Oklahoma Worksheet - Escrow Fees

Description

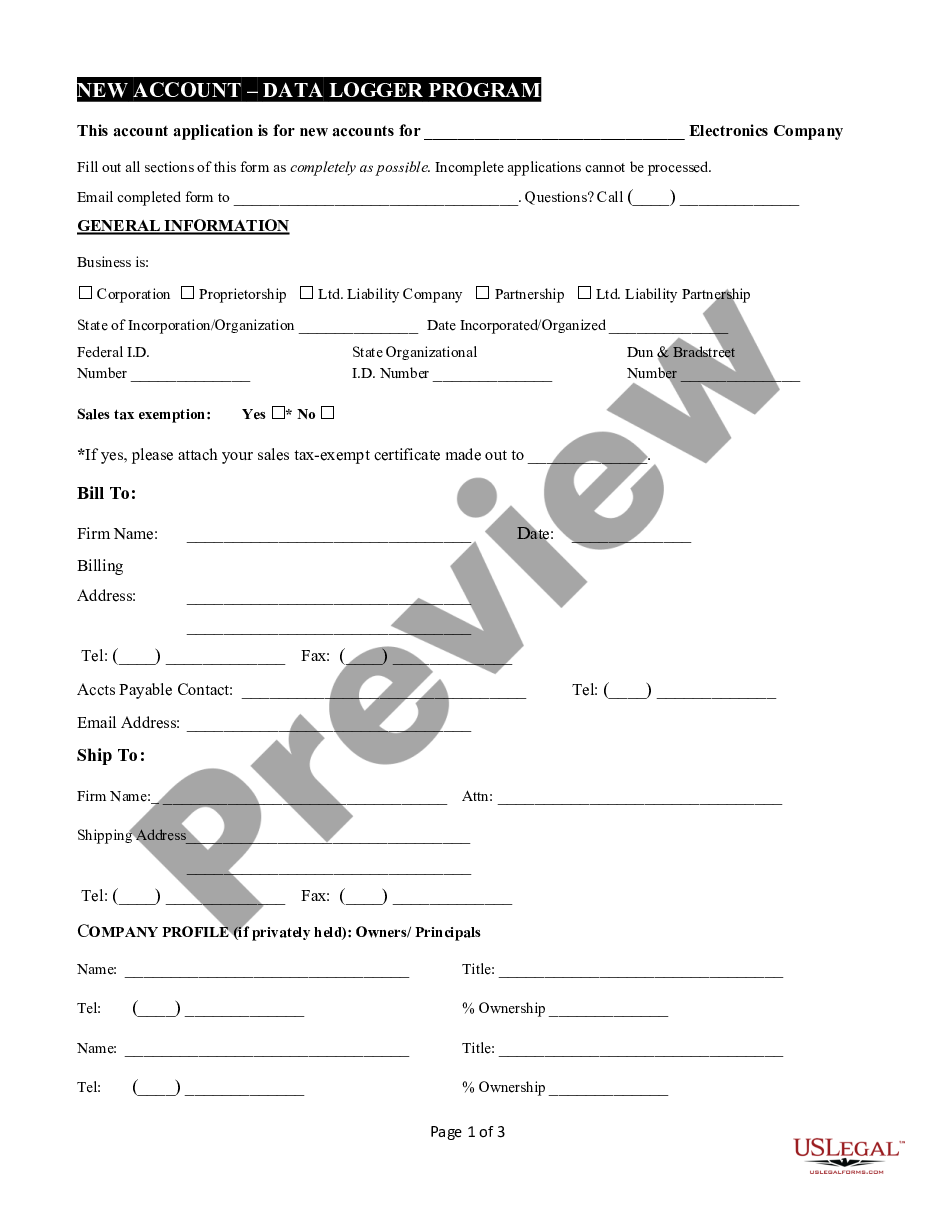

How to fill out Worksheet - Escrow Fees?

If you have to full, down load, or print out legal record web templates, use US Legal Forms, the greatest assortment of legal kinds, that can be found on the web. Use the site`s simple and easy convenient research to discover the papers you require. Different web templates for organization and specific functions are sorted by groups and states, or keywords and phrases. Use US Legal Forms to discover the Oklahoma Worksheet - Escrow Fees in a couple of clicks.

When you are previously a US Legal Forms customer, log in for your bank account and then click the Acquire button to find the Oklahoma Worksheet - Escrow Fees. You can even gain access to kinds you earlier delivered electronically in the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form to the right metropolis/land.

- Step 2. Take advantage of the Preview choice to look over the form`s information. Never forget to learn the information.

- Step 3. When you are unsatisfied together with the develop, utilize the Search discipline on top of the display screen to locate other models in the legal develop design.

- Step 4. Once you have located the form you require, go through the Acquire now button. Pick the costs strategy you choose and include your credentials to register for the bank account.

- Step 5. Process the purchase. You may use your bank card or PayPal bank account to finish the purchase.

- Step 6. Choose the file format in the legal develop and down load it on your product.

- Step 7. Full, revise and print out or indicator the Oklahoma Worksheet - Escrow Fees.

Every single legal record design you get is your own forever. You may have acces to every develop you delivered electronically inside your acccount. Click on the My Forms segment and decide on a develop to print out or down load once again.

Remain competitive and down load, and print out the Oklahoma Worksheet - Escrow Fees with US Legal Forms. There are many skilled and state-specific kinds you can utilize for your personal organization or specific needs.

