partnership, the assignment of interests is generally transferable to the assignor interest in the partnership of profits and surplus. Without the approval of other partners, the assignee does not become a partner. The assignee has received only the rights to share profits.

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

Any one or more domestic corporations may merge or consolidate with one or more domestic or foreign entities, unless the laws of the jurisdiction or jurisdictions under which such entity or entities are formed prohibit the merger or consolidation.

Partners have important duties in a partnership, including (1) the duty to serve?that is, to devote herself to the work of the partnership; (2) the duty of loyalty, which is informed by the fiduciary standard: the obligation to act always in the best interest of the partnership and not in one's own best interest; (3) ...

What rights will be assigned? Full partnership rights usually require consent from remaining partners as they give the new partner the right to participate in business operations and management.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Assignment of Partnership Interest: A partner may assign his or her interest in the partnership to another party, who will then be entitled to receive the partner's share of profits and, upon termination, the partner's capital contribution.