Form popularity

FAQ

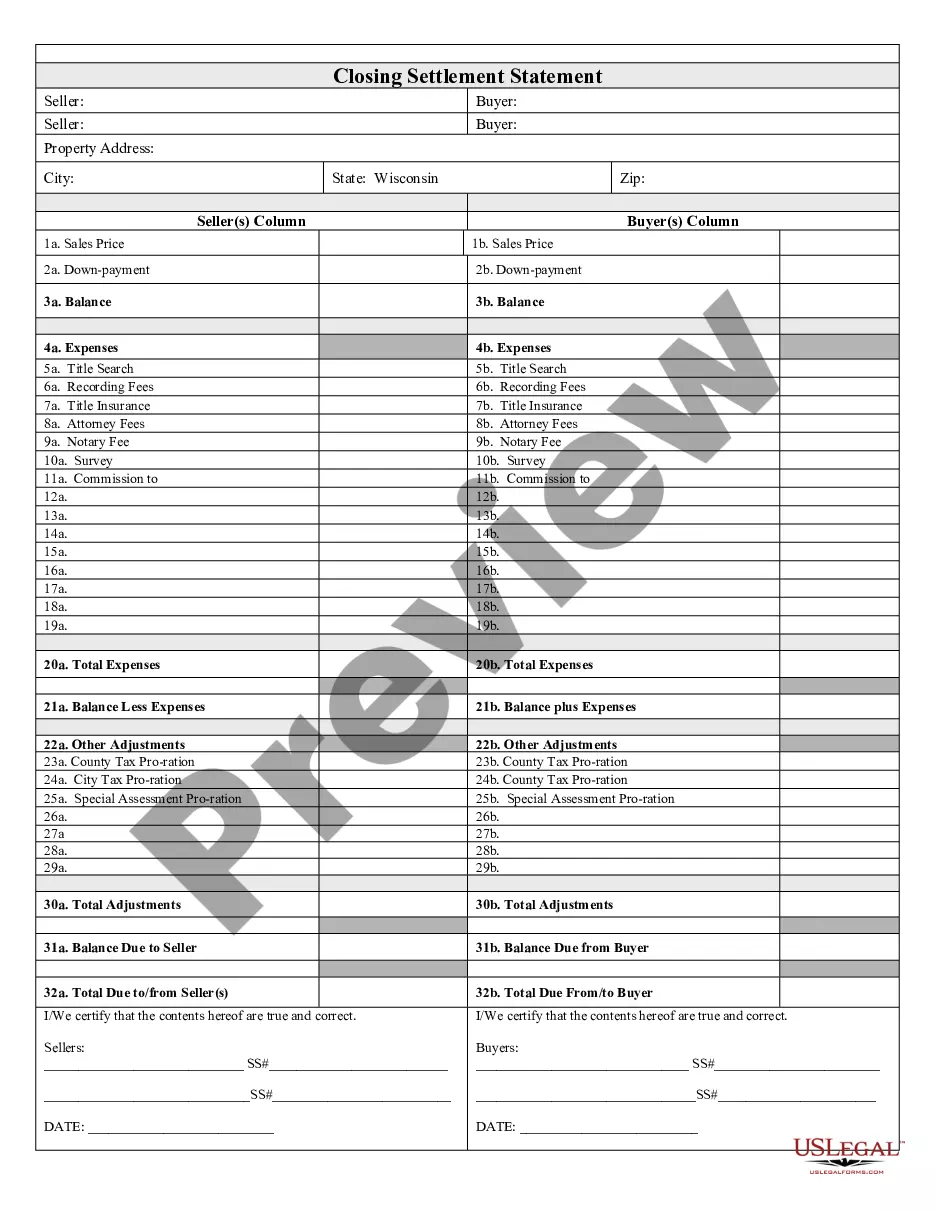

REFINANCE Closing Fees$175Title Examination$200Final Written GAP Search$150Title Services$200Secure Doc Fee$452 more rows

In Oklahoma, sellers typically pay for the title and closing service fees, owner's title insurance policy, transfer taxes, and recording fees at closing. Optional costs for sellers include buyer incentives, pro-rated property taxes, or for an attorney.

The Bottom Line: Escrow Is Mutually Beneficial, But Not Free These fees pay for third-party services that help you sell your home or complete the tasks required to successfully close your loan.

Buyer closing costs comprise some mandatory expenses irrespective of the mortgage type. These include Oklahoma appraisal fees, loan origination fees, underwriting fees, etc. Additionally, there are some costs specific to the type of home loan. These are MIPs, funding fees, guarantee fees, etc.

The average closing cost for a buyer in Oklahoma is 1.5% of the total purchase price, as per ClosingCorp. It includes the cost of financing, property-related costs, and paperwork costs. Not all Oklahoma home buyers pay the same costs at closing. It largely depends on the property's location.

Title Insurance Cost Oklahoma Title policies usually cost about 0.5% to 1.0% of the home's purchase price and are included in the Oklahoma home's closing costs.

The Seller customarily pays for the abstracting and examination fees. These fees must be charged as a separate fee on the HUD.

Not necessarily. There are two types of Title Insurance. Your lender likely will require that you purchase a Lender's Policy. This policy only insures that the financial institution has a valid, enforceable lien on the property